Research News and Market Data on CYDVF

February 24, 2025 – Vancouver, Canada – Century Lithium Corp. (TSXV: LCE) (OTCQX: CYDVF) (Frankfurt: C1Z) (“Century Lithium” or “the Company”) is pleased to announce that the Company has completed its initial internal, non-independent review, optimization work, and studies (“Optimization Study”) related to the estimated capital (“CAPEX”) described in the NI 43-101 Technical Report on the Feasibility Study of the Clayton Valley Lithium Project (now known as Angel Island), Nevada, USA, dated April 29, 2024 (“Feasibility Study”). The Optimization Study identified potential cost reductions of up to 25% of CAPEX on its initial Phase 1 CAPEX of $1.581 billion.

Optimization Study highlights leading to the CAPEX reductions:

- Reduced capital costs through changes in flow sheet, equipment selection and updated vendor quotes in the processing areas of filtration, Direct Lithium Extraction (“DLE”) and the chlor-alkali plant

- Internal evaluation of the estimated engineering and construction plans to identify areas of overlap and locations within the plan where modifications of site facilities and elimination of redundancies and inefficiencies can streamline the process from mining to the planned on-site production of battery-grade lithium carbonate (“Li2CO3”)

- Reductions in the estimated cost for on-site services resulting from the changes in processing

- Reduction in estimated indirect costs for contingency and EPCM calculated in the Feasibility Study as a percentage of direct costs as a result of the cost reductions set out above

“We are very pleased with the outcome of the Optimization Study. These results, if confirmed by an updated Feasibility Study, will have a significant impact on the economics of Angel Island,” said Century Lithium President and CEO, Bill Willoughby. “The Company is also in the process of outlining new initiatives at Angel Island that will further unlock value for our shareholders and place Angel Island in the forefront of lithium resources under development in North America.”

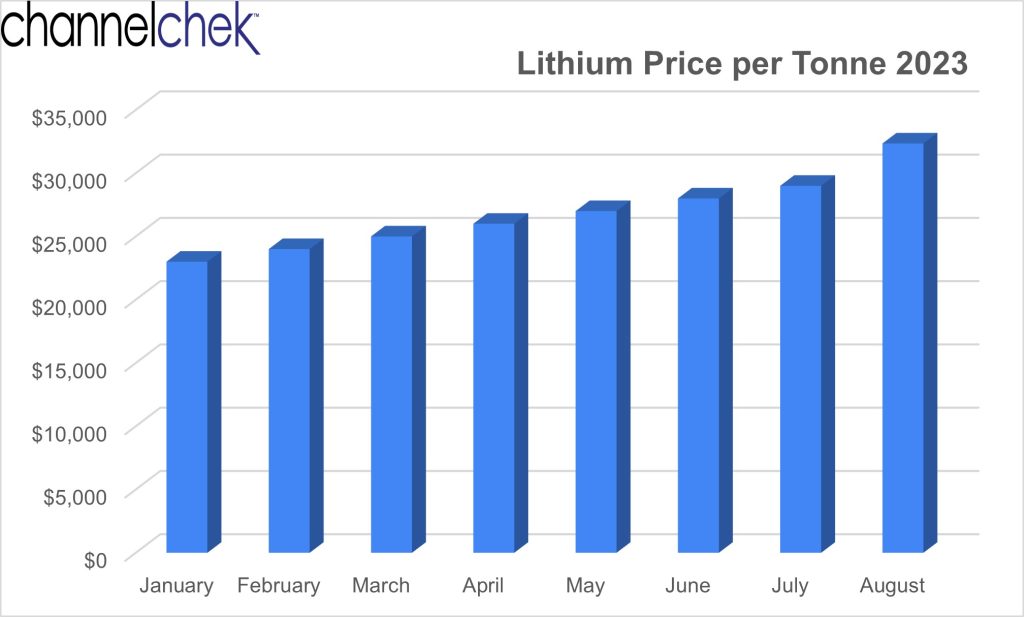

“Lithium remains critical for Western independence in its energy transformation, underpinning the long-term fundamentals of the industry despite current depressed prices. We believe that with these improved economics and its advanced stage of development Angel Island has now become a key asset in the broader United States’ lithium strategy.”

Century Lithium will initiate work on an Updated Feasibility Study for Angel Island to confirm the results of the Optimization Study to the required level. Century Lithium believes that the optimizations to Angel Island’s mine plan and processing, and the sale of surplus sodium hydroxide generated in the production process, will lead to competitive estimated capital and operating costs.

