Research, News, and Market Data on SMTS

OCTOBER 25, 2022

(All metal prices reported in USD)

TORONTO–(BUSINESS WIRE)– Sierra Metals Inc. (TSX: SMT) (BVL:SMT) (NYSE AMERICAN: SMTS) (“Sierra Metals” or “the Company”) reports third quarter 2022 production results and announces its decision to voluntarily delist its common shares from the New York Stock Exchange American (“NYSE”) and the Bolsa de Valores de Lima (“BVL”). Delisting is intended to reduce costs and simplify Sierra’s administrative and compliance structure associated with these listings. The Company’s common shares will continue to be listed and traded in Canadian dollars on the TSX.

Production results are from Sierra Metals’ three underground mines in Latin America: The Yauricocha polymetallic mine in Peru, and the Bolivar copper and Cusi silver mines in Mexico.

Third Quarter 2022 Consolidated Production Highlights

- As a result of the mudslide incident and the community blockade that followed, mining operations at Yauricocha were suspended for approximately 20 days in September.

- Consolidated mill throughput decreased 12% when compared to the previous quarter and 25% when compared to Q3 2021, due to lower throughput at Yauricocha and slower ramp up at Bolivar as a result of an unforeseen flooding event in the Bolivar NorthWest zone.

- Consolidated copper equivalent production was 7% lower compared to the previous quarter and 24% lower when compared to Q3 2021

- Suspension of production and financial guidance remains in effect.

Consolidated Q3 2022 Results – The Company previously announced that results will be released on Tuesday, November 15th with a shareholder conference call and webcast on Wednesday, November 16th.

Correction: The Company’s Q3 2022 results will be released on Monday, November 14th after market close and the shareholder conference call and webcast will be held on Tuesday, November 15th at 11:00 AM EST. Dial in and event link details remain the same. Click here to register.

Luis Marchese, CEO of Sierra Metals, commented,“The tragic mudslide event that took place at the Yauricocha Mine last month has been extremely difficult for all of us at Sierra Metals. Safety for everyone remains our highest priority. As such, mining operations have re-commenced at a portion of the Yauricocha Mine, while a very thorough safety assurance process continues before restarting operations in the remaining areas.”

Additionally, the extended work stoppage at Yauricocha, due to the road blockade by a local community, concluded after an agreement was reached. The agreement is currently in the process of being implemented.”

He continued,“Bolivar’s turnaround effort has been delayed due to unexpected flooding events during most of the quarter at the Bolivar NorthWest zone in addition to operational delays in implementing a new raise bore to add ventilation. The flooding is currently under control.

Further, after an in-depth review, examining the advantages and disadvantages of Sierra’s listings, management and the Board determined that it would be in the best interest of the Company and its shareholders to voluntarily delist from both the NYSE and the BVL exchanges. The decision is intended to create simplification and to reduce significant costs associated with the continued listing on the NYSE and BVL.”

He concluded,“Sierra Metals has endured an unfortunate sequence of events, that have brought the Company to its current position. Our goal is to find the best path forward for the Company and its stakeholders.”

Consolidated Production Results

Throughput from the Yauricocha Mine during Q3 2022 was 269,057 tonnes, a 15% decline when compared to the previous quarter. When compared to Q3 2021, throughput from the Yauricocha Mine was 17% lower due to the suspension of mining activity and work stoppages during the third quarter, which resulted in a 31% decrease in copper equivalent pounds produced.

At the Bolivar Mine, throughput was 227,669 tonnes during Q3 2022 or 11% lower as compared to Q2 2022. Lower throughput, combined with lower grades in copper and silver resulted in a 10% decrease in copper equivalent pound production when compared to the previous quarter. When compared to Q3 2021, throughput at Bolivar was 38% lower and while grades were higher for silver and gold, they were not enough to offset the lower throughput, resulting in a 16% decrease in copper equivalent pounds produced.

At Cusi, throughput was 65,180 tonnes during Q3 2022 or 2% lower as compared to Q2 2022. The slightly lower throughput was offset by higher grades in all metals, resulting in a 32% increase in silver equivalent production. When compared to Q3 2021, a 7% increase in throughput, combined with higher head grades for all metals except lead, resulted in a 22% increase in silver equivalent production.

