Research, News, and Market Data on GAME

12/08/2022

Combination creates end to end digital media and technology platform connecting global brands with gaming and youth culture audiences

GameSquare Esports shareholders are expected to own approximately 60% of combined company, and Engine Gaming shareholders are expected to own approximately 40% of the combined company which will trade on the NASDAQ and TSX Venture Exchange under the ticker symbol GAME

TORONTO, ON and NEW YORK, NY / ACCESSWIRE / December 8, 2022 / GameSquare Esports Inc. (CSE:GSQ);(OTCQB:GMSQF);(FRA:29Q1) (“GameSquare”), a vertically integrated, international digital media and entertainment company focused on gaming and esports, and Engine Gaming and Media, Inc. (“Engine Gaming” or “Engine”) (NASDAQ:GAME);(TSXV:GAME), a data-driven, gaming, media and influencer marketing platform company, today announced that they have entered into a definitive arrangement agreement (the “Arrangement”) dated December 7, 2022to combine their businesses via an all share deal, whereby each common share of GameSquare (a “Gamesquare Share”) will be exchanged for 0.08262 Engine Gaming common shares (the “Engine Gaming Shares”).

Following the all-share transaction, former GameSquare Esports shareholders are expected to own approximately 60% of the combined entity, and current Engine Gaming shareholders are expected to own approximately 40% of the combined entity on a fully diluted basis, and it is intended that the Engine Gaming Shares will continue to trade on the Nasdaq Stock Market (the “Nasdaq”) and TSX Venture Exchange (the “TSXV”) under the symbol “GAME.” The combined entity will retain the “GameSquare” brand globally.

Justin Kenna is expected to lead the combined company as CEO and Lou Schwartz is expected to oversee the combined company’s technology platforms, as President. In addition, Jerry Jones, owner of the Dallas Cowboys, and John Goff, Chairman and Founder of Goff Capital, Inc. will continue to be the largest investors of the combined entity. Representatives of the Jones Family and of Goff Capital will continue to hold significant board representation of the new company.

The combined company integrates GameSquare’s award winning content, advertiser, and influencer businesses with Engine’s market leading data, analytics, advertising and marketing technology platforms. The transaction creates a market leading, end-to-end platform with reach across esports, sports, influencer, publisher, and advertising networks for brands to connect with the increasingly difficult to reach youth culture audiences. The combined company will provide global brands and advertisers with solutions that develop innovative strategies to connect to youth audiences.

“Today’s announcement is a transformative opportunity for our customers, team members, and shareholders, as we build what we believe will be one of the world’s largest and most influential gaming, esports, and media companies focused on youth culture,” said Justin Kenna, CEO of GameSquare. “The merger immediately expands our scale, which we expect will help us on an accelerated path to profitability in 2023, while creating an organization with a leading platform of end-to-end media, content, and technology assets. GameSquare and Engine Gaming have highly complementary core strengths, including broad product portfolios, and passionate team members committed to the gaming and esports markets. As a combined organization, we will have an enhanced platform and expanded resources, including essential data and analytic solutions, to serve a broader base of global customers and accelerate growth. I am excited by the significant opportunities we will have as a combined company to create substantial value for our shareholders.”

“We are thrilled to announce the merger with GameSquare,” commented Lou Schwartz, CEO of Engine Gaming. “Engine Gaming’s unique technology assets, including live streaming data, analytics, influencer marketing platform, and programmatic advertising solutions enhance and expand GameSquare’s capabilities in connecting brands with fans. As a full service, integrated company, we will be able to meet the needs of any brand sponsor through our SaaS revenue-based technology platforms. We believe the combined company will drive powerful growth and scale, while enabling an accelerated path to profitability.”

Tom Rogers, Executive Chairman of Engine Gaming added, “This merger is the successful culmination of our previously announced strategic alternatives process. We believe the merger between GameSquare and Engine provides strong potential return for shareholders, and allows Engine’s stockholders to participate in the value creation of the combined company. The transaction satisfies all the announced goals of the strategic process – greater scale, catalyzing growth, and significant cost and revenue synergies.

Transaction Highlights:

- Significant financial profile. GameSquare and Engine Gaming, combined, have delivered $70+ million of trailing twelve-month revenue (unaudited), reflecting a nearly doubling of revenues over that same period.[1]

- Enhanced financial predictability. The transaction is expected to improve the recurring and reoccurring revenue profile of the combined business. Management believes that a larger, predictable revenue profile from the entity’s agency, programmatic, SaaS, sponsorships, and league fees provide an improved financial foundation for accelerated growth.

