The latest inflation report released on Friday provides further evidence that price pressures are cooling, opening the door for the Federal Reserve to pivot to rate cuts next year.

The core personal consumption expenditures (PCE) index, which excludes food and energy costs, rose 3.2% in November from a year earlier. That was slightly below economists’ expectations for a 3.3% increase, and down from 3.7% inflation in October.

On a 6-month annualized basis, core inflation slowed to 1.9%, dipping below the Fed’s 2% target for the first time in three years. The moderating price increases back up Fed Chair Jerome Powell’s comments last week that inflation has likely peaked after months of relentless gains.

Following Powell’s remarks, financial markets boosted bets that the Fed would begin slashing interest rates in early 2024 to boost economic growth. Futures prices now show traders see a more than 70% likelihood of a rate cut by March.

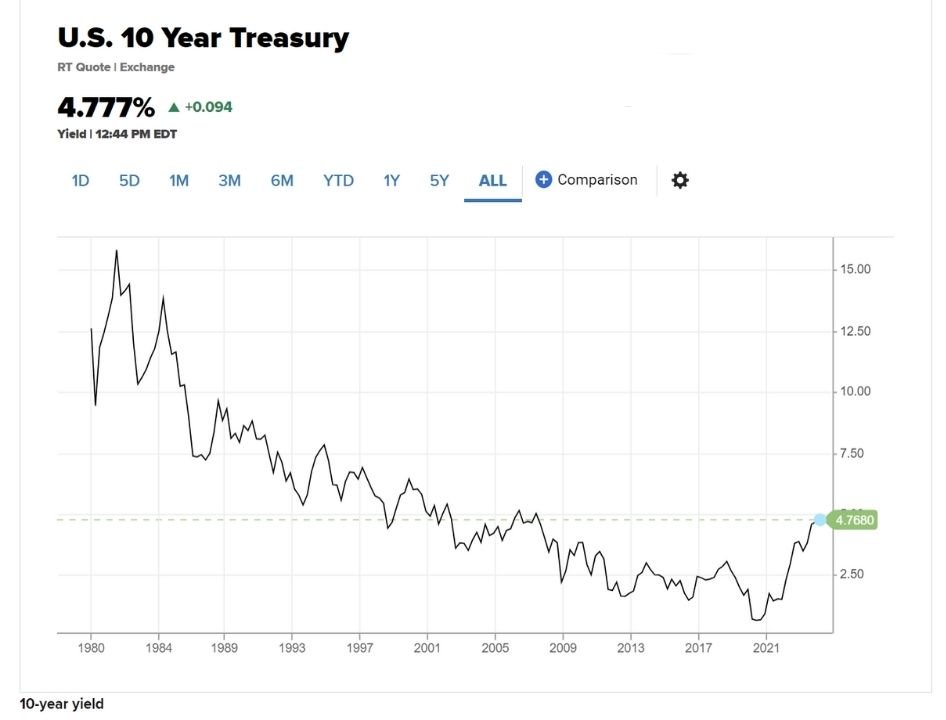

The Fed kicked off its tightening cycle in March, taking its benchmark rate up to a 15-year high of 4.25% – 4.50% from near zero. But Powell signaled last week the central bank could hold rates steady at its next couple meetings as it assesses the impacts of its aggressive hikes.

Still, some Fed officials have pumped the brakes on expectations for imminent policy easing. They noted it is premature to pencil in rate cuts for March when recent inflation data has been mixed.

Cleveland Fed President Loretta Mester said markets have “gotten a little bit ahead” of the central bank. And Richmond Fed President Tom Barkin noted he wants to see services inflation, which remains elevated at 4.1%, also moderate before officials can decide on cuts.

More Evidence Needed

The Fed wants to see a consistent downward trajectory in inflation before it can justify loosening policy. While the latest core PCE print shows prices heading the right direction, policymakers need more proof the disinflationary trend will persist.

Still, the report marked a step forward after inflation surged to its highest levels in 40 years earlier this year on the back of massive government stimulus, supply chain snarls and a red-hot labor market.

The Commerce Department’s downward revision to third quarter core PCE to 2%, right at the Fed’s goal, provided another greenshoot. Personal incomes also grew a healthy 0.4% in November, signaling economic resilience even in the face of tighter monetary policy.

Fed officials will closely monitor upcoming inflation reports, especially core services excluding housing. Categories like healthcare, education and recreation make up 65% of the core PCE index.

Moderation in services inflation is key to convincing the Fed that broader price pressures are easing. Goods disinflation has been apparent for months, helped by improving supply chains.

Path to Rate Cuts

To justify rate cuts, policymakers want to see months of consistently low inflation paired with signs of slowing economic growth. The Fed’s forecasts point to GDP growth braking from 1.7% this year to just 0.5% in 2023.

Unemployment is also projected to rise, taking pressure off wage growth. Leading indicators like housing permits and manufacturing orders suggest the economy is heading for a slowdown.

Once the Fed can be confident inflation will stay around 2% in the medium term, it can then switch to stimulating growth and bringing down unemployment.

Markets are currently betting on the Fed starting to cut rates in March and taking them back down by 1.25 percentage points total next year. But analysts warn against getting too aggressive in rate cut expectations.

“There is mounting evidence that the post-pandemic inflation scare is over and we expect interest rates to be cut significantly next year,” said Capital Economics’ Andrew Hunter.

The potential for financial conditions to tighten again, supply chain problems or an inflation rebound all pose risks to the dovish outlook. And inflation at 3.2% remains too high for the Fed’s comfort.

Fed Chair Powell has warned it could take until 2024 to get inflation back down near officials’ 2% goal. Monetary policy also acts with long lags, meaning rate cuts now may not boost growth until late 2023 or 2024.

With risks still skewed, the Fed will likely take a cautious approach to policy easing. But the latest data gives central bankers confidence their inflation fight is headed in the right direction.