| Key Points: – U.S. GDP shrank by 0.3%, driven by a historic 41.3% surge in imports as businesses rushed to front-load goods ahead of new Trump-era tariffs. – While consumer spending and business investment grew, rising inflation and policy uncertainty cloud near-term growth prospects. – Elevated inflation and softening growth raise the stakes for the Federal Reserve’s next policy moves, with potential implications for rate cuts. |

The U.S. economy unexpectedly contracted in the first quarter of 2025, shrinking at a 0.3% annualized pace, according to Commerce Department data released Wednesday. The headline miss was driven largely by a record-breaking surge in imports, as companies raced to secure goods before a new wave of tariffs took effect under President Trump’s trade policy agenda.

This marked the first negative GDP print since early 2022 and diverged sharply from Wall Street forecasts, which had anticipated modest growth. The main culprit: a 41.3% quarterly spike in imports, with goods imports alone climbing over 50%. Since imports subtract from gross domestic product, this front-loading of supply chains delivered a mechanical but powerful hit to the quarter’s output.

While on paper this suggests economic weakness, some analysts argue that the downturn may be short-lived if imports stabilize in coming quarters. “It’s less a collapse in demand and more a reflection of distorted trade timing,” said one economist.

A Conflicting Mix for Markets and the Fed

Despite the GDP drop, consumer spending still advanced 1.8%, though this was down from the previous quarter’s 4% gain. Business investment saw strong momentum, up 21.9%, driven by firms increasing equipment spending — again, likely an effort to beat tariff hikes. On the downside, federal government spending fell 5.1%, continuing a recent pullback in public sector outlays.

Inflation data added another wrinkle to the economic picture. The personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge, rose 3.6% in the quarter. Core PCE, which excludes food and energy, jumped 3.5%. These hotter-than-expected figures could make the Fed more cautious about cutting rates despite emerging signs of slower growth.

For small-cap and micro-cap investors, this mixed data environment adds complexity. On one hand, tariff-driven disruptions and rising input costs may squeeze margins for smaller firms with less pricing power. On the other, a potential pivot by the Fed toward easing — should growth remain weak — could lower borrowing costs and boost liquidity in risk assets.

Tariff Uncertainty and Market Sentiment

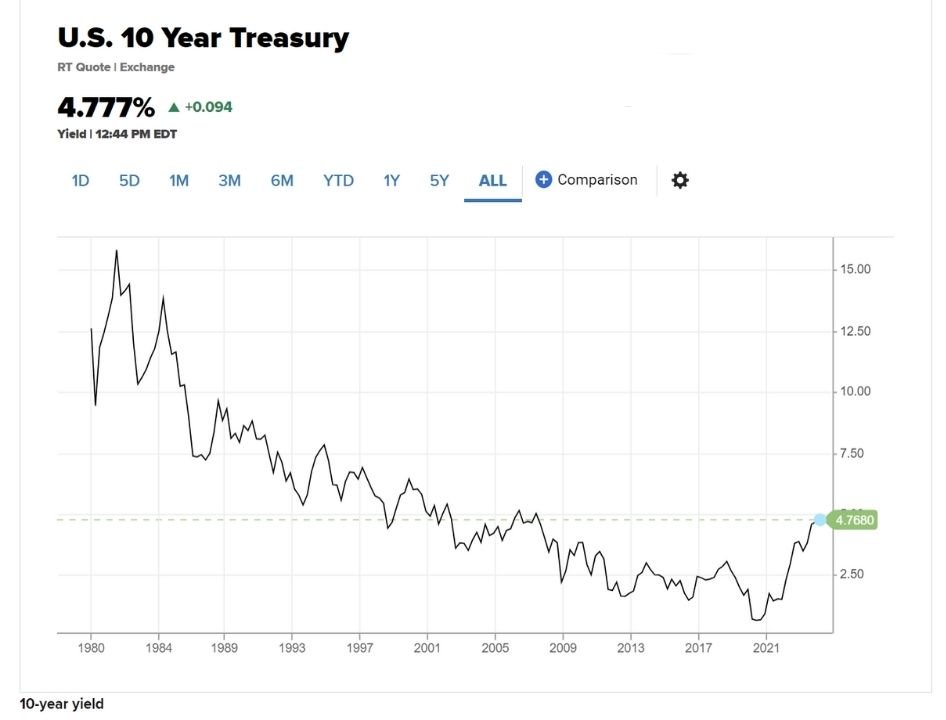

Markets are already reacting to the policy noise. Stock futures dipped on the GDP miss, while Treasury yields rose slightly, pricing in the inflation risk. Meanwhile, Trump’s “Liberation Day” tariff strategy — including broad-based 10% levies and sector-specific duties — remains in flux as negotiations continue. The president has promised a manufacturing revival, but business leaders warn that volatility in trade rules could delay investment and hiring.

From a small-cap perspective, volatility can be a double-edged sword. On one hand, it creates valuation dislocations and buying opportunities. On the other, it adds risk for companies with fragile supply chains or tight capital access. Investors may want to watch domestically focused firms with strong balance sheets and limited exposure to global inputs.

Looking Ahead

With the labor market softening — job openings recently fell to a near four-year low — and inflation still elevated, the Federal Reserve faces a high-stakes balancing act. All eyes now turn to Friday’s nonfarm payrolls report for a clearer picture of economic momentum heading into Q2.