The Pace of the U.S. Treasury Burn Rate Toward a $0.00 Balance

The US Treasury Department is nearing its last ounce of blood as it has been bleeding operating funds. All parties know that the debt ceiling has to be raised if the country is to avoid a financial catastrophe. Still, an impasse on debt ceiling negotiations continues. While the House of Representatives has passed a borrowing cap plan, it is not expected that the Senate would agree on the spending reductions, and President Biden made clear he would not sign it.

The markets, of course, have been paying attention, but for the most part, they have chosen to ignore the drama. Anyone that has been involved in the markets for a few years knows that in the past, there have been stop-gap measures or 11th hour decisions that have avoided a US debt default.

It is Getting Close

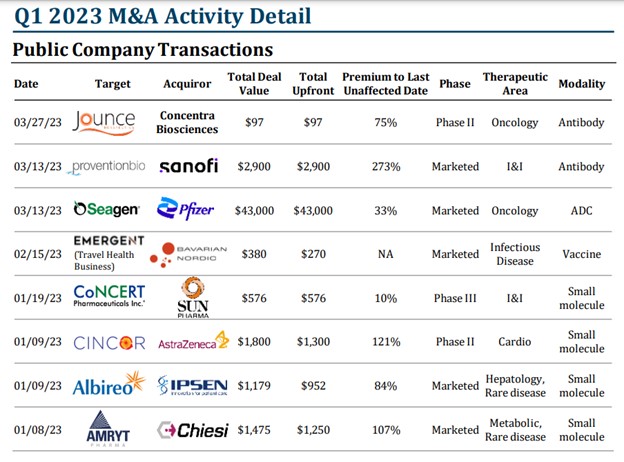

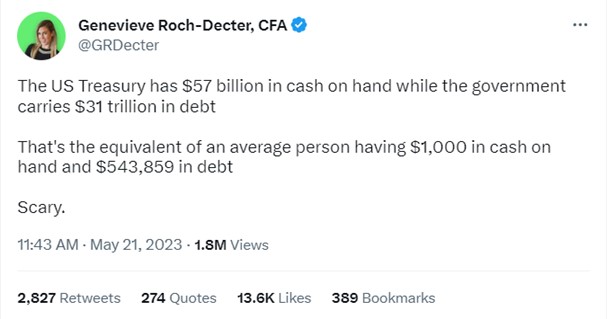

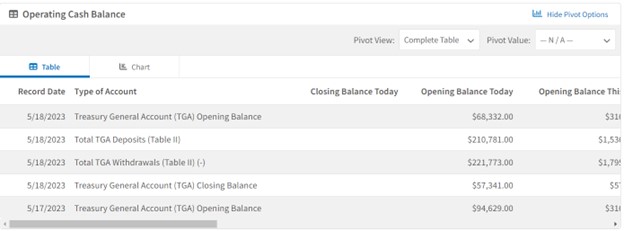

The US Treasury reported last Thursday that it had $57.3 billion in cash on hand. As with any ongoing entity, each week, it receives revenue and pays expenses. So the daily balance runoff fluctuates by different amounts each day. A snapshot is reported each Thursday along with other US financial data. The current pace, while not a precise rate to gauge the net burn rate, is useful.

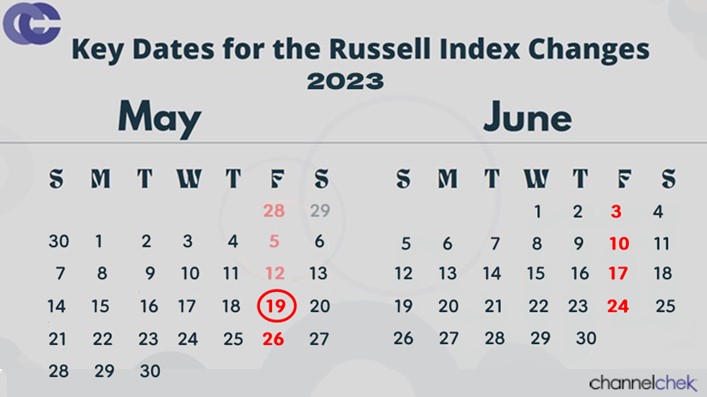

The operating balance used to pay our bills as a nation has declined from $238.5 billion at the start of May, when tax collections helped boost balances. That’s a $181.2 billion decline over 18 days, or $10 billion per day. If the pace holds, the United States balance sheet reaches zero before the June 1 date previously estimated by US Treasury Secretary Janet Yellen.

