Research News and Market Data on MGMLF

Vancouver, British Columbia–(Newsfile Corp. – May 18, 2023) – Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF) (FSE: M3G) (“Maple Gold” or the “Company“) is pleased to provide an update regarding property-wide volcanogenic massive sulfide (“VMS”) targeting and plans for a summer field program at the Douay and Joutel Gold Projects (“Douay” and “Joutel”, respectively) located in Québec, Canada, which are held by a 50/50 joint venture (the “JV”) between the Company and Agnico Eagle Mines Limited. The Company is also planning VMS exploration work at its 100%-owned Morris Project (“Morris”) located approximately 30 kilometres (“km”) east of the town of Matagami in Morris Township, Québec.

The JV’s primary focus remains on testing resource expansion targets at Douay and testing prospective near-mine extension targets in the Telbel mine area at Joutel. However, the Douay and Joutel projects each have demonstrated potential for gold and base metals VMS mineralization, as is illustrated by a series of targets previously defined by field mapping and geophysical surveying across the combined 400 km² property package (see news from July 19, 2022). Under the terms of the JV agreement, the partners agreed to jointly fund C$500,000 in exploration on VMS targets on the western portion of Douay (see news from February 3, 2021).

Summary of VMS-focused exploration and corporate initiatives:

- The Company’s mapping, sampling and top of bedrock drilling during 2018 identified six (6) priority target areas for potential base metals and gold-rich VMS mineralization (see press release November 14, 2018).

- The Company subsequently appointed Dr. Gérald Riverin, a recognized VMS expert with 40+ years of experience in the Abitibi Greenstone belt, to its board of directors and Technical Advisory Committee (see news from June 9, 2020).

- In late 2021, the JV consolidated two (2) inlier claim blocks covering 22 claims and 12.3 km² of ground in the central portion of Douay in an area deemed prospective for zinc and copper mineralization (see news from October 19, 2021).

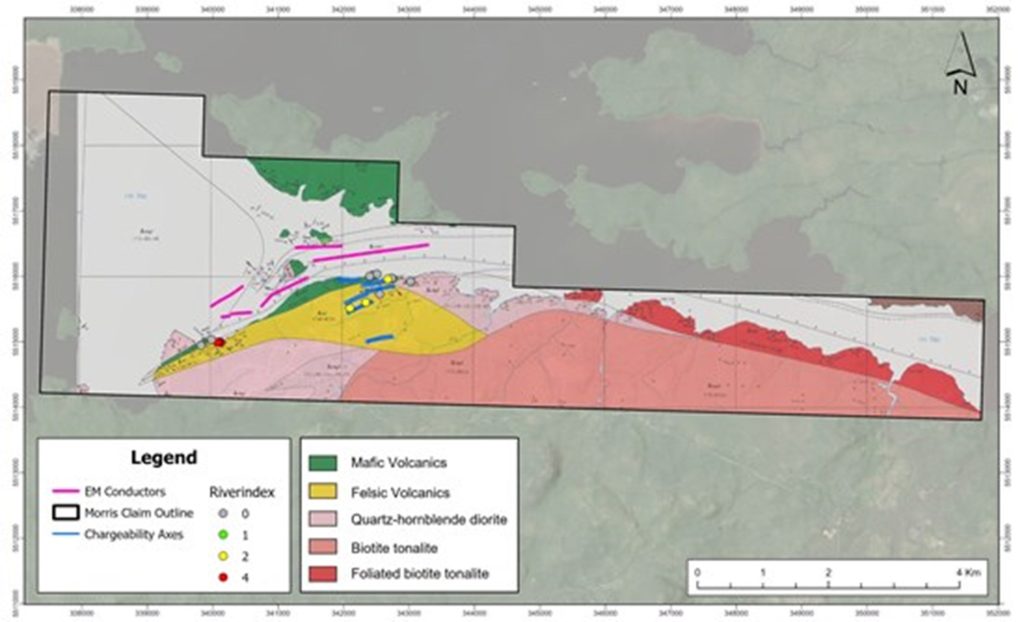

- Also in 2021, the Company acquired 100% of Morris and completed preliminary ground geophysics and lithogeochemical sampling. In 2022 and 2023, the Company completed deep penetrating pulse electromagnetic (“PEM”) surveys that outlined a 3 km long conductive zone adjacent to a favorable rhyolite unit.

