Research News and Market Data on LGO

November 8, 2023

All amounts expressed are in U.S. dollars, denominated by “$”

TORONTO–(BUSINESS WIRE)– Largo Inc. (“Largo” or the “Company“) (TSX: LGO) (NASDAQ: LGO) today announces its third quarter 2023 financial results.

Largo Reports Third Quarter 2023 Financial Results; Announces First Commercial Shipment of Ilmenite as By-Product of its Vanadium Operations in Brazil (Photo: Business Wire)

Q3 2023 and Other Highlights

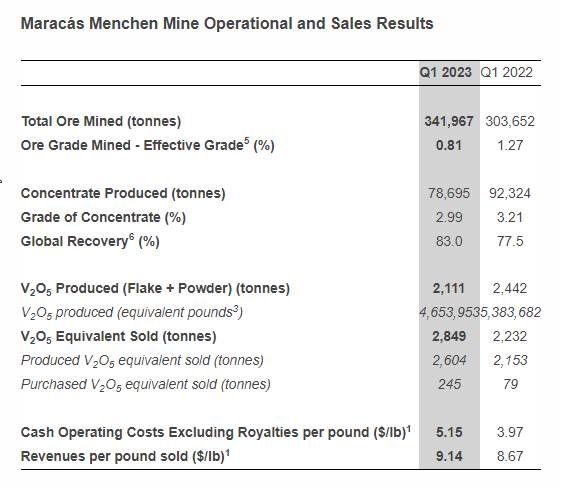

- Revenues of $44.0 million vs. revenues of $54.3 million in Q3 2022; Decline driven by lower vanadium prices and lower vanadium sales volumes; Revenues per lb sold3 of V2O5 equivalent of $8.34 vs. $8.80 in Q3 2022

- Operating costs of $42.5 million vs. $45.6 million in Q3 2022; Cash operating costs excluding royalties1 per pound sold of $5.44 vs. 4.86 per lb sold in Q3 2022

- Net loss of $11.9 million vs. net loss of $2.6 million in Q3 2022; Basic loss per share of $0.19 vs. basic loss per share of $0.04 in Q3 2022

- Cash used before working capital items of $4.4 million vs. cash provided before working capital items of $4.3 million in Q3 2022

- Cash balance of $39.5 million, net working capital surplus of $91.0 million and debt of $65.0 million exiting Q3 2023

- V2O5 equivalent sales of 2,385 tonnes (inclusive of 256 tonnes of purchased material) vs. 2,796 tonnes (inclusive of 351 tonnes of purchased material) sold in Q3 2022

- Production of 2,163 tonnes (4.8 million lbs1) of V2O5 vs. 2.906 tonnes in Q3 2022

- Largo Clean Energy’s (“LCE”) 6 megawatt-hour (“MWh”) vanadium redox flow battery (“VRFB”) deployment for Enel Green Power España (“EGPE”) was validated to operate on test conditions according to EGPE specifications and LCE test procedures in October

- The Company successfully commissioned and is in the process of ramping up production of its new ilmenite concentrate plant with initial production of 350 tonnes in August and 700 tonnes in September; The first commercial shipment of ilmenite is in progress and should contribute to the Company’s revenues in Q4 2023 as a by-product of its vanadium operations

- Q3 2023 results conference call: Thursday, November 9th at 1:00 p.m. ET

Vanadium Market Update2

- The average benchmark price per lb of V2O5 in Europe was $8.03, a 2.5% decrease from the average of $8.23 seen in Q3 2022

- Vanadium spot demand was soft in Q3 2023, primarily due to adverse conditions in the Chinese and European steel industries. However, strong demand growth from the aerospace and energy storage sectors continued

Daniel Tellechea, Director and Interim CEO of Largo commented: “Q3 2023 was a challenging quarter for Largo, primarily due to the tragic accident that occurred at the Company’s chemical plant in July as well as technical delays in commissioning our new crushing plant. The accident at the chemical plant resulted in a capacity bottleneck in the evaporator section of the plant, which resulted in lower overall production rates of vanadium in July and August. In early September, our operating team recommissioned the evaporator circuit, which is now operating at its original capacity. A delay in ramp up of the new magnetic separation crushing plant also temporarily impacted vanadium production in Q3 2023. The new crushing plant was designed to offset the impact of lower mined vanadium grades, as per the Company’s mine plan. The operating team is in the process of resolving these issues, and we are pleased to report that the crushing plant exceeded 1,000 tonnes of contained V2O5 in October, despite additional crushing plant improvements scheduled to be implemented in November and December.”

