Research News and Market Data on CVGI

November 1, 2023

EPS of $0.22, up 100% year-over-year

Adjusted EBITDA of $16.6 million, up 16.1% year-over-year

Our strategy continues to favorably impact our results as Electrical Systems revenues were up 16.8% year-over-year

NEW ALBANY, Ohio, Nov. 01, 2023 (GLOBE NEWSWIRE) — CVG (NASDAQ: CVGI), a diversified industrial products and services company, today announced financial results for its third quarter ended September 30, 2023.

Third Quarter 2023 Highlights (Compared with prior year, where comparisons are noted)

- Revenues of $246.7 million, down 1.9% due primarily to higher revenue in the prior year as a result of a COVID backlog in Asia-Pacific which offset an increase in revenue in Electrical Systems in 2023.

- Operating income of $12.4 million, up 30.5%; adjusted operating income of $12.5 million, up 17.9%. Improved operating income was driven primarily by improved pricing and cost management, partially offset by volume decreases.

- Net income and adjusted net income were both $7.3 million, or $0.22 per diluted share, compared to net income of $3.6 million, or $0.11 per diluted share and adjusted net income of $5.1 million, or $0.15 per diluted share.

- Adjusted EBITDA of $16.6 million, up 16.1% with an adjusted EBITDA margin of 6.7%, up from 5.7%.

- New business wins year-to-date are expected to be approximately $140 million when fully ramped. The majority of the new business awards continue to be in the Electrical Systems segment.

- Strong free cash flow and debt pay down reduced our leverage ratio down to 1.5x from 2.7x.

Robert Griffin, Chairman of the Board and Interim President and Chief Executive Officer, said, “CVG continues to execute on its strategic long-term plan, which again delivered year-over-year bottom line improvements in the quarter. Electrical Systems remains a key growth area for the Company, as evidenced by the strong revenue growth compared to last year and the successful start-up at our new Electrical Systems facilities in Aldama, Mexico, and Tangier, Morocco, which has gone very well. As always, I would like to thank our global CVG teams for their hard work, dedication, and commitment as we continue to execute our strategic goals.”

Andy Cheung, Chief Financial Officer, added, “CVG continued executing on our strategy, delivering strong year-over-year improvements in profitability during the quarter. Despite the strong performance, revenues declined slightly year-over-year against a tough comparable base year in 2022, when our Asia-Pacific business benefited from a post-COVID increase in backlogged sales orders. We also had improved earnings and generated strong free cash flow of $12.5 million during the quarter, further strengthening our financial foundation, and reduced our leverage to 1.5x from 2.7x in the third quarter last year.”

“Going forward, we remain committed to driving strong free cash flow, paying down debt, and investing to support our growing, diverse portfolio of businesses.”

Third Quarter Financial Results

(amounts in millions except per share data and percentages)

| Third Quarter | |||||||||||||

| 2023 | 2022 | $ Change | % Change | ||||||||||

| Revenues | $ | 246.7 | $ | 251.4 | $ | (4.7 | ) | (1.9)% | |||||

| Gross profit | $ | 33.9 | $ | 26.8 | $ | 7.1 | 26.5% | ||||||

| Gross margin | 13.7 | % | 10.7 | % | |||||||||

| Adjusted gross profit 1 | $ | 34.0 | $ | 27.4 | $ | 6.6 | 24.1% | ||||||

| Adjusted gross margin 1 | 13.8 | % | 10.9 | % | |||||||||

| Operating income | $ | 12.4 | $ | 9.5 | $ | 2.9 | 30.5% | ||||||

| Operating margin | 5.0 | % | 3.8 | % | |||||||||

| Adjusted operating income 1 | $ | 12.5 | $ | 10.6 | $ | 1.9 | 17.9% | ||||||

| Adjusted operating margin 1 | 5.1 | % | 4.2 | % | |||||||||

| Net income | $ | 7.3 | $ | 3.6 | $ | 3.7 | 102.8% | ||||||

| Adjusted net income 1 | $ | 7.3 | $ | 5.1 | $ | 2.2 | 43.1% | ||||||

| Earnings per share, diluted | $ | 0.22 | $ | 0.11 | $ | 0.11 | 100.0% | ||||||

| Adjusted earnings per share, diluted 1 | $ | 0.22 | $ | 0.15 | $ | 0.07 | 46.7% | ||||||

