Federal Open Market Committee Minutes Reveal Uncertainty

The Federal Reserve released the minutes of its last Federal Open Market Committee (FOMC) meeting. They show the Fed, as a whole, at the May 2-3 meeting as less than clear as to the near-term direction of monetary policy. The U.S. central bank officials are best described as believing they need to be nimble and react, keeping their options open rather than have a plan to continue raising interest rates or hold them steady after future meetings.

Fed officials remained concerned about inflation. Conversations and debates centered on the impact of tighter financial conditions and the degree of lag with which monetary policy would have an impact. According to the meeting minutes, the expected lag could mean their tightening campaign is nearly finished.

This release provided long-awaited insight and shed a modicum of light on how seriously Fed officials were considering changing course or holding interest rates steady when they met last month.

Actual Decision

Federal Reserve officials moved unanimously to raise interest rates at the central bank’s meeting on monetary policy in May despite significant debate at the time over whether pausing tightening efforts would instead be the more prudent move.

The minutes from the Fed’s May 2-3 meeting show concerns and offer clues as to what is important to various factions of the FOMC.

Key Language in Minutes

Banking

“Participants noted that risks associated with the recent banking stress had led them to raise their already high assessment of uncertainty around their economic outlooks. Participants judged that risks to the outlook for economic activity were weighted to the downside, although a few noted the risks were two-sided.”

In their discussion, various participants commented on developments in banking, noting that the banking system was sound and resilient. They also patted themselves on the back, saying that, “actions taken by the Federal Reserve in coordination with other government agencies had served to calm conditions in that sector, but that stresses remained.”

Some participants noted that the banking sector was well-capitalized overall. The belief is that “the most significant issues in the banking system appeared to be limited to a small number of banks with poor risk-management practices or substantial exposure to specific vulnerabilities.”

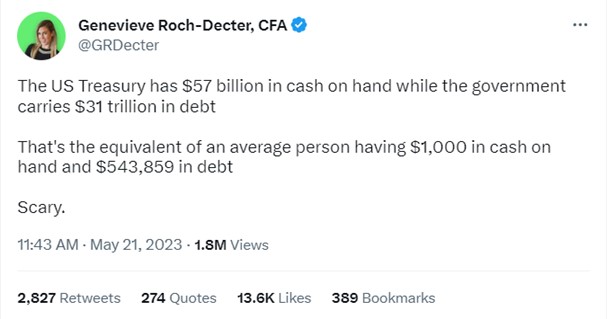

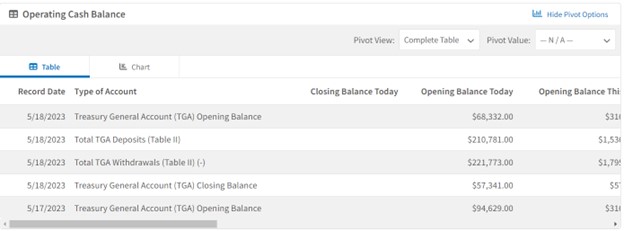

U.S. Debt Ceiling

“Some participants also noted concerns that the statutory limit on federal debt might not be raised in a timely manner, threatening significant disruptions to the financial system and tighter financial conditions that weaken the economy.”

Inflation

“Regarding risks to inflation, participants cited the possibility that price pressures could prove more persistent than anticipated because of, for example, stronger-than-expected consumer spending and a tight labor market, especially if the effect of bank stress on economic activity proved modest.”

A few members felt further tightening could bring supply and demand imbalances more in line and reduce inflation pressures.

“Some participants cited the possibility that further tightening of credit conditions could slow household spending and reduce business investment and hiring, all of which would support the ongoing rebalancing of supply and demand in product and labor markets and reduce inflation pressures.”

Lag of Policy on Economy

A number of members saw evidence that policy was on track to rebalance price pressures and having its desired effect.

“In discussing the policy outlook, participants generally agreed that in light of the lagged effects of cumulative tightening in monetary policy and the potential effects on the economy of a further tightening in credit conditions, the extent to which additional increases in the target range may be appropriate after this meeting had become less certain.”

“Participants agreed that it would be important to closely monitor incoming information and assess the implications for monetary policy.”

There are two factors that the FOMC minutes noted would be determinants to whether additional policy actions would be needed, they are:

“…the degree and timing with which cumulative policy tightening restrained economic activity and reduced inflation, with some participants commenting that they saw evidence that the past years’ tightening was beginning to have its intended effect.”

“… the degree to which tighter credit conditions for households and businesses resulting from events in the banking sector would weigh on activity and reduce inflation, which participants agreed was very uncertain.”

“Some participants commented that, based on their expectations that progress in returning inflation to 2 percent could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings.”

“Several participants noted that if the economy evolved along the lines of their current outlooks, then further policy firming after this meeting may not be necessary.”

“Almost all participants stated that, with inflation still well above the Committee’s longer-run goal and the labor market remaining tight, upside risks to the inflation outlook remained a key factor shaping the policy outlook. A few participants noted that they also saw some downside risks to inflation.”

Uncertainty

Some participants commented at the meeting that they, “saw evidence that the past years’ tightening was beginning to have its intended effect.”

The members seemed to not have a handle on the impact of the health of the banking industry’s impact, the minutes read, “the degree to which tighter credit conditions for households and businesses resulting from events in the banking sector would weigh on activity and reduce inflation, which participants agreed was very uncertain.”

Take Away

The path forward for monetary policy is, as the Federal Reserve has continually stated, data dependent. The clarity of trends of the data is unclear in part because of any expected lag, the health of banking, and the stickiness of inflation.

Paul Hoffman

Managing Editor, Channelchek

Sources

https://www.federalreserve.gov/monetarypolicy/fomcminutes20230503.htm