Avoiding a Hurricane May Mean Adjusting Your Portfolio

Like most people that live in Florida, I usually first learn of approaching hurricanes from concerned family members up North. My reaction is probably different than others. My first thoughts on rare news events is to ask myself, “is this bullish or bearish?” When it comes to hurricanes, there is an answer – like most events that impact stocks, the answer is, “it depends.” Getting out of the way of a hurricane could also mean a slight adjustment to holdings.

I will mention that the toll on life and property of natural disasters, or any travesty, is not lost on me. But as investors, we must control the risks that we can and look for the rainbow in situations we have no control over.

Economic Damage

Dubravko Lakos-Bujas, JP Morgan’s head of U.S. equity and quantitative strategy, shared insights on the economic impact of hurricanes a couple of years before hurricane Ian struck Naples Florida. But the value of the information has not changed. “Major U.S. hurricane landfalls have had less significant impact on aggregate market performance (~2% decline) given the subsequent pick-up in disaster-induced public and private spending,” Mr. Lakos-Bujas said. “The most significant impact on equity performance is seen at the stock and sub-industry level.”

Money May Grow on Trees

Does your portfolio contain Orange Growers? Gulf Coast REITS? Companies that operate in the affected area of the storm see a loss in production as they close up and, at the same time, a jump in costs as they make repairs. These stocks are most likely to underperform. For those companies in the repair business, for example, lumber and roofing supplies, they could generate business whether a storm actually makes landfall or not. The rebuilding effort will cost insurance companies with a concentration of insured properties in the path of a storm.

Lakos-Bujas warned, “The underperformance should be concentrated in insurance (i.e. property loss coverage), and companies with Hotels, Restaurants, Leisure, & Airlines (i.e. based on occupancy/traffic, rising commodity costs), Telecom and Cable (i.e. capital expenditure tied to repair and potentially lower revenue per unit), and Industrials (i.e. rising input costs, disruption in production and transportation) depending on geographic footprint.”

Solutions tend to gravitate toward problems, even if those problems include damage and destruction. This is a good thing, it is capitalism working in a way that helps others. This help is profitable and could make some sectors outperformers. “The largest outperformers include industries tied to replacing and/or repairing existing capital stock (i.e. Energy Equipment & Services, Communication Equipment, Autos), transportation and logistics (i.e. Distribution, Air Freight, Trading Companies), and construction (Basic Materials and Engineering),” Lakos-Bujas’ said.

The analysis of the JP Morgan equity strategist is based on a study of 31 hurricanes between 1965 and 2014, which had a combined cost of $520 billion. Two o the large storms, Irma and Harvey, represent a high percentage of the total cost.

“Based on current unofficial damage estimates for hurricanes Harvey and Irma, losses this year are expected to exceed 50% of combined costs over the last 50 years,” he said. “These outsized losses could currently drive more pronounced moves at the stock and sub-industry levels than historically.”

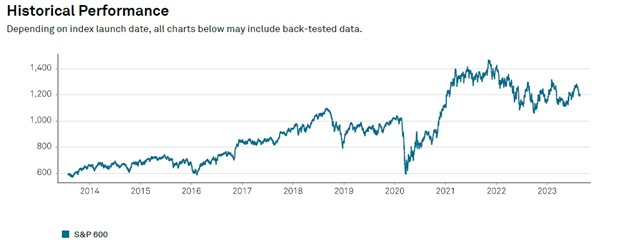

So, a person may live across the country or around the globe from the storm and still feel an impact. For historical context, the S&P 500 (^GSPC) has seen an average decline of 2% in the week following a hurricane’s passing.

Rebuilding Benefits Stockholdings Differently

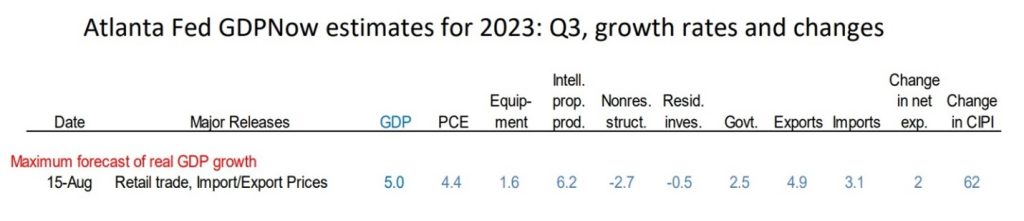

Much of the backstop in the economy and the markets is based on the idea that rebuilding after a storm is stimulative. Households and businesses suddenly jam work that needed to be done into a short time span and spend much more on what could’ve been routine maintenance. Economists say that the near-term impact on GDP is a net positive once the hurricanes pass. A lasting positive impact occurs if a natural disaster brings about rebuilding that improves on the existing structures or facilities instead of just restoring them to their previous state.”

One caveat is that labor markets have been tight. Most other years, roofers and builders flocked to the highest bidders and the flow of money helped speed the rebuilding process. If there are currently not sufficient human resources, this will push costs up more than they otherwise would have. Unfortunately, there continue to be reports of labor shortages in many industries, including construction. Fox Business News reported on August 28, 2023, “America’s shortage of skilled workers is impacting the ability of businesses in the construction and manufacturing industries to staff their businesses and complete jobs on time.” This situation could certainly slow any needed rebuild.

As wildfires in Hawaii have shown us, funds for rebuilding efforts are further complicated by politics. Three of the Floridian candidates for president, including the governor, are from a party that is not in power

Take Away

Opportunity comes in all forms. This includes opportunity to avoid a dip in some of your holdings, and an opportunity to capitalize on increased company profits this includes disasters of all types. Weather events can impact stock performance of individual companies and industry subsets. At roughly a negative 2% average, the overall market could impact investors over the following 30 days at a rate that feels like normal monthly swings.

As a positive thought, after the storm clears, come join Channelchek, Noble Capital Markets and an expected 150 public companies companies all converging on South Florida in early December for NobleCon19, the investment conference where you’ll discover actionable investment ideas inspired directly from company management. Learn more here.

Managing Editor, Channelchek

Sources

https://finance.yahoo.com/news/hurricane-irma-mean-stocks-105038376.html