The Markets During the First Half of 2023 Were Reflective of the People that Trade Them

Financial markets reflect the collective actions and expectations of market participants. This includes rational analysis, irrational emotions, and at times less than rational analysis. The emotions and number crunching get their cue from a daily barrage of information including: profits, policy, panic, prices, politics, purchasing power, the president …and that’s just the Ps. So each day, as Channelchek prepares to deliver research, articles, and pertinent video content to subscriber’s inboxes, we plow through an abundance of information and hope to share what is either not being addressed or covered, or present front page news from the point of view of seasoned investors, not less experienced news writers.

Below are six articles, one from each month this year. Although I have favorites not included here, and these may not have been the most read or shared, they told a slightly expanded story than found on the mainstream take on the subject and are still relevant to some investors.

As a content provider to this popular investment research platform, my job is not to call the market; it is to present thoughts and knowledge to help investors make decisions on small and microcap stocks along with the overall universe of investment opportunities. The insights below from earlier this year are still quite current, and worth digesting.

January 2023

Will Three Bank Regulators Kill Cryptocurrency in 2023?

On the very first business day of 2023, three regulators announced concerns over businesses involved in cryptocurrency citing the lack of oversight, lack of standards, and unknown risk. As the year progressed, the three federal agencies, which do not include work on oversight being done by the SEC or CFTC, are now working hard to regulate what banks can do involving crypto. The SEC for its part has been creating headaches for some of the larger crypto exchanges. Banks are having a particularly difficult time incorporating the asset in their business.

February 2023

Michael Burry Warns Against the Market Hoping for Economic Weakness

Investment content providers love Michael Burry. The reason is that readership goes through the roof whenever his name is mentioned. Still, if there is nothing to write about the subject, or if it is old news, the writer, blogger, or vlogger is doing investors a disservice.

We’re choosy about when to take one of Burry’s rare tweets and decipher them for readers. But, we always try to be among the first when his fund’s public holdings are reported each quarter on SEC form 13-F. But there are only few times during the year when there is actually worthwhile news. This is because Burry is usually tightlipped. Unless required by a regulator, the successful hedge fund manager is out of the public spotlight, presumably crunching numbers and rebuilding old guitars.

This article is good advice that can be used any time the Fed is trying to reel in inflation.

March 2023

The CFA Institute Makes First Major Change to Program Since Inception

It was 1963 the last time the CFA Institute (Chartered Financial Analyst) made any changes to their prestigious designation. However, the investment world is changing, and the CFA Institute is responding in order to better serve those that benefit from the services of skilled analysts. In 2023 CFA candidates will have more choices, more study material available, and the ability to take credit for their rigorous studies beginning after passing Level I.

Some thoughts on why, eligibility, and the new focus are presented here along with how it should help keep the credential fresh and more useful.

April 2023

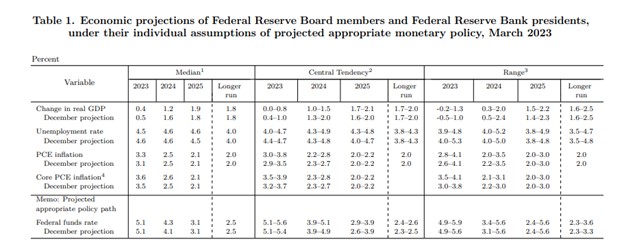

U.S. Money Supply, Here’s Why it’s Critical for Inflation Forecasts

It wasn’t too long ago that the Federal Reserve did not announce its intentions. If a Fed-watcher or market participant wanted to know for certain if the FOMC adjusted monetary policy, the best they could do is see if measures of money supply increased or decreased. Weeks later the FOMC Minutes would be released, and the markets would know for sure what the Fed did at the previous meeting.

When the Fed became more transparent, the market focus on money-supply disappeared. This has now reversed as the stimulative money that had been injected into the economy to prevent undue weakness during the pandemic is now being methodically removed via quantitative tightening (Q.T.). The renewed focus on M2 is to make sure the Fed sticks with its plan. Signs that it may not be impact the amount of money available to chase goods and services, this impacts inflation.