| Adjusted EBITDA 1 | $ | 16.6 | $ | 14.3 | $ | 2.3 | 16.1% | ||||||

| Adjusted EBITDA margin 1 | 6.7 | % | 5.7 | % | |||||||||

| 1 See Appendix A for GAAP to Non-GAAP reconciliation | |||||||||||||

Consolidated Results

Third Quarter 2023 Results

- Third quarter 2023 revenues were $246.7 million, compared to $251.4 million in the prior year period, a decrease of 1.9%. The overall decrease in revenues was due to higher revenue in the prior year as a result of a COVID backlog in Asia-Pacific. Foreign currency translation also favorably impacted third quarter 2023 revenues by $2.0 million, or 0.8%.

- Operating income in the third quarter 2023 was $12.4 million compared to $9.5 million in the prior year period. The increase in operating income was attributable to improved pricing and cost management, partially offset by volume decreases. Third quarter 2023 adjusted operating income was $12.5 million, excluding special charges.

- Interest associated with debt and other expenses was $2.6 million and $2.8 million for the third quarter 2023 and 2022, respectively.

- Net income was $7.3 million, or $0.22 per diluted share, for the third quarter 2023 compared to net income of $3.6 million, or $0.11 per diluted share, in the prior year period.

On September 30, 2023, the Company had $5.0 million of outstanding borrowings on its U.S. revolving credit facility and $4.1 million outstanding on its China credit facility, $46.3 million of cash and $152.0 million of availability from the credit facilities, resulting in total liquidity of $198.3 million.

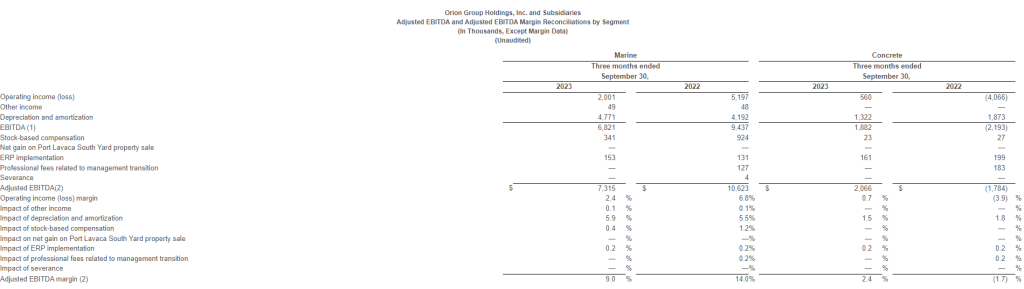

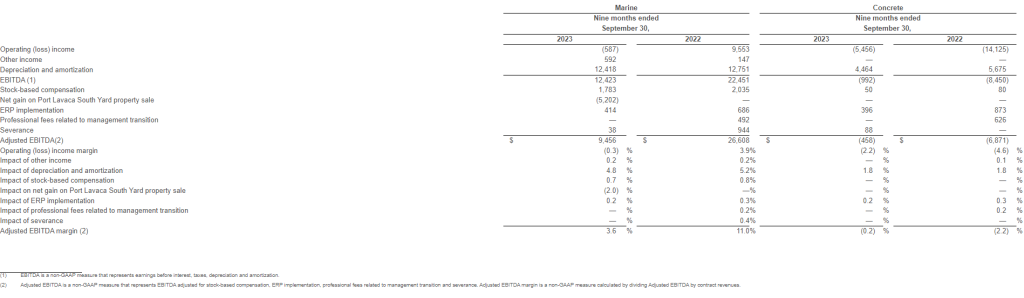

Third Quarter 2023 Segment Results

Vehicle Solutions Segment

- Revenues were $145.4 million compared to $154.0 million for the prior year period, a decrease of 5.6%, due to higher revenue in the prior year as a result of a COVID backlog in Asia-Pacific.