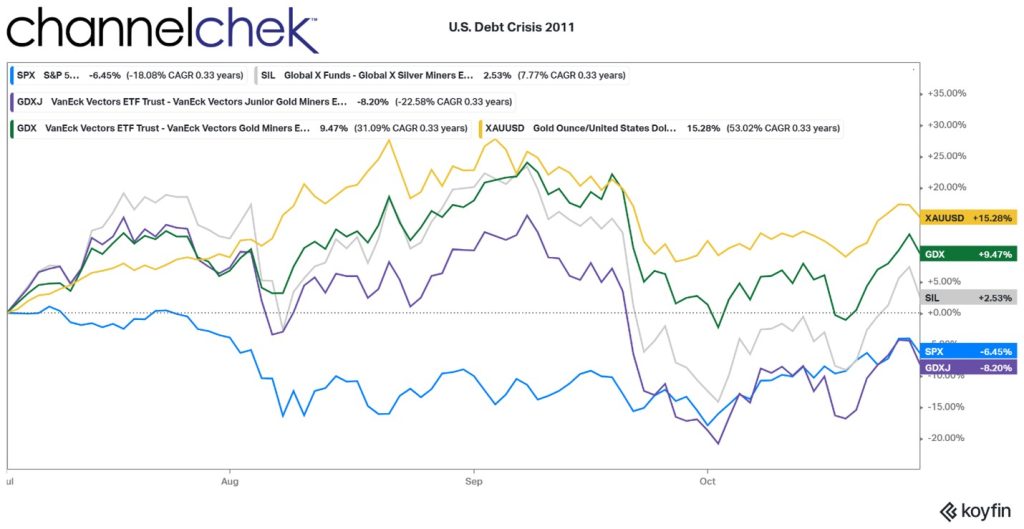

- In 2022, the JV completed a regional airborne magnetic and electromagnetic (“Mag-EM”) survey to support exploration drill targeting, which identified 55 targets within four (4) primary target areas prospective for pyritic gold and VMS mineralization (see news from July 19, 2022). After geophysical review, sixteen (16) of these targets were selected for priority follow-up (see Figure 1).

- In 2023, the Company appointed Paul Harbidge, CEO of Faraday Copper Corp., an emerging U.S. copper developer, to its Technical Advisory Committee to further strengthen the Company’s technical group and support gold and base metals exploration (see news from February 7, 2023).

- The JV has recently hired Dr. Marina Schofield, an expert in volcanology, structural geology and VMS systems, to lead the Company’s VMS exploration efforts.

“We have methodically built a pipeline of prospective gold and base metals VMS targets across the large >400 km² Douay-Joutel property package and have expanded our technical expertise in order to systematically evaluate and advance a VMS-focused exploration program,” statedMatthew Hornor, President and CEO of Maple Gold. “The past-producing high-grade Estrades zinc-gold mine is located just over 11 km to the west of Douay-Joutel and the same geologic horizon that hosted that mine appears to continue onto the western portion of the Douay property. Further to the southeast, historical regional exploration drilling along the Joutel Deformation Zone, east of the historical Eagle-Telbel deposits, has also returned anomalous zinc and gold values. We look forward to completing further cost-effective field work this summer to bring the highest priority VMS discovery targets to a drill-ready stage.”

VMS Targets and Associated 2023 Summer Exploration Plans:

Figure 1: Geology base map highlighting VMS and VMS-like base metal mines and deposits in the region and copper-zinc showings.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3077/166582_final%20fig%201%20may%2018.png

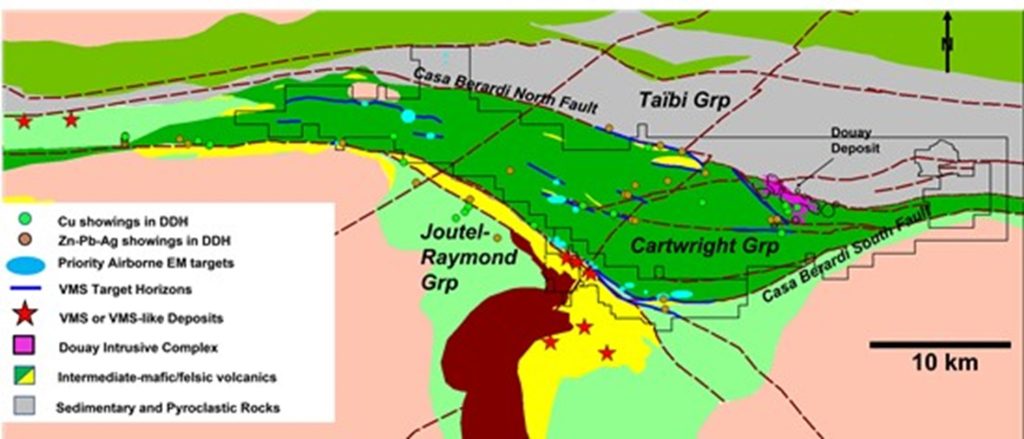

The Douay-Joutel property straddles the Casa Berardi Deformation Zone, which is geologically underlain, from south to north, by predominantly intermediate to felsic tuffs of the Joutel-Raymond Grp, the basinal sediments of the Harricana Grp and the predominantly mafic volcanic sequence forming the Cartwright Hills Grp, followed by further basinal sediments of the Taïbi Grp. Although the geological model for Eagle-Telbel is still evolving, gold mineralization was associated with mixed sedimentary and pyroclastic horizons hosting abundant iron carbonate and semi-massive sulfide (pyrite) at the top of the volcanic package that hosts the past-producing Joutel/Poirier VMS mining camp. The main VMS target horizons occur laterally along the Eagle-Telbel Mine Horizon, as well as along multiple interflow horizons within The Cartwright Hills Grp, which include the interpreted eastern extension of the Estrades horizons.

