Research News and Market Data on HUSIF

February 3, 2026

VANCOUVER, BC, February 3, 2026 – Nicola Mining Inc. (the “Company” or “Nicola”) (TSX: NIM) (OTCQB: HUSIF) (FSE: HLIA) is pleased to provide an update for the 2025 Exploration Diamond Drilling Program (the “2025 Program”) at its New Craigmont Copper Project (“New Craigmont”), near Merritt, BC.

Exploration Summary

Three targets (Figure 1) were drilled in Nicola’s 2025 program: MARB-CAS, Draken and a new target at WP/West Craigmont identified by ALS Geoanalytics[1]. The purpose of the 2025 Program was to collect geological data for target development for a potential porphyry copper system at New Craigmont.[1]

- Seven holes totaling 3347m were drilled (Table 1), logged and sampled.

- Over 2600 samples (including QC samples) were submitted to AGAT Labs for multi-element analysis (results pending). Results from the analyses will be interpreted by Nicola and used for porphyry vectoring.

- Eleven samples representative of lithology and alteration were selected and sent to Vancouver Petrographic for thin section petrography to help classify rock types and alteration mineral assemblages. This contributes to understanding the geological framework of the property.

- Over 5000 samples selected from 10 holes drilled since 2016 across the property and analyzed on site with a portable X-Ray fluorescence (pXRF) and short-wave infrared (SWIR). This data is a component of the Company’s exploration target development program designed to identify vectors to a mineralized porphyry centre.

Table 1: 2025 Drill Holes

Figure 1. 2025 Drill Hole Collar Locations

Summary of Findings and Interpretations

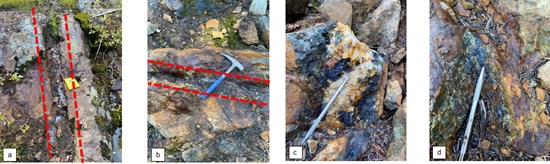

Drill core observations from 2025 support the presence of a porphyry system at Draken (Figure 2). Holes DR-25-001 and DR-25-002 show downhole zonation from pyrite-chalcopyrite to chalcopyrite to chalcopyrite-molybdenite. Outcrop observations are consistent with drill hole observations. The weak mineralization of chalcopyrite with minor bornite and rare molybdenite are associated with classic porphyry alteration assemblages of quartz, epidote, potassium feldspar, chlorite, and sericite. Mineralization is associated with quartz veinlets with varying amounts of potassium feldspar, chlorite, and sericite. Mineralization and alteration are hosted in the Guichon Border Phase diorite. Observations demonstrate the presence of copper and molybdenite in the hydrothermal system and suggest proximity to a porphyry centre. (figures 3 and 4). Nicola’s observations and interpretation of Draken being associated with a porphyry system are consistent with the finding of the UBC MDRU study (see below).

Copper results from MARB are encouraging with MB-25-008 returning 9.5m of 0.39% Cu from 220.5m to 230.0m (Figure 5 and Table 2). This interval consists of a Nicola Group basalt fragmental package with mixed patches of intercalated sandstone, siltstone and fragmental units and a porphyritic andesitic section within. A number of well-preserved quartz-K-feldspar-biotite dykes are enveloped by quartz diorite dykes. Alteration includes pervasive quartz-chlorite with fine-grained biotite. Mineralization consists of disseminated magnetite, trace disseminated pyrite. Fine-grained chalcopyrite, along with pyrite, occurs within quartz stringers with magnetite and chlorite. Nicola geologists interpret the mineralization occurring at MARB to be associated with the skarn at Embayment and CAS. More drilling will be required to demonstrate continuity.

The third target, at WP/West Craigmont (hole (WP-25-007) did not encounter anything visually more indicative of a porphyry system than Draken, leaving Draken as the most promising target on the west side of the property.

Figure 2. Conceptual interpretation of Draken showing 2025 drill holes superimposed on a porphyry system. (See Figure 1 for cross-section location.)

Figure 3. DR-25-001, 111.45m

Bornite ± chalcopyrite ± magnetite assemblages signal hypogene copper mineralization at high temperature.

Figure 4. DR-25-002, 232.50m

Molybdenite with chalcopyrite indicates proximity to a porphyry core or thermal centre.

Figure 5. Cross-section of MARB-CAS showing 2024 and 2025 drill holes. (See Figure 1 for cross-section location)

Table 2: 2025 Significant Copper Intercepts

| Hole ID | From (m) | To (m) | Length (m) | Cu (%) |

| MB-25-008 | 220.5 | 230 | 9.5 | 0.39 |

| 220.5 | 221.25 | 0.75 | 0.12 | |

| 221.25 | 222.6 | 1.35 | 0.12 | |

| 222.6 | 224 | 1.4 | 0.81 | |

| 224 | 225 | 1 | 0.51 | |

| 225 | 226 | 1 | 0.25 | |

| 226 | 227 | 1 | 0.63 | |

| 227 | 228 | 1 | 0.10 | |

| 228 | 229 | 1 | 0.39 | |

| 229 | 230 | 1 | 0.46 |

Ongoing UBC MDRU Study

The University of British Columbia’s (UBC) Mineral Deposit Research Unit (MDRU) has been working on province-wide porphyry study, of which the New Craigmont project is a component. One of the objectives is to investigate whether the Craigmont skarn is related to porphyry-type mineralization in the Guichon Creek batholith. Findings suggest Craigmont is a porphyry related skarn deposit tied to magmatism within the Guichon Creek border phase. Another objective is the use epidote trace element chemistry as a porphyry indicator mineral for vectoring. Alteration types and epidote chemistry indicated a nearby porphyry centre and distinguish it from a distal footprint of the Highland Valley porphyry systems. Geochemistry indicated the best prospects for a porphyry centre are West Craigmont (where Draken is located) and deep to the east of the Craigmont mine (where the ZTEM anomaly is located – see drilling plans for 2026 below).