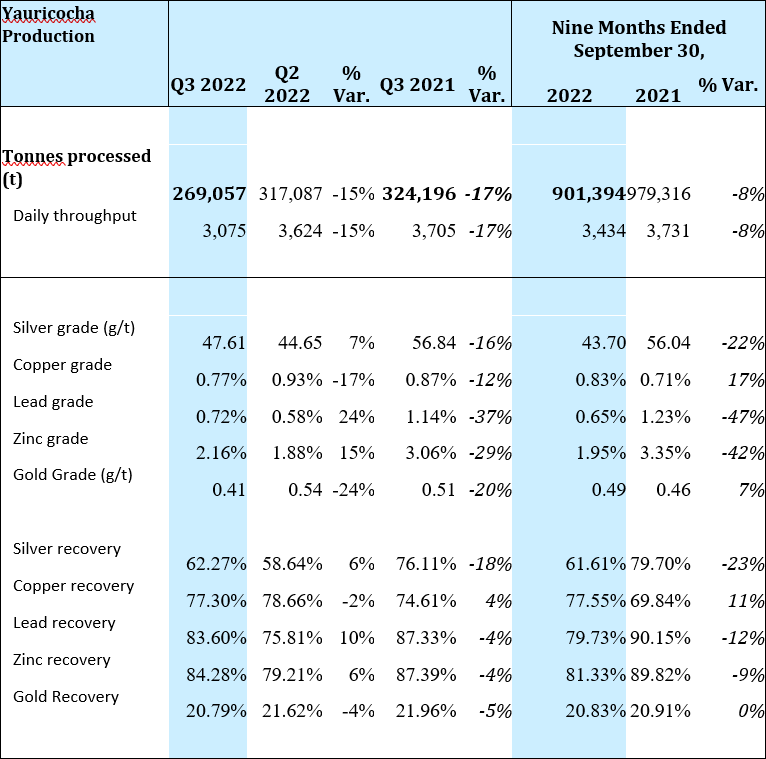

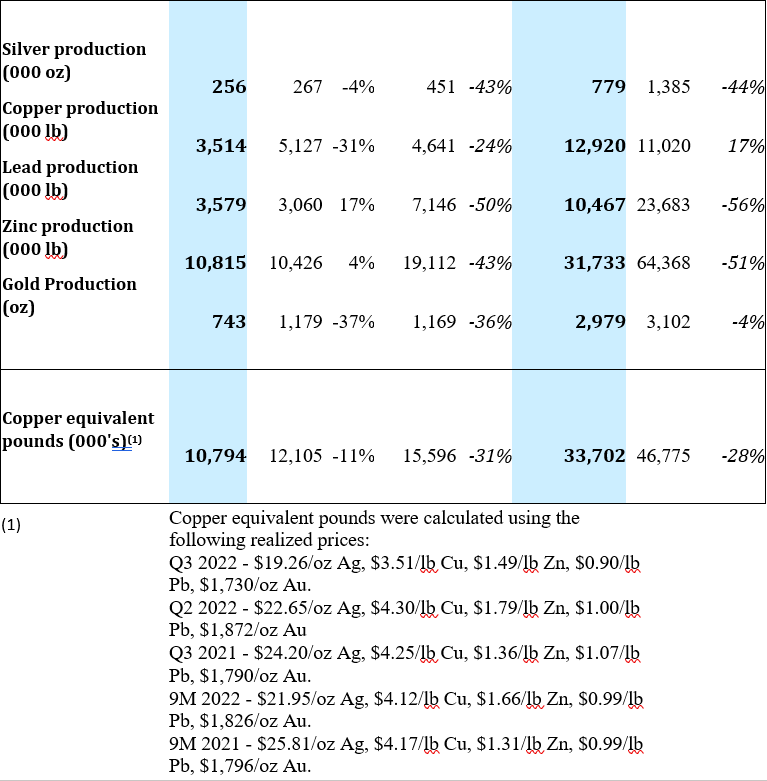

Yauricocha Mine, Peru

The Yauricocha Mine processed 269,057 tonnes during Q3 2022, which was a 15% decrease when compared to Q2 2022 and an 11% decrease in copper equivalent pounds produced. While silver, lead and zinc grades increased by 7%, 24% and 15%, respectively, copper grades decreased by 17% and gold decreased by 24% when compared to the previous quarter.

