U.S. Treasury yields fell significantly on Wednesday as soft economic data increased expectations for the Federal Reserve to cut interest rates by September. The decline was driven by weaker reports on private-sector job growth and a contraction in service-sector activity, leading traders to price in a more aggressive pace of monetary easing.

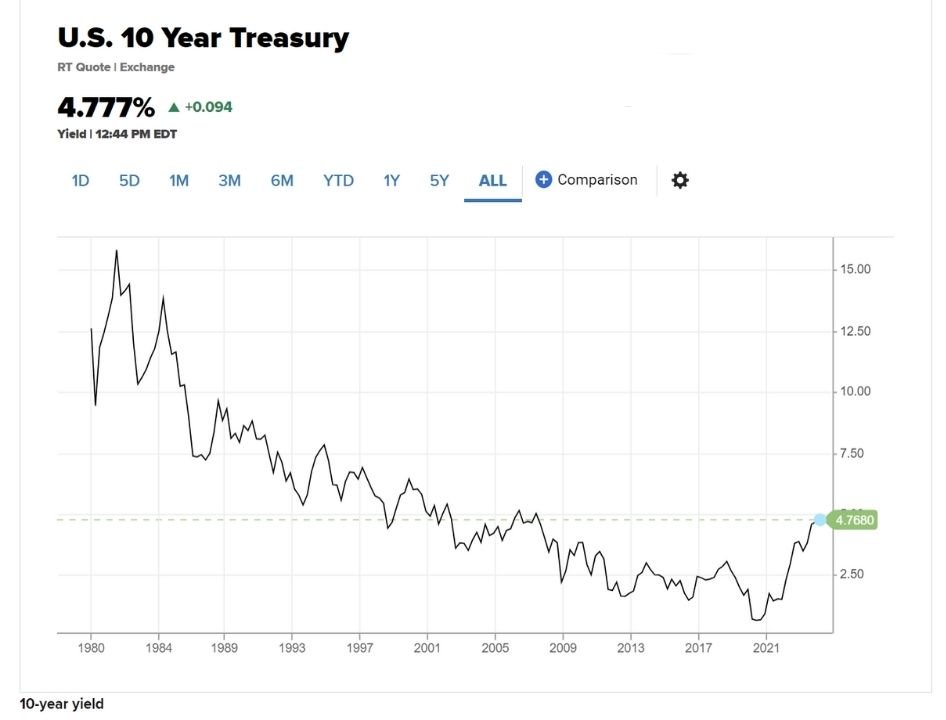

Yields across the curve, particularly from the 2-year to the 10-year notes, dropped to their lowest levels since early May. The benchmark 10-year yield declined to 4.35%, highlighting the bond market’s strong reaction to signs of slowing economic momentum.

The first catalyst came from the ADP employment report, which showed the slowest pace of job creation in two years. That was followed by the Institute for Supply Management’s services index, which signaled contraction for the first time in nearly a year. Together, these indicators pointed to a potential softening in the labor market and raised concerns about overall economic resilience.

Market participants increased their bets that the Fed could start cutting rates as early as September, with the probability of a move rising to around 95%, up from just over 80% the day before. Additionally, expectations for two rate cuts by the end of 2025—likely in October and December—also gained traction.

Adding to the market’s reaction was a sharp decline in oil prices, spurred by indications that Saudi Arabia may be open to increasing oil production. Falling energy prices helped reinforce the idea that inflation pressures could be easing, giving the Fed more room to support the economy with lower interest rates.

Despite these signals, not all data pointed to weakness. A separate government report released Tuesday showed that job openings increased in April, and hiring also improved. Furthermore, within the ISM services report, the employment component showed unexpected strength, and the prices paid index rose to its highest level since late 2022. These mixed signals reflect the complexity of the current economic environment and suggest that the Fed will continue to weigh multiple indicators before making a policy decision.

Recent volatility in rate expectations followed a series of mixed economic releases throughout the spring. While rate cut hopes grew late last year, persistent inflation and stronger-than-expected economic activity had cooled those expectations in recent months. May saw the Treasury market lose 1%, as measured by a Bloomberg index, though it remains up 2.1% year-to-date through early June.

All eyes now turn to the upcoming U.S. government employment report for May, due Friday. Economists expect a payroll gain of 130,000 jobs, down from April’s increase of 177,000, with the unemployment rate forecast to remain at 4.2%. A notable rise in the jobless rate could give the Fed additional justification to pivot toward rate cuts.

Investors will continue to monitor labor market indicators, inflation data, and Fed commentary as they navigate an uncertain path for interest rates heading into the second half of 2025.