Figure 2: Gold, VMS and base metal target areas in the greater Joutel area (same legend as Fig 1).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3077/166582_final%20fig%202%20may%2018.png

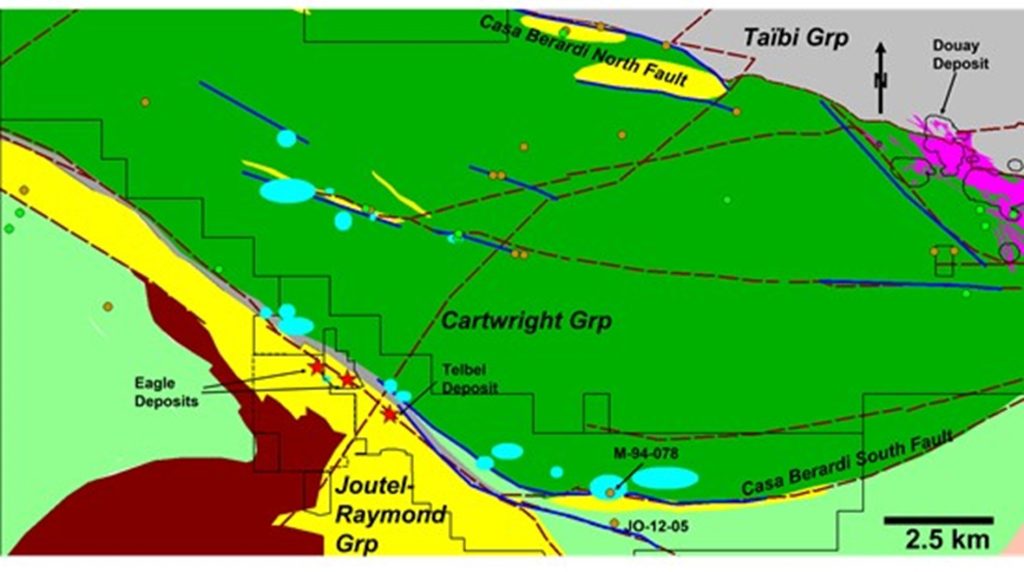

The Joutel Targets (see Figure 2 above) include several EM anomalies within ~2-5 km of the historical Eagle, Telbel and Eagle West deposits that have very limited drilling. These deposits are associated with the Harricana and Joutel Deformation Zones and appear as discrete conductive zones aligned along a well-defined northwest trend. The Mag-EM survey indicates possible similar structures extending more than 9 km further to the east in this area where historical drilling intersected anomalous gold (“Au”) and zinc (“Zn”) in several holes. Hole M-94-078 (also known as McClure 93-2 showing) intersected 0.81% Zn over 0.6 metres (“m”); hole JO-12-05 intersected 6.1 g/t Au over 1.5 m, as well as 0.55% Zn over 4 m further downhole, including 0.88% Zn over 1m.

Planned work to advance VMS targets at Douay and Joutel is expected to include compilation of existing data, including review of historical drill logs, followed by field work including lithogeochemistry and initial follow-up ground EM surveys to support bringing highest priority VMS target areas towards a drill ready stage.

Separately, planned work at Morris is expected to include detailed lithogeochemical sampling to establish the full extent of strong VMS related hydrothermal alteration identified in 2021 and identify promising portions of the 3 km long conductor identified by ground geophysics in 2022 and 2023 (see Figure 3). Morris is located approximately 30 km east of the Matagami VMS mining camp and hosts the Watson Lake rhyolite unit which forms the footwall of all the VMS mines at Matagami.

Figure 3: 100% owned Morris claims with geology and geophysics compilation. Favorable alteration is highlighted by higher Riverindex values.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3077/166582_a96d77c1043a2814_003full.jpg

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work.

About Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Québec’s prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel. In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

The district-scale property package also hosts a significant number of regional exploration targets along a 55 km strike length of the Casa Berardi Deformation Zone that have yet to be tested through drilling, making the project ripe for new gold and polymetallic discoveries. The Company is well capitalized and is currently focused on carrying out exploration and drill programs to grow resources and make new discoveries to establish an exciting new gold district in the heart of the Abitibi. For more information, please visit www.maplegoldmines.com.

ON BEHALF OF MAPLE GOLD MINES LTD.

“Matthew Hornor”

B. Matthew Hornor, President & CEO

For Further Information Please Contact:

Mr. Joness Lang

Executive Vice-President

Cell: 778.686.6836

Email: jlang@maplegoldmines.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward Looking Statements:

This press release contains “forward-looking information” and “forward-looking statements” (collectively referred to as “forward-looking statements”) within the meaning of applicable Canadian securities legislation in Canada, including statements about exploration work and results from current and future work programs. Forward-looking statements are based on assumptions, uncertainties and management’s best estimate of future events. Actual events or results could differ materially from the Company’s expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.’s filings with Canadian securities regulators available on www.sedar.com or the Company’s website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.