Can Biden and McCarthy Avert a Calamitous Debt Default? Three Evidence-Backed Leadership Strategies that Might Help

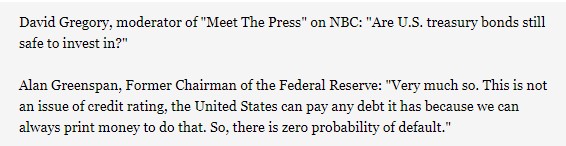

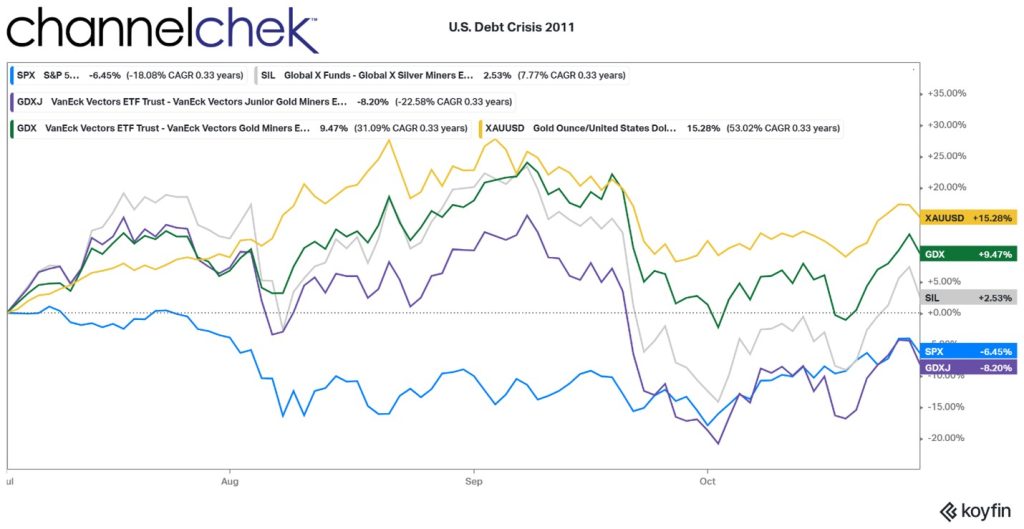

The U.S. is teetering toward an unprecedented debt default that could come as soon as June 1, 2023.

In order for the U.S. to borrow more money, Congress needs to raise the debt ceiling – currently $31.4 trillion. President Joe Biden has refused to negotiate with House Republicans over spending, demanding instead that Congress pass a stand-alone bill to increase the debt limit. House Speaker Kevin McCarthy won a small victory on April 26 by narrowly passing a more complex bill with GOP support that would raise the debt ceiling but also slash spending and roll back Biden’s policy agenda.

Biden recently invited congressional leaders, including GOP leader McCarthy, to the White House on May 9 to discuss the situation but insisted he isn’t willing to negotiate.

Rather than leading the nation, Biden and McCarthy seem to be waging a partisan political war. Biden likely doesn’t want to be seen as giving in to Repubicans’ demands and diminishing legislative wins for his liberal constituency. McCarthy, with his slim majority in the House, needs to appease even the most hard-line members of his party.

This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It represents the research-based findings and thoughts of, Wendy K. Smith, Professor of Business and Leadership, University of Delaware.

Having studied leadership for over 25 years, I would suggest that their leadership styles are polarized, oppositional, short-term and highly ineffective. Such combative leadership risks a debt default that could send the U.S. into recession and potentially lead to a global economic and financial crisis.

While it may seem almost impossible in the current political climate, Biden and McCarthy have an opportunity to turn around this crisis and leave a positive and lasting legacy of courageous leadership. To do so, they need to put aside partisanship and adopt a different approach. Here are a few evidence-backed strategies to get them started.

Moving From a Zero-Sum Game to a More Holistic Approach

Political leaders often risk being hijacked by members of their own party. McCarthy faces a direct threat by hard-line conservative members of his coalition.

For example, back in January, McCarthy agreed to let a single lawmaker force a vote for his ouster to win enough votes from ultraconservative lawmakers to become speaker. That and other concessions give the most extreme members of his party a lot of control over his agenda and limit McCarthy’s ability to make a compromise deal with the president.

Biden, who just announced he’s running for reelection in 2024, is betting his first-term accomplishments – such as unprecedented climate investments and student loan forgiveness – will help him keep the White House. Negotiating any of that away could cost him the support of key parts of his base.

My research partner Marianne W. Lewis and I label this kind of short-term, one-sided leadership as “either/or” thinking. That is, this approach assumes that leadership decisions are a zero-sum game – every inch you give is a loss to your side. We argue that this kind of leadership is limited at best and detrimental at worst.

Instead, we find that great leadership involves what we call “both/and” thinking, which involves seeking integration and unity across opposing perspectives. History offers examples of how this more holistic leadership style has achieved substantial achievements.

