Equity Research Allows Investors to More Confidently Step Away from the Growing Index Valuations

Hedge Fund Managers Michael Burry and Bill Ackman have expressed deep concern over indexed funds for a years and for different reasons. Burry primarily fears a bubble growing, and Ackman agrees but also fears investors are giving away control to parties that may not have their best interests at heart. Both make understandable cases. Below we discuss the overall concerns and how an individual investor who shares their concerns may “hedge” their portfolio against these risks.

Michael Burry

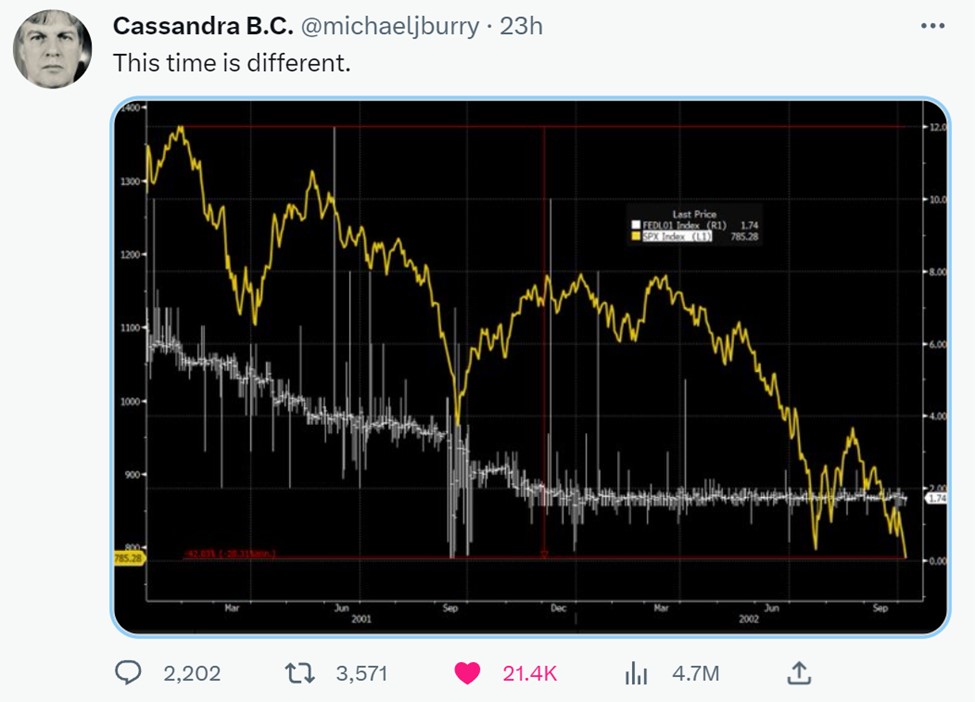

“The bubble in passive investing through ETFs and index funds as well as the trend to very large size among asset managers has orphaned smaller value-type securities globally,” Michael Burry told Bloomberg News in August of 2019. “Orphaned” presumably refers to a lack of attention now paid to this market segment.

Burry’s concerns centered around the idea that the rise of passive investing could lead to distortions in the stock market. He believed that as more and more investors put their money into indexed funds, the valuations of the companies included in those indices might become disconnected from their underlying fundamentals as fund managers were required to own the index at the established weighting. In his view, this could create a bubble-like situation where certain stocks are overvalued due to indiscriminate buying driven by the popularity of index funds.

While many view this hedge fund manager, made most famous by the movie The Big Short, as a pessimist, it is easy to think of him as an optimist finding opportunity, even where there could be trouble.

As he discussed then, the rush into indexed funds has punished small cap value stocks. Burry also highlighted, “There is all this opportunity, but so few active managers.”

Bill Ackman

“We believe that it is axiomatic that while capital flows will drive market values in the short term, valuations will drive market values over the long term. As a result, large and growing inflows to index funds, coupled with their market-cap driven allocation policies, drive index component valuations upwards and reduce their potential long-term rates of return,” according to Bill Ackman in a statement which agrees with Burry’s thoughts. Bull Bill Ackman also sees another risk.

In a letter to shareholders earlier this year, the activist investor, and big boss at Pershing Square Capital, made the point that the passive funds not only follow indexes but encourage active managers to stay close to the index where investors pay for active management, but get index-like results because the fund company fears shareholder reaction if returns deviates sharply from the index benchmark.

More telling is Ackaman’s fear of proxy votes and other governance taken out the hands of the masses and bestowed on so few. Ackman believes that passive managers like Vanguard, BlackRock, and State Street hurt investors by concentrating corporate power in a small group of players “who get larger by the minute.” With 20% or more of fund flows headed to an indexed fund or ETF, Ackman wonders who will “look out for one another’s interests?”