- Operating income was $10.9 million, compared to $9.6 million in the prior year period, an increase of 14.0%, primarily attributable to price increases, material and freight cost reduction improvements, partially offset by volume decreases.

Electrical Systems Segment

- Revenues were $53.9 million compared to $46.1 million in the prior year period, an increase of 16.8%, primarily resulting from increased sales volume, pricing and favorable foreign exchange.

- Operating income was $5.9 million compared to $5.2 million in the prior year period, an increase of 13.7%. The increase in operating income was primarily attributable to increased sales volume and pricing, partially offset by startup costs related to new facilities.

Aftermarket & Accessories Segment

- Revenues were $34.4 million compared to $37.1 million in the prior year period, a decrease of 7.4%, primarily resulting from decreased sales volume.

- Operating income was $4.5 million compared to $5.0 million in the prior year period, a decrease of 9.1%. The decrease in operating income was primarily attributable to cost inflation, partially offset by increased pricing.

Industrial Automation Segment

- Revenues were $13.0 million compared to $14.1 million in the prior year period, a decrease of 7.8%, primarily due to lower sales volume due to decreased customer demand.

- Operating income was $0.7 million compared to an operating loss of $1.0 million in the prior year period. The increase in operating income was primarily attributable to profit reported from the liquidation of certain excess inventories. Adjusted operating income was $0.8 million.

2023 Demand Outlook

According to ACT Research, the 2023 North American Class 8 truck production levels are expected to be at 336,000 units, compared to approximately 315,000 units in 2022. Class 8 estimates from FTR for 2023 are 327,000 units, slightly lower than ACT Research for Class 8 truck builds. Class 5-7 production levels are expected to be at 266,000 units in 2023. The 2024 forecast Class 8 truck builds according to ACT Research is approximately 274,000 units.

According to Transparency Market Research Inc, the global commercial and automotive vehicle wire harness market is growing at approximately 5% per year.

According to Interact Analysis, the Global Off-Highway vehicle market is expected to increase approximately 5% in 2023. Beyond 2023, the Off-Highway vehicle market is expected to grow in the 4-5% range.

According to MacKay and Company, North American aftermarket truck parts are expected to see at least 4% growth in 2023. Compounded annual growth of at least 4% is forecasted for 2023-2027.

GAAP to Non-GAAP Reconciliation

A reconciliation of GAAP to non-GAAP financial measures referenced in this release is included as Appendix A to this release.

Conference Call

A conference call to discuss this press release is scheduled for Thursday, November 2, 2023, at 10:00 a.m. ET. Management intends to reference the Q3 2023 Earnings Call Presentation during the conference call. To participate, dial (888) 259-6580 using conference code 93330617. International participants dial (416) 764-8624 using conference code 93330617.

This call is being webcast and can be accessed through the “Investors” section of CVG’s website at ir.cvgrp.com, where it will be archived for one year.

A telephonic replay of the conference call will be available for a period of two weeks following the call. To access the replay, dial (877) 674-7070 using access code 051647 and international callers can dial (416) 764-8692 using access code 051647.

Company Contact

Andy Cheung

Chief Financial Officer

CVG

IR@cvgrp.com

Investor Relations Contact

Ross Collins or Stephen Poe

Alpha IR Group

CVGI@alpha-ir.com

About CVG

At CVG, we deliver real solutions to complex design, engineering and manufacturing problems while creating positive change for our customers, industries and communities we serve. Information about the Company and its products is available on the internet at www.cvgrp.com.

