Global Dynamics Have Helped Silver’s Impressive Price Increase

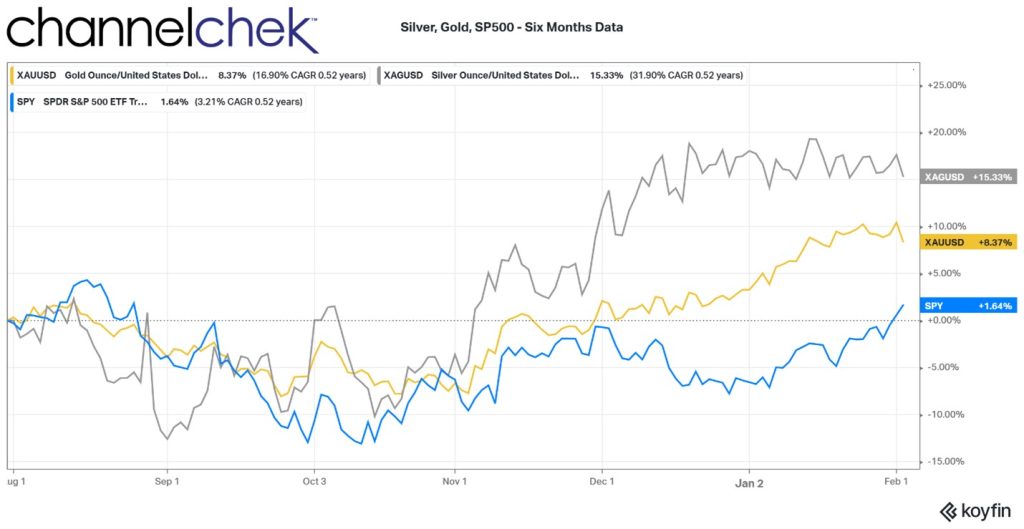

In mid-October, silver performance began outpacing gold, and it has stayed more or less on track since. During this 3.5-month period, silver had better than a 25% gain in value. What’s behind its current strength, and can it continue to outperform not only the mineral it is most closely associated with but the overall stock market as well? Much of the price rise is likely in response to perceived growing demand in much the same way as petroleum prices have risen each time China is rumored to be opening up after their pandemic response, but there is more to the story.

Silver would have more of a tailwind than gold in a growing global economy as it’s an industrial metal with growing utility in manufacturing. Gold is used for primarily for jewelry and a diversifying store of wealth. So this enhances its performance as it gets its value from scarcity like gold, is a precious metal that investors speculate in, and is becoming more in demand to build photovoltaic cells, electronics, and medicines. The appeal of silver can be used as an indicator that investors see the global economy growing stronger, with more demand for industrial metals. While much of the focus surrounding a full opening of China has centered on renewed demand for petroleum, the impact should reach much farther.

Other industrial metals have also gained as Chinese pandemic restrictions have eased. China is the worlds largest consumer of metals, copper and iron-ore futures on Comex each climbed by nearly 11% in January.

In addition to its functional utility, the price increase has also come at a time when uncertainty and in some cases turmoil around the globe has caused investors to seek shelter in precious metals.

There is more causing the strength as well. There is substantially more demand now than before the coronavirus shutdowns because in many parts of the world there is a push toward alternative and clean-energy production. This includes more products with more electrical connectors, the ability to produce power from solar, and other technology that is more in demand now than ever.

Over the same three-month-plus period as above, both gold and silver gained while the ICE U.S. Dollar index, a benchmark for the international value of the dollar, lost over 8%. The Fed slowing its interest rate hikes has had a depressive impact on dollar strength. It now simply takes more dollars to buy the same amount of silver.

Take Away

There are a number of factors why silver has been outperforming gold, the stock market, and the US dollar. These include its reputation as a store of value, parts of the world gearing up for what is expected to be an energy renaissance, the opening of the largest metals consuming country, and a weakening dollar.

Managing Editor, Channelchek

Sources

https://www.barrons.com/articles/silver-gold-prices-economy-51675291146?mod=hp_LEADSUPP_2