| Key Points: – Investors are watching tonight’s Trump-Harris debate closely for insights on future economic policies and potential market movements. – Trump Media stock surged ahead of the debate, signaling possible volatility in political-adjacent companies. – The debate could influence market sectors like tech, healthcare, and energy, depending on the candidates’ policy discussions. |

As former President Donald Trump and Vice President Kamala Harris prepare to face off in tonight’s highly anticipated debate, investors and market watchers are gearing up for potential shifts in stock prices. With both candidates proposing different economic policies, the outcome of the debate could have significant consequences for the U.S. stock market. Investors are particularly interested in how the candidates will address pressing economic issues like inflation, interest rates, and taxation.

In a notable development, Trump Media stock saw a surge of over 10% ahead of the debate. The stock, which is tied to Trump’s social media company Truth Social, often acts as a gauge for Trump’s political fortunes. This sudden rise in value demonstrates how political events can trigger movements in individual stocks, particularly those closely tied to the candidates. For investors, this surge could signal increased market volatility, especially for companies that are either directly influenced by politics or considered riskier assets.

Beyond Trump Media, broader sectors of the stock market may be affected depending on how the debate unfolds. Technology stocks, which tend to react strongly to policy changes, could see immediate shifts. Major players like Amazon, Alphabet, and Meta have experienced volatility during election seasons, and tonight’s debate may reignite similar trends. Investors will be paying close attention to how both Trump and Harris propose to regulate Big Tech, particularly in areas like data privacy, AI regulation, and antitrust issues.

The healthcare and energy sectors could also experience fluctuations based on the candidates’ policy positions. Harris is expected to focus on expanding healthcare access and pushing for environmental reforms, while Trump is likely to emphasize deregulation and lower taxes. How these policies are presented could impact sectors like renewable energy, oil and gas, and healthcare providers.

From an investment standpoint, clarity in economic policy is crucial. Both Trump and Harris have been rolling out proposals in the lead-up to the debate, but tonight’s event offers a platform for more detailed discussions. Investors will be looking for any indication of how each candidate plans to handle inflation, interest rates, and fiscal stimulus—topics that directly affect market stability. As inflation continues to be a hot-button issue, any hints at future federal rate cuts or spending plans could sway market sentiment.

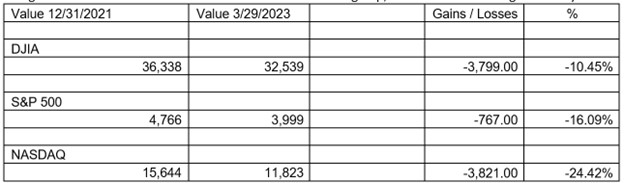

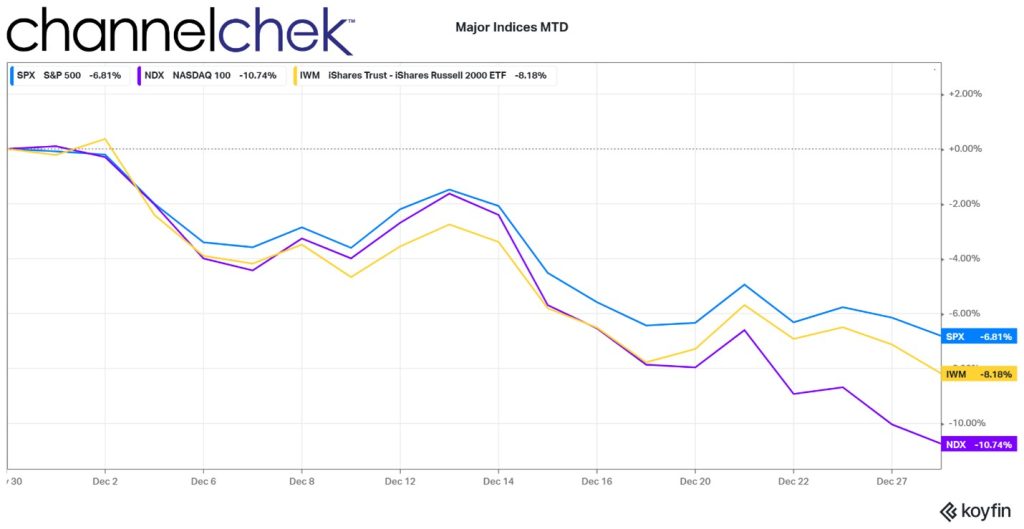

In particular, the debate takes place as the stock market has been navigating heightened volatility. The S&P 500 recently experienced its worst week of the year, and uncertainty around inflation and economic growth has left investors anxious. With polling showing Trump and Harris in a tight race, the outcome of the debate could introduce new dynamics into the market, particularly if one candidate clearly outshines the other in terms of their economic vision.

It’s important to note that while debates can influence market sentiment, they do not always lead to long-term market shifts. However, the candidates’ positions on fiscal policy, corporate taxes, and economic growth will be critical for long-term investors. If Trump signals a return to policies that focus on corporate tax cuts and deregulation, sectors like technology, energy, and financials could see positive momentum. On the other hand, if Harris pushes for increased regulation and green energy initiatives, renewable energy stocks may experience a rally.

Regardless of tonight’s outcome, investors should approach the market with caution in the days following the debate. Political uncertainty often leads to short-term market volatility, and traders may reposition themselves based on perceived shifts in the political landscape. However, the debate is only one factor influencing a complex global market, and long-term investors should weigh broader economic indicators before making any major decisions.

For those tracking the stock market, tonight’s debate offers more than just political theater—it’s an opportunity to gain insights into the future direction of the U.S. economy and its potential impact on market sectors. Investors should remain vigilant and keep a close eye on how both candidates articulate their economic policies, as these discussions will likely shape market expectations moving forward.