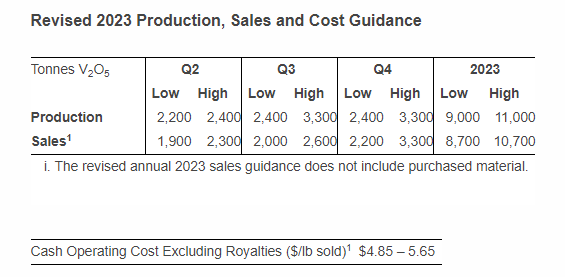

He continued: “It is our priority to continue to optimize our operations, reduce costs, and achieve production and sales targets safely. In light of this, we maintain our guidance for 2023. Additionally, further measures are being implemented to improve the organization’s performance, including optimizing operational efficiencies through the implementation of the new crushing system, concentrating on increasing production of high purity vanadium, restructuring equipment maintenance processes to further reduce costs, and ramping up ilmenite production starting in the fourth quarter of 2023 to diversify revenues. We are beginning to see a notable reduction in key consumable costs, such as sodium carbonate, as well as ongoing overhead cost reductions through a reduction of the number of contractors at the mine through efficiency improvement programs and further reductions in the headcount at LCE. The Company considers these ongoing initiatives to be a vitally important measures to counter the current decrease in vanadium prices.”

He concluded: “During this past year, we have also made several significant investments that are necessary for the sustainability of our operations in a lower vanadium price environment. Among these investments are an increased waste rock pre-stripping and aggressive infill drilling program to optimize production in the years to come. Our team has successfully built and commissioned an ilmenite plant to diversify future revenues as a by-product of the vanadium mine, built a new magnetic separation crushing plant for the purpose of mining lower-grade material without reducing production levels, and delivered the Company’s first vanadium battery to EGPE, our European energy storage customer. A substantial investment has been made in LCE, which is not yet generating significant revenues, but continues to consume cash. With our current strategic review process in place, Largo expects to optimize the value proposition of LCE and participate in one of the most significant macrotrends, the clean energy transition with vanadium as a critical material. With these investments, we believe that Largo is on the path to a brighter future.”

Financial and Operating Results – Highlights

| (thousands of U.S. dollars, except as otherwise stated) | Three months ended | Nine months ended | ||

| Sept. 30, 2023 | Sept. 30, 2022 | Sept. 30, 2023 | Sept. 30, 2022 | |

| Revenues | 43,983 | 54,258 | 154,514 | 181,750 |

| Operating costs | (42,580) | (45,602) | (131,540) | (125,264) |

| Net income (loss) | (11,884) | (2,601) | (19,057) | 13,410 |

| Basic earnings (loss) per share | (0.19) | (0.04) | (0.30) | 0.21 |

| Cash (used) provided before working capital items | (4,360) | 4,328 | 7,631 | 35,479 |

| Cash operating costs excl. royalties3 ($/lb) | 5.44 | 4.86 | 5.25 | 4.37 |

| Cash | 39,572 | 62,713 | 39,572 | 62,713 |

| Debt | 65,000 | 15,000 | 65,000 | 15,000 |

| Total mined – dry basis (tonnes) | 6,406,626 | 4,178,185 | 11,373,683 | 7,780,061 |

| Total ore mined (tonnes) | 447,165 | 351,450 | 1,279,024 | 1,033,375 |

| Effective grade4 of ore milled (%) | 0.94 | 1.28 | 1.04 | 1.32 |

| V2O5 equivalent produced (tonnes) | 2,163 | 2,906 | 6,913 | 8,432 |

Q3 2023 Notes

- The decrease in operating costs in Q3 2023 is largely attributable to lower overall sales in the period, which includes a reduction in the sale of purchased products and lower royalties due to lower sales.

