The annual Russell reconstitution is one of the biggest events in the investing world, shaping the composition of the widely followed Russell indexes, including the influential Russell 2000 and Russell 3000 indexes. This comprehensive process ensures these indexes accurately represent various U.S. market segments by reflecting changes in company market capitalizations and characteristics.

What is the Russell Reconstitution?

The Russell reconstitution is an annual rebalancing process where all Russell equity indexes undergo a complete overhaul. During reconstitution, the index provider FTSE Russell rebuilds the Russell indexes from the ground up based on new data on eligible stocks’ market caps, trading volumes, and other criteria.

This vital event maintains the integrity of Russell indexes as accurate benchmarks by updating their holdings to reflect the current landscape of the U.S. stock market. Reconstitution allows companies that have grown or shrunk in value to be properly represented in the appropriate Russell indexes.

The Importance of the Russell 3000 Index

A major focus of the reconstitution is the Russell 3000 Index, considered one of the leading benchmarks for the overall U.S. equity market. This index aims to capture 98% of U.S. stocks by market cap.

On May 24, 2024, FTSE Russell published its annual reconstitution updates, revealing notable new additions to the Russell 3000 like Ocugen, Eledon Pharmaceuticals, NN Inc., and Bitcoin Depot. Such changes highlight how reconstitution allows the index to evolve with the market.

The Closely Watched Russell 2000 Index

Another keenly watched Russell index is the small-cap Russell 2000, which tracks the smallest 2,000 companies in the Russell 3000 by market cap. This index is considered a leading benchmark for small-cap U.S. stocks.

During reconstitution, companies can move in or out of the Russell 2000 based on changes to their market capitalization or investment style exposures like value vs growth. This rebalancing ensures the Russell 2000 precisely represents today’s small-cap universe.

IPO Additions Throughout the Year

In addition to the annual reset, FTSE Russell regularly adds eligible IPO stocks to its indexes on a quarterly basis. This allows newly public companies to quickly enter major benchmarks like the Russell 3000 instead of waiting for reconstitution.

Russell’s IPO treatment distinguishes between fully underwritten IPOs and partial or “best efforts” public offerings when determining appropriate share weights and eligibility.

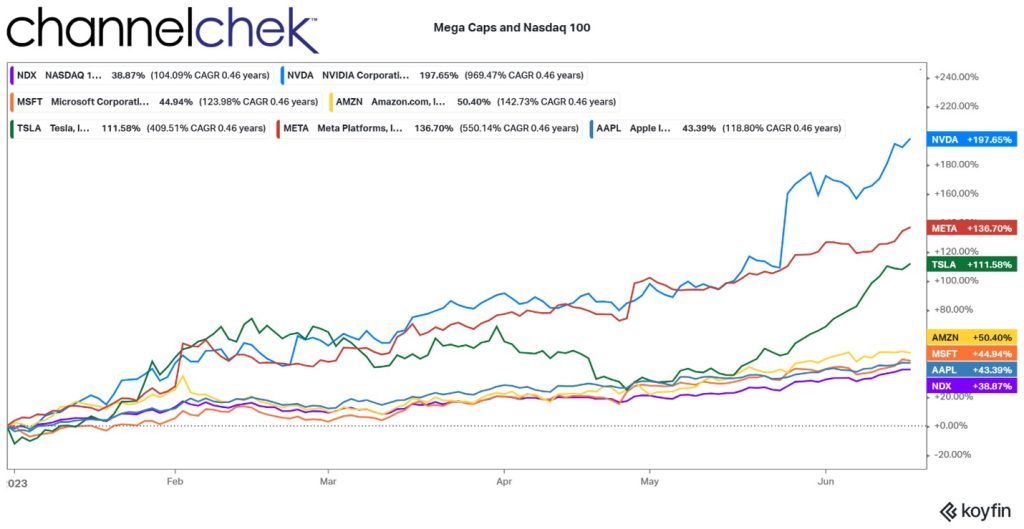

Rebalancing Drives Major Trading Activity

Russell reconstitution is a major trading event, as index funds and ETFs tracking Russell benchmarks must rebalance their portfolios to match updated index constituents and weightings.

Estimates suggest hundreds of billions in assets follow the Russell benchmarks, meaning their reconstitution announcements can trigger massive shifts in demand for newly added or removed stocks.

