Heading Into the Unofficial End of Summer, Powell Gave the Market a Lot to Think About

The last “unofficial” week of summer will likely be characterized by light trading, which could amplify volatility. This week follows what is viewed by many as a more hawkish tone than expected by Fed Chair Powell on Friday. The next FOMC meeting is not until September 19–20; that is a long time to obsess over every economic number, and there are many key numbers that will be released this week. Investors will be watching the labor report, alongside the PCE price index, personal income and spending data, JOLTS job openings, ISM Manufacturing PMI, and the second estimate of Q2 GDP growth.

Monday 8/28

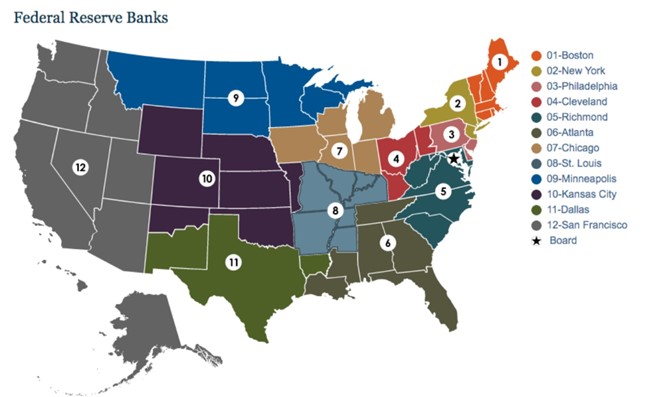

• 10:30 AM ET, the Dallas Fed Manufacturing Index is expected to post a 16th straight negative number, at a steep minus 21.0 in August versus minus 20.0 in July. The survey asks manufacturers whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month. Responses are aggregated into an index where positive values generally indicate growth while negative values generally indicate contraction.

Tuesday 8/29

• 10:00 AM ET, Consumer Confidence is expected to dip slightly in August, at a consensus 116.5 versus July’s 117.0. This report has exceeded not only the consensus in the last three reports but the full consensus range as well.

• 10:00 AM ET, The JOLTS report consensus for July is 9.559 million near its June’s 9.582 million level. Economist consensus have been fairy accurate for this well monitored indicator. The JOLTS report tracks monthly change in job openings and offers rates on hiring and quits.

Wednesday 8/30

• 8:30 AM ET, GDP (the second estimate of second-quarter) is expected to show no change from 2.4 percent growth in the quarter’s first estimate. Personal Consumption Expenditures (PCE), at 1.6 percent growth in the first estimate, is expected to come in at 1.7 percent in the second estimate.

• 10:00 AM ET, Pending Home Sales are expected to fall by 0.4% after rising .3% in June. The National Association of Realtors developed the Pending Home Sales report as a leading indicator of housing activity. Specifically, it is a leading indicator of existing home sales, not new home sales. A pending sale is one in which a contract was signed, but not yet closed. It usually takes four to six weeks to close a contracted sale. Home transactions are a harbinger for economic activity.

• 10:00 AM ET, The State Street Investor Confidence Index measures confidence by looking at actual levels of risk in investment portfolios. This is not an attitude survey. The State Street Investor Confidence Index measures confidence directly by assessing the changes in investor holdings of equities. The prior number (July) was 96.2%.

• 10:30 PM ET, EIA The Energy Information Administration (EIA) provides the Petroleum Status Report weekly with information on petroleum inventories in the US, whether produced in the US or abroad. The level of inventories helps determine prices for petroleum products.

Thursday 8/30

• 7:30 AM ET, The Challenger Job-Cut Report for August will be reported and compared to last months 23,697 job cuts.

• 8:30 AM ET, Jobless claims for the week ended 8/26 are expected to come in at 238,000. The prior week the figure was 230,000.

• 8:30 AM ET, Personal Income is expected to have risen 0.3 percent in July with Consumption Expenditures expected to increase a solid 0.6 percent. These stats will be compared with June’s 0.3 percent increase for income and 0.5 percent increase for consumption.

• 9:45 AM ET, The Chicago PMI is expected to have risen in August to 44.6 versus 42.8 in July which was the eleventh straight month of sub-50 contraction.

• 3:00 PM ET, Farm Prices for July are expected to have risen month over month by 0.4%, however year-on-year declined by 5.3%. Farm prices are a leading indicator of food price changes in the producer and consumer price indices. There is not a one-to-one correlation, but general trends move in tandem. Inflation is a general increase in the prices of goods and services.

• 4:30 PM ET, The Fed’s Balance Sheet totaled $8.139 trillion last week. Further declines in line with the Feds quantitative tightening (QT) is expected.

Friday 9/1

• 8:30 AM ET, the Employment Situation report is expected to show a moderating but still strong 170,000 increase for nonfarm payroll growth in August versus 187,000 in July which was a bit lower than expected. Average hourly earnings in August are expected to rise 0.3 percent on the month for a year-over-year rate of 4.4 percent; these would compare with 0.4 and 4.4 percent in the prior two reports. August’s unemployment rate is expected to hold unchanged at 3.5 percent.

• 10:00 AM ET, The ISM manufacturing index has been in contraction the last nine months. August’s consensus is 46.8 versus July’s 46.4.

• 10:00 AM ET, Construction Spending for July is expected to have risen 0.5% to match June’s 0.5% increase that had benefited from a second strong month for residential spending.

What Else

There is no early close scheduled for the US markets on Friday before the three day Labor Day weekend.

Have you attended an in-person roadshow organized by Noble Capital Markets. Noble has been reaching out to retail and institutional investors and holding these events designed for investors to meet management teams. Investors have been able to discover more about their companies, often enough to make an informed decision. The forum has been getting rave reviews from investors and company management teams. Use this link to see if a roadshow is scheduled near you.

Managing Editor, Channelchek

Sources

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm