Will the November Fed rate announcement cause a stock market rally?

The next time the Federal Reserve is expected to adjust the target range of the Fed Funds overnight lending rate is Wednesday, November 2nd. Few have doubt at this point that this will again be a 0.75% increase. That level is already baked into equities. Stock market strength and direction shouldn’t veer much from the rate move but could dramatically turn as a result of the Fed’s forward guidance. If Chairman Powell & Co. suggests a slower benchmark lending rate increase, it would be a very welcome sign for investors.

Focus on the Post Meeting Announcement

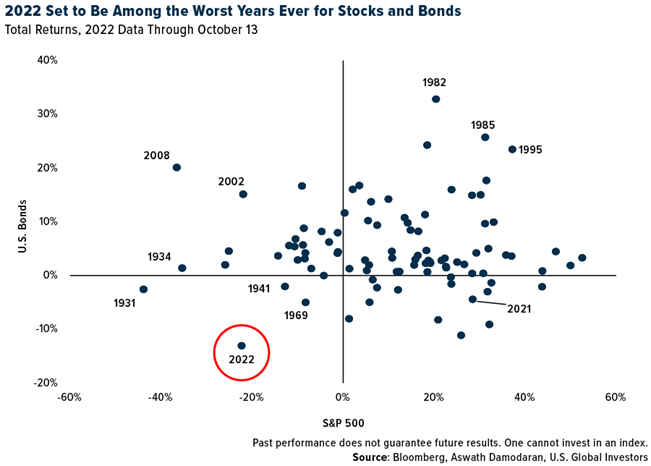

There are already signs the Fed may slow the pace of Fed Funds increases. There are also indications it may alter its quantitative tightening (QT) in a way that could quicken a yield curve steepening. In other words, the speed of QT may increase. To date, the real rate of return on bonds, of most all maturities, is viewed as unnatural as they are below zero (Yield – Inflation = Real Rate). While an increase in QT may do more to raise rates and reduce the money supply, the effect is stealthier; it doesn’t provide a panicky headline for investors to react to abruptly.

Some Fed governors have already shown signs that they believe the best course from here is to slow the ratcheting up of the funds level and perhaps even stop raising Fed Funds rates early next year. A hiatus would allow them time to see if the moves have had an impact and give members a chance to see if further moves are prudent. The Fed always runs the risk of overreacting and going too far when tightening; this “oversteering” by previous Feds has occurred a high percentage of the time as they contend with a lag between monetary policy shifts and economic reaction.

Where We Are, Where We’re Going

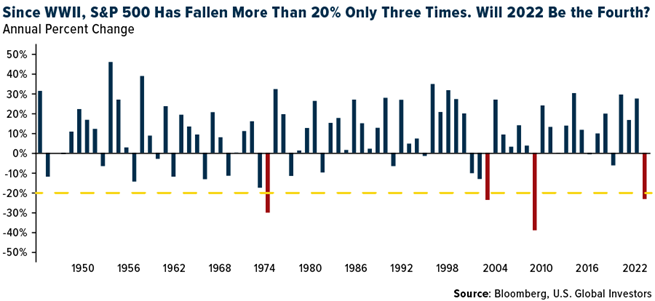

In the most aggressive pace since early 1980, so far in 2022, the Fed raised its benchmark federal-funds rate by 0.75 points at each of its past three meetings. The most recent move was in late September. This left the overnight interest rate at a range between 3% and 3.25%.

The stock market wants the Fed to slow down. It rallied in July and August on expectations that the Fed might slow the pace of increase. Slowing, at least at the time, would have conflicted with the central bank’s inflation target because easy financial conditions stimulate spending, economic growth, and related inflation pressures. This rally in stocks may have prompted Powell to redraft a very public speech to economists in late August. He spoke about nothing else for eight minutes at Jackson Hole except for his resolve to win the fight against higher prices.

But sentiment related to how forceful the FOMC now needs to be may be shifting. Fed Vice Chairwoman Lael Brainard, joined by other officials, have recently hinted they are uneasy with raising rates by 0.75 points beyond next month’s meeting. In a speech on Oct. 10th, Brainard laid out a case for pausing rate rises, noting how they impact the economy over time.

Others that are concerned about the danger of raising rates too high include Chicago Fed President Charles Evans. Evans told reporters on Oct. 10th that he was worried about assumptions that the Fed could just cut rates if it decided they were too high. He felt a need to share his thought that promptly lowering rates is always easier in theory than in practice. The Chicago Fed President said he would prefer to find a rate level that restricted economic growth enough to lower inflation and hold it there even if the Fed faced “a few not-so-great reports” on inflation. “I worry that if the way you judge it is, ‘Oh, another bad inflation report—it must be that we need more [rate hikes],’… that puts us at somewhat greater risk of responding overly aggressive,” Evans said.

Kansas City Fed President Esther George also had something to say on this topic last week. She said she favored moving “steadier and slower” on rate increases. “A series of very super-sized rate increases might cause you to oversteer and not be able to see those turning points,” according to the Kansas City Fed President.

Others like Fed governor Waller don’t view steady 0.75% increases as a done deal but instead something to be reviewed, “We will have a very thoughtful discussion about the pace of tightening at our next meeting,” Waller said in a speech earlier this month.

The caution surrounding oversteering isn’t unanimous; at least one Fed official wants to see proof that inflation is falling before easing up on the economic brake pedal. “Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4% by the end of the year,” said Philadelphia Fed President Patrick Harker.

The ultimate result is likely to come down to what Mr. Powell decides as he seeks to fashion a consensus. In the past, votes, while not always unanimous, tend to defer to the Chairperson at the time.

Take-Away

If, after the next FOMC meeting, the Fed is entertaining a lower 0.50% rate rise in December (not 0.75%), they will prepare the markets (bond, stock, and foreign exchange) for the decision in the moments and weeks following their Nov. 1-2 meeting. If this occurs, it could cause stocks to perform well just before election day and perhaps make up some lost ground in the year’s final two months.

Managing Editor, Channelchek

https://www.federalreserve.gov/newsevents/speech/waller20221006a.htm

https://www.federalreserve.gov/aboutthefed/federal-reserve-system-philadelphia.htm