When compared to Q3 2021, there was a 17% decrease from the 324,196 tonnes processed in the same quarter of 2021 and a 31% decrease in copper equivalent pounds produced. Negative variances in the grades of all metals were the result of restricted access to higher grade areas of the mine and contributed to the lower production of all metals at Yauricocha during Q3 2022.

The significant decrease in tonnage and copper equivalent pounds produced at Yauricocha is a result of the suspension of mining activities due to the mudslide that occurred on September 11, 2022 and the subsequent blockade that took place at the mine’s main entrance.

A summary of production from the Yauricocha Mine for Q3 2022 is provided below:

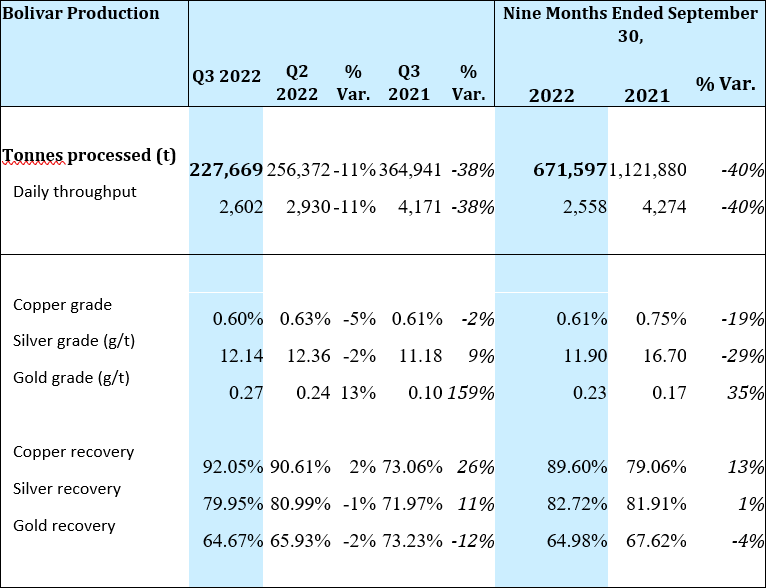

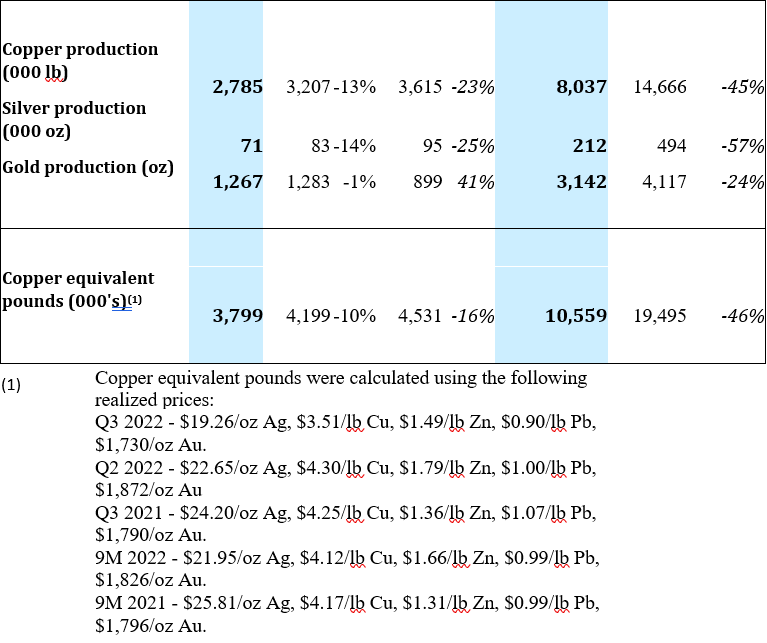

Bolivar Mine, Mexico

The Bolivar mine processed 227,669 tonnes in Q3 2022, an 11% decrease from 256,372 tonnes in Q2 2022. Lower production during Q3, a 5% decrease in copper grades and a 2% decrease in silver grades resulted in a 10% decrease in copper equivalent pound production when compared to Q2 2022.

When comparing Q3 2022 to Q3 2021, the Bolivar mine processed 38% fewer tonnes of ore. Copper grades were 2% lower while silver and gold grades were 9% and 159% higher, respectively which was not enough to offset the overall decrease in tonnes processed. The mine’s copper equivalent production for the quarter decreased by 16% when compared to the same quarter last year. Operational ramp up has been slower than expected due to unforeseen flooding in the Bolivar NorthWest zone during the quarter.

A summary of production for the Bolivar Mine for Q3 2022 is provided below:

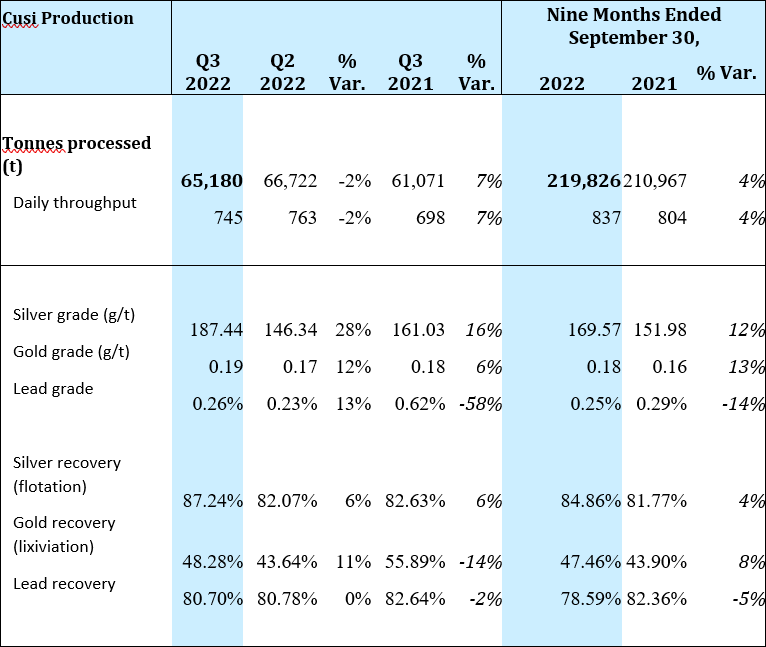

Cusi Mine, Mexico

Operating at an average throughput of 745 tpd, Cusi processed 2% fewer tonnes of ore in Q3 2022 as compared to Q2 2022. Higher grades in all metals resulted in a 32% increase in silver equivalent ounces.

When comparing Q3 2022 to Q3 2021, ore tonnage increased by 7%. Silver production increased 31%, with gold and lead production decreasing by 2% and 57%, respectively. Silver equivalent production of 374,000 ounces for the quarter was 22% higher than in Q3 2021.

A summary of production for the Cusi Mine for Q3 2022 is provided below:

Delisting From The NYSE American and BVL Stock Exchanges

Sierra Metals will notify the U.S. Securities and Exchange Commission (the “SEC”) and the National Commission on the Supervision of Companies and Securities of its withdrawal of the common shares from listing on the NYSE and BVL, respectively.

The Company decided to pursue the voluntary de-listings after concluding that the disadvantages of maintaining its listing on the NYSE and the BVL outweighed the benefits to the Company and its shareholders. It was determined that a delisting will simplify Sierra’s administrative and compliance structure and reduce costs associated with the listing fees.

The decision to voluntarily delist the common shares from the NYSE and BVL will not impact the Company’s listing on the Toronto Stock Exchange (“TSX”). The common shares will continue to be listed and traded on the TSX, subject to compliance with TSX continued listing standards.

The Company expects that the last day of trading of the common shares on the NYSE will be on or about November 14, 2022 and on the BVL on or about December 15, 2022, subject to the satisfaction of the requirements and completion of the internal processes of the latter exchange.