Actively Managed and Self-Directed Investing

The Nasdaq 100 index just reorganized in order to lessen potential risks to being overweighted in a few stocks. Surrounding this event and through the years there has been no shortage of discussion around index bubbles and why some see indexes as an eventual train wreck:

“Is There an Index Fund Bubble?” (Bloomberg, September 4, 2019)

“The Index Fund Bubble Is Coming” (The Motley Fool, January 23, 2020)

“Is the Index Fund Bubble About to Burst?” (Investopedia, March 11, 2021)

“The Index Fund Bubble Is Real, and It’s Going to Burst” (MarketWatch, April 20, 2022)

“The Index Fund Bubble Is Even Bigger Than You Think” (Barron’s, May 23, 2023)

And there is also fear in the consolidation of power into the hands of a few fund companies that could impact all of us more subtly.

While index fund investing is growing in popularity and has been rewarding, investors can prepare by scaling down these investments and making their own selections, weighting their portfolio in a way that makes more sense in light of the risks to them. This could include seeking managed funds with a manager that has a good track record over the years, but it also may mean adding stocks that are not well represented in major indexes. Investors like to use Morningstar for fund selection, for stocks information including excellent research on what Burry termed “small-cap value stocks,” and other small and microcap offerings is likely found on Channelchek.

The Forgotten Benefits of Equity Research

Informed stock market investors read equity research reports for several reasons:

Informed Decision-Making: Equity research reports provide detailed analysis and insights about a company’s financial performance, industry trends, competitive landscape, and growth prospects. Investors may save weeks putting together enough information to believe they understand an opportunity enough to make a decision.

Valuation Insights: Research reports will include valuation models that estimate a company’s intrinsic value. This can help investors understand whether a stock is overvalued, undervalued, or fairly priced, guiding their buy, sell, or hold decisions. Some research will actually provide an analyst’s price target.

Risk Assessment: Equity research reports assess the risks associated with an investment. This could include factors like regulatory changes, industry volatility, management quality, and financial stability. Understanding these risks helps investors manage their portfolios effectively.

Industry and Market Trends: Research reports not only focus on individual companies but also provide insights into broader industry trends and market dynamics. Investors can gain a better understanding of how macroeconomic factors might impact their investments.

Company Performance Analysis: Detailed financial analysis in these reports helps investors understand a company’s revenue streams, profit margins, debt levels, and growth potential. This information is crucial for evaluating a company’s overall financial health.

Competitive Landscape: Equity research reports often compare a company’s performance to its competitors. This analysis helps investors gauge a company’s competitive position within its industry.

Long-Term Investment Strategy: Investors with a long-term perspective can benefit from equity research by identifying companies with strong growth potential, sustainable competitive advantages, and solid management teams.

Industry Diversification: Research reports can make it easier for investors to diversify holdings by defining the category the company is in and even highlighting opportunities in various sectors or industries.

News Interpretation: Equity research reports can provide context and interpretation for press releases and other news including, earnings releases, and developments related to the company. This helps investors understand the potential impact on the stock price.

Investor Growth: For novice investors, equity research reports can provide valuable insights into how professionals analyze stocks and make investment decisions, enhancing their investment knowledge over time.

It’s important to note that equity research reports are typically produced by financial analysts working for brokerage firms, investment banks, or independent research firms. Investors should exercise critical thinking and compare and contrast multiple sources of information.

Take Away

Credible professional investors make the case that the surging assets in index funds are leading to a bubble. There is also concern that control is taken out of the hands of individuals and placed in the hands of a few large companies whose corporate interests may not match individual investor interests.

Taking back control of the management of one’s portfolio may seem daunting, but quality equity research is a tool that can serve to help the selection process while at the same time increasing the self-directed investors’ understanding of what is important to watch. Channelchek is a no-cost platform leading the way in North America, providing company-sponsored research on small and microcap stocks.

Individual stock investors may also wish to consider attending NobleCon19, in December. This investment conference is widely recognized as the place investors go to discover small emerging companies that they may act upon through their traditional brokerage account. Discover more about about NobleCon19 here.

Paul Hoffman

Managing Editor, Channelchek

Sources

https://www.bloomberg.com/news/articles/2019-08-28/the-big-short-s-michael-burry-sees-a-bubble-in-passive-investing

https://www.harriman-house.com/press/full/2958#:~:text=%E2%80%9CIndex%20funds%20and%20other%20passive,is%20good%20reason%20for%20this.

https://www.marketwatch.com/story/bubble-in-passive-investing-offers-small-cap-opportunity-big-short-investor-says-2019-08-28