| Key Points: – TransAlta acquires Heartland Generation for $542 million, adjusting for asset divestitures. – Acquisition to add 1,747 MW of capacity, enhancing TransAlta’s Alberta portfolio. – Deal expected to yield $85-$90 million in annual EBITDA and $20 million in annual synergies. |

TransAlta Corporation announced an amended acquisition agreement to purchase Heartland Generation from Energy Capital Partners (ECP) at a revised price of $542 million. This agreement, which includes the assumption of $232 million of debt, strengthens TransAlta’s presence in Alberta’s energy market, adding diverse power generation assets critical for the province’s growing needs. The transaction is expected to close by December 4, 2024, and includes the divestiture of Heartland’s Poplar Hill and Rainbow Lake assets, which account for 97 MW of power. These divestitures, required to meet federal Competition Bureau guidelines, prompted an $80 million reduction in the purchase price and will allow TransAlta to focus on core, high-value assets in its portfolio.

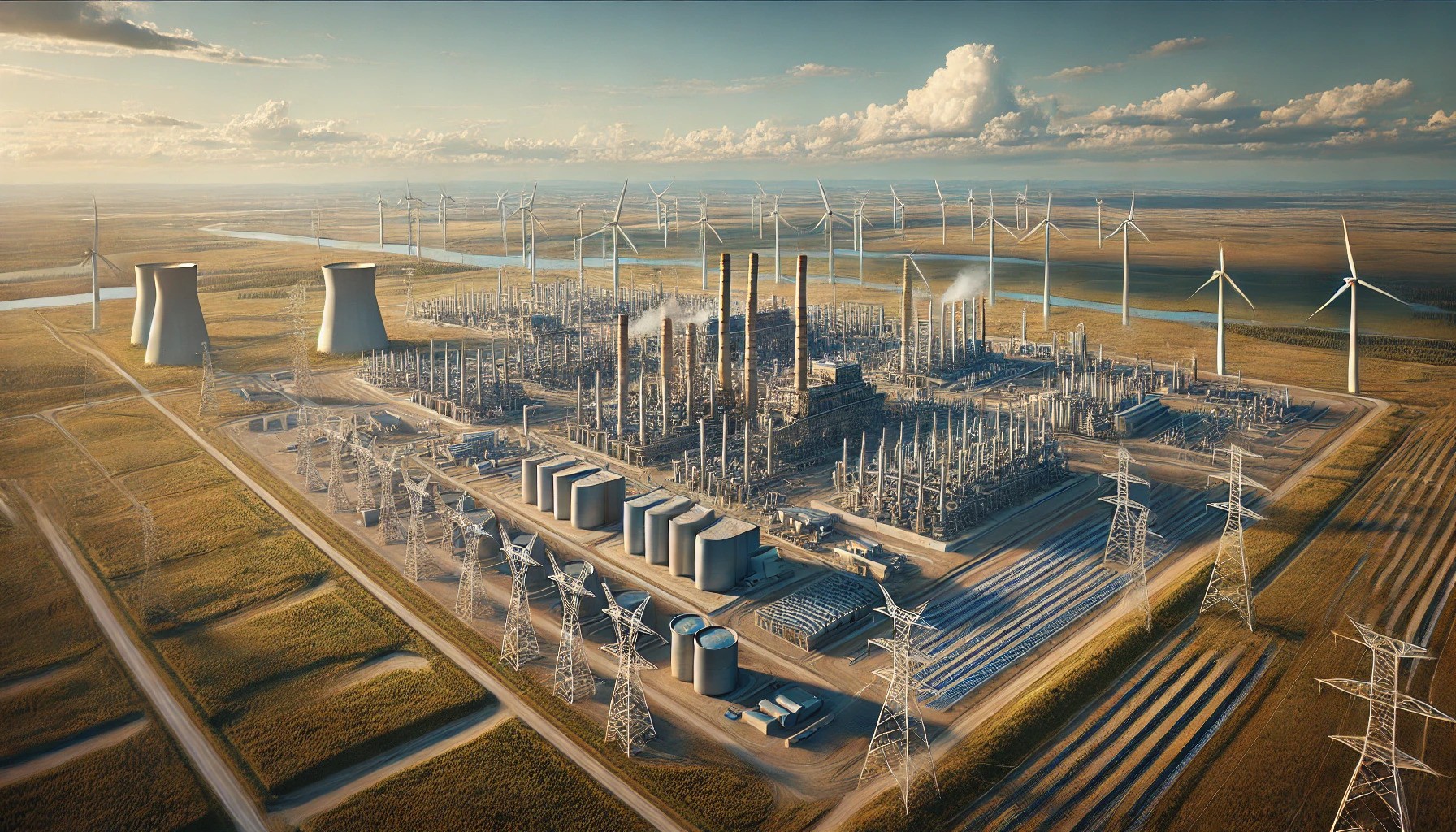

Heartland Generation’s assets are strategically valuable to TransAlta. By adding 1,747 MW of capacity, including gas-fired and peaking generation, as well as cogeneration facilities, TransAlta will significantly enhance its energy capabilities. This expanded portfolio is expected to be highly accretive to the company’s cash flow, contributing an estimated $85 to $90 million in annual EBITDA post-synergies and divestitures. Approximately 60% of Heartland’s revenues are under long-term contracts with an average remaining life of 15 years, ensuring steady, reliable income from high-credit, stable clients. According to TransAlta, the acquisition will yield substantial free cash flow and achieve a cash yield backed by low-cost, high-efficiency energy generation, supporting Alberta’s dynamic power needs.

CEO John Kousinioris emphasized the alignment of this acquisition with TransAlta’s growth strategy in Alberta. “The pending acquisition of Heartland will allow TransAlta to incorporate high-demand generation capabilities, enhancing our role in supporting grid reliability. Consistent with our original investment thesis, the Alberta market will increasingly require low-cost, flexible, and fast-responding generation to support grid reliability over the coming years. This transaction supports our competitive position by ensuring we maintain a robust and diversified portfolio,” he noted. The deal allows TransAlta to better meet Alberta’s evolving energy demands and gain an edge in the market by offering reliable power that complements and balances renewable energy sources, particularly as renewables are scaled up across Alberta.

TransAlta will also leverage significant operational and financial synergies by integrating Heartland’s assets. The company expects $20 million in annual synergies through shared corporate and operational costs. With TransAlta’s existing assets, the expanded scale will enable supply chain efficiencies, operational optimizations, and additional synergies that will enhance margins and support long-term growth. Heartland’s portfolio, with critical infrastructure for future hydrogen development, is also well-suited to support sustainable initiatives, aligning with TransAlta’s commitment to advancing clean energy solutions.

The transaction metrics are favorable to TransAlta’s growth outlook, with an estimated $270 per kilowatt valuation for the Heartland assets. The acquisition’s 5.4 times EBITDA multiple positions TransAlta for long-term value creation through low-cost power generation assets that are increasingly valuable in Alberta’s shifting energy landscape. With the strategic advantages of this acquisition, TransAlta’s enhanced portfolio and market reach will play a vital role in securing Alberta’s energy future.