- Highly complementary businesses. Management believes that the businesses within Engine Gaming and GameSquare are highly complementary and expect significant opportunities for revenue synergies and acceleration of growth. The combination of creative digital agencies, an influencer marketing platform, innovative advertising solutions, leading programmatic businesses, an elite esports organization, audience intelligence technology, content production, and merchandise and consumer product design means that the new entity will have an unrivaled end-to-end suite of services for brands seeking to reach gaming and esports fans.

- Global client base with limited cross over. Management believes the limited overlap of existing brands and clients will provide numerous opportunities for cross selling and optimization, to delivering more outstanding outcomes to our clients, including The Kraft Heinz Group, Tyson Foods, Jack in the Box, Converse, HyperX, Epic Games, Microsoft, the Dallas Cowboys, Riot Games, Activision Blizzard, Electronic Arts, and many more.

- Large audience in gaming and esports Management believes that the combination of GameSquare and Engine Gaming may result in an audience and reach as large as any gaming and esports company currently in the market. Specifically, GameSquare has an audience of 220 million and Engine has 130 million monthly followers within the advertising network.

- Improved access to U.S. investors and capital. The combined entity intends to retain Nasdaq and TSXV dual listing under the ticker GAME. Management believes that access to the U.S. financial markets as a gaming and esports company with significant revenue scale could represent an opportunity for valuation rerating catalyst for the combined company.

- Accelerated path to profitability. The combined entity is expected be on an accelerated path to profitability in 2023 as it benefits from significant operating leverage, outsized revenue growth, and meaningful cost synergies created by the new Company.

- Experienced management and board of directors. The Company expects to greatly benefit from substantial experience of the post-Transaction management team and a strong board of directors. The leadership team will be composed of executives from GameSquare and Engine Gaming that will have deep managerial expertise supported by the talented staff and leaders throughout the two companies.

Additional Details regarding the Arrangement

Under the Arrangement, Engine Gaming will issue to GameSquare shareholders 0.08262 Engine Gaming Shares in exchange for each GameSquare Share held (the “Exchange Ratio”). Based on the number of outstanding GameSquare Shares as of the date of this press release, it is expected that Engine Gaming will issue an aggregate of approximately 25,409,372 Engine Gaming Shares to GameSquare shareholders. All warrants, stock options and restricted share units of GameSquare will be exchanged for replacement warrants, stock options and restricted share units of Engine Gaming on identical terms, as adjusted in accordance with the Exchange Ratio and the Consolidation (as defined below), if applicable.

The Arrangement is anticipated to close in the first quarter of 2023. The completion of the Arrangement is subject to customary terms and conditions, including the following: approval of the Arrangement by Engine Gaming and GameSquare shareholders; court approval of the Arrangement; and, receipt of all required regulatory approvals, including acceptance by the TSXV.

Prior to closing of the Arrangement, Engine Gaming shall apply to list the post-closing Engine Gaming Shares on the Nasdaq and TSXV. There can be no assurances that Nasdaq or TSXV will accept such listing.

If required, in order to comply with policies of the Nasdaq, prior to or concurrently with closing of the Arrangement, Engine Gaming may consolidate the Engine Gaming Shares based on a consolidation ratio to be determined by Engine Gaming at such time (the “Consolidation”).

Engine Gaming and GameSquare are arm’s length.

Board Recommendations and Shareholder Approvals

The board of directors of each of Engine Gaming and GameSquare, after receiving financial and legal advice, have unanimously approved the Arrangement and recommend that their respective shareholders vote in favor of the Arrangement. Evans & Evans, Inc. has provided an opinion to the board of directors of GameSquare stating that, based upon and subject to the assumptions, limitations, and qualifications set forth therein, the consideration to be received by the GameSquare Shareholders pursuant to the Arrangement is fair, from a financial point of view to the GameSquare Shareholders. Haywood Securities Inc. has provided an opinion to the board of directors of Engine Gaming stating that, based upon and subject to the assumptions, limitations, and qualifications set forth therein, the Exchange Ratio is fair, from a financial point of view to the Engine Gaming Shareholders.

The Arrangement requires approval by at least 66.67% of the holders of the GameSquare Shares who vote at the meeting. It is expected that all proportionate voting shares of GameSquare shall be converted to GameSquare Shares prior to the meeting of the GameSquare Shareholders to approve the Arrangement.

Pursuant to the policies of the TSXV, the Arrangement requires approval of at least a majority of Engine Gaming Shareholders.

Board and Management

The board of directors of Engine Gaming following the Arrangement are anticipated to be comprised of Justin Kenna, Tom Walker, Travis Goff and Jerami Gorman, who are currently directors of GameSquare, as well as Tom Rogers who will be Executive Chairman of the Board, Lou Schwartz, and Stu Porter who are currently directors of Engine Gaming. These directors shall hold office until the first annual meeting of the shareholders of the Resulting Issuer following closing, or until their successors are duly appointed or elected.

