Fed Chairman Powell is Being Ignored by the Markets – What Next?

Is Fed Chairman Powell getting the George Costanza treatment from the bond market? I asked myself this as I listened to the Chair double down on his hawkishness yesterday while at the same time watching the bond market yawn. Rates were effectively unchanged out in the periods. It reminded me of the Seinfeld episode where George tells his girlfriend, point blank, I’m breaking up with you.” She simply replies, “No.” Similar to George, Powell’s wishes are not being recognized by the market which would be hurt by them. Today mortgage rates dropped along with treasury yields, this all makes Powell’s job tricky.

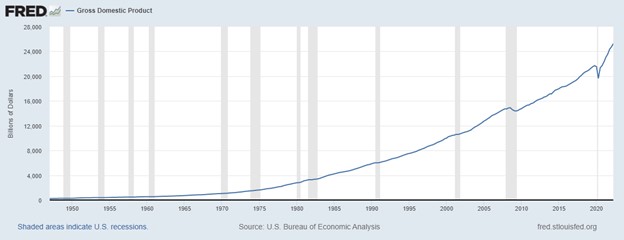

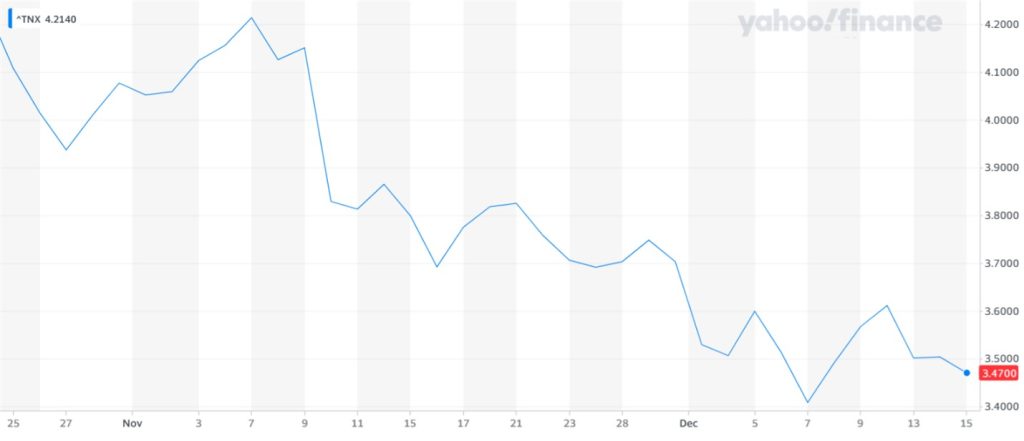

The FOMCs final episode of the 2022 season ended as expected with a 50 bp increase, and the Fed Chairman addressing reporters and trying to be taken seriously by the markets. Afterall, he can say he’s raising rates all he wants to slow growth, if lending rates don’t rise, the Fed doesn’t achieve its goal. Since October 24, the Fed has raised overnight rates 1.25%. As seen below in the chart, despite the increase from a 3% target to a 4.25% target (which is a 42% increase in bank lending rates), the ten year which is a benchmark for consumer lending rates, declined by 0.75% (which is an 18% decline).

U.S. 10- Yr. Treasury Note Market Rates

What’s Going On?

Markets are forward looking. Currently they seem to be, more farsighted than usual. As Chairman Powell repeats after each increase that officials anticipate that “ongoing increases” in the Fed Funds rate will be “appropriate,” this would be expected by someone of Powell’s experience to cause the market to look toward rate increases and shift the yield curve higher. The Fed has done more than this. The official one-year-out Fed forecast is for the Fed funds rate to end 2023 at 5.1% and 4.1% for 2024. These were 4.6% and 3.9% previously. Mortgage rates today hit recent lows.

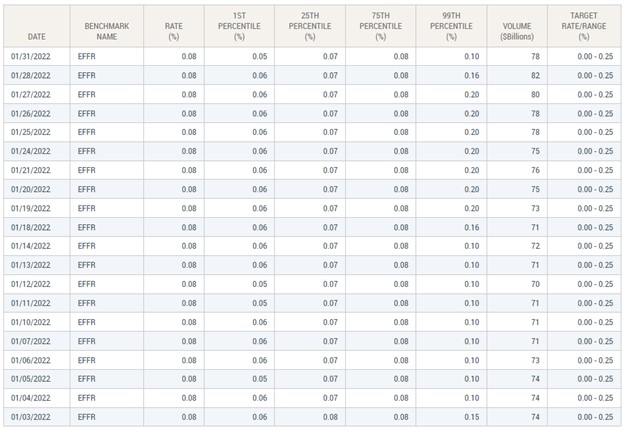

Meanwhile overnight interest rates this year have increased by 50 times from where they started (.08% to 4.00%). By comparison the benchmark Treasury was trading at 1.73% at the start of the year, so its level has gone up by two times.