Forward-Looking Statements

This press release contains forward-looking statements that are subject to risks and uncertainties. These statements often include words such as “believe”, “anticipate”, “plan”, “expect”, “intend”, “will”, “should”, “could”, “would”, “project”, “continue”, “likely”, and similar expressions. In particular, this press release may contain forward-looking statements about the Company’s expectations for future periods with respect to its plans to improve financial results, the future of the Company’s end markets, changes in the Class 8 and Class 5-7 North America truck build rates, performance of the global construction equipment business, the Company’s prospects in the wire harness, warehouse automation and electric vehicle markets, the Company’s initiatives to address customer needs, organic growth, the Company’s strategic plans and plans to focus on certain segments, competition faced by the Company, volatility in and disruption to the global economic environment and the Company’s financial position or other financial information. These statements are based on certain assumptions that the Company has made in light of its experience as well as its perspective on historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. Actual results may differ materially from the anticipated results because of certain risks and uncertainties, including those included in the Company’s filings with the SEC. There can be no assurance that statements made in this press release relating to future events will be achieved. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on behalf of the Company are expressly qualified in their entirety by such cautionary statements.

| COMMERCIAL VEHICLE GROUP, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS Three Months and Nine Months Ended September 30, 2023 and 2022 (Unaudited) (Amounts in thousands, except per share amounts) | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | ||||||||

| Revenues | $ | 246,687 | $ | 251,412 | $ | 771,590 | $ | 746,635 | |||

| Cost of revenues | 212,763 | 224,570 | 664,056 | 672,531 | |||||||

| Gross profit | 33,924 | 26,842 | 107,534 | 74,104 | |||||||

| Selling, general and administrative expenses | 21,476 | 17,304 | 64,498 | 49,955 | |||||||

| Operating income | 12,448 | 9,538 | 43,036 | 24,149 | |||||||

| Other expense | 383 | 1,924 | 488 | 2,798 | |||||||

| Interest expense | 2,614 | 2,813 | 8,308 | 6,892 | |||||||

| Loss on extinguishment of debt | — | — | — | 921 | |||||||

| Income before provision for income taxes | 9,451 | 4,801 | 34,240 | 13,538 | |||||||

| Provision for income taxes | 2,161 | 1,250 | 8,110 | 3,520 | |||||||

| Net income | $ | 7,290 | $ | 3,551 | $ | 26,130 | $ | 10,018 | |||

| Earnings per Common Share: | |||||||||||

| Basic | $ | 0.22 | $ | 0.11 | $ | 0.79 | $ | 0.30 | |||

| Diluted | $ | 0.22 | $ | 0.11 | $ | 0.78 | $ | 0.30 | |||

| Weighted average shares outstanding: | |||||||||||

| Basic | 33,100 | 32,460 | 33,010 | 32,950 | |||||||

| Diluted | 33,350 | 32,922 | 33,408 | 33,645 | |||||||

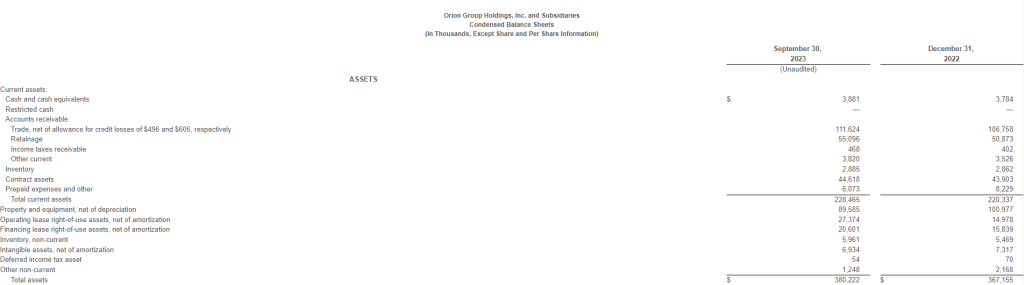

| COMMERCIAL VEHICLE GROUP, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (Amounts in thousands, except per share amounts) | |||||||

