Understanding ImmunoGen’s Great Performance, and Related Stocks

Discovering a company developing a novel and more effective mechanism or method of doing something, and then investing in shares, is one reason investors pay attention to small-cap stocks. Innovations that improve results of any kind are valuable and usually rewarded. Nowhere is this more true than in biotech or biopharma stocks. After all, better treatments for frightening diseases will always be in demand. However, the big difference between the biotech industry and say, computer technology, is the approval process. FDA requirements are many and approval is slow and uncertain – overall, it’s a high bar to overcome.

Is it Worth it for Investors?

Over the past two days, ImmunoGen (IMGN:Nasdaq) a U.S. based clinical-stage biotech company, has had the kind of moonshot trajectory that investors dream about. The company reported promising topline phase III data and overall survival benefits in folate receptor alpha (FRα)-positive platinum-resistant ovarian cancer patients. Immunogen plans to submit the drug for full approval in the U.S. and Europe. The company’s therapy is a is a first-in-class ADC comprising folate receptor alpha-binding antibody. The stock during the first four days of this week is up over 145%. The reason for the sudden moonshot is the company announced that it expects full FDA approval of one of its ADC candidates (Elahere). ADC, or antibody-drug conjugates, are a very targeted way to treat some solid tumor cancers, and seem to represent the “more effective mechanisms or method of doing something” mentioned above as sought after by small-cap investors.

Excitement Over ADC

An antibody-drug conjugate consists of an antibody that targets a specific antigen or receptor on cancer cells, it carries with it an impactful anticancer drug. The antibody which is linked to a toxin such as a chemotherapy drug, is found by folate receptors on the cancer cells; they will bind with the receptors on the cancer cells, the toxic payload is then delivered to the cells, which internalize it. Once in the cancer cell, the toxin is released. This therapy is designed to result in the selective killing of cancer cells while minimizing damage to healthy cells. ADCs have continued to show promising results in treating various types of cancer and are an active area of research by a few publicly traded small-cap biotechs developing alternatives in oncology.

Stock Market Behavior

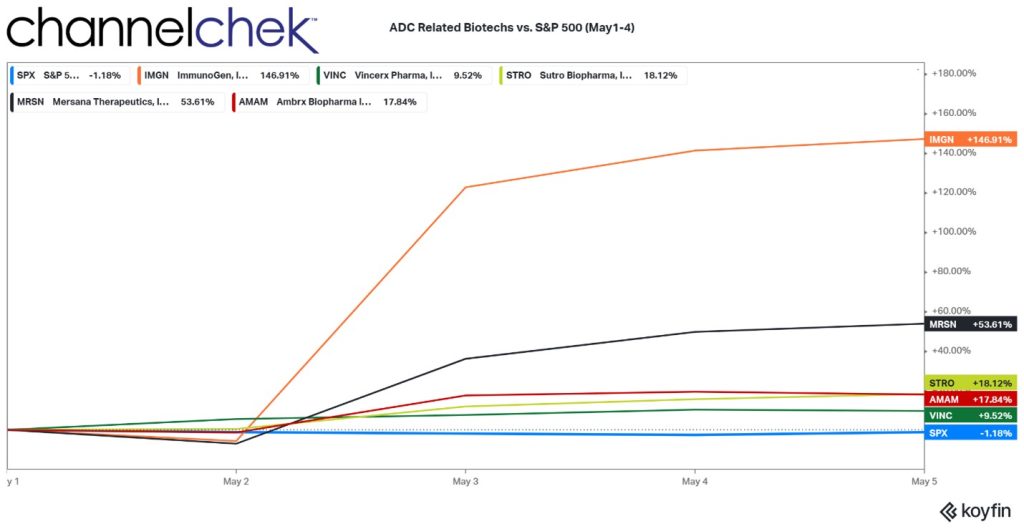

As with other industries, the stocks of the peer group will often respond to news of the other. This was the case this week for the subgroup of stocks that are in various stages of researching ADC therapies against cancer.

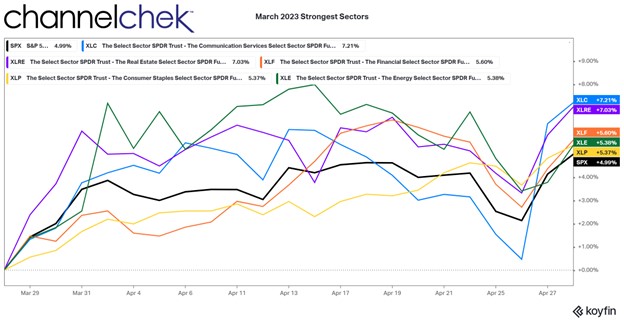

As the chart below indicates, since May 1, the S&P 500 sank by more than 1.00%, yet cancer research biotech, which is not highly correlated to the overall market, rewarded investors in companies working with ADC technology for better cancer outcomes.

