Diversifying Your Diversified Portfolio

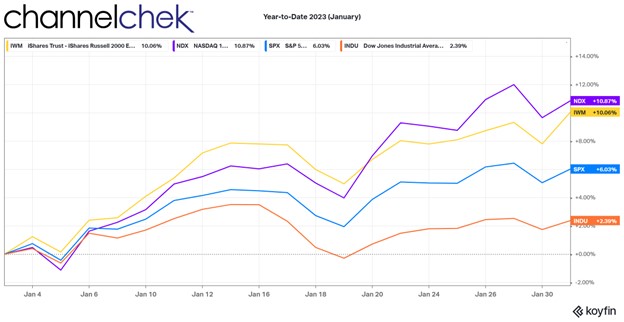

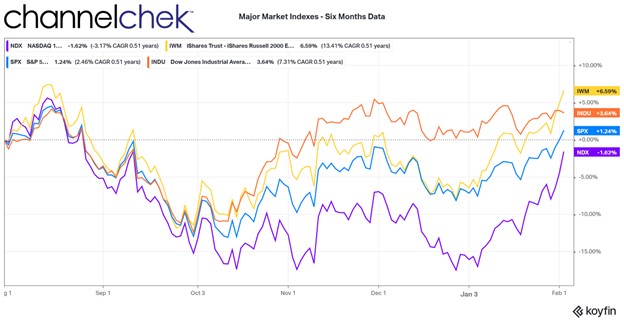

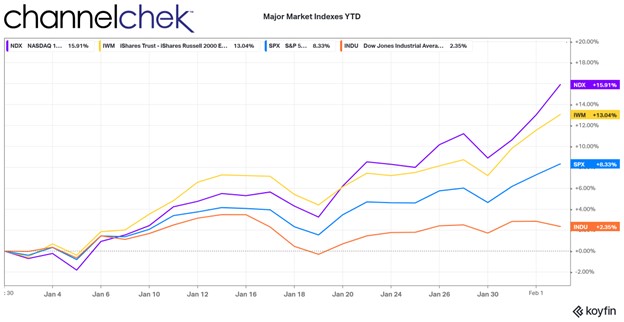

Different investing environments call for adjustments to portfolios. What’s in your equity portfolio mix? Whether you’re an index investor, stock picker, or a 60/40 with a regular rebalance investor, stocks of different companies, different sectors, and different sizes are not the same. The characteristics of each slice of your portfolio can swing performance from negative to positive. For example, the Dow Industrials have returned less than 2.50% this year, while the large-cap Nasdaq 100 and the small-cap Russell 2000 have exceeded the Dow’s performance by well over 10%.

Performance

The reason for the tech large-cap resurgence may be a reaction to last year’s sell-off, a declining dollar, some surprise strength in earnings, or any combination of things. Can the large-cap rally be trusted? Time will tell. Small-caps are also doing well; they had been running behind the other indexes in terms of performance based on price/earnings averages and overall return. The two have different forces driving the performance of each; for this reason, investors looking to diversify could find comfort in allocating to large and smaller stocks if they haven’t already. The 60% of a 60/40 mix should be mixed and varied if the investor is truly interested in diversification. Recent performance shows small-cap stocks have outperformed over the last six months with the Dow Industrials in second place and measured year-to-date with the Dow barely getting off the starting line – the small-cap index however has taken off.

The Russell 2000 index turned around in late summer last year after it hit its low. The large-caps didn’t bottom until early winter, a little over a month ago. This discrepancy in timing shows they trade on different factors and often have very different investors. One example is large-cap stocks are in the news each day and easily driven by hype, while small-cap stocks that are out of the spotlight are driven by other factors, including growth prospects, sharp pencil analysis, and even raw speculation.

Market Strength

The optimism that kicked off 2023, includes the Fed nearing the end of its aggressive tightening, a healthy labor market, and an economy that is still flush with capital looking for a home. Add in a weakening dollar, as US interest rates have remained stagnant, and last year’s weak markets may continue to unwind their negativity as higher highs are reached.

A Word on Diversification

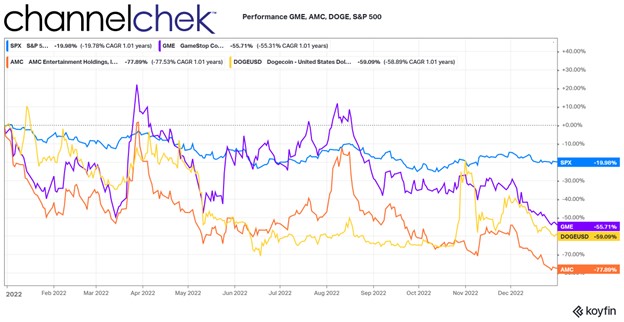

An investor in a fund that tracks the S&P 500 may feel they have the diversification of 500 multi-industry stocks. They do have exposure to 500 stocks, however the top 10 of the 500 represents more than 25% of the performance of the index – and most of these would qualify as tech stocks. For this reason diversifying away and into investments that are less correlated to tech may be prudent. Small-cap stocks, especially considering the past six months, would seem to be the best offset to this concentration risk.

If an investor is astute enough to understand market dynamics, digest research on industries and companies within those industries, and know how to recognize high-quality objective research, the investor may do better hand selecting a variety of stocks rather than being an index investor or even a single index investor.

This experience doesn’t happen automatically, if you are already there, may I suggest signing up for Channelchek’s daily emails to get introduced to, and stay on top of some interesting small companies (small and microcap)? And if you don’t believe that you are at that level yet, let Channelchek build on your knowledge with exclusive video content, insightful articles, and top-tier company research?

The year 2023 will be filled with opportunity. Let Channelchek help you explore. Complementary registration here.

Managing Editor, Channelchek

Sources

https://www.barrons.com/articles/tech-earnings-amd-intel-stock-51675279355?mod=hp_LEAD_1