Research News and Market Data on ZVSA

May 12, 2023

Key Highlights:

- Continued progress has been made in advancing an investigator-initiated clinical trial to gain human proof-of-concept for Cholesterol Efflux Mediator™ VAR 200 in patients with renal disease

- Announced publication of several peer-reviewed journal articles supporting ASC inhibition as a promising therapeutic target – data continue to demonstrate that multiple types of inflammasomes are activated in various conditions (Alzheimer’s disease, traumatic brain injury, and injury from intracortical implants), and substantiate that extracellular release of ASC specks to neighboring cells heighten and perpetuate damaging inflammation leading to disease progression in conditions such as Parkinson’s disease and alcoholic hepatitis

- Added three internationally recognized experts in the field of glomerular disease to Renal Scientific Advisory Board, and an internationally recognized authority in the field of innate immunity to our Inflammatory Disease Scientific Advisory Board

- Enhanced our Board of Directors with addition of three biopharmaceutical leaders with impeccable credentials and a proven track record of success

WESTON, Fla., May 12, 2023 (GLOBE NEWSWIRE) — ZyVersa Therapeutics, Inc. (Nasdaq: ZVSA; “ZyVersa”), a clinical stage specialty biopharmaceutical company developing first-in-class drugs for treatment of patients with renal and inflammatory diseases who have unmet medical needs, provides a corporate update and reports financial results for the first quarter of 2023 ending March 31, 2023.

“This is a very exciting time in the growth and evolution of ZyVersa as we seek to build shareholder value through development of first-in-class drugs at the forefront of innovation for renal and inflammatory diseases,” said Stephen C. Glover, Co-founder, Chairman, Chief Executive Officer, and President of ZyVersa. “We are currently advancing a dynamic pipeline of drug candidates with multiple programs built around our two proprietary technologies – Cholesterol Efflux Mediator™ VAR 200 for treatment of kidney diseases and Inflammasome ASC Inhibitor IC 100 for treatment of multiple CNS and other inflammatory diseases. We believe that both technologies have transformative potential, enabling development of drugs for patients who have limited or no therapeutic options.”

Mr. Glover continued: “Highlighting our Inflammasome ASC Inhibitor IC 100, ZyVersa expects to complete IC 100’s preclinical program this year, with an Investigational New Drug (“IND”) submission anticipated in second quarter of 2024. We were pleased to report publication of data in several peer-reviewed journal articles demonstrating the role of ASC specks in heightening and perpetuating damaging inflammation in neurological conditions (Alzheimer’s disease, Parkinson’s disease, and traumatic brain injury), and in alcoholic hepatitis. These data support the therapeutic potential of inhibiting ASC and ASC specks with IC 100 to control inflammation associated with various inflammatory diseases.”

“Regarding Cholesterol Efflux Mediator™ VAR 200, ZyVersa continues to leverage relationships with experts in the field of renal disease,” stated Mr. Glover. “To that end, we welcomed three new members to our Renal Disease Scientific Advisory Board. We look forward to benefitting from their decades of experience as we advance our investigator-initiated trial to evaluate VAR 200 in patients with renal disease, expected to begin in the fourth quarter of 2023.”

FIRST QUARTER AND RECENT PROGRAM UPDATES

Targeting Renal Disease with Phase 2a-Ready Cholesterol Efflux Mediator™ VAR 200

- Continued progress is being made to launch an investigator-initiated clinical trial in patients with renal disease to gain human proof-of-concept for Cholesterol Efflux Mediator™ VAR 200, with trial initiation expected in the fourth quarter of 2023

- Added to ZyVersa’s Renal Scientific Advisory Board (1) Dr. Daniel C. Cattran, Professor of Medicine, University of Toronto; (2) Dr. Fernando C. Fervenza, Professor of Medicine, Mayo Graduate School of Medicine and Director of the Nephrology Collaborative Group; and (3) Dr. Richard J. Glassock, Professor Emeritus, David Geffen School of Medicine, UCLA

Inflammasome ASC Inhibitor IC 100: Targeting Inflammation Associated with Multiple CNS and Other Inflammatory Diseases

- On track to complete IND-enabling preclinical studies by end of year, with the goal of filing an IND application with the U.S. Food and Drug Administration in the second quarter of 2024

- Highlighted peer-reviewed journal articles supporting the potential of ASC inhibition to control damaging inflammation associated with numerous diseases, including Alzheimer’s disease, Parkinson’s disease, traumatic brain injury, and alcohol induced hepatitis

- Added to ZyVersa’s Inflammatory Disease Scientific Advisory Board Dr. Douglas Golenbock, The Neil and Margery Blacklow Chair in Infectious Diseases and Immunology, and Professor and Chief, Division of Infectious Diseases and Immunology at the UMass Chan Medical School

