Research News and Market Data on BSGM

January 10, 2023

Westport, CT, Jan. 10, 2023 (GLOBE NEWSWIRE) —

- Leading Midwest healthcare system reports significant cost savings and noise reduction following evaluation of the PURE EP™ System

- Medical center signs agreement to acquire the Company’s digital signal processing technology for arrhythmia care

BioSig Technologies, Inc. (NASDAQ: BSGM) (“BioSig” or the “Company”) an advanced digital signal processing technology company delivering unprecedented accuracy and precision to intracardiac signal visualization with its proprietary PURE EP™ System, today announced that Bellin Health System in Green Bay, Wisconsin has signed an agreement to acquire the Company’s PURE EP™ System.

The agreement follows a 60-day formal evaluation of the PURE EP™ System at Bellin Health. The hospital reported that the PURE EP™ demonstrated a significant cost savings per case as well as a substantial reduction in noise and signal interference compared to the use of conventional systems only.

The agreement grants Bellin Health full autonomy with respect to its operation of the PURE EP™ System, and BioSig will not be required to provide an on-site clinical account manager following the new system install.

The PURE EP™ System is a combination of hardware and software that enables the real-time acquisition of raw signal data—absent of unnecessary noise or interference—allowing physicians to make informed clinical decisions based on clear and precise data. With the heightened visualization of active signals, the PURE EP™ System is facilitating personalized patient care and innovations in the field of electrophysiology.

“Bellin has observed, first-hand, that clear cardiac signals provide more information that can impact procedural efficiency without driving up procedural costs,” commented Gray Fleming, Chief Commercial Officer, BioSig Technologies. “The terms of this agreement represent a new milestone for the PURE EP™ System—expanding the accessibility and automaticity of our novel digital signal processing technology.”

Bellin Health recently announced plans to combine operations with Gundersen Health System, a physician-led, nonprofit, integrated healthcare network headquartered in La Crosse, Wisconsin. The hospital serves 22 counties in western Wisconsin, southeastern Minnesota, and northeast Iowa. The merger allows the health systems to offer access to more resources and a broader network of top-tier clinical services, shared provider expertise, state-of-the-art technology and digital healthcare tools that bring virtual care options into homes and workplaces.1

About Bellin Health

Bellin Health’s Heart and Vascular Team brings more than 50 years of experience in all facets of cardiac care, making the medical center the most experienced program in the region. The physicians at Bellin are board-certified specialists with experience in all areas of cardiovascular care including echocardiography, nuclear cardiology, interventional cardiology, electrophysiology, and endovascular medicine. As the largest group of cardiovascular specialists in Green Bay, Bellin Health is renowned for its comprehensive cardiovascular care centers across the Midwest and its surrounding regions. (www.bellin.org).

About BioSig Technologies

BioSig Technologies is an advanced digital signal processing technology company bringing never-before-seen insights to the treatment of cardiovascular arrhythmias. Through collaboration with physicians, experts, and healthcare leaders across the field of electrophysiology (EP), BioSig is committed to addressing healthcare’s biggest priorities — saving time, saving costs, and saving lives.

The Company’s first product, the PURE EP™ System, an FDA 510(k) cleared non-invasive class II device, provides superior, real-time signal visualization allowing physicians to perform insight-based, highly targeted cardiac ablation procedures with increased procedural efficiency and efficacy.

The PURE EP™ System is currently in a national commercial launch and an integral part of well-respected healthcare systems, such as Mayo Clinic, Texas Cardiac Arrhythmia Institute, Cleveland Clinic, and Kansas City Heart Rhythm Institute. In a blinded clinical study recently published in the Journal of Cardiovascular Electrophysiology, electrophysiologists rated PURE EP™ as equivalent or superior to conventional systems for 93.6% of signal samples, with 75.2% earning a superior rating.

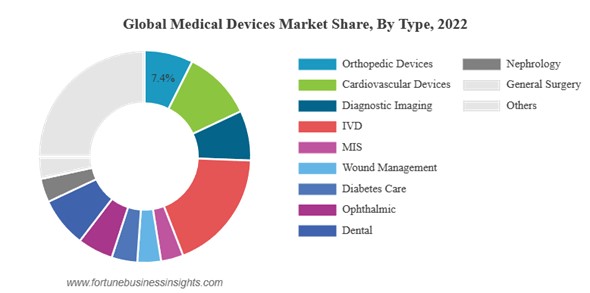

The global EP market is projected to reach $16B in 2028 with a 11.2% growth rate.2

Forward-looking Statements

This press release contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward- looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) market conditions and the Company’s intended use of proceeds; (ii) the geographic, social and economic impact of COVID-19 on our ability to conduct our business and raise capital in the future when needed; (iii) our inability to manufacture our products and product candidates on a commercial scale on our own, or in collaboration with third parties; (iv) difficulties in obtaining financing on commercially reasonable terms; (v) changes in the size and nature of our competition; (vi) loss of one or more key executives or scientists; and (vii) difficulties in securing regulatory approval to market our products and product candidates. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.

1 https://www.gundersenhealth.org/news/gundersen-bellin-anticipate-merger-closing-nov-30-start-of-operations-dec-1

2Global Market Insights Inc. March 08, 2022.

Andrew Ballou

BioSig Technologies, Inc.

Vice President, Investor Relations

55 Greens Farms Road, 1st Floor

Westport, CT 06880

aballou@biosigtech.com

203-409-5444, x133

Source: BioSig Technologies, Inc.