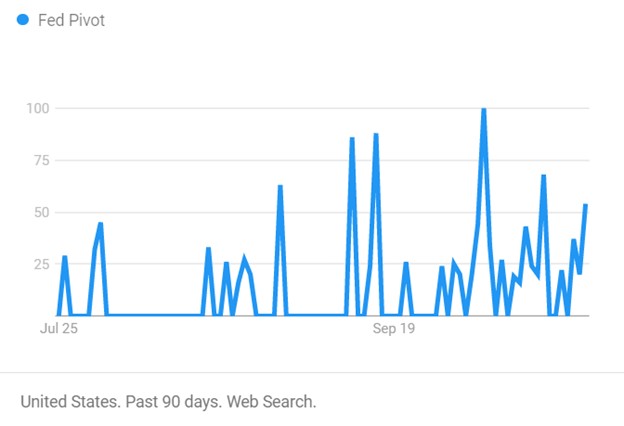

But the current market has been so forward-looking in 2022, that each time the Fed puts on its hawkish face, the bond markets take it as more assurance that the U.S. will fall into a recession. They trade on the reassurance that the Fed will need to ease, and it effectively eases borrowing rates as benchmark yields decline. The bond and even stock markets expect the tightening to be transitory. They also only half listen to the Fed Chair because they know how wrong he was when he suggested inflation was transitory just one year ago.

CPI is also causing markets to be optimistic. Two consecutive consensus misses of inflation have led the participants to believe we are getting very close to the peak for interest rates, and rate cuts will soon be on the agenda. The Fed has been doing everything it can to change people’s minds.

The Fed’s View

While the market may be saying “no” and not allowing Powell to impose higher rates along the curve, the Fed certainly is going to keep trying. A 2% inflation target with inflation running approximately three times this won’t allow for an easing of policy. Even if overnight Fed Funds are so high that they are near historical norms.

For the Fed to accept what the market is pricing for, it will want to see substantial evidence that inflation is slowing. This will take more than just one or two months, where core inflation has come in less than the market was expecting. It isn’t an exact science to bring down inflation, but mathematically to get inflation to 2% YoY, over time, we need to see month-on-month readings averaging 0.17% MoM. We are not close, considering it is the core PCE deflator that the Fed pays the most attention to. In fact, the Fed just revised its inflation forecast upward because the core PCE deflator is likely to be stickier than core CPI. The revision has its core PCE estimate at 3.5% for the end of 2023 versus 3.1% previously, with 2024 revised up to 2.5% from 2.3%.

Take Away

What happens when monetary policy throws us huge increases in Fed Funds in seven out of its eight meetings, and late in the year, the interest rate markets decides, “No?”

It seems the Fed is working on its ability to jawbone rates higher. We saw this after the FOMC meeting with Powell doubling down on his rhetoric. We can expect more Fed addresses trying to move rates in a way that direct action concerning overnights has failed to accomplish. In the end, it’s the markets that set levels; if the bond market and stock market participants keep taking this hawkish language as recessionary, the hawkish stance could continue to backfire on the Fed.

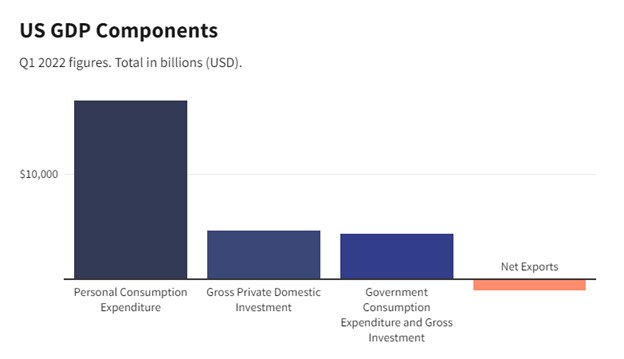

Comments from Fed Chair Powell emphasized that the FOMC wants financial conditions to “reflect the policy restraint that we’re putting in place”. After all, inflation is indeed still running well above target, the jobs market and wage pressure remain hot, and activity data is pointing to a decent fourth-quarter GDP report after a healthy 2.9% growth rate in the third quarter. Will he succeed? If my memory serves me correctly, in the Seinfeld episode George wound up engaged to the woman he was breaking up with.

Managing Editor, Channelchek