The Current Environment for IPOs is Best in Over 15 Months

Does the elevated reading of the Consumer Confidence report, along with the extended period of low market volatility, and belief the Federal Reserve is near the end of the tightening cycle, set the climate for more companies going public? Goldman Sachs Research just released readings of its IPO Issuance Barometer. This measures the environment for initial public offerings (IPOs) using many different metrics. There is only one out of more than a dozen factors which does not support the expectation that the IPO climate is improving for companies.

As stock market prices stabilize and corporate executives grow more confident, the economic conditions in the United States are becoming more favorable for IPOs according to Goldman Sachs Research.

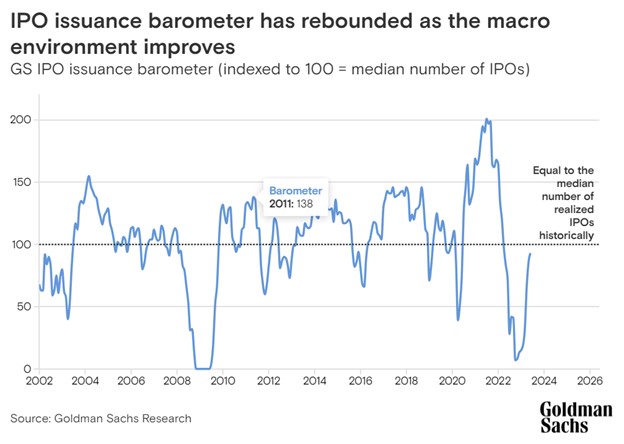

The GS IPO Issuance Barometer has risen to 93, a level consistent with steady IPO activity. After hitting a low point of 7 in September 2022, the Issuance Barometer is now at its highest level since March 2022. A reading of 100 represents the historical average number of IPOs realized in a given month.

The measure takes into account several factors including the S&P 500 drawdown (the difference between the index’s current value and its 52-week high), CEO confidence levels, the ISM Manufacturing Index, the six-month change in two-year Treasury note yields, and the S&P 500’s trailing enterprise value/sales ratio.

The most impactful contributor behind the improvement in the IPO Barometer has been the stabilization of stock market prices. Chief U.S. Equity Strategist at GS Research, David Kostin notes in the report that the S&P 500, which represents U.S. stocks, has remained relatively stable due to indications of resilient economic growth and the expected end of interest rate hikes by the Federal Reserve. Kostin also highlights that the drawdown in the S&P 500 has been the most significant factor influencing IPO activity. The largest decline from peak to trough this year was 8%, compared to an average of 13% since 1928. In the second quarter, the maximum drawdown has been only 3%. Additionally, market volatility has decreased, as indicated by the VIX, which measures the implied volatility of the S&P 500, dropping below 15, its lowest level since before the pandemic.

Although the S&P 500 has reached a new 52-week high, it is still 10% below its all-time high in January 2022.

The other components in Goldman’s IPO gauge that have also made large contributions to its current reading include improvements in CEO confidence, despite the fact that the median professional forecaster gives a 65% probability of a recession in the next 12 months. Short-term Treasury yields seem to have reached their peak, suggesting that the Federal Reserve’s tightening cycle is nearing its end. Also positive for companies deciding if now is a good time to go public is that stock valuation multiples remain high compared to historical levels. The only variable in the barometer that has not improved since September 2022 is the ISM Manufacturing Index.

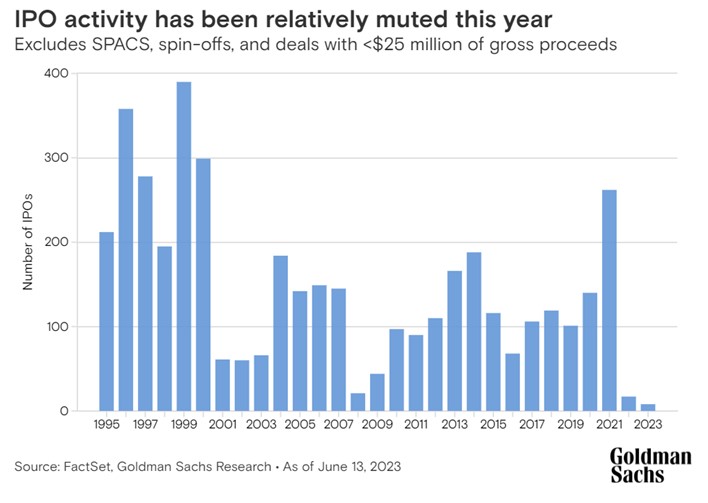

Although the positive macroeconomic conditions have yet to translate into increased IPO activity, follow-on stock offerings, which occur after a company has gone public, have shown greater resilience. This year, there have been eight U.S. IPOs exceeding $25 million in size, excluding special purpose acquisition companies (SPACs) and spin-offs. These deals have raised a total of $2.4 billion in gross proceeds, compared to $3.8 billion for the entirety of 2022.

Forecasts from Goldman Sachs’ economists indicate a 25% chance of a recession in the next 12 months, but they suggest that the environment for IPOs could further improve in the second half of the year. Additionally, analysts at Goldman Sachs Research have recently increased their year-end price target for the S&P 500 to 4500, representing approximately a 2.5% increase from the current level.

If the U.S. economy experiences a “soft landing” characterized by stable equity prices and interest rates, modestly improving CEO confidence, an uptick in the ISM Manufacturing Index, and flat valuation multiples, the IPO Issuance Barometer could reach 119 (compared to 93 as of May 31). This would indicate an even more supportive environment for IPO activity according the research.

What Else?

After having an empty IPO calendar last week, six deals are scheduled this week. Four of them exceed $100 million. According to Renaissance Capital, a provider of IPO ETFs, there have been 46 U.S. deals so far in 2023. This is a 21% increase over the same period last year, and 89 deals have been filed which is a 16% increase.

Also likely to get the attention of management teams sitting on the fence determining if the timing is right, are returns. According to Renaissance, the ETF ticker symbol IPO, which invests in initial offerings, is up 26% so far this year. The S&P 500 is up only 13%.

Managing Editor, Channelchek

Sources