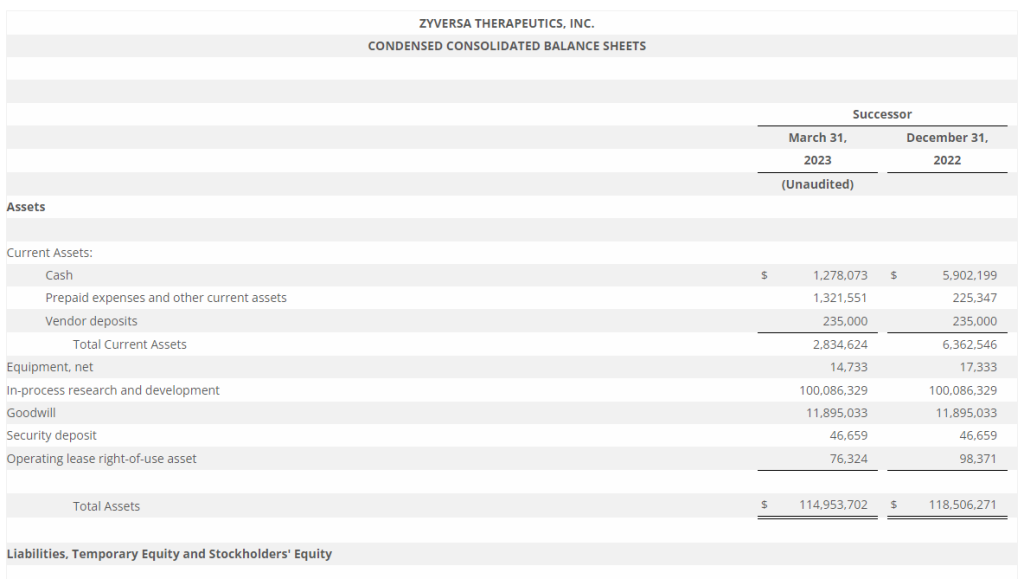

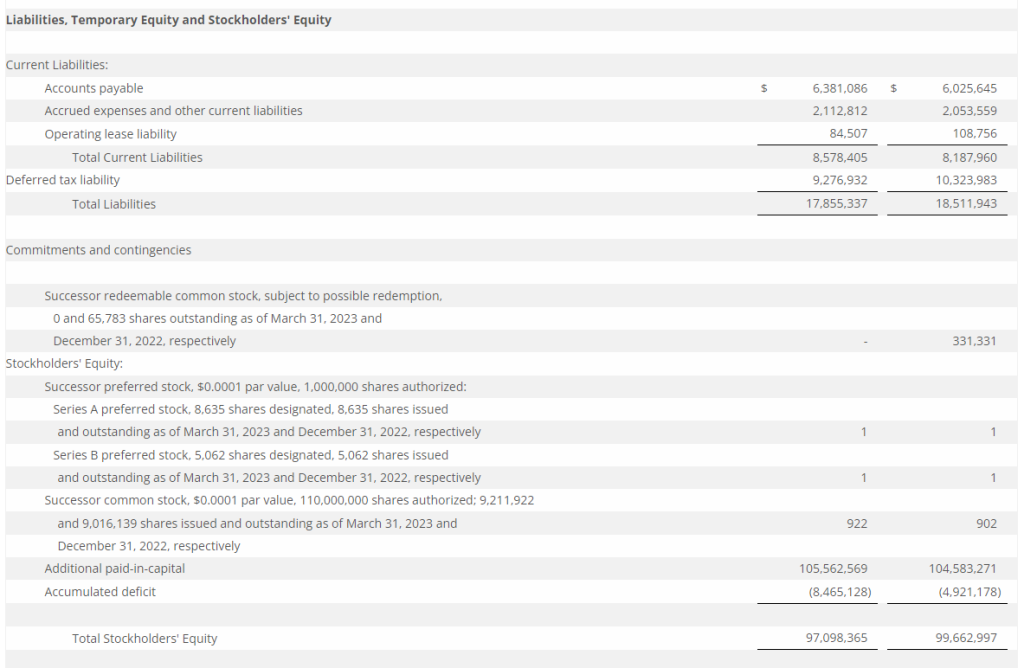

FIRST QUARTER FINANCIAL RESULTS

Since its inception in 2014 through March 31, 2023, ZyVersa has not generated any revenue and has incurred significant operating losses and negative cash flows from its operations. Based on our current operating plan, we expect our cash of $1.3 million as of March 31, 2023, will only be sufficient to fund our operating expenses and capital expenditure requirements on a month-to-month basis. ZyVersa will need additional financing to support its continuing operations. ZyVersa will seek to fund its operations through public or private equity or debt financings or other sources, which may include government grants and collaborations with third parties.