- V2O5 equivalent production of 2,163 tonnes in Q3 2023 decreased from 2,639 tonnes produced in Q2 2023. Production in July 2023 was 644 tonnes, with 775 tonnes produced in August and 744 tonnes produced in September, for a total of 2,163 tonnes of V2O5 equivalent produced. July and August production were negatively impacted as a result of the chemical plant operating at limited capacity due to the accident in the evaporation section of the plant in July 2023. In addition, September production was negatively impacted by low availability of the crushing circuit, combined with the planned lower vanadium grade of ore mined. V2O5 production in October continued to improve with 866 tonnes produced.

- The Company is actively working to achieve higher levels of operational stability to better manage its costs which have increased due in part to lower grades of ore mined as compared with prior quarters. The lower grade of ore mined in Q3 2023 was according to plan, representing a 27% decrease year-over-year. The Company is actively working towards increasing the availability of its new crushing system to offset lowers grades of ore mined and reach production of 1,000 tonnes of V2O5 per month in future months.

- Total mined (dry basis) of 6.4 million tonnes increased by 53% and total ore mined of 447,165 tonnes was 27% higher than Q3 2022, respectively. Increased mining rates and higher mining costs impacted the Company’s financial performance in Q3 2023.

- As part of its ongoing mitigation efforts, the Company is focused on reducing its fixed cost structure through contract renegotiations and an optimization of key operational areas, including mining, maintenance, equipment rental and consumables.

- The commissioning and ramp up of the ilmenite plant commenced in Q3 2023 with production of 350 tonnes in August and 700 tonnes in September. The Company expects the ramp up to conclude in Q2 2024 with revenue expectations in Q4 2023.

- Exploration and evaluation costs of $2.3 million increased by $1.8 million from Q3 2022. This was driven by infill drilling and geological model work at the Maracás Menchen Mine and diamond drilling at Campo Alegre de Lourdes to support the maintenance of the Company’s mineral rights. During Q3 2023, the Company completed approximately 9,100 metres of diamond drilling in the near mine deep drilling and exploration program. In the nine months ended September 30, 2023, approximately 19,100 metres of diamond drillholes have been completed in Campo Alegre de Lourdes and Maracas targets. A re-assay program began in Q2 2023 to perform chemical analysis on previously interpreted results. The focus of this program is to increase measured and indicated resources. Approximately 5,000 samples were prepared and sent to the external laboratory for analysis in Q3 2023.

The information provided within this release should be read in conjunction with Largo’s unaudited condensed interim consolidated financial statements for the three and nine months ended September 30, 2023 and 2022 and its management’s discussion and analysis (“MD&A”) for the three and nine months ended September 30, 2023 which are available on our website at www.largoinc.com or on the Company’s respective profiles at www.sedarplus.com and www.sec.gov.

About Largo

Largo is a globally recognized vanadium company known for its high-quality VPURE™ and VPURE+™ products, sourced from its Maracás Menchen Mine in Brazil. The Company is currently focused on implementing an ilmenite concentrate plant and is undertaking a strategic evaluation of its U.S.-based clean energy business, including its advanced VCHARGE vanadium battery technology to maximize the value of the organization. Largo’s strategic business plan centers on maintaining its position as a leading vanadium supplier with a growth strategy to support a low-carbon future.

Largo’s common shares trade on the Nasdaq Stock Market and on the Toronto Stock Exchange under the symbol “LGO”. For more information on the Company, please visit www.largoinc.com.

Cautionary Statement Regarding Forward-looking Information:

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United States securities legislation. Forward-looking information in this press release includes, but is not limited to, statements with respect to the timing and amount of estimated future production and sales; the future price of commodities; costs of future activities and operations, including, without limitation, achieving operational stability and managing unit costs; and the expected completion of the ilmenite plan ramp up in Q4 2023.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price of V2O5, other vanadium products, ilmenite and titanium dioxide pigment; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company’s operations at the Maracás Menchen Mine or relating to Largo Clean Energy; the availability of financing for operations and development; the availability of funding for future capital expenditures; the ability to replace current funding on terms satisfactory to the Company; the ability to mitigate the impact of heavy rainfall; the reliability of production, including, without limitation, access to massive ore, the Company’s ability to procure equipment, services and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources and reserves at the Maracás Menchen Mine are within reasonable bounds of accuracy (including with respect to size, grade and recovery and the operational and price assumptions on which such estimates are based); the accuracy of the Company’s mine plan at the Maracás Menchen Mine, the competitiveness of the Company’s vanadium redox flow battery (“VRFB“) technology; the ability to obtain funding through government grants and awards for the Green Energy sector, the accuracy of cost estimates and assumptions on future variations of VCHARGE battery system design, that the Company’s current plans for ilmenite and VRFBs can be achieved; the Company’s “two-pillar” business strategy will be successful; the Company’s sales and trading arrangements will not be affected by the evolving sanctions against Russia; and the Company’s ability to attract and retain skilled personnel and directors; the ability of management to execute strategic goals.

Forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. All information contained in this news release, other than statements of current and historical fact, is forward looking information. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Largo to be materially different from those expressed or implied by such forward-looking statements, including but not limited to those risks described in the annual information form of Largo and in its public documents filed on www.sedarplus.ca and available on www.sec.gov from time to time. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Although management of Largo has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Largo does not undertake to update any forward-looking statements, except in accordance with applicable securities laws. Readers should also review the risks and uncertainties sections of Largo’s annual and interim MD&A which also apply.

Trademarks are owned by Largo Inc.

Non-GAAP5 Measures

The Company uses certain non-GAAP measures in this press release, which are described in the following section. Non-GAAP financial measures and non-GAAP ratios are not standardized financial measures under IFRS, the Company’s GAAP, and might not be comparable to similar financial measures disclosed by other issuers. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

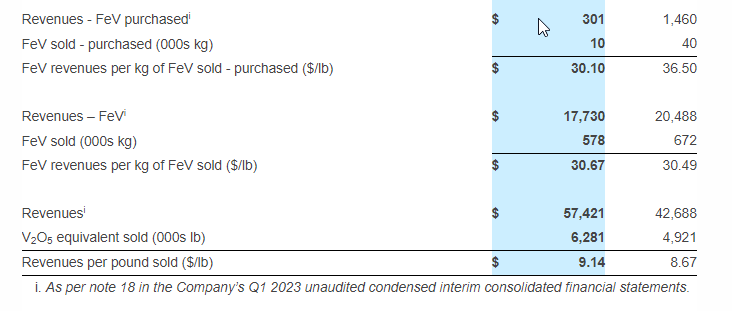

Revenues Per Pound

This press release refers to revenues per pound sold, a non-GAAP performance measure that is used to provide investors with information about a key measure used by management to monitor performance of the Company.

This measure, along with cash operating costs and total cash costs, is considered to be one of the key indicators of the Company’s ability to generate operating earnings and cash flow from its Maracás Menchen Mine and sales activities. This revenues per pound measure does not have any standardized meaning prescribed by IFRS and differs from measures determined in accordance with IFRS. This measure is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. This measure is not necessarily indicative of net earnings or cash flow from operating activities as determined under IFRS.

The following table provides a reconciliation of this measure per pound sold to revenues as per the Q3 2022 unaudited condensed interim consolidated financial statements.

| Three months ended | Nine months ended | |||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | |||||||||

| Revenues – V2O5 produced1 | $ | 25,268 | $ | 30,831 | $ | 90,352 | $ | 98,621 | ||||

| V2O5 sold – produced (000s lb) | 3,017 | 3,745 | 9,898 | 10,824 | ||||||||

| V2O5 revenues per pound of V2O5 sold – produced ($/lb) | $ | 8.38 | $ | 8.23 | $ | 9.13 | $ | 9.11 | ||||

| Revenues – V2O5 purchased1 | $ | 2,066 | $ | 1,655 | $ | 7,531 | $ | 3,184 | ||||

| V2O5 sold – purchased (000s lb) | 309 | 207 | 1,014 | 339 | ||||||||

| V2O5 revenues per pound of V2O5 sold – purchased ($/lb) | $ | 6.69 | $ | 8.00 | $ | 7,43 | $ | 9.39 | ||||

| Revenues – V2O51 | $ | 27,334 | $ | 32,486 | $ | 97,883 | $ | 101,805 | ||||

| V2O5 sold (000s lb) | 3,326 | 3,952 | 10,912 | 11,163 | ||||||||

| V2O5 revenues per pound of V2O5 sold ($/lb) | $ | 8.22 | $ | 8.22 | $ | 8.97 | $ | 9.12 | ||||