| ASSETS | September 30, 2023 | December 31, 2022 | |||||

| Current assets: | |||||||

| Cash | $ | 46,293 | $ | 31,825 | |||

| Accounts receivable, net | 159,863 | 152,626 | |||||

| Inventories | 128,192 | 142,542 | |||||

| Other current assets | 29,892 | 12,582 | |||||

| Total current assets | 364,240 | 339,575 | |||||

| Property, plant and equipment, net | 71,554 | 67,805 | |||||

| Intangible assets, net | 12,041 | 14,620 | |||||

| Deferred income taxes | 11,181 | 12,275 | |||||

| Other assets, net | 37,026 | 35,993 | |||||

| Total assets | $ | 496,042 | $ | 470,268 | |||

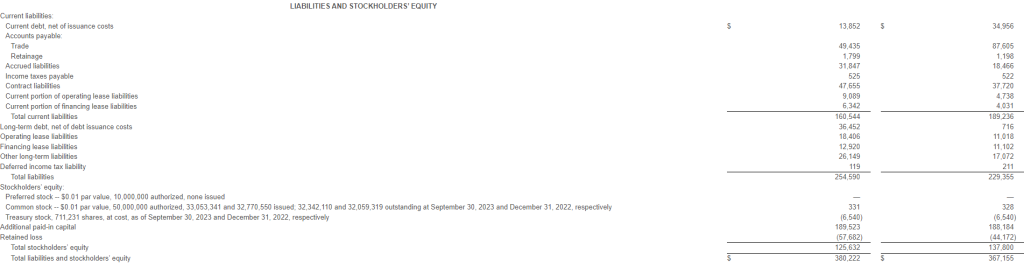

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 105,110 | $ | 122,091 | |||

| Accrued liabilities and other | 52,999 | 42,809 | |||||

| Current portion of long-term debt and short-term debt | 18,331 | 10,938 | |||||

| Total current liabilities | 176,440 | 175,838 | |||||

| Long-term debt | 135,573 | 141,499 | |||||

| Pension and other post-retirement benefits | 9,325 | 8,428 | |||||

| Other long-term liabilities | 28,150 | 24,463 | |||||

| Total liabilities | $ | 349,488 | $ | 350,228 | |||

| Stockholders’ equity: | |||||||

| Preferred stock | $ | — | $ | — | |||

| Common stock | 330 | 328 | |||||

| Treasury stock | (15,322 | ) | (14,514 | ) | |||

| Additional paid-in capital | 263,641 | 261,371 | |||||

| Retained deficit | (69,465 | ) | (95,595 | ) | |||

| Accumulated other comprehensive loss | (32,630 | ) | (31,550 | ) | |||

| Total stockholders’ equity | 146,554 | 120,040 | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 496,042 | $ | 470,268 | |||

| COMMERCIAL VEHICLE GROUP, INC. AND SUBSIDIARIES BUSINESS SEGMENT FINANCIAL INFORMATION (Unaudited) (Amounts in thousands) | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||

| Vehicle Solutions | Electrical Systems | Aftermarket and Accessories | Industrial Automation | Corporate/Other | Total | |||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Revenues | $ | 145,393 | $ | 154,024 | $ | 53,862 | $ | 46,129 | $ | 34,412 | $ | 37,143 | $ | 13,020 | $ | 14,116 | $ | — | $ | — | $ | 246,687 | $ | 251,412 | ||||||||||||||

| Gross profit | 17,661 | 13,839 | 7,881 | 6,210 | 6,605 | 6,389 | 1,777 | 404 | — | — | 33,924 | 26,842 | ||||||||||||||||||||||||||

| Selling, general & administrative expenses | 6,761 | 4,279 | 2,018 | 1,055 | 2,104 | 1,436 | 1,087 | 1,371 | 9,506 | 9,163 | 21,476 | 17,304 | ||||||||||||||||||||||||||

| Operating income (loss) | $ | 10,900 | $ | 9,560 | $ | 5,863 | $ | 5,155 | $ | 4,501 | $ | 4,953 | $ | 690 | $ | (967 | ) | $ | (9,506 | ) | $ | (9,163 | ) | $ | 12,448 | $ | 9,538 | |||||||||||

| Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||

| Vehicle Solutions | Electrical Systems | Aftermarket and Accessories | Industrial Automation | Corporate/Other | Total | |||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Revenues | $ | 458,707 | $ | 436,966 | $ | 172,236 | $ | 133,350 | $ | 108,870 | $ | 99,530 | $ | 31,777 | $ | 76,789 | $ | — | $ | — | $ | 771,590 | $ | 746,635 | ||||||||||||||

