In an explosive return, the man who inspired the historic GameStop “meme stock” mania in 2021 has re-emerged from a three-year hiatus – sending shockwaves through Wall Street once again.

Keith Gill, known online as the legendary “Roaring Kitty” had been silent across social media since rallying an “ape army” of retail traders to bet big against hedge funds that were shorting GameStop stock. That is, until May 13th, 2024, when he ominously posted a simple image of an intensely focused video gamer to his X account.

The GameStop “Roaring Kitty” Rallying Cry Heard Again

It was all the wake-up call the meme stock movement needed. Within hours of Gill’s first post in over 1,000 days, shares of GameStop Corp (GME) were halted for volatility multiple times as they skyrocketed as much as 110%. When the mayhem settled, the video game retailer’s stock closed a staggering 70% higher on the day.

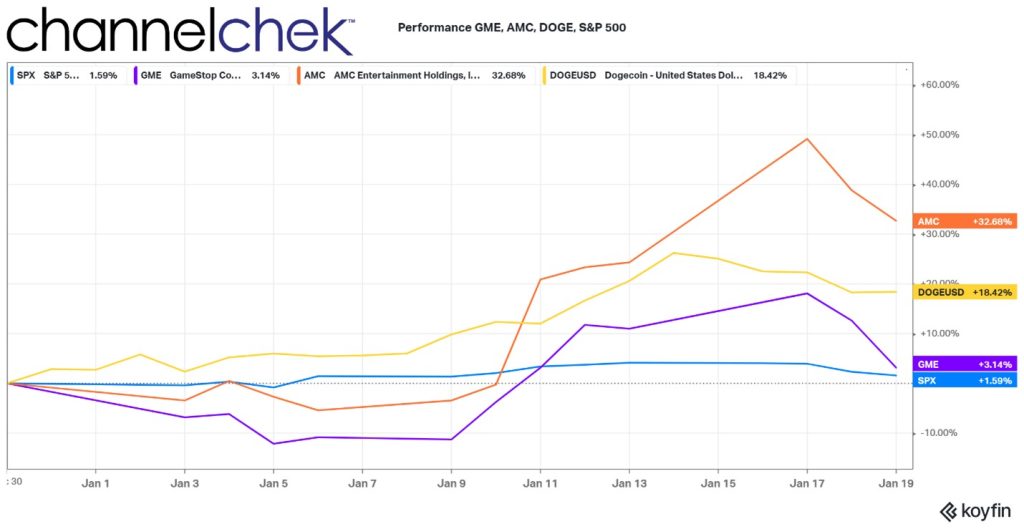

The Roaring Kitty-inspired surge was a flashback to January 2021, when GameStop became the poster child for a new era of disruption on Wall Street. Gill’s passionate YouTube streams advocating for the struggling company had mobilized a horde of online day traders from the Reddit forum r/WallStreetBets.

By piling into GameStop shares and options contracts, these self-dubbed “apes” triggered a cataclysmic short squeeze – forcing institutional investors with massive bearish bets against GME to cover their positions at rapidly escalating prices. Within two weeks, the stock had captured the world’s attention by inexplicably spiking over 2,700% from $17.25 to an intraday peak of $483.

Hedge Fund Decimation and Hollywood Deals

Billion-dollar hedge funds like Melvin Capital were decimated by the GameStop short squeeze, requiring emergency cash injections to stay afloat. The historic market event shined a light on the fragility of Wall Street’s short-selling practices and the power of unified retail investors.

Roaring Kitty himself faced intense scrutiny over his role. Gill testified before Congress about his GameStop windfall and was slapped with a class-action lawsuit alleging he misrepresented his expertise. The saga even inspired the 2023 feature film “Dumb Money,” with actor Paul Dano portraying Gill’s journey to meme stock fame.

Can Lightning Strike Twice for Meme Stocks?

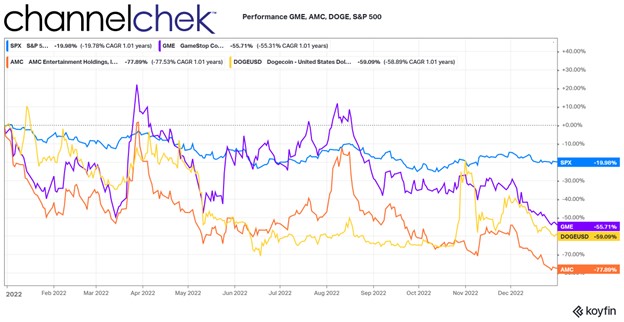

While the hype around GameStop had cooled off in recent years, Roaring Kitty’s comeback appearance instantly rejuvenated the movement he started. But can retail traders engineer another shocking short squeeze against institutional behemoths?

GameStop’s core business remains on shaky ground against digital downloads and e-commerce juggernauts. In its latest earnings report, the company posted lower revenue and cut jobs to reduce costs, showing its stock may still be disconnected from fundamentals.

However, with Roaring Kitty leading the rallying cry once more, the army of “ape” traders is ready to shake up the establishment all over again. And with nearly 25% of GameStop’s shares still sold short, the conditions may be ripe for another seismic confrontation in the meme stock revolution.

| Want small cap opportunities delivered straight to your inbox? Channelchek’s free newsletter will give you exclusive access to our expert research, news, and insights to help you make informed investment decisions. Get Instant Access |