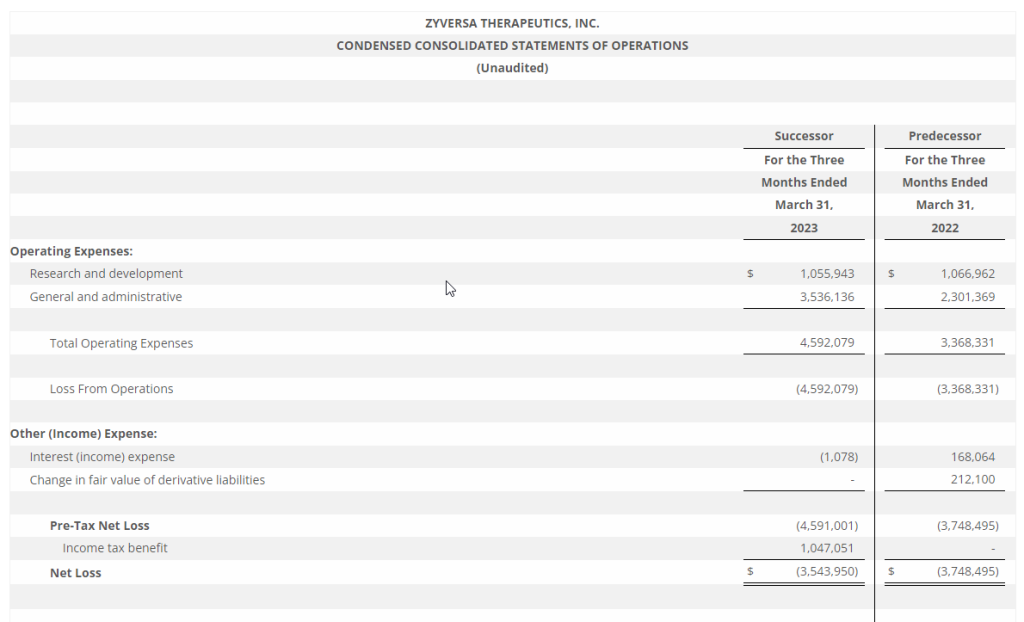

Research and development expenses were consistent at approximately $1.1 million for the three months ended March 31, 2023 (“Successor Period”), with an immaterial decrease of $11 thousand or 1.0% from the three months ended March 31, 2022 (“Predecessor Period”).

General and administrative expenses were $3.5 million for the three months ended March 31, 2023, an increase of $1.2 million or 53.7% from $2.3 million for the three months ended March 31, 2022. The increase is primarily attributable to an increase of $0.4 million in director and officer insurance, a $0.4 million increase in marketing costs for investor and public relations, and $0.4 million in payments for the Effectiveness Failure related to the PIPE shares.

Net losses were approximately $3.5 million for the three months ended March 31, 2023, with an improvement of $0.2 million or 5.5% compared to a net loss of approximately $3.7M, for the three months ended March 31, 2022. Net losses for the three months ended March 31, 2023 benefited from a $1.0 Million deferred tax benefit compared to none for the year earlier period.

About ZyVersa Therapeutics, Inc.

ZyVersa (Nasdaq: ZVSA) is a clinical stage specialty biopharmaceutical company leveraging advanced, proprietary technologies to develop first-in-class drugs for patients with renal and inflammatory diseases who have significant unmet medical needs. The Company is currently advancing a therapeutic development pipeline with multiple programs built around its two proprietary technologies – Cholesterol Efflux Mediator™ VAR 200 developed to ameliorate renal lipid accumulation that damages the kidneys’ filtration system in patients with glomerular kidney diseases, and Inflammasome ASC Inhibitor IC 100, targeting damaging inflammation associated with numerous CNS and other inflammatory diseases. For more information, please visit www.zyversa.com.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this press release regarding matters that are not historical facts, are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These include statements regarding management’s intentions, plans, beliefs, expectations, or forecasts for the future, and, therefore, you are cautioned not to place undue reliance on them. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. ZyVersa Therapeutics, Inc (“ZyVersa”) uses words such as “anticipates,” “believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,” “continue,” “guidance,” and similar expressions to identify these forward-looking statements that are intended to be covered by the safe-harbor provisions. Such forward-looking statements are based on ZyVersa’s expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements due to a number of factors, including ZyVersa’s plans to develop and commercialize its product candidates, the timing of initiation of ZyVersa’s planned preclinical and clinical trials; the timing of the availability of data from ZyVersa’s preclinical and clinical trials; the timing of any planned investigational new drug application or new drug application; ZyVersa’s plans to research, develop, and commercialize its current and future product candidates; the clinical utility, potential benefits and market acceptance of ZyVersa’s product candidates; ZyVersa’s commercialization, marketing and manufacturing capabilities and strategy; ZyVersa’s ability to protect its intellectual property position; and ZyVersa’s estimates regarding future revenue, expenses, capital requirements and need for additional financing.

New factors emerge from time-to-time, and it is not possible for ZyVersa to predict all such factors, nor can ZyVersa assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking statements included in this press release are based on information available to ZyVersa as of the date of this press release. ZyVersa disclaims any obligation to update such forward-looking statements to reflect events or circumstances after the date of this press release, except as required by applicable law.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy, any securities.

Corporate and IR Contact

Karen Cashmere

Chief Commercial Officer

kcashmere@zyversa.com

786-251-9641

Media Contacts

Tiberend Strategic Advisors, Inc.

Casey McDonald

cmcdonald@tiberend.com

646-577-8520

Dave Schemelia

Dschemelia@tiberend.com

609-468-9325