| Gross profit | 58,035 | 35,657 | 26,524 | 16,857 | 21,620 | 13,341 | 1,355 | 8,249 | — | — | 107,534 | 74,104 | ||||||||||||||||||||||||||

| Selling, general & administrative expenses | 19,609 | 18,269 | 6,932 | 3,998 | 6,017 | 4,636 | 3,588 | 4,242 | 28,352 | 18,810 | 64,498 | 49,955 | ||||||||||||||||||||||||||

| Operating income (loss) | $ | 38,426 | $ | 17,388 | $ | 19,592 | $ | 12,859 | $ | 15,603 | $ | 8,705 | $ | (2,233 | ) | $ | 4,007 | $ | (28,352 | ) | $ | (18,810 | ) | $ | 43,036 | $ | 24,149 | |||||||||||

| COMMERCIAL VEHICLE GROUP, INC. AND SUBSIDIARIES Appendix A: Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited) (Amounts in thousands, except per share amounts and percentages) | |||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | ||||||||||||

| Gross profit | $ | 33,924 | $ | 26,842 | $ | 107,534 | $ | 74,104 | |||||||

| Restructuring | 70 | 607 | 1,443 | 2,958 | |||||||||||

| Adjusted gross profit | $ | 33,994 | $ | 27,449 | $ | 108,977 | $ | 77,062 | |||||||

| % of revenues | 13.8 | % | 10.9 | % | 14.1 | % | 10.3 | % | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | ||||||||||||

| Operating income (loss) | $ | 12,448 | $ | 9,538 | $ | 43,036 | $ | 24,149 | |||||||

| Restructuring | 70 | 647 | 1,501 | 3,387 | |||||||||||

| Deferred consideration purchase accounting | — | 103 | — | 341 | |||||||||||

| Executive transition | — | 329 | — | 329 | |||||||||||

| Total operating income adjustments | 70 | 1,079 | 1,501 | 4,057 | |||||||||||

| Adjusted operating income | $ | 12,518 | $ | 10,617 | $ | 44,537 | $ | 28,206 | |||||||

| % of revenues | 5.1 | % | 4.2 | % | 5.8 | % | 3.8 | % | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | ||||||||||||

| Net income | $ | 7,290 | $ | 3,551 | $ | 26,130 | $ | 10,018 | |||||||

| Operating income adjustments | 70 | 1,079 | 1,501 | 4,057 | |||||||||||

| Pension settlement | — | 1,116 | — | 1,116 | |||||||||||

| Loss on extinguishment of debt | — | — | — | 921 | |||||||||||

| Hryvnia fair value adjustments on forward exchange contracts | — | (153 | ) | — | 98 | ||||||||||

| Adjusted provision for income taxes1 | (18 | ) | (511 | ) | (375 | ) | (1,548 | ) | |||||||

| Adjusted net income | $ | 7,342 | $ | 5,082 | $ | 27,256 | $ | 14,662 | |||||||