The officers of the Resulting Issuer are anticipated to be Justin Kenna as Chief Executive Officer (currently Chief Executive Officer of GameSquare), Lou Schwartz as President ( currently Director, and Chief Executive Officer of Engine Gaming), Mike Munoz as Chief Financial Officer (currently Chief Financial Officer of Engine Gaming), Sean Horvath as Chief Revenue Officer (currently Chief Revenue Officer of GameSquare), Paolo DiPasquale as Chief Strategy Officer (currently Chief Strategy Officer of GameSquare), John Wilk as General Counsel (currently General Counsel of Engine Gaming), Matt Ehrens as Chief Technology Officer (currently Chief Technology Officer of Engine Gaming), and Jill Peters as Chief Media Officer (currently Chief Operations Officer of GameSquare).

About GameSquare Esports Inc.

GameSquare was incorporated under the Business Corporations Act (Ontario) on December 13, 2018. GameSquare is a vertically integrated, international digital media and entertainment company enabling global brands to connect and interact with gaming and esports fans. GameSquare owns a portfolio of companies including Code Red Esports Ltd., an esports talent agency serving the UK, GCN, a digital media company focusing on the gaming and esports audience based in Los Angeles, USA., Cut+Sew (Zoned), a gaming and lifestyle marketing agency based in Los Angeles, USA, Complexity Gaming, a leading esports organization operating in the United States, Fourth Frame Studios, a multidisciplinary creative production studio, and Mission Supply, a merchandise and consumer products business. The Company is headquartered in Toronto, Canada.

Year ended December 31, 2021*

Assets $30,209,519

Liabilities $7,839,020

Revenues $13,687,889

Gross Profit $4,437,258

Net Profit (losses) ($26,556,311)

*Denotes all values in Canadian dollars as at time of reporting (started reporting to USD in 2022)

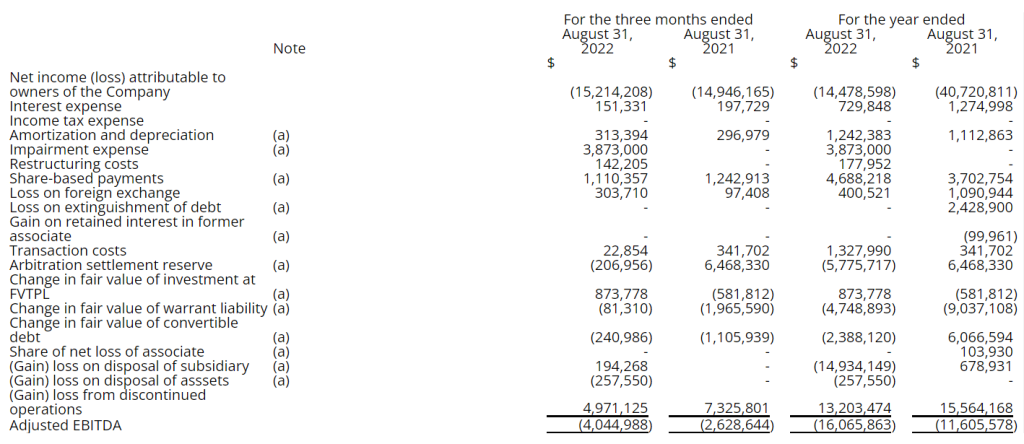

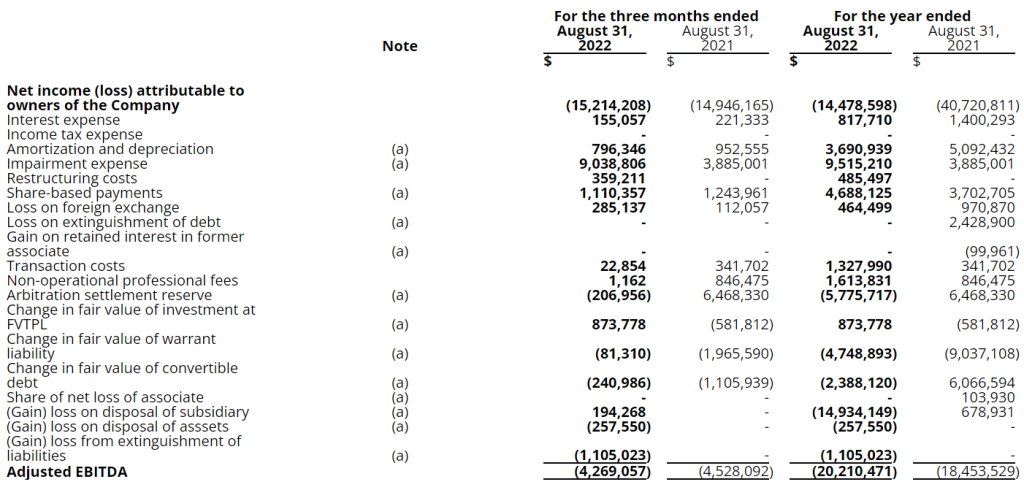

About Engine Gaming and Media, Inc.