How are Officials Reacting?

The US reached its Congressionally imposed borrowing cap in January. Since then, there has been a cutting back on spending, as had been announced in January by Janet Yellen. The Treasury has since been operating under an “Extraordinary Measures” plan, reducing less than critical spending to pay obligations that can not be ignored without great consequence. This bandaid approach will go on and, at this point, can only be “fixed” if the debt ceiling is raised once again by Congress.

Treasury Secretary Janet Yellen has been clear in warning lawmakers that the Treasury’s ability to avoid default could end as soon as June 1. The nation has to increase its ability to legally borrow to make its payments while its obligations exceed its revenue.

Averting a June Crisis Without Congress

While most US citizens are aware of the mid-April individual tax date, corporate tax dates are quarterly. The next time most corporations pay their estimated taxes is June 15th. If Secretary Yellen can squeeze the Treasury balances until June 15th, she will no longer be driving on fumes – instead, she will have added a little more gas, not enough to get her to the next corporate tax date.

Another thought depends on one’s interpretation of the 14th Amendment. This amendment of the US Constitution contains several provisions, one of which is Section 4. This section states that “the validity of the public debt of the United States, authorized by law… shall not be questioned.” While the exact interpretation of this provision is a matter of legal debate, it has been suggested that it could potentially provide a legal basis for the government to continue meeting its financial obligations, even if the debt ceiling is reached.

Some argue that the 14th Amendment could empower the President to bypass the debt ceiling and ensure that the government continues to pay its debts on time, based on the principle that the United States must honor its financial obligations.

Stalled Talks

Although the date of $zero balance is not far off if the President and Senate doesn’t agree to the House plan, or if the House is inflexible, negotiations have moved in fits and starts with Congressional leaders meeting on and off with each other and with the Executive branch.

If the nation does default, it will unleash global economic and financial upheaval. The full consequences are not known since it’s never happened before. Those likely to see funds come to a crawl or be turned off are:

- Interest on the debt: While the debt itself would continue to be serviced, a stringent austerity plan could potentially result in reduced payments towards interest on the national debt.

- Government programs and agencies: Funding for discretionary programs, such as infrastructure projects, education initiatives, environmental programs, or research grants, could be reduced or eliminated.

- Social welfare programs: Payments for social welfare programs, such as unemployment benefits, food assistance, housing subsidies, or healthcare subsidies, may be reduced or scaled back.

- Defense spending: Military expenditures and defense contracts may face cuts, impacting payments to defense contractors and the procurement of military equipment and services.

- Government salaries and benefits: Austerity measures could involve salary freezes, reductions, or furloughs for government employees, including civil servants, military personnel, or elected officials.

- Infrastructure projects: Funding for infrastructure development and maintenance, including transportation systems, highways, bridges, and public facilities, may face reductions or delays.

- Grants to states and local governments: Payments to states and local governments for various programs, such as education, healthcare, or community development, could be reduced.

The above are not set in stone, it’s important to note that the specific impacts of an austerity plan would depend on the policies and priorities set by the government, and different austerity measures are also a matter of negotiation.

While Yellen, the Congressional Budget Office, and multiple other forecasters think the $Zero date is likely during the first two weeks of June, it’s possible that the Treasury will have enough funds to carry it through the middle of the month, which would add more time.

However, as it looks now, the US Government is running on fumes; in the past, it has not allowed itself to completely run out of gas. If today’s situation follows past history, the markets will get scared a few more times before the US leaders agree and the country is back to business as usual.

Managing Editor, Channelchek

Sources

https://fiscaldata.treasury.gov/datasets/daily-treasury-statement/operating-cash-balance