| Revenues – V2O3 produced1 | $ | 3,734 | $ | 3,798 | $ | 7,575 | $ | 3,798 | ||||

| V2O3 sold – produced (000s lb) | 308 | 308 | 619 | 308 | ||||||||

| V2O3 revenues per pound of V2O3 sold – produced ($/lb) | $ | 12.12 | $ | 12.33 | $ | 12.24 | $ | 12.33 | ||||

| Revenues – V2O3 purchased1 | $ | — | $ | 482 | $ | 1,155 | $ | 482 | ||||

| V2O3 sold – purchased (000s lb) | — | 43 | 88 | 43 | ||||||||

| V2O3 revenues per pound of V2O3 sold – purchased ($/lb) | $ | — | $ | 11.21 | $ | 13.13 | $ | 11.21 | ||||

| Revenues – V2O31 | $ | 3,734 | $ | 4,280 | $ | 8,730 | $ | 4,280 | ||||

| V2O3 sold (000s lb) | 308 | 350 | 707 | 350 | ||||||||

| V2O3 revenues per pound of V2O3 sold ($/lb) | $ | 12.12 | $ | 12.23 | $ | 12.35 | $ | 12.23 | ||||

| Revenues – FeV produced1 | $ | 11,750 | $ | 12,756 | $ | 46,408 | $ | 54,667 | ||||

| FeV sold – produced (000s kg) | 444 | 394 | 1,591 | 1,576 | ||||||||

| FeV revenues per kg of FeV sold – produced ($/kg) | $ | 26.46 | $ | 32.38 | $ | 29.17 | $ | 34.69 | ||||

| Revenues – FeV purchased1 | $ | 1,058 | $ | 4,736 | $ | 1,386 | $ | 20,998 | ||||

| FeV sold – purchased (000s kg) | 39 | 159 | 50 | 516 | ||||||||

| FeV revenues per kg of FeV sold – purchased ($/kg) | $ | 27.13 | $ | 29.79 | $ | 27.72 | $ | 40.69 | ||||

| Revenues – FeV1 | $ | 12,808 | $ | 17,492 | $ | 47,794 | $ | 75,665 | ||||

| FeV sold (000s kg) | 483 | 553 | 1,641 | 2,092 | ||||||||

| FeV revenues per kg of FeV sold ($/kg) | $ | 26.52 | $ | 31.63 | $ | 29,12 | $ | 36.17 | ||||

| Revenues1 | $ | 43,876 | $ | 54,258 | $ | 154,407 | $ | 181,750 | ||||

| V2O5 equivalent sold (000s lb) | 5,259 | 6,164 | 17,177 | 18,340 | ||||||||

| Revenues per pound sold ($/lb) | $ | 8.34 | $ | 8.80 | $ | 8.99 | $ | 9.91 | ||||

| 1. As per note 18 of the Company’s Q3 2023 unaudited condensed interim consolidated financial statements. | ||||||||||||

Cash Operating Costs Per Pound

The Company’s MD&A refers to cash operating costs per pound and cash operating costs excluding royalties per pound, which are non-GAAP ratios based on cash operating costs and cash operating costs excluding royalties, which are non-GAAP financial measures, in order to provide investors with information about a key measure used by management to monitor performance. This information is used to assess how well the Maracás Menchen Mine is performing compared to plan and prior periods, and also to assess its overall effectiveness and efficiency.

Cash operating costs includes mine site operating costs such as mining costs, plant and maintenance costs, sustainability costs, mine and plant administration costs, royalties and sales, general and administrative costs (all for the Mine properties segment), but excludes depreciation and amortization, share-based payments, foreign exchange gains or losses, commissions, reclamation, capital expenditures and exploration and evaluation costs. Operating costs not attributable to the Mine properties segment are also excluded, including conversion costs, product acquisition costs, distribution costs and inventory write-downs.