President Lyndon B. Johnson and fellow Democrats were struggling to get a Senate vote on the Civil Rights Act of 1964 and needed Republican support. Despite his initial opposition, Republican Sen. Everett McKinley Dirksen – then the minority leader and a staunch conservative – led colleagues in crossing party lines and joining Democrats to pass the historic legislation.

Another example came in 1990, when South Africa’s then-President Frederik Willem de Klerk freed opponent Nelson Mandela from prison. The two erstwhile political enemies agreed to a deal that ended apartheid and paved the way for a democratic government – which won them both the Nobel Peace Prize. Mandela became president four years later.

This integrative leadership approach starts with a shift of mindset that moves away from seeing opposing sides as conflicting and instead values them as generative of new possibilities. So in the case of the debt ceiling situation, holistic leadership means, at the least, Biden would not simply put up his hands and refuse to negotiate over spending. He could acknowledge that Republicans have a point about the nation’s soaring debt load. McCarthy and his party might recognize they cannot just slash spending. Together they could achieve greater success by developing an integrative plan that cuts costs, increases taxes and raises the debt ceiling.

Champion a Long-Term Vision Over Short-Term Goals

What we call “short-termism” plagues America’s politics. Leaders face pressure to demonstrate immediate results to voters. Biden and McCarthy both have strong incentives to focus on a short-term victory for their side with the presidential and congressional elections coming soon. Instead, long-term thinking can help leaders with competing agendas.

In a 2015 study, Natalie Slawinski and Pratima Bansal studied executives at five Canadian oil companies who were dealing with tensions between keeping costs low in the short term while making investments that could mitigate their industry’s environmental impact over the long run. The two scholars found that those who focused on the short term struggled to reconcile the two competing forces, while long-term thinkers managed to find more creative solutions that kept costs down but also allowed them to do more to fight climate change.

Likewise, if Biden and McCarthy want to avert a financial crisis and leave a lasting legacy, they would benefit from focusing on the long term. Finding points of connection in this shared long-term goal, rather than stressing their significant differences about how to get there, can help shift away from their standoff and toward a solution.

Be Adaptive, Not Assured

Voters often praise political leaders who act swiftly and with confidence and self-assurance, particularly at a moment of economic uncertainty.

Yet finding a creative solution to America’s greatest challenges often requires leaders to put aside the swagger and adapt, meaning they take small steps to listen to one another, experiment with solutions, evaluate these outcomes and adjust their approach as needed.

In a study of business decisions at a Fortune 500 technology company, I spent a year following the senior management teams in charge of six units – each of which had revenues of over $1 billion. I found that the team leaders who were most innovative tended to be good at adaptation. They constantly explored whether they had made the right investment and made changes if needed.

Small steps are also necessary to build unlikely relationships with political foes. In his 2017 book, “Collaborating With the Enemy,” organizational consultant Adam Kahane describes how he facilitated workshops to help former enemies take small steps toward reconciliation, such as in South Africa at the end of apartheid and in Colombia amid the drug wars. Such efforts helped South Africa become a successful multiracial democracy and Colombia end decades of war with a guerrilla insurgency.

This kind of leadership requires small steps toward connection rather than large political leaps. It also requires that both sides let go of their positions and consider where they are willing to compromise.

Biden and McCarthy could learn from two former Tennessee governors, Democrat Phil Bredesen and Republican Bill Haslam. Though they oppose each other on almost every political issue, including gun control, the two former leaders have built a constructive relationship over the years. Rather than tackle the big divisive issues, they started with identifying the small points where they agreed with each other. Doing so led them to build greater trust and continue to look for connections.

So when a gunman killed six people at a school in Nashville recently, the two former governors were able to move beyond political finger-pointing and focus on how their respective parties could work together on meaningful gun reform.

Of course, it’s easier to do this once you’re out of office and the pressure from voters and parties goes away. And although current Tennessee Gov. Bill Lee agreed on the need for gun reform, his fellow Republicans in the state Legislature balked.

A Long Shot, But …

And that’s why I know this is a long shot. The two main political parties are as polarized as ever. The odds of a breakthrough that leads to anything more than a last-second deal that kicks the debt ceiling can down the road remain pretty low – and even that seems in doubt.

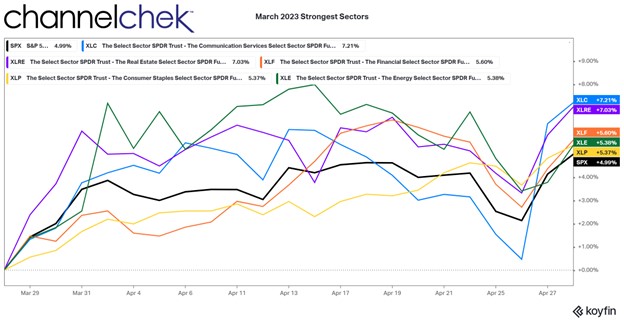

But this is about more than the debt ceiling. The U.S. faces a long list of problems big and small, from high inflation and a banking crisis to the war in Ukraine and climate change.

Americans need and deserve leaders who will tackle these issues by working together toward a more creative outcomes.