Engine Gaming and Media, Inc. (NASDAQ:GAME);(TSXV:GAME) provides unparalleled live streaming data and social analytics, influencer relationship management and monetization, and programmatic advertising to support the world’s largest video gaming companies, brand marketers, ecommerce companies, media publishers and agencies to drive new streams of revenue. The company’s subsidiaries include Stream Hatchet, the global leader in gaming video distribution analytics; Sideqik, a social influencer marketing discovery, analytics, and activation platform; and Frankly Media, a digital publishing platform used to create, distribute, and monetize content across all digital channels. Engine Gaming generates revenue through a combination of software-as-a-service subscription fees, managed services, and programmatic advertising. For more information, please visit www.enginegaming.com.

Year ended August 31, 2022

Assets $42,694,808

Liabilities $26,808,217

Revenues $41,882,613

Net Profit (losses) ($14,478,598)

*GAME does not provide gross margins

Advisors

Oak Hills Securities, Inc. served as GameSquare’s exclusive financial advisor. Evans & Evans, Inc. is acting as financial advisor to GameSquare on the Arrangement and Haywood Securities Inc. is acting as financial advisor to Engine Gaming on the Arrangement. Polsinelli PC and Miller Thomson LLP are acting as counsel to GameSquare on the Arrangement and Fogler, Rubinoff LLP and Dorsey Whitney LLP are acting as counsel to Engine Gaming on the Arrangement.

Contact

GameSquare Esports Inc.

For further information, please contact Investor Relations for GameSquare Esports Inc.:

Paolo DiPasquale, Chief Strategy Officer

Phone: (216) 464-6400

Email: IR@gamesquare.com

Andrew Berger

Phone: (216) 464-6400

Email: IR@gamesquare.com

Engine Gaming and Media, Inc.

For further information, please contact Investor Relations for Engine Gaming & Media, Inc.:

Shannon Devine

MZ North America

Main: 203-741-8811

GAME@mzgroup.us

Notice Regarding Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements“) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: the combined entity’s future performance and revenue; continued growth and profitability; the combined entity’s ability to execute its business plans; and the proposed use of net proceeds of the Offering. These forward-looking statements are provided only to provide information currently available to Engine Gaming and GameSquare and are not intended to serve as and must not be relied on by any investor as, a guarantee, assurance or definitive statement of fact or probability. Forward-looking statements are necessarily based upon a number of estimates and assumptions which include, but are not limited to: the combined entity being able to grow its business and being able to execute on its business plan, the combined entity being able to complete and successfully integrate acquisitions, the combined entity being able to recognize and capitalize on opportunities and the combined entity continuing to attract qualified personnel to supports its development requirements. These assumptions, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: Engine Gaming and GameSquare’s ability to complete the Arrangement; the combined entity’s ability to achieve its objectives, the combined entity’s successfully executing its growth strategy, the ability of the combined entity to obtain future financings or complete offerings on acceptable terms, failure to leverage the combined entity’s portfolio across entertainment and media platforms, dependence on the combined entity’s key personnel and general business, economic, competitive, political and social uncertainties including impact of the COVID-19 pandemic and any variants. These risk factors are not intended to represent a complete list of the factors that could affect Engine Gaming and GameSquare which are discussed in each of Engine Gaming and GameSquare’s most recent MD&A. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. Engine Gaming and GameSquare assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

Completion of the Arrangement is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable, disinterested shareholder approval. Where applicable, the Arrangement cannot close until the required shareholder approval is obtained. There can be no assurance that the Arrangement will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Engine Gaming and GameSquare should be considered highly speculative.

This press release is not an offer of the securities for sale in the United States. The securities have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an exemption from registration. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this news release.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

[1] Financial statements of GameSquare and Engine Gaming are available for review on each company’s respective profile at www.sedar.com and summary financial results are provided below.

SOURCE: GameSquare Esports Inc.

View source version on accesswire.com:

https://www.accesswire.com/730831/GameSquare-Esports-Inc-and-Engine-Gaming-Media-Inc-Enter-Definitive-Arrangement-Agreement