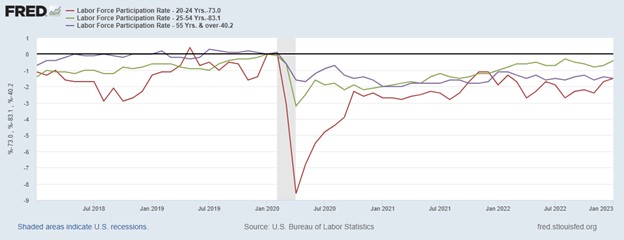

The latest US jobs data released this week points to a cooling labor market as the country heads into 2024, although conditions remain relatively strong compared to historical averages. The Labor Department reported there were 8.7 million job openings in October, down significantly from 9.4 million in September and the lowest level since March 2021.

While job growth is moderating, the labor market retains a level of resilience as employers appear reluctant to lay off workers en masse despite economic uncertainties. The quits rate held steady in October, indicating many Americans still feel secure enough in their job prospects to leave current positions for better opportunities.

However, the days of workers having their pick of jobs may be over, at least for now. Job openings have declined in most sectors, especially healthcare, finance, and hospitality – fields that had gone on major hiring sprees during the pandemic recovery. This reversal follows a series of steep Fed interest rate hikes aimed at cooling runaway inflation by dampening demand across the economy.

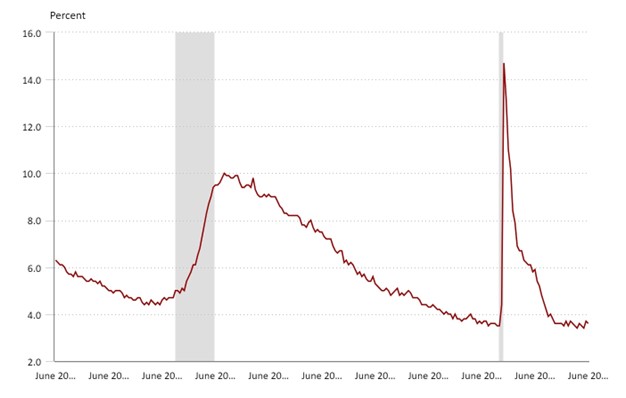

So far the Fed seems to have achieved a soft landing for the job market. Employers added a steady 150,000 jobs in October and unemployment remains low at 3.7%. The most recent data is welcome news for the Fed as it tries to bring down consumer prices without triggering a recession and massive job losses.

Heading into 2024, economists expect monthly job gains will average around 170,000 – still solid but below 2023’s pace when the economy added over 400,000 jobs a month. Wage growth is anticipated to continue easing as well.

While layoffs remain limited for now, companies are taking a more cautious stance on hiring, noted Nela Richardson, chief economist at ADP. “Business leaders are prepared for an economic downturn, but they are not foreseeing the kind of massive job cuts that happened in past downturns,” she said.

Some sectors still hungry for workers

Certain sectors continue urgently hiring even as the broader labor market slows. Industries like healthcare and technology still report hundreds of thousands of open jobs. Despite downsizing at high-profile firms like Amazon, the tech sector remains starved for engineers, developers and AI talent.

Demand still outweighs supply for many skilled roles. “We have around 300,000 open computing jobs today versus an average of 60,000 open computing jobs before the pandemic,” said Allison Scott, Chief Research Officer at KLA.

Restaurants and the wider hospitality industry also plan to bulk up staffing after cutting back earlier this year. American Hotel & Lodging Association CEO Katherine Lugar expects hotels to hire over 700,000 workers in 2024.

Traffic, bookings and travel spending are rebounding. “As we continue working our way back, hiring has picked up,” Lugar noted.

Uncertainties Cloud 2024 Outlook

Economists warn many uncertainties persist around inflation, consumer spending and business sentiment heading into 2024. “The outlook for next year is tough to forecast,” said Oren Klachkin of Oxford Economics. “A lot hinges on whether the Fed can tame inflation without severely harming employment.”

While the Fed intends to keep rates elevated for some time, markets increasingly expect a rate cut in 2024 if inflation continues cooling and economic growth stalls.

For jobseekers and workers, 2024 promises slower but steadier hiring without the wage bidding wars and unprecedented quitting rates seen last year. However, landing a new job may require more effort amid mounting competition.

The days of an ultra-tight labor market may have passed, but for now at least, most employers still remain eager to retain and recruit staff despite the slowing economy. The soft landing continues, but turbulence could still be ahead.