| Diluted EPS | $ | 0.22 | $ | 0.11 | $ | 0.78 | $ | 0.30 | |||||||

| Adjustments to diluted EPS | $ | — | $ | 0.04 | $ | 0.04 | $ | 0.14 | |||||||

| Adjusted diluted EPS | $ | 0.22 | $ | 0.15 | $ | 0.82 | $ | 0.44 | |||||||

- Reported Tax Provision adjusted for tax effect of special charges at 25%

| Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | ||||||||||||

| Net income | $ | 7,290 | $ | 3,551 | $ | 26,130 | $ | 10,018 | |||||||

| Interest expense | 2,614 | 2,813 | 8,308 | 6,892 | |||||||||||

| Provision for income taxes | 2,161 | 1,250 | 8,110 | 3,520 | |||||||||||

| Depreciation expense | 3,639 | 3,749 | 10,615 | 11,043 | |||||||||||

| Amortization expense | 847 | 851 | 2,544 | 2,563 | |||||||||||

| EBITDA | $ | 16,551 | $ | 12,214 | $ | 55,707 | $ | 34,036 | |||||||

| % of revenues | 6.7 | % | 4.9 | % | 7.2 | % | 4.6 | % | |||||||

| EBITDA adjustments | |||||||||||||||

| Restructuring | $ | 70 | $ | 647 | $ | 1,501 | $ | 3,387 | |||||||

| Deferred consideration purchase accounting | — | 103 | — | 341 | |||||||||||

| Loss on extinguishment of debt | — | — | — | 921 | |||||||||||

| Hryvnia fair value adjustments on forward exchange contracts | — | (153 | ) | — | 98 | ||||||||||

| Executive transition | — | 329 | — | 329 | |||||||||||

| Pension settlement | — | 1,116 | — | 1,116 | |||||||||||

| Adjusted EBITDA | $ | 16,621 | $ | 14,256 | $ | 57,208 | $ | 40,228 | |||||||

| % of revenues | 6.7 | % | 5.7 | % | 7.4 | % | 5.4 | % | |||||||

| Three Months Ended September 30, 2023 | |||||||||||||||||||||||

| Vehicle Solutions | Electrical Systems | Aftermarket and Accessories | Industrial Automation | Corporate/Other | Total | ||||||||||||||||||

| Operating income (loss) | $ | 10,900 | $ | 5,863 | $ | 4,501 | $ | 690 | $ | (9,506 | ) | $ | 12,448 | ||||||||||

| Restructuring | — | — | — | 70 | — | 70 | |||||||||||||||||

| Adjusted operating income (loss) | $ | 10,900 | $ | 5,863 | $ | 4,501 | $ | 760 | $ | (9,506 | ) | $ | 12,518 | ||||||||||

| % of revenues | 7.5 | % | 10.9 | % | 13.1 | % | 5.8 | % | 5.1 | % | |||||||||||||

| Nine Months Ended September 30, 2023 | |||||||||||||||||||||||

| Vehicle Solutions | Electrical Systems | Aftermarket and Accessories | Industrial Automation | Corporate/Other | Total | ||||||||||||||||||

| Operating income (loss) | $ | 38,426 | $ | 19,592 | $ | 15,603 | $ | (2,233 | ) | $ | (28,352 | ) | $ | 43,036 | |||||||||

| Restructuring | 423 | 8 | — | 1,070 | — | 1,501 | |||||||||||||||||

| Adjusted operating income (loss) | $ | 38,849 | $ | 19,600 | $ | 15,603 | $ | (1,163 | ) | $ | (28,352 | ) | $ | 44,537 | |||||||||

| % of revenues | 8.5 | % | 11.4 | % | 14.3 | % | (3.7 | )% | 5.8 | % | |||||||||||||

| Three Months Ended September 30, 2022 | |||||||||||||||||||||||

| Vehicle Solutions | Electrical Systems | Aftermarket and Accessories | Industrial Automation | Corporate/Other | Total | ||||||||||||||||||

| Operating income (loss) | $ | 9,560 | $ | 5,155 | $ | 4,953 | $ | (967 | ) | $ | (9,163 | ) | $ | 9,538 | |||||||||

| Restructuring | 66 | 445 | 136 | $ | 647 | ||||||||||||||||||

| Deferred consideration purchase accounting | — | — | — | 103 | — | 103 | |||||||||||||||||

| Executive transition | — | — | — | — | 329 | 329 | |||||||||||||||||

| Adjusted operating income (loss) | $ | 9,626 | $ | 5,155 | $ | 5,398 | $ | (728 | ) | $ | (8,834 | ) | $ | 10,617 | |||||||||

| % of revenues | 6.2 | % | 11.2 | % | 14.5 | % | (5.2 | )% | 4.2 | % | |||||||||||||

| Nine Months Ended September 30, 2022 | |||||||||||||||||||||||

| Vehicle Solutions | Electrical Systems | Aftermarket and Accessories | Industrial Automation | Corporate/Other | Total | ||||||||||||||||||