ADC Companies that Rallied this Week

Among the stocks that seemed to have gotten a boost from Immunogen’s good news are:

Ambrx Biopharma (AMAM:Nasdaq) is a clinical-stage biologics company. The company’s lead product candidate is ARX788, an anti-HER2 antibody-drug conjugate (ADC), which is being investigated in various clinical trials for the treatment of breast cancer, gastric/gastroesophageal junction cancer, and other solid tumors.

Mersana Therapeutics (MRSN:Nasdaq) is a clinical-stage biopharmaceutical company developing antibody-drug conjugates (ADC) for cancer patients with unmet needs.

Vincerx Pharma (VINC:Nasdaq) is a four-year-old clinical-stage biopharmaceutical company. VIP236, a small molecule drug conjugate that is in Phase 1 clinical trials to treat solid tumors. The company’s preclinical stage product candidates include VIP943 and VIP924 for the treatment of hematologic malignancies.

Sutro Biopharma (STRO:Nasdaq) is a clinical-stage oncology company that develops site-specific and novel-format antibody-drug conjugates (ADC). The company’s candidates include STRO-001, an ADC directed against the cancer target CD74 for patients with multiple myeloma and non-Hodgkin lymphoma, an ADC directed against folate receptor-alpha for patients with ovarian and endometrial cancers, which is in Phase 1 clinical trials.

As these biotech companies that are focused on ADC cancer treatment move their products through clinical trials, each success (or failure) is likely to impact the group. Not yet in the publicly traded group, but also being watched by those involved with ADC cancer stocks is OS Therapies.

OS Therapies (OSTX) is a U.S.-based biotech company that is developing therapies to treat specific cancers. The company completed its filing with the SEC last month to go public through an initial public offering (IPO). The biotech company hopes to list its shares on the NYSE American and trade under the symbol OSTX. It is a clinical-stage phase II biopharmaceutical company focused on the identification, development, and commercialization of treatments for Osteosarcoma (OS) and other solid tumors. There have not been any new treatments approved by the FDA for Osteosarcoma for more than 40 years.

The lead core product candidates OS Therapies is researching are OST-HER2 and the OST-Tunable Drug Conjugate (OST-TDC) platform. The company says it intends to expand its pipeline beyond osteosarcoma into solid tumors. The OST-Tunable Drug Conjugate (OST-TDC) platform could deliver the next-generation ADC technology with the intent of providing a more potent drug and better efficacy with an improved safety profile, a potential “Best-in-Class”. Importantly, OS Therapies lead ADC drug will target folate receptor alpha-binding utilizing a small molecule ligand the same druggable target to Immunogen’s (IMGN) folate receptor alpha-binding site which is something that could become extremely notable to investors and larger pharmaceutical companies. Immunogen has now proved that folate receptor alpha-binding site can work.

The next generation ADC, according to the company filing, will be targeting ovarian, lung and pancreatic cancers. “Tunable” is a term used in drug development that refers to the properties that can be influenced by chemical modifications, and “antibody-drug conjugate.”

An IPO date for OS Therapies has not yet been confirmed.

Take Away

Stocks tend to trade up or down depending on the mood of the market. The current mood is that the overall market may still be overpriced. As such, 2023 has been marked by the bulls and bears duking it out – without any clear direction.

Biotech stocks tend to be far less correlated to what is going on in other areas of the market. This makes the sector and various peer groups worth a visit in bad markets. For example, when the pandemic began to unfold, many biotech stocks rocketed during the same period the overall market was crashing.

Within biotech, companies those working on the production of related technology typically trade in rough tandem with each other. Biotech stocks developing ADC, presumed to be a breaktrough in treating many types of cancers, have gotten a lift in anticipation of the imminent success of one of their peers.

To do a deeper dive into small-cap names, scroll up to the search bar found next to the Channelchek logo, then enter a company name, ticker, or other keyword.

Managing Editor, Channelchek

Source

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10137214/

https://www.nature.com/articles/s41416-022-02031-x

https://www.sec.gov/Archives/edgar/data/1795091/000121390023025493/fs12023_ostherapies.htm#T99001