Shareholders holding shares in U.S. brokerage accounts should contact their brokers to confirm how to trade Sierra Metals’ shares in the future on the TSX. Likewise, shareholders holding shares acquired through Peruvian stockbroker agents should contact their brokers to confirm how to trade Sierra Metals’ shares in the future on the TSX.

Quality Control

Américo Zuzunaga, FAusIMM (Mining Engineer) and Vice President, Technical, is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Sierra Metals

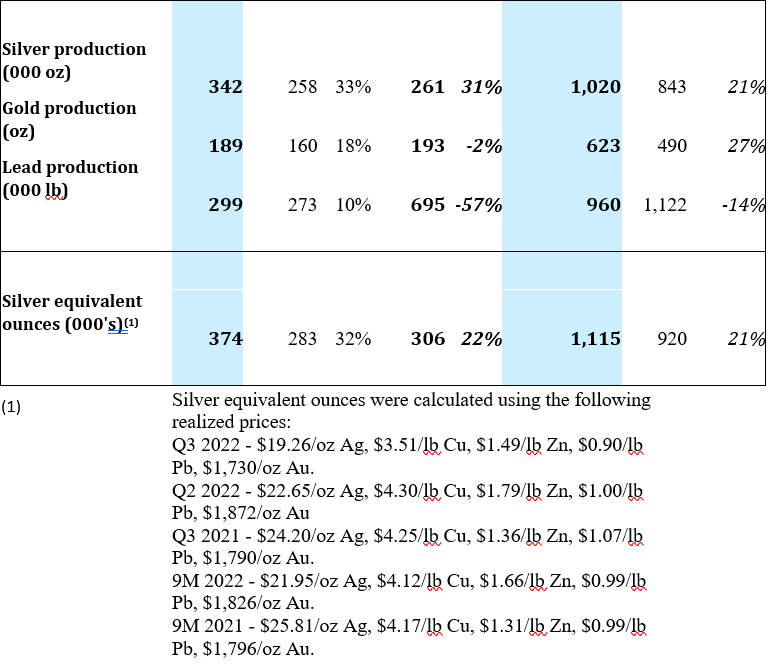

Sierra Metals Inc. is a diversified Canadian mining company with Green Metal exposure including copper production and base metal production with precious metals byproduct credits, focused on the production and development of its Yauricocha Mine in Peru, and Bolivar and Cusi Mines in Mexico. The Company is focused on increasing production volume and growing mineral resources. The Company also has large land packages at all three mines with several prospective regional targets providing longer-term exploration upside and mineral resource growth potential.

For further information regarding Sierra Metals, please visit www.sierrametals.com.

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals | Facebook: SierraMetalsInc |

LinkedIn: Sierra Metals Inc | Instagram: sierrametals

Forward-Looking Statements

This press release contains forward-looking information within the meaning of Canadian and United States securities legislation, including with respect to the delisting of the Common Shares on the NYSE and BVL (and the timing thereof), results of the delisting and the timing of the release of the Company’s Q3 2022 results and shareholders’ call and webcast. Forward-looking information relates to future events or the anticipated performance of Sierra and reflect management’s expectations or beliefs regarding such future events and anticipated performance based on an assumed set of economic conditions and courses of action. In certain cases, statements that contain forward-looking information can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur” or “be achieved” or the negative of these words or comparable terminology. By its very nature forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual performance of Sierra to be materially different from any anticipated performance expressed or implied by such forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading “Risk Factors” in the Company’s annual information form dated March 16, 2022 for its fiscal year ended December 31, 2021 and other risks identified in the Company’s filings with Canadian securities regulators and the United States Securities and Exchange Commission, which filings are available at www.sedar.com and www.sec.gov, respectively.

The risk factors referred to above are not an exhaustive list of the factors that may affect any of the Company’s forward-looking information. Forward-looking information includes statements about the future and is inherently uncertain, and the Company’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors. The Company’s statements containing forward-looking information are based on the beliefs, expectations, and opinions of management on the date the statements are made, and the Company does not assume any obligation to update such forward-looking information if circumstances or management’s beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221025006064/en/

Investor Relations

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Email: info@sierrametals.com

Luis Marchese

CEO

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Source: Sierra Metals Inc.