Boston Scientific Corporation has taken a major strategic step to strengthen its position in the vascular medical technology space by announcing a definitive agreement to acquire Silk Road Medical, Inc. for approximately $1.16 billion. This acquisition adds an innovative and clinically differentiated technology for stroke prevention to Boston Scientific’s already impressive portfolio of vascular solutions.

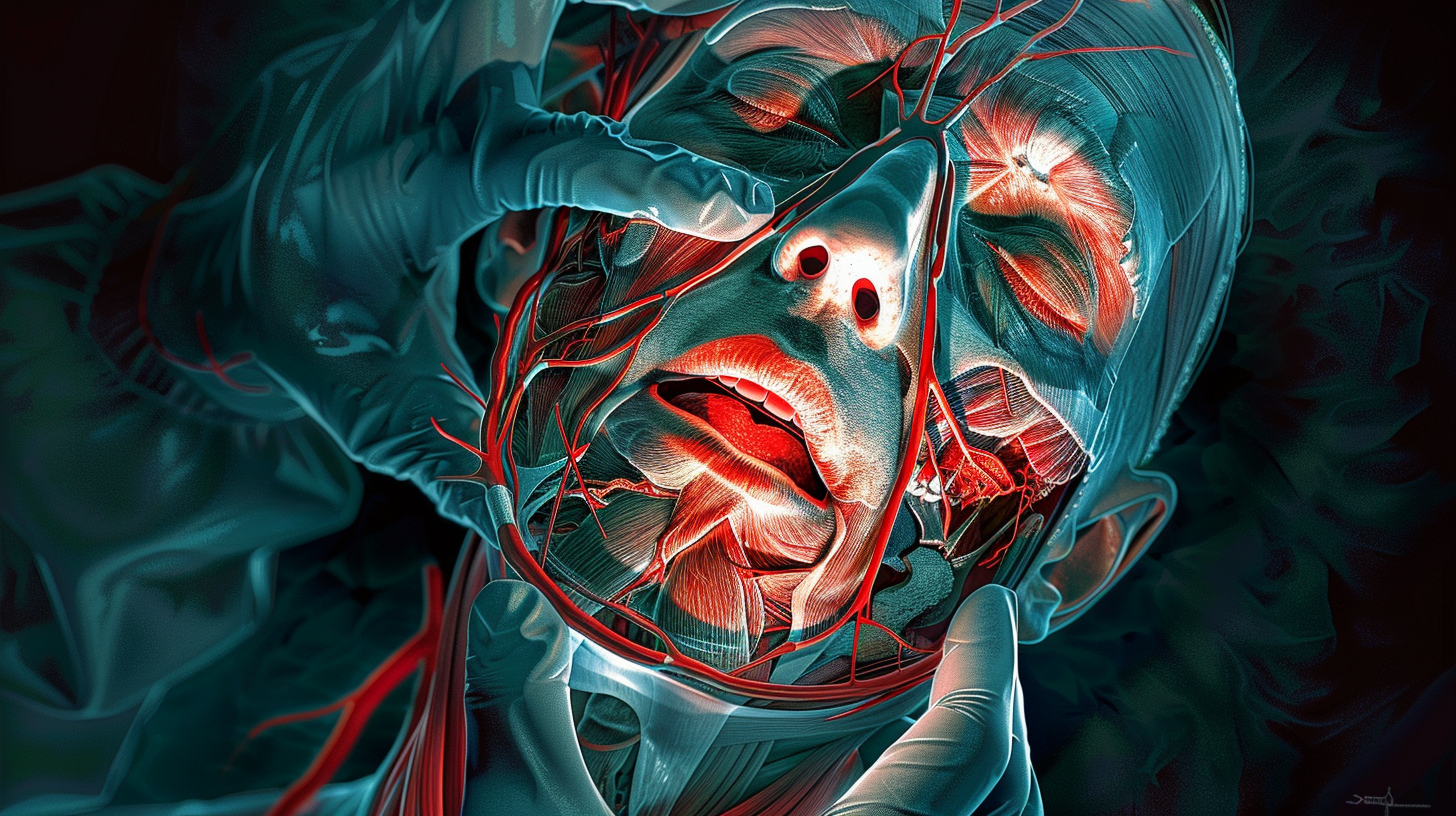

The target company, Silk Road Medical, is a pioneering medical device firm that has developed a revolutionary platform called TCAR (transcarotid artery revascularization) to treat carotid artery disease, a major cause of strokes. Carotid artery disease is responsible for one-third of all strokes and occurs when the carotid arteries in the neck become narrowed or blocked due to plaque buildup. Traditional treatment options include medical therapy management, stenting, or open surgery, all of which carry risks.

Silk Road’s TCAR procedure takes a minimally invasive approach by accessing the carotid artery through a small incision in the neck and temporarily reversing blood flow away from the brain during stenting. This prevents plaque from dislodging and causing a stroke, while a stent is placed to stabilize the blockage and prevent future strokes. Cat Jennings, President of Vascular Peripheral Interventions at Boston Scientific, praised the TCAR platform as “a notable advancement in the field of vascular medicine” that has “revolutionized stroke prevention and the treatment of carotid artery disease.”

The TCAR system gained U.S. Food and Drug Administration approval in 2015 and is supported by several clinical studies demonstrating a reduced risk of stroke and other complications associated with traditional open surgery. Notably, Silk Road Medical’s products are the only devices commercially available for use during the TCAR procedure, positioning the company as a leader in this fast-growing market segment.

Under the terms of the agreement, Boston Scientific will acquire all outstanding shares of Silk Road Medical for $27.50 per share in cash. Silk Road Medical is expected to generate net revenue of $194-198 million in 2024, reflecting 10-12% growth over the prior fiscal year. Boston Scientific anticipates the acquisition will be immaterial to its adjusted earnings per share in 2024 and 2025, and accretive thereafter.

For Boston Scientific, this strategic acquisition aligns perfectly with its core vascular business and strengthens its stroke solutions capabilities. By acquiring Silk Road Medical, Boston Scientific gains access to the innovative TCAR technology and can leverage its global commercial footprint and extensive physician relationships to drive further adoption of the platform. The combined entity can also explore potential synergies and opportunities to expand the applications of the TCAR technology beyond carotid artery disease.

The transaction is subject to customary closing conditions, including regulatory approvals, and Boston Scientific expects to complete the acquisition in the second half of 2024. While integrating Silk Road Medical’s operations, Boston Scientific plans to reinforce its commitment to providing meaningful innovation for physicians who treat patients with peripheral vascular disease.

This acquisition represents a strategic move by Boston Scientific to bolster its vascular offerings with a clinically differentiated and commercially successful stroke prevention technology. By integrating Silk Road Medical’s cutting-edge TCAR platform, Boston Scientific further solidifies its position as a leader in the vascular medical technology space and demonstrates its dedication to advancing solutions that improve patient outcomes and reduce the cost of healthcare.

Take a moment to take a look at more emerging growth biotechnology companies by looking at Noble Capital Markets Senior Research Analyst Robert LeBoyer’s coverage list.