Why Small Lithium Developers and Producers May Become Stars By Mid-Decade

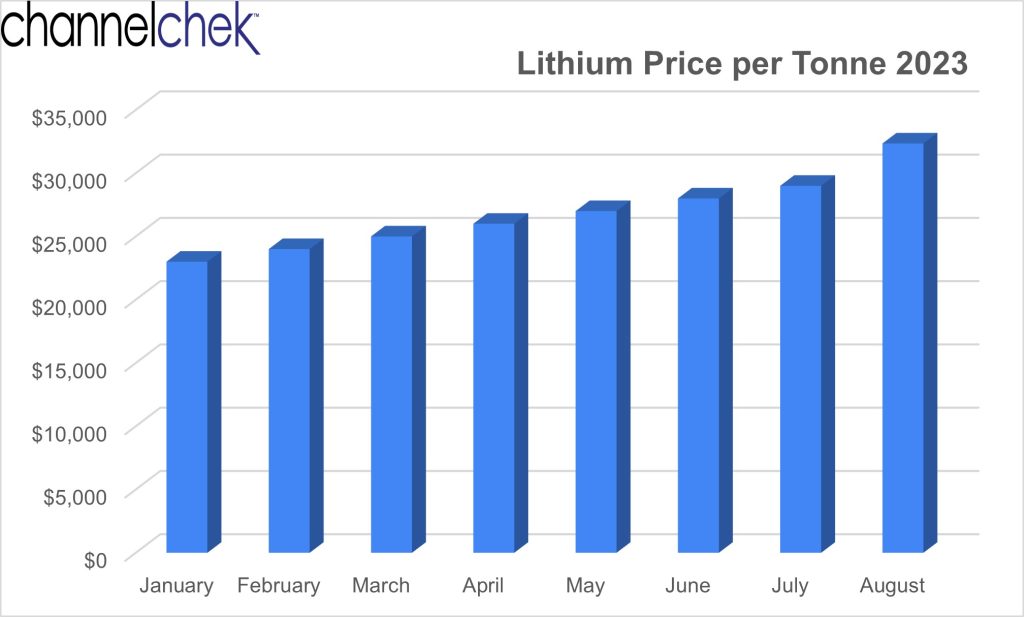

Lithium demand isn’t going away; in fact, it is likely to skyrocket. While most people link future EV sales forecasts with Lithium-ion battery growth, the increased use of li-ion batteries goes well beyond electric vehicle production. Some highly regarded analysts are now predicting a difficult lithium deficit as early as 2025. If demand outstrips supply that quickly, prices of the mineral will be under extreme upward pressure. If the accelerating demand unfolds as expected, investors looking to get ahead of the curve may want to increase their exposure to lithium investments soon. Below is a background on current forecasts and ideas to explore.

Background

The Fitch subsidiary, Business Monitor International (BMI), is a research unit of the parent company best known for its rating service. BMI has a team of over 300 analysts who specialize in a variety of industries, including energy, mining, and technology. The company’s research is used by businesses to make informed decisions about their operations. BMI now estimates that China’s lithium demand for EVs will grow by an average of 20.4% each year between 2023 and 2032. However, current estimates for the country’s lithium output are only expected to grow by 6% over the same period. This means that China will need to import massive amounts of lithium just to meet its growth in EV production.

At the same time, the global demand for lithium is also expected to grow significantly. Some informed projections are that global demand for lithium will reach over 3 million metric tons (tonne) by 2030. As a comparison, this is up from 540,000 metric tons in 2021.

There are currently just 101 lithium mines in the world, and many of these mining operations are nearing the end of their lifespan. In addition, the permitting process for new lithium mines can be lengthy and complex. This is slowing the development of new lithium production facilities. Consequently, the growing demand for lithium, which is already seen as straining global supply, may become substantially more challenging over the next 18 months.

More demand relative to supply is the most basic recipe for higher prices. As a result of the supply constraints, lithium prices are expected to remain high in the coming years. Lithium carbonate prices surged to a record of almost 600,000 yuan per tonne in November 2022.

The EV industry is working to address the lithium supply deficit, but it is the producers that are working to be more efficient and productive. Some companies are developing new ways to extract lithium from brines, which are salty water bodies that contain lithium. Other companies are working to recycle lithium-ion batteries. However, lithium is a finite resource, and an approaching supply deficit shows no signs of being fixed soon. In the meantime the EV industry and others will compete for what is what is being produced, which could drive up prices.

What This Means for Investors

Investors who are interested in the lithium market should take note of the projections for the growing supply/demand imbalance. Lithium mining companies, especially smaller pure-plays on the demand for lithium, may have the highest percentage benefit from higher prices. Three such companies are listed below with links to further information and data relevant to the company.

Century Lithium Corp. (LCE:CA) is a Canadian-based advanced-stage lithium Company, focused on developing its 100%-owned Clayton Valley Lithium Project in the U.S. (Nevada). Century Lithium is actively testing material from its lithium-bearing claystone deposit at its Lithium Extraction Facility while moving toward the completion of a Feasibility Study, with the goal to become a domestic producer of lithium for the growing electric vehicle and battery storage market.

Mark Reichamn, Noble Capital Markets senior research analyst for natural resources, published a research note explaining a collaboration between Century Lithium and Koch Technology Solutions (KTS) where lithium is being recovered from leach solution.

Noble rates the shares of Century Lithium Corp. as outperform.

LithiumBank Resources Corp. (LBNKF) is an exploration and development company focused on lithium-enriched brine projects in Western Canada where low-carbon-impact, rapid DLE technology is used. LithiumBank currently holds over 3.77 million acres of mineral titles, 3.44M acres in Alberta and 326K acres in Saskatchewan. LithiumBank is advancing and de-risking several projects in parallel of the Boardwalk Lithium Brine Project.

Mark Reichman, of Noble Capital Markets put out a research note this month explaining LithiumBank’s reasons for selling three of its projects.

Noble rates the shares of Century Lithium Corp. as outperform.

Piedmont Lithium Inc, (PLL) is a lithium-based company focused on the development of its Piedmont Lithium Project located within the Carolina TinSpodumene Belt (”TSB”) and along trend to the Hallman Beam and Kings Mountain mines.

Piedmont has been in the news recently for having received a partial prepayment of $31.6 million for the sale of 15,000 dry metric tonnes of lithium concentrate under its offtake deal with North American Lithium (NAL). According to news reported by Reuters, its CEO Keith Phillips expects sales from Piedmont shipments to help fund strategic initiatives while reducing the company’s need to raise capital in the equity markets. Piedmont said the prepayment increased its cash position to about $100 million.

A video discussion with Piedmont’s CEO Keith Phillips taken in March 2023 as part of Channelchek’s Takeaway Series is a great way to become familiar with the projects and strategies this “Made in the USA” lithium developer is involved with.

Take Away

A lithium supply deficit is expected to emerge as early as 2025, according to analysts at BMI. The deficit is being driven by the growing demand for lithium-ion batteries for electric vehicles. Investors who are looking to understand the plans of small lithium developers and producers should visit the Company Data / Quotes tab on Channelchek and use the search bars to begin exploring.

Managing Editor, Channelchek

Sources:

https://www.cnbc.com/2023/08/29/a-worldwide-lithium-shortage-could-come-as-soon-as-2025.html