Research News and Market Data on MAIA

November 07, 2023 8:15am ESTDownload as PDF

Related Documents

10-QFiling

PDFHTML

XBRL

ZIPXLSHTML

- Substantial THIO program progress including unprecedented disease control rate (DCR) of 100% in second-line non-small cell lung cancer (NSCLC)

- Key THIO findings in gliomas, pediatric brain cancer, and second generation THIO-derived cancer therapies

- Strong pace of enrollment in THIO-101 Phase 2 trial exceeds average enrollment pace in similar NSCLC trials

CHICAGO–(BUSINESS WIRE)– MAIA Biotechnology, Inc., (NYSE American: MAIA) (“MAIA” or the “Company”), a clinical-stage biopharmaceutical company developing telomere-targeting immunotherapies for cancer, today reported financial results for the third quarter ended September 30, 2023 and key operational updates.

“Our successful and productive third quarter was punctuated by the outstanding data on our lead asset THIO that we recently revealed, and an accelerating pace of enrollment in our THIO-101 Phase 2 trial,” said Vlad Vitoc, M.D., MAIA’s Chairman and Chief Executive Officer. “We are expanding our trial in Europe, and with the FDA’s recent clearance for THIO studies in the U.S. as part of THIO-101, we have reached an essential milestone in the clinical development of THIO. Preliminary efficacy data from the trial is excellent and includes an unprecedented disease control rate (DCR) of 100% in second-line NSCLC treatment, far surpassing the standard of care DCR of 53-64%. We achieved the pre-determined statistical requirements to proceed to the next stage of the trial earlier than expected, and we look forward to sharing our continuing progress in the coming months and into 2024.”

Third Quarter Business Highlights and Recent Developments

THIO Program

Announced 100% Disease Control in Second-Line Non-Small Cell Lung Cancer Demonstrating Impressive Positive Preliminary Efficacy Data: 100% preliminary DCR was observed in second-line and 88% in third-line, in highly difficult-to-treat patients who already progressed through previous lines of treatment. DCRs across all dose levels met the pre-determined statistical requirements earlier than expected to proceed to next stage of the THIO-101 Phase 2 trial.

Highly Potent Anticancer Activity in Gliomas: MAIA’s lead asset THIO showed highly potent anticancer activity in models of glioma, an aggressive type of brain tumor that originates from glial cells and is among the most difficult-to-treat cancers. As a monotherapy, THIO demonstrated efficacy in multiple glioma cell lines that had acquired resistance to the current state-of-the-art care temozolomide (TMZ).

THIO as Potential Therapy for Pediatric Brain Cancer: Study data showed THIO’s potent anticancer activity in diffuse intrinsic pontine glioma (DIPG), one of the most aggressive tumors affecting the central nervous system in children. The treatment resulted in noticeably increased tumor sensitivity to immune or ionizing radiation therapies.

Higher Anticancer Potency of Next Generation THIO Conjugates: Positive Investigational New Drug-enabling study data on telomere-targeting agents derived from lipid-modified THIO molecules warrant further in vivo in-depth investigation of THIO-like agents as second generation cancer therapies.

THIO-101 Phase 2 Clinical Trial

U.S. FDA Clearance of THIO IND Application: The U.S. Food and Drug Administration (FDA) cleared an Investigational New Drug (IND) application enabling THIO to be evaluated in the U.S. as part of THIO-101, the Company’s ongoing global phase 2 clinical study in patients with advanced non-small cell lung cancer (NSCLC). THIO is being tested in sequential combination with a checkpoint inhibitor (CPI) to evaluate anti-tumor activity and immune response in NSCLC patients.

Strong Pace of Enrollment in THIO-101: 49 patients have been dosed to date at a pace of enrollment that is currently exceeding the average enrollment pace in similar NSCLC trials. Out of the 49 patients dosed, 37 have already completed at least one post baseline assessment.

Continuing Positive Preliminary Survival Data: The first 2 subjects dosed on trial (both receiving 3rd line of treatment) reported long term survival of 14.6 and 12.5 months, respectively, at the latest post baseline assessment with no new anti-cancer treatment initiated. Follow up was ongoing for the first subject at the time of data cut-off.

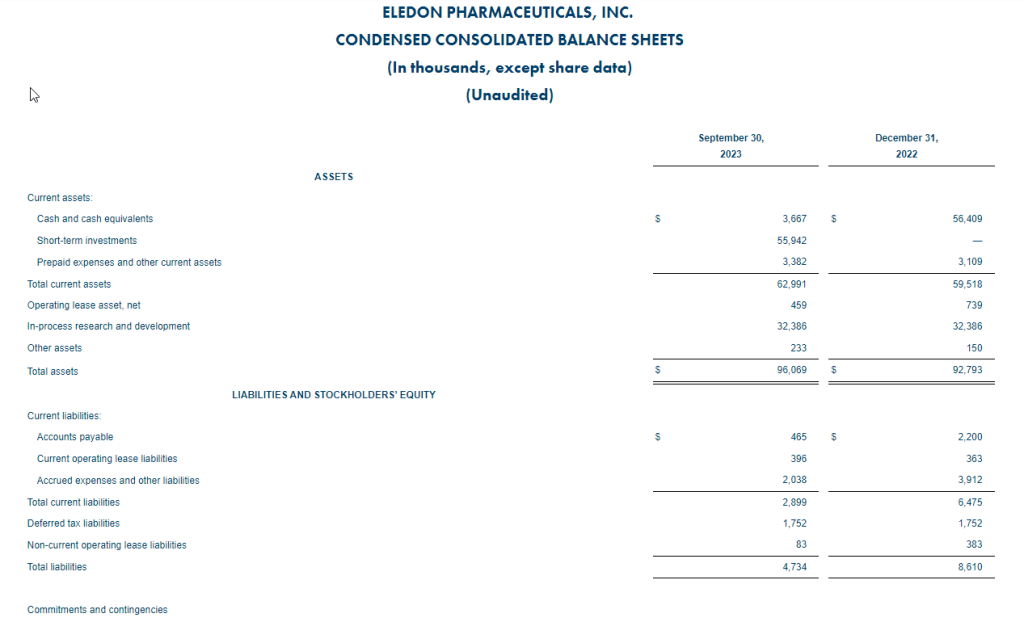

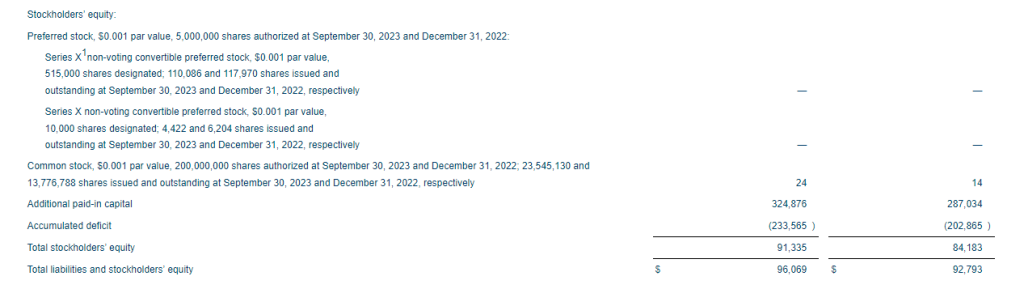