Qualified Person

Todd Fayram, MMSA-QP and Senior Vice President, Metallurgy of Century Lithium is the qualified person as defined by National Instrument 43-101 and has approved the technical information in this release.

ABOUT CENTURY LITHIUM CORP.

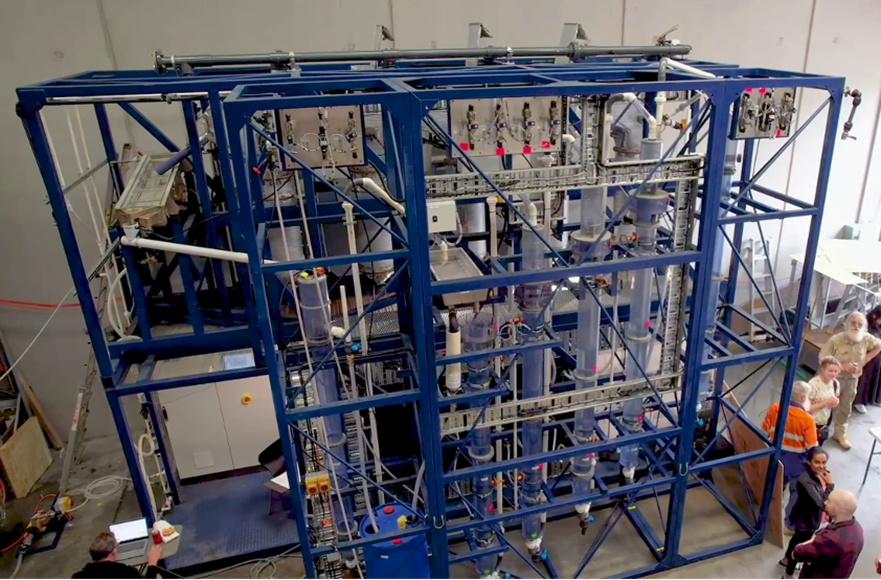

Century Lithium Corp. is an advanced stage lithium company, focused on developing its wholly owned Angel Island project in Esmeralda County, Nevada, which hosts one of the largest sedimentary lithium deposits in the United States. The Company has utilized its patent-pending process for chloride leaching combined with Direct Lithium Extraction to make battery-grade lithium carbonate product samples from Angel Island’s lithium-bearing claystone on-site at its Demonstration Plant in Amargosa Valley, Nevada.

Angel Island is one of the few advanced lithium projects in development in the United States to provide an end-to-end process to produce battery-grade lithium carbonate for the growing electric vehicle and battery storage market. Angel Island is currently in the permitting stage for a three-phase feasibility-level production plan expected to yield an estimated life-of-mine average of 34,000 tonnes per year of lithium carbonate over a 40-year mine-life, with one of the lowest estimated operating costs for lithium projects in North America.

Century Lithium trades on both the TSX Venture Exchange under the symbol “LCE” and the OTCQX under the symbol “CYDVF”; and on the Frankfurt Stock Exchange under the symbol “C1Z”.

To learn more, please visit centurylithium.com

ON BEHALF OF CENTURY LITHIUM CORP.

WILLIAM WILLOUGHBY, PhD., PE

President & Chief Executive Officer

For further information, please contact:

Spiros Cacos | Vice President, Investor Relations

Direct: +1 604 764 1851

Toll Free: 1 800 567 8181

scacos@centurylithium.com

centurylithium.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

Cautionary Note Regarding Forward-Looking Statements

This release contains certain forward-looking statements within the meaning of applicable Canadian securities legislation. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” and similar expressions suggesting future outcomes or statements regarding an outlook.

Forward-looking statements relate to any matters that are not historical facts and statements of our beliefs, intentions and expectations about developments, results and events which will or may occur in the future, without limitation, statements with respect to the potential development and value of the Project and benefits associated therewith, statements with respect to the expected project economics for the Project, such as estimates of life of mine, lithium prices, production and recoveries, capital and operating costs, IRR, NPV and cash flows, any projections outlined in the Feasibility Study in respect of the Project, the permitting status of the Project and the Company’s future development plans.

These and other forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict, that may cause their actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein. These risks include those described under the heading “Risk Factors” in the Company’s most recent annual information form and its other public filings, copies of which can be under the Company’s profile at www.sedarplus.com. The Company expressly disclaims any obligation to update-forward-looking information except as required by applicable law. No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place reliance on forward-looking statements or information. Furthermore, Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.