| Operating income (loss) | $ | 17,388 | $ | 12,859 | $ | 8,705 | $ | 4,007 | $ | (18,810 | ) | $ | 24,149 | ||||||||||

| Restructuring | 270 | 571 | 1,440 | 800 | 306 | 3,387 | |||||||||||||||||

| Deferred consideration purchase accounting | — | — | — | 341 | — | 341 | |||||||||||||||||

| Executive transition | — | — | — | — | 329 | 329 | |||||||||||||||||

| Adjusted operating income (loss) | $ | 17,658 | $ | 13,430 | $ | 10,145 | $ | 5,148 | $ | (18,175 | ) | $ | 28,206 | ||||||||||

| % of revenues | 4.0 | % | 10.1 | % | 10.2 | % | 6.7 | % | 3.8 | % | |||||||||||||

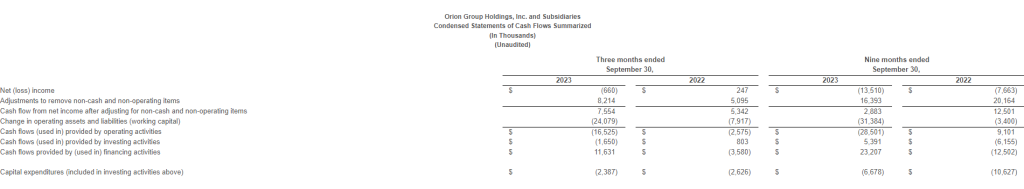

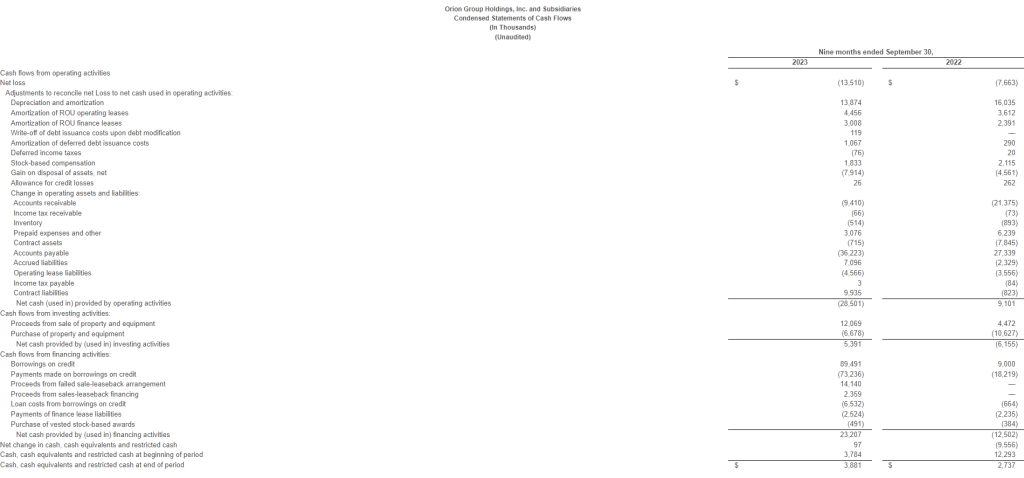

| Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | ||||||||||||

| Cash flows from operating activities | $ | 18,468 | $ | 38,301 | $ | 29,990 | $ | 33,794 | |||||||

| Purchases of property, plant and equipment | (6,017 | ) | (3,925 | ) | (15,196 | ) | (12,541 | ) | |||||||

| Free cash flow | $ | 12,451 | $ | 34,376 | $ | 14,794 | $ | 21,253 | |||||||

Use of Non-GAAP Measures

This earnings release contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). In general, the non-GAAP measures exclude items that (i) management believes reflect the Company’s multi-year corporate activities; or (ii) relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. Management uses these non-GAAP financial measures internally to evaluate the Company’s performance, engage in financial and operational planning and to determine incentive compensation.

Management provides these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on the Company’s financial and operating results and in comparing the Company’s performance to that of its competitors and to comparable reporting periods. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP. The financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth above should be carefully evaluated.

Source: Commercial Vehicle Group, Inc.