Following Russell’s Transparent Methodology

FTSE Russell’s reconstitution process follows an objective, rules-based methodology spelled out in publicly available documentation. Key eligibility factors include:

- Trading on eligible U.S. stock exchanges

- Meeting minimum price, market cap, and liquidity thresholds

- Sufficient public share float and voting rights

- Eligible corporate structures like public operating companies

Staying on top of Russell’s transparent reconstitution rules allows investors to understand how index changes may impact their portfolios and positions.

The Russell Reconstitution’s Continuing Impact

As indexes like the Russell 3000 continue gaining prominence as core portfolio benchmarks, Russell reconstitution’s influence grows. The 2024 event reinforces the Russell indexes’ role in definitively capturing U.S. market performance by surgery evolving index holdings to match current realities.

Whether reallocating client assets, developing new index funds, or simply understanding market composition changes, the 2024 Russell reconstitution guide will prove essential reading for investors. Follow this yearly event closely, as it shapes the benchmarks driving U.S. equity allocations for years to come.

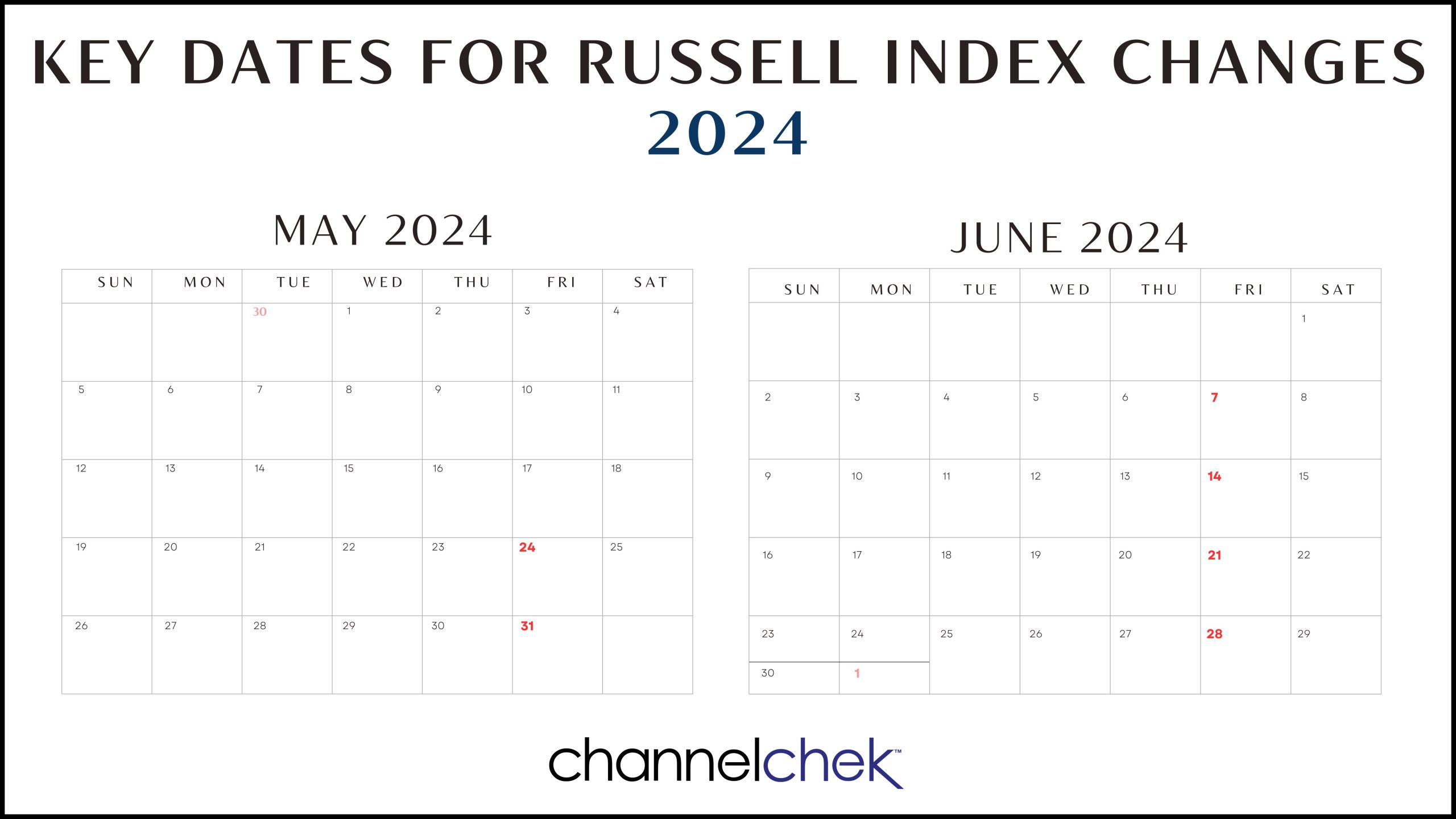

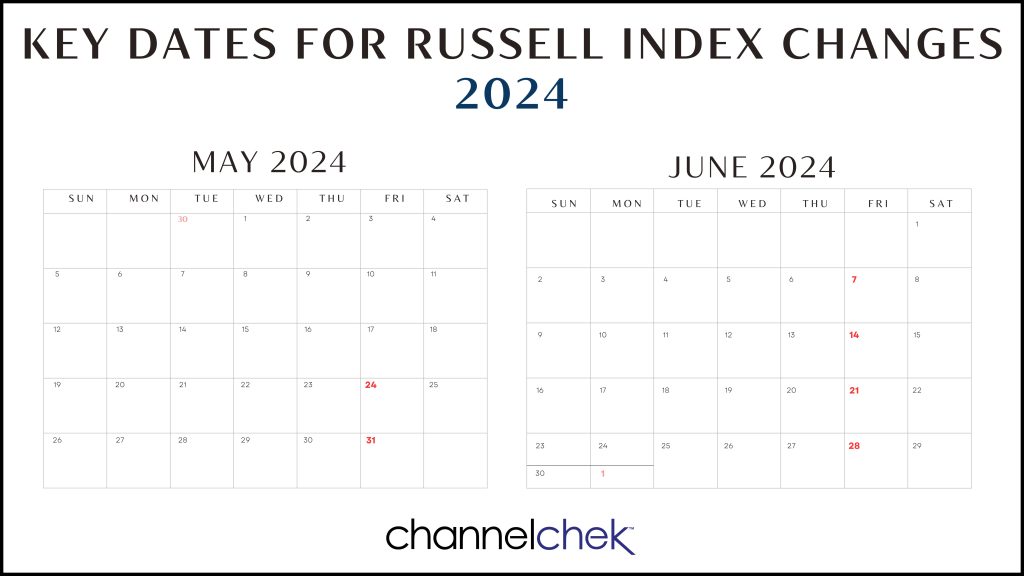

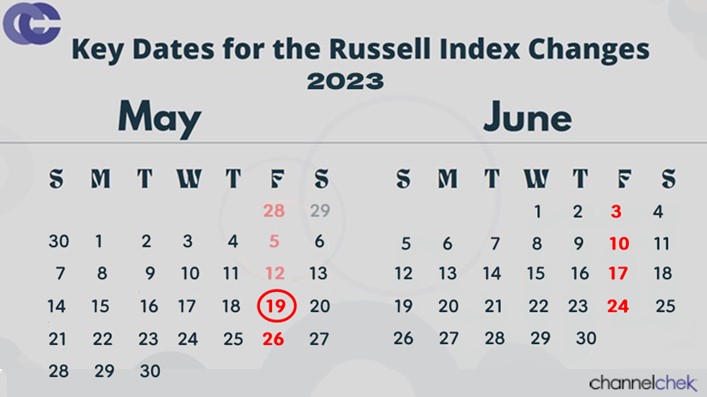

Upcoming 2024 Russell Reconstitution Schedule

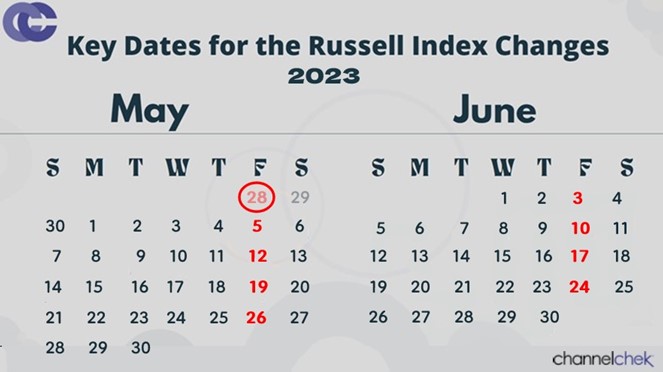

Friday, May 31st, June 7th, 14th, and 21st – Preliminary membership lists (reflecting any updates) posted to the FTSE Russell website after 6PM US eastern time.

Monday, June 10th – “Lock-down” period begins with the updates to reconstitution membership considered to be final.

Friday, June 28th – Russell Reconstitution is final after the close of the US equity markets.

Monday, July 1st – Equity markets open with the newly reconstituted Russell US Indexes.