Recommendations for Further Work

- Continue the ongoing process of building a New Craigmont database with all current and historic exploration data. This is a mandatory before creating a model.

- Create a 3D geological model for New Craigmont. This is a necessary step to develop more precise target concepts and will be mandatory for resource development.

- Process, interpret 2025 pXRF and SWIR data (this will be carried out by ALS Geoanalytics) and integrate it into target concepts.

- Continue to collect pXRF and SWIR data and have it analysed to contribute to more detailed modeling and targeting.

- Drill a previously identified, but untested target, Jotun, north of the old mine (see below).

- Continue to develop a target concept for Draken and drill test.

Diamond Drilling Plans for 2026

In 2022 a property-wide Z-axis Tipper Electromagnetic (ZTEM) survey[2] was conducted for Nicola by Geotech LTD. Interpretations of the data show a large resistivity anomaly directly north of the historical open pit (Figure 6). Drilling in 2023 (NC23-005 and NC23-006) to the south of the anomaly encountered encouraging porphyry-style alteration[3]. Nicola has termed this the “Jotun” (pronounced Yoten) target. Jotun is an exciting target that could represent the causative intrusion for the high-grade copper skarn that was historically mined at Craigmont. Nicola is planning a long hole for 2026 to test this hypothesis.

Figure 6. Cross section (and plan view) of the Jotun target: untested ZTEM resistivity high.

Quality Assurance and Quality Control (QA/QC)

Nicola maintains tight sample security, and quality assurance and quality control (QA/QC) for all aspects of its exploration program. Geological work, and sample selection and preparation for transport was supervised by Nicola’s Senior Geologist Vicente García (GIT) and VP Exploration Will Whitty (P. Geo.), who were on site the entire program. All NQ and HQ-sized core samples from 2025 were logged, photographed and sampled on site by staff or consulting geologists and geotechnicians. Sample sizes ranged from approximately 0.5m – 2m in length depending on geological features. Core was sawed in half lengthwise, with one half going into poly sample bags and the other half going back into the box to be stored on site. Sample identification tags with unique sample numbers were placed in each bag, and bags were zip-tied closed. There were no markings on the bag or tag identify the location of the sample. The samples were packed into rice bags and shipped to AGAT Laboratories Ltd.’s ISO/IEC 17025:2017 and ISO 9001:2015 accredited lab in Calgary, AB for preparation (crushing and pulverizing) and analyzed for 34 elements by 4 acid digestion with ICP-OES (method code 201-070). Company protocols include the insertion of quality control (QC) samples consisting of Certified Reference Materials (CRMs), blanks and duplicates into the sample stream at a rate of 1 of each control sample for every 20 regular samples.

Qualified Person

The scientific and technical disclosures included in this news release have been reviewed and approved by Will Whitty, P.Geo., who is the Qualified Person as defined by NI 43-101. Mr. Whitty is Vice President, Exploration for the Company.

About Nicola Mining

Nicola Mining Inc. is a junior mining company listed on the TSX-V Exchange and Frankfurt Exchange that maintains a 100% owned mill and tailings facility, located near Merritt, British Columbia. It has signed Mining and Milling Profit Share Agreements with high-grade BC-based gold projects. Nicola’s fully permitted mill can process both gold and silver mill feed via gravity and flotation processes.

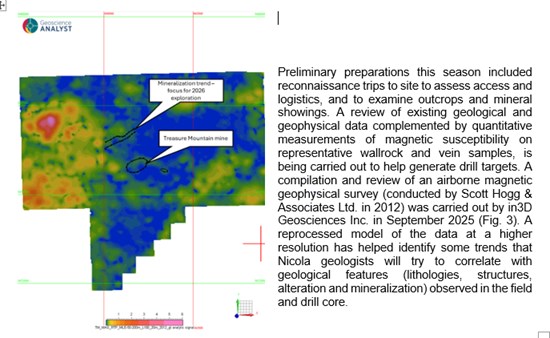

The Company owns 100% of the New Craigmont Project, a property that hosts historic high-grade copper mineralization and covers an area of over 10,800 hectares along the southern end of the Guichon Batholith and is adjacent to Highland Valley Copper, Canada’s largest copper mine. The Company also owns 100% of the Treasure Mountain Property, which includes 30 mineral claims and a mineral lease, spanning an area exceeding 2,200 hectares.

On behalf of the Board of Directors

“Peter Espig”

Peter Espig

CEO & Director

For additional information

Contact: Peter Espig

Phone: (778) 385-1213

Email: info@nicolamining.com

URL: www.nicolamining.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.