Oil markets were thrown into turmoil on Wednesday after the OPEC+ alliance unexpectedly postponed a critical meeting to determine production levels. Prices promptly plunged over 5% as hopes for additional output cuts to stabilize crude markets were dashed, at least temporarily.

The closely-watched meeting was originally slated for December 3-4. But OPEC+, which includes the 13 member countries of the Organization of Petroleum Exporting Countries along with Russia and other non-members, said the summit would now take place on December 6 instead, offering no explanation for the delay.

The last-minute postponement fueled speculation that the group is struggling to build consensus around boosting production cuts aimed at reversing oil’s steep two-month slide. Disagreements apparently center on Saudi dissatisfaction with other nations flouting their output quotas. Compliance has emerged as a major flashpoint as oil revenue pressures intensify amid rising recession fears.

Prices Rally on Cut Hopes

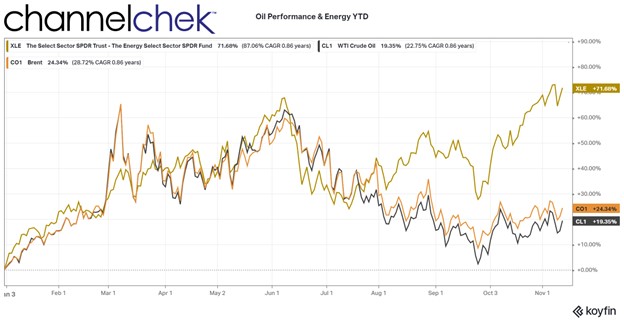

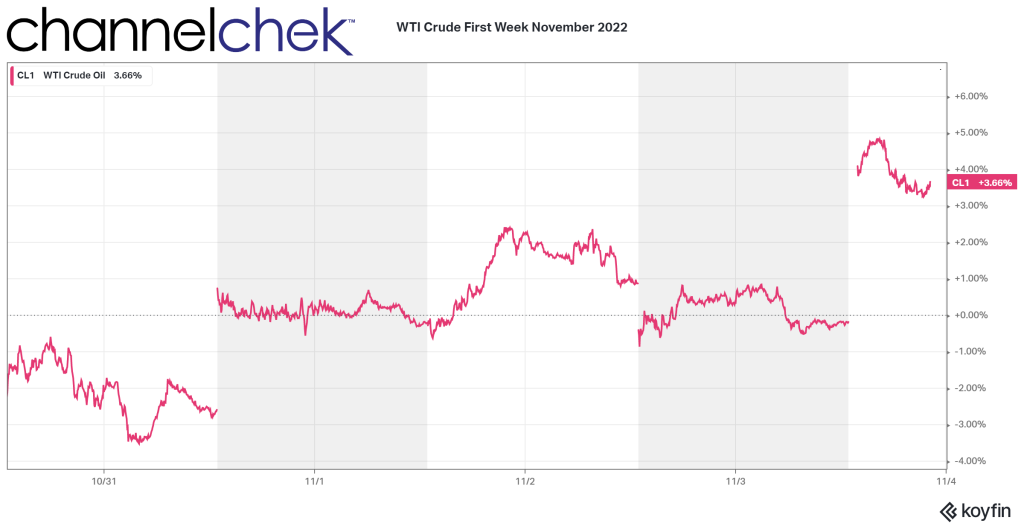

In recent weeks, oil had rebounded from mid-October lows on mounting expectations that OPEC+ would intervene to tighten supply and put a floor under prices once more.

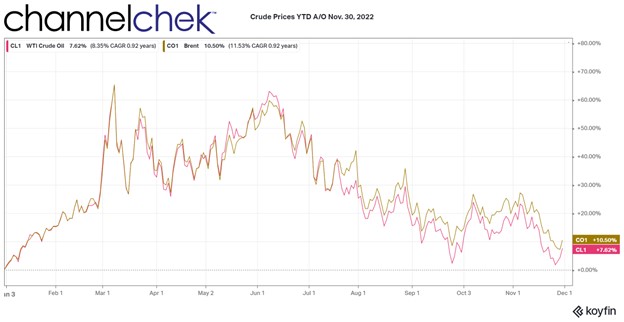

The alliance has already removed over 5 million barrels per day since 2023 through unilateral Saudi production cuts and collective OPEC+ reductions. But crude has continued drifting lower, with Brent plunging below $80 per barrel last week for the first time since January.

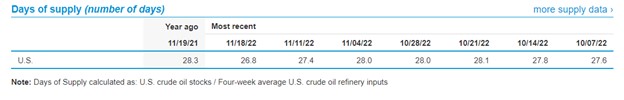

Demand outlooks have deteriorated significantly, especially in China where crude imports fell in October to their lowest since 2007. At the same time, releases from strategic petroleum reserves and resilient non-OPEC production have expanded inventories, exacerbating the supply glut.

Output Quotas Trigger Internal Rifts

Energy analysts widely anticipate that OPEC+ will finalize plans at next week’s rescheduled talks to extend existing production cuts until mid-2024. Saudi Arabia and Russia, the alliance’s de factor leaders, both support additional trims.

However, firming up commitments from the broader group may prove challenging. Crude exports are critical to the economies of many member nations. With government budgets squeezed by weakened prices, some countries have little incentive to curb production.

Unconfirmed reports suggest that Saudi Arabia demanded Iraq and several other laggards bolster compliance with quotas before it agrees to further output reductions. But getting all parties in line with their assigned targets has long confounded the alliance.

Where Oil Goes Next

For now, oil markets are in limbo awaiting next Thursday’s OPEC+ gathering. Prices could see added volatility until the cartel unveils its plans.

Most analysts still expect that additional cuts will emerge, possibly in the 500,000 barrels per day range. That may be enough to place a temporary floor under the market and keep Brent crude from approaching $70 per barrel.

But if internal dissent paralyzes OPEC+ from reaching an agreement, or one that falls significantly short of projections, another downward spiral is probable. Pressure would only escalate on the alliance to take more drastic actions to stabilize prices in 2024 as economic storm clouds gather.