The Fed’s battle to drain the cash put into the system, and do it in a way that doesn’t crash banks, or the overall economy is perilous, is continuing and well worth understanding.

May 2023

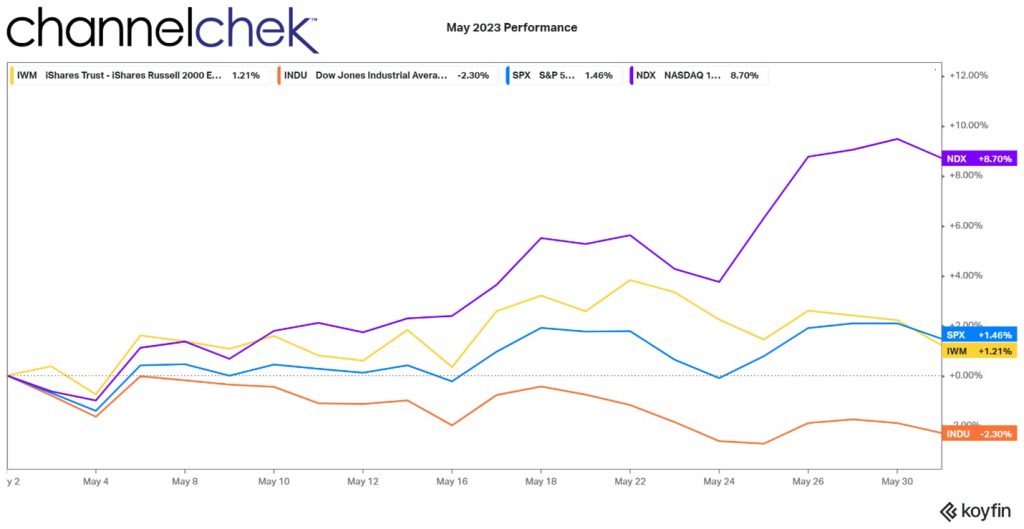

Solid Evidence a Recession is Unlikely this Year

Economists and news writers have been negative about the economic outlook, scaring people with the word recession since before the year even began. And while there are some weaknesses, the stimulative money supply is still exceedingly high, jobs are more abundant than workers, and home sales have not reacted as expected when mortgage rates rise from 3% to 7%.

The often-repeated line that the downward slope of the yield curve is a time-tested indicator of an impending recession was the echo chamber talking point that probably didn’t apply to this economy because of a novel Fed policy.

From a textbook position, those saying a negative yield curve indicates a recession got the answer right if they were taking a college quiz. However, those that were saying this inverted yield curve indicates a recession may have flunked. And if you copied off the economist next to you, and they somehow missed that the Fed owned 33% of all U.S. Treasuries outstanding, and because of their policy of yield-curve-control, the yield curve was not market-driven, and therefore not a reliable indicator of anything. What we know is that when the Fed buys one out of every three bonds, it leaves a mark on the area of the curve that they are active.

With higher than expected GDP released last week, most have stopped talking about a recession in 2023. We put out several articles beginning in 2022 explaining why others may have this yield curve indicator wrong, this is addition is most recent.

I highly recommend reviewing this article if your summer backyard barbecues include conversations about economic strength (or weakness).

June 2023

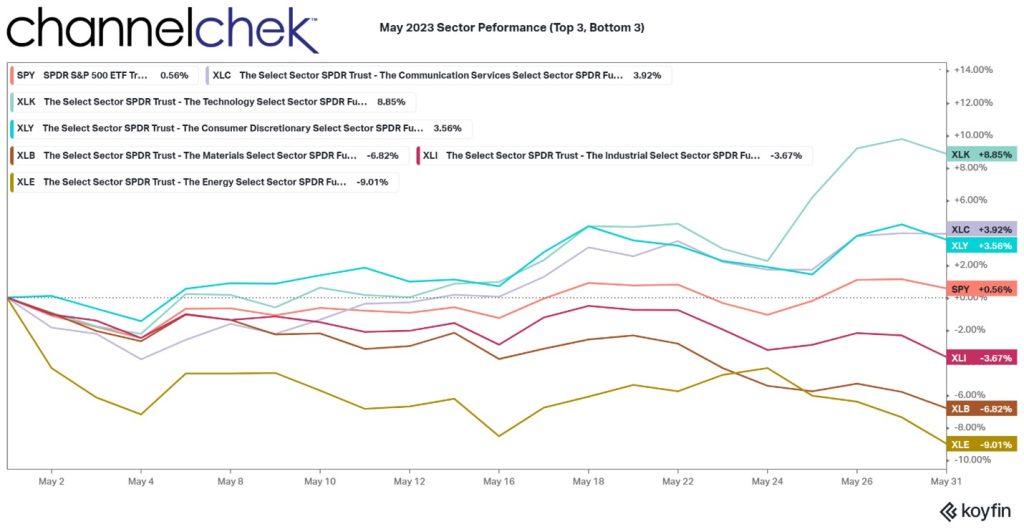

Why Small Cap Stocks Started to Attract Mega Cap Investors

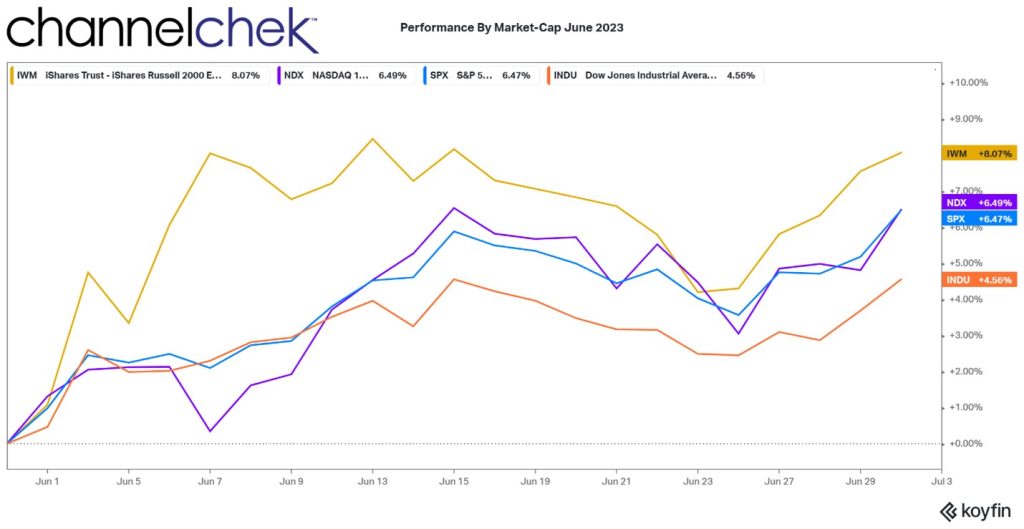

Small Cap stocks had been lagging behind larger companies. Historically they are more volatile, but investors expect to be compensated over time for the additional risk they take. Yet, over a longer than normal period, they still lagged. This seemed to have changed; during the first week in June there were some days that small company returns had a little more giddy-up than they had in recent months or years. On June 6th we published the above article.

Small cap stocks finished the month well ahead of the large caps and even mega-cap companies. This momentum has carried into the second half.

Let’s Start the Second Half of 2023 Together

If you are one of our free subscribers, thank you for trusting us as one of your news and research resources.

If you have not yet signed up, now is a great time to make sure you don’t miss any research, videos, special events, and market insights. Sign up here.

I hope you found these six articles compelling, and if you have not registered for no-cost insights to your inbox each day, here’s your chance to start the second half with a slightly different investment angle.

Managing Editor, Channelchek