Investors Have Far Fewer Reservations Against Investing in Leisure

Memorial Day Weekend in the U.S. marks the beginning of the travel season. After a few years on hiatus, as a result of Covid-19 restrictions, travel in 2023 is expected to surpass pre-pandemic numbers. While many investors are focused on the debt ceiling, less accommodative monetary policy, and looking for an entry point to invest in AI technology, post-pandemic travel plans are increasing – and the returns of some companies reflect this. One segment of the travel sector has benefitted and provided double-digit YTD stock returns. Below we discuss this segment and the potential for the future.

Travel Booking Stocks

When was the last time you went to an airline website to book a flight with them, or even a hotel for that matter? Most of us now find ourselves on a booking website when we’re planning a vacation. On these platforms, we can compare prices more easily, and if we’d like, add on extras like a car rental. Some even have proprietary package deals.

Technological advancements have created even greater efficiencies among booking and vacation travel package companies. Other positives for growth are pent-up demand, diversified revenue streams, and valuations still considered attractive. These all provide a backdrop and potential for the medium and long-term growth of the travel booking industry.

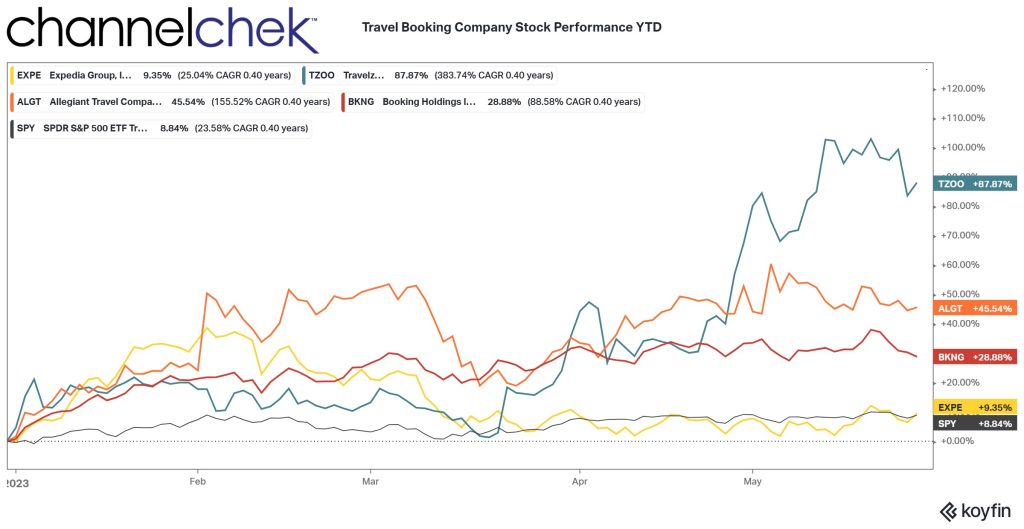

The chart above is a year-to-date sampling of examples of stocks in this leisure segment that have outperformed the overall market (S&P 500). Below, from weakest performer to strongest, are details of each company’s unique business, market cap, and other interesting investor information:

- Expedia (EXPE) is a global travel company that provides a wide range of travel services, including flights, hotels, car rentals, and vacation packages.

This is a large cap stock with a current market cap of $14.33 billion, at $96.85 per share.

The company is headquartered in Seattle, Washington.

- Booking Holdings (BKNG) is a travel company that owns a number of popular travel brands, including Booking.com, Priceline.com, and Kayak.com.

This is a large-cap stock with a current market cap of $97.61 billion, at $45.41 per share.

The company is headquartered in Norwalk, CT.

- Allegiant Travel (ALGT) is a leisure travel company that provides travel services and other products to under-served cities in the U.S. This includes flights between vacation destinations. As of February 1, 2023, Allegiant operated a fleet of 122 Airbus A320 series aircraft.

This is a small cap stock with a current market cap of $1.85 billion, at a price of $99.96 per share.

The company is headquartered in Las Vegas, Nevada.

- Travelzoo (TZOO) has a unique business model as it operates as an Internet media company that provides travel, entertainment, and deals from travel and leisure businesses worldwide. Publication products include the Travelzoo Top 20 email newsletter, Travelzoo emails, Travelzoo Network, Travelzoo mobile applications, Jack’s Flight Club website, Jack’s Flight Club mobile applications, and Jack’s Flight Club newsletters.

The year-to-date performance of TZOO is 10x that of the S&P 500.

In a research report dated April 28, 2023, Michael Kupinski, the senior research analyst for media and entertainment, had this to say about Travelzoo, “We believe that there is a disconnect with investors and the improved fundamentals at the company. Near current levels, the TZOO shares appear compelling, trading at 5.3 times Enterprise Value to our 2024 cash flow estimate or below the low end of the company’s 10-year and 15-year average trading ranges.” See the report here.

Current market cap is $133.05 million, at $8.69 per share.

The company is headquartered in New York, NY.

Image: “This Memorial Day weekend could be the busiest at airports since 2005” – AAA Newsroom

Take Away

Travel booking companies are well-positioned to benefit from the recovery of the overall leisure industry. Small cap travel booking companies are often more nimble and innovative than larger companies; this could give them an advantage in the travel booking market.

People are spending more money on travel. Companies like those mentioned above welcome the opening of China, allowing citizens to travel and return. In addition to the overall post-pandemic volume of business, travelers are spending more money on trips than they did before the restrictions.

Managing Editor, Channelchek

Sources