Retail Traders Looking in the Right Place, Never Had it So Good

Do you feel like every time you buy a stock, it goes down? You’re not alone, it’s a common complaint. Yet there’s a large universe of industries, companies, and ideas to choose to invest in. And at the same time, a flood of people who make a living telling you where you should invest. So why do so many investors buy after a run-up, perhaps even at the high, then watch their holdings languish?

Part of the problem may be in how the self-directed investor, consumes information. Watching investment news, digesting a fast-talking influencer’s words, or being told which moving average to rely on is, at best a good start to knowing what the masses are seeing, but taking time away from the hype, and absorbing well-presented material, data, and other information will provide a better look at companies in a way that could help prevent the late-in-the-trade buys that retail investors are known for.

Multiple Sources of Investment Information

When it comes to making investment decisions, the probability of success should increase if you take a look from different angles by using a few sources of trusted information. Beginner investors learn quickly that, if success was as easy as just buying your favorite TV stock pickers love of day, viewers of shows like Mad Money on CNBS would all be rich. It clearly doesn’t work that way.

But if you’re not prone to acting on hype, watching stockpickers fall in and out of love, every show is entertaining. If you are prone to hype, as most humans are, you have to be suspicious of anyone who has to come up with a stock or two for each show (or article). Then speak or write about it with a convincing and engaging style. Keep in mind, viewers or readers are their customers, they lose customers if they’re boring, they gain customers by instilling hope. Yet, as a person who managed billions in institutional funds, I can attest to you that most days, it is best to sit on your hands, monitor your current holdings, and keep scouring resources for high-probability stocks to watch.

Celebrity CEOs

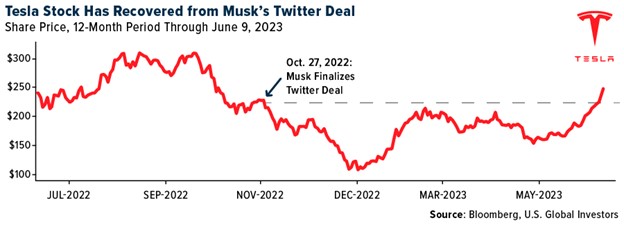

Another problem with mainstream media’s financial news is the coverage universe is typically only familiar household names. You can turn on Fox Business, read the Wall Street Journal, or even Yahoo Finance and expect that on any given day there will be information on Apple, Tesla, and Microsoft, and they’ll be highlighting celebrity CEOs of similar companies. As mentioned earlier, there is a large universe of stocks to choose from. If the only stocks that have your attention are the huge names, largely held by funds and transacted by Wall Street’s most powerful, you could be in the same position you’d be in if you came down from the stands at a pro basketball game and played for a couple of quarters. You’re considered lucky if you put any points on the board.

Broadening your watchlist stocks to include companies that you have to search for, because they aren’t hyped, may include making a few additions to your stock market news, information, and analysis regimen.

News Information and Analysis

In addition to the traditional sources for investment ideas, including TV market analysts, stock picking columnists, and any paid-for advertorial seen on even big name financial websites and publications. You may wish to explore lesser-known companies and review emotionless equity investment research. Outside of stock research, you may find an appealing company you never heard of by viewing videos that invite you to “Meet the CEO” and listen to someone who knows the company better than anyone. If you’re in a metropolitan area, you may get on an email list to see what roadshows are within driving distance so you can attend and better understand an opportunity. Investors who aren’t near financial hubs that attract roadshows can still benefit from face-to-face presentations, including questions and answers at an investor conference geared toward their interests.

Investment Research

Receiving up-to-date research from analysts that never forget they have a reputation to maintain used to be difficult for retail investors. It was expensive to subscribe to financial firms’ research, and with good reason. Large investor’s could afford it because they stood to benefit most from the insights, justifying the cost. And the firm doing the research and setting the price was justified because maintaining a staff of analysts is expensive. But it kept a lot of good info from smaller players. This has evolved recently and become more fair.

The availability of quality stock research began to fall off last decade as regulatory bodies began making rules on who can provide valuable research, based on financial licenses, company registrations, and compensation arrangements.

Equity research that was once paid for by subscribers, has now taken a similar path as “free” trading apps. Retail customers, or institutional are not the ones paying for it, in many cases, the company that wants to be evaluated is. This is called company-sponsored research or CSR.

There are a number of firms that now provide this investor service, Channelchek, with the expertise of the equity analysts at Noble Capital Markets, is the largest provider of CSR in North America.

So no hype investment research is available, and more companies are recognizing how it helps interest in their stock if investors have trusted sources evaluating their business.

Video Presentations

While it isn’t hard to find the CEO of Tesla or many other mega-cap companies talking about their plans, the CEO’s of the thousands of less celebrated, often higher potential, companies have to be sought out and there has to be a means to understand their plans, ideas, and expectations. Technology has helped solve some of this. In fact YouTube and similar platforms has opened the floodgates to information on everything from fixing your air conditioner, to how to braid hair. While there are many video presentations best avoided, presentations direct from company management, in a six months or younger video, can provide tremendous insight, and confidence to pull the buy trigger, or even confidence to decide not to.

A large selection of content of this type can be found in Channelchek’s Video Library.

In-Person Roadshows

A roadshow is essentially management of a company, getting out of their office and meeting in different towns with investors. This could be done individually, perhaps at a financial institutions office, or in a reserved area in a public restaurant or other venue. This is particularly interesting as not only do investors get to look the person presenting directly in the eye, they benefit from questions being asked from all the other interested investors – they often have a great question you hadn’t thought of.

While every firm that conducts road shows has its own way of getting the word out, Noble Capital Markets organized roadshows list their calendar of roadshows on Channelchek.

Investment Conferences

While roadshows are great if it’s a company you want to hear from, and if it is convenient, a conference with many interesting companies, and perhaps in a vacation destination, can really help investors in a few short days hear many management presentations, ask questions and listen to other’s questions, and meet and network with investors of all levels. These events tend to be held in vacation destinations, so self-directed investors tend to bring family members, and professionals can spend a productive day of work enjoying a beautiful change of scenery.

I won’t even try to hide that I have a favorite conference.

Each year Noble Capital Markets puts on a popular two or three day investor event called NobleCon. Now in its 19th year, it attracts companies with interesting stories and business models from various industries, and professional and retail investors from three continents.

Now in its 19th year, NobleCon19 will be held in Late Fall 2023. The plans are pretty hush, but the opportunities for presenting companies and those looking to enhance their portfolios, I’m told, will be even greater than previous NobleCons. That’s a high hurdle.

Take Away

Understanding that the person on TV saying a stock is a buy, sell, or hold is, in a way, part of a reality TV show that needs to entertain to retain an audience, could improve your investment performance. Much of what is written is the same. Frankly, most days, there is little or nothing worth acting on, but they aren’t going to tell you this – it’s just not in their best career interest.

Alternative sources of ideas and information involve less hype and include, company- sponsored research, management discussions on video, roadshows, and investment conferences.

Most years there are many opportunities, most of these are under the radar companies that, even after they do well, are still under the radar. The ability to find these companies is becoming easier to all investors, but not if they are not looking for it.

Paul Hoffman

Managing Editor, Channelchek