Oil prices are on track to post gains this week, driven higher by geopolitical tensions in the Middle East despite ongoing concerns about still high inflation and a cloudy demand outlook.

West Texas Intermediate crude futures have risen approximately 2% week-to-date and were trading around $78 per barrel on Friday. Brent crude, the international benchmark, was up 1.8% on the week to $83 per barrel.

According to analysts, speculative traders and funds are bidding up oil futures based on worries that simmering conflicts in the Middle East could disrupt global supplies. Volatility and uncertainty in the region tends to spur speculative trading in oil markets.

“This is geopolitics with flashing flights, it points right to specs taking advantage of the situation,” said Bob Yawger, managing director at Mizuho America. “They’re rolling the dice expecting something will happen.”

Tensions have escalated on the border between Israel and Lebanon after Israel conducted airstrikes in southern Lebanon this week in retaliation for rocket attacks from the area. The powerful Lebanese militia Hezbollah has vowed to strike back against Israel in response.

There are worries the Israel-Lebanon clashes could spread to a wider conflict, potentially including Israel’s ongoing offensive in Gaza. This could disrupt oil production or transit through the critical Suez Canal. The Middle East accounted for nearly 30% of global oil production last year.

Prices Shake Off Demand Worries

Notably, crude prices have shaken off downward pressure this week from stubbornly high inflation as well as forecasts for weaker demand growth in 2024.

US consumer and wholesale inflation reports this week came in hotter than expected. Persistently high inflation reduces the chances of the Federal Reserve pivoting to interest rate cuts this year which could otherwise boost oil demand.

Demand outlooks for 2024 have also been murky. The International Energy Agency (IEA) downwardly revised its 2024 oil demand growth forecast to 1.2 million barrels per day, half of 2023’s pace. It sees supply growth outpacing demand this year.

However, OPEC offered a more bullish view in its latest report, projecting world oil demand will increase by 2.2 million barrels per day in 2024. The cartel sees demand growth exceeding non-OPEC supply growth.

Investors Shake Off Bearish Signals

Given the conflicting demand forecasts, the resilience of oil prices likely reflects investor optimism over tightening fundamentals outweighing potentially bearish signals.

“There is and has been a yawning chasm in demand estimates,” said Tamas Varga, analyst at PVM brokerage. “The difference of opinions in global oil consumption for this year and the individual quarters, even for the current one, is clearly puzzling.”

Ultimately, lingering Middle East geopolitical risks appear to be overshadowing inflation and demand concerns in driving investor sentiment. With tensions still elevated, investors seem positioned for further volatility and potential price spikes on any supply disruptions.

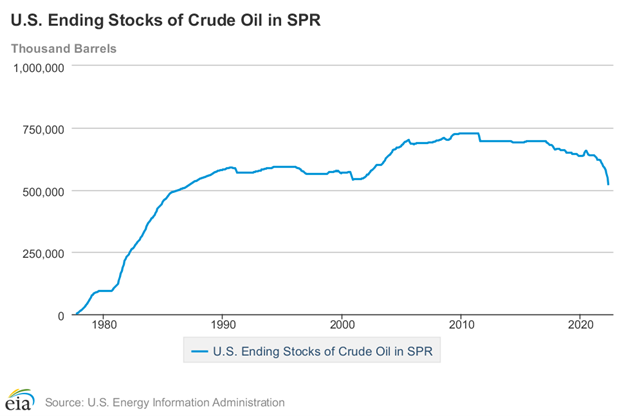

The diverging demand forecasts and data points mean uncertainty persists around whether markets will tighten as much as OPEC expects or remain oversupplied per the IEA outlook. But with inventories still low by historical standards, prices have room to run higher on any bullish shocks.

What’s Next For Oil Markets

Looking ahead, Middle East tensions, China’s reopening, and the extent of Fed rate hikes will be key drivers of oil price trends. Any military escalation or supply disruptions from the Israel-Lebanon tensions could send crude prices spiking higher.

China’s demand recovery as it exits zero-Covid policies will also remain in focus. Signs of China’s crude imports and manufacturing activity reviving could offer a bullish boost to prices.

At the same time, stubborn inflation likely keeps the Fed on track for further rate hikes in the near term. Only clear signs of slowing price growth might promptdiscussion of rate cuts to stimulate growth. For now, Fed policy looks set to weigh on oil demand and limit significant upside.

Overall, investors should brace for continued volatility in oil markets in 2024. While prices may trend higher on tight supplies, lingering demand uncertainties and geo-political tensions look set to drive choppy price action. Nimble investors able to capitalize on price spikes and dips may find opportunities. But those with a lower risk tolerance may wish to stay on the sidelines until fundamentals stabilize.