Cash operating costs excluding royalties is calculated as cash operating costs less royalties. Cash operating costs per pound and cash operating costs excluding royalties per pound are obtained by dividing cash operating costs and cash operating costs excluding royalties, respectively, by the pounds of vanadium equivalent sold that were produced by the Maracás Menchen Mine. Cash operating costs, cash operating costs excluding royalties, cash operating costs per pound and cash operating costs excluding royalties per pound, along with revenues, are considered to be key indicators of the Company’s ability to generate operating earnings and cash flow from its Maracás Menchen Mine. These measures differ from measures determined in accordance with IFRS, and are not necessarily indicative of net earnings or cash flow from operating activities as determined under IFRS.

The following table provides a reconciliation of cash operating costs and cash operating costs excluding royalties, cash operating costs per pound and cash operating costs excluding royalties per pound for the Maracás Menchen Mine to operating costs as per the Q3 2023 unaudited condensed interim consolidated financial statements.

| Three months ended | Nine months ended | |||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | |||||||||||||

| Operating costsi | $ | 42,580 | $ | 45,602 | $ | 131,540 | $ | 125,264 | ||||||||

| Professional, consulting and management feesii | 747 | 1,181 | 2,215 | 3,784 | ||||||||||||

| Other general and administrative expensesiii | 408 | 383 | 1,032 | 859 | ||||||||||||

| Less: iron ore costsi | (145 | ) | (200 | ) | (638 | ) | (637 | ) | ||||||||

| Less: conversion costsi | (1,413 | ) | (1,655 | ) | (5,551 | ) | (5,839 | ) | ||||||||

| Less: product acquisition costsi | (5,449 | ) | (7,248 | ) | (13,380 | ) | (20,651 | ) | ||||||||

| Less: distribution costsi | (2,202 | ) | (2,581 | ) | (6,174 | ) | (6,887 | ) | ||||||||

| Less: inventory write-downiv | (978 | ) | (1,655 | ) | (1,661 | ) | (1,655 | ) | ||||||||

| Less: depreciation and amortization expensei | (6,003 | ) | (5,111 | ) | (19,456 | ) | (14,923 | ) | ||||||||

| Cash operating costs | 27,545 | 28,716 | 87,927 | 79,315 | ||||||||||||

| Less: royalties1 | (2,024 | ) | (2,497 | ) | (6,919 | ) | (8,264 | ) | ||||||||

| Cash operating costs excluding royalties | 25,521 | 26,219 | 81,008 | 71,050 | ||||||||||||

| Produced V2O5 sold (000s lb) | 4,693 | 5,390 | 15,434 | 16,272 | ||||||||||||

| Cash operating costs per pound ($/lb) | $ | 5.87 | $ | 5.33 | $ | 5.70 | $ | 4.87 | ||||||||

| Cash operating costs excluding royalties per pound ($/lb) | $ | 5.44 | $ | 4.86 | $ | 5.25 | $ | 4.37 | ||||||||

| i. As per note 19 of the Company’s Q3 2023 unaudited condensed interim consolidated financial statements. | ||||||||||||||||

| ii. As per the Mine properties segment in note 15 of the Company’s Q3 2023 unaudited condensed interim consolidated financial statements. | ||||||||||||||||

| iii. As per the Mine properties segment in note 15 of the Company’s Q3 2023 unaudited condensed interim consolidated financial statements less the increase in legal provisions of $0.4 million (Q3 2023) and $0.8 million (nine months ended September 30, 2023) as noted in the “other general and administrative expenses” section on page 6 of the Company’s Q3 2023 management discussion and analysis. | ||||||||||||||||

| iv. As per notes 5 and 19 of the Company’s Q3 2023 unaudited condensed interim consolidated financial statements for purchased finished products. | ||||||||||||||||

____________________________

1 Conversion of tonnes to pounds, 1 tonne = 2,204.62 pounds or lbs.

2 Fastmarkets Metal Bulletin.

3 The cash operating costs excluding royalties and revenues per pound per pound sold are reported on a non-GAAP basis. Refer to the “Non-GAAP Measures” section of this press release. Revenues per pound sold are calculated based on the quantity of V2O5 sold during the stated period.

4 Effective grade represents the percentage of magnetic material mined multiplied by the percentage of V2O5 in the magnetic concentrate

5 GAAP – Generally Accepted Accounting Principles

Investor Relations

Alex Guthrie

Senior Manager, External Relations

+1.416.861.9778

aguthrie@largoinc.com

Source: Largo Inc.