How the U.S. and its Allies Plan to Put the Squeeze on Russian Oil Profits

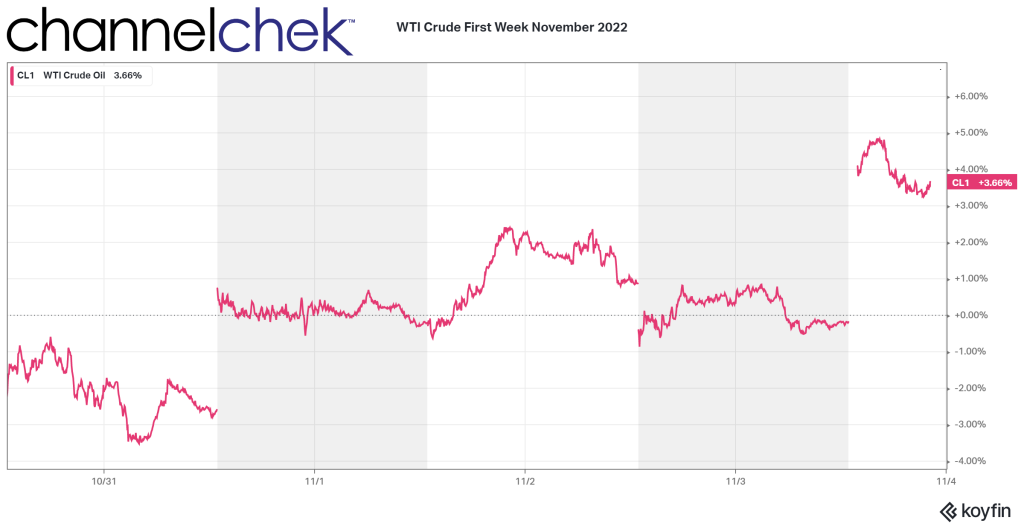

Volatility in oil prices this week has been extreme, even by the standards already set this decade. The price of WTI rose nearly 5% just today. The month ahead promises to create even more volatility as Saudi Arabia just cut prices to Asia; meanwhile, the US and its allies have agreed to put a cap on Russian oil. Details on many of these influences have not yet been worked out or announced. What is known is that the price cap and other sanctions against Russia begin in one month. The commodity trading days leading to the planned December 5 start date and the weeks that follow ought to create a great deal of speculation and price movement. Here is what we do know the allies have agreed upon.

The Cap Map

Sales of Russian oil to the participating countries will be subject to a price cap. The cap pertains to the initial purchase of a load of seaborne Russian oil. The agreement settled by the US and its allies doesn’t subject any subsequent sale of crude as falling under the same cap. The cost of transporting Russian oil is not included in the calculation of the cap. However, these rules only apply once the load of oil makes land. Out at sea, the rules are different.

Trades of Russian oil that occur once the load is at sea are expected to still fall under the cap. However, if the Russia-originated oil has been refined into products such as diesel or gasoline, then it is not subject to the cap.

Restrictions and Jurisdictions

Under the expected price-cap plan, the Group of Seven and Australia are planning to restrict firms in their countries from providing insurance and other key maritime services for any Russian oil shipment unless the oil is sold below a set price. Because much of the world’s maritime services are based in G-7 countries and the European Union, the Western partners are aiming to effectively dictate the price at which Russia can sell some of its oil on global markets.

The Precise Price

The US and its allies have yet to set the price for the scheme, but they expect to define the level or range well before the December 5 implementation date. The slow pace of finalizing the plan have left some oil-market participants concerned that shipments of Russian oil at sea on December 5 could face the cap restrictions. The US Treasury Department, earlier this week, has clarified how this would be determined. The agreement rules that Russian oil shipped before December 5 would be exempt from the cap if it is unloaded at its destination by January 19.

It’s expected the price cap would not bring a crushing blow to banks, insurers, shippers, and traders that help make Russian oil available on global markets. The goal is to cut into the profits Russia earns from its oil sales, the hope by participants is to keep global markets supplied with Russian oil and keep energy prices steady.

The precise price is unknown, however a price range in the mid-60s has been discussed as the possible cap range, as it represents levels in line with where Russian oil had traded before the big run-up.

What Else?

Officials speaking for Russia have threatened to cut their oil production in retaliation for any price cap. It remains seen whether this game of each party partaking in ugly medicine for the survival of both will play out in unexpected ways.

The plan for the price cap for Russian crude will go into effect on December 5, while two separate price limits for refined Russian petroleum products will kick in on February 5.

Expect volatility in oil prices, leading up to and after the caps go into effect. At the same time, expect the unexpected as it relates to energy.

Managing Editor, Channelchek

https://oilprice.com/Latest-Energy-News/World-News/The-G7-Will-Set-A-Fixed-Price-On-Russian-Oil.html

https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Cuts-Oil-Prices-For-Asia.html

https://oilprice.com/Energy/Energy-General/Oil-Prices-Rise-As-Bullish-Sentiment-Builds.html

https://www.aa.com.tr/en/energy/oil/oil-prices-show-over-3-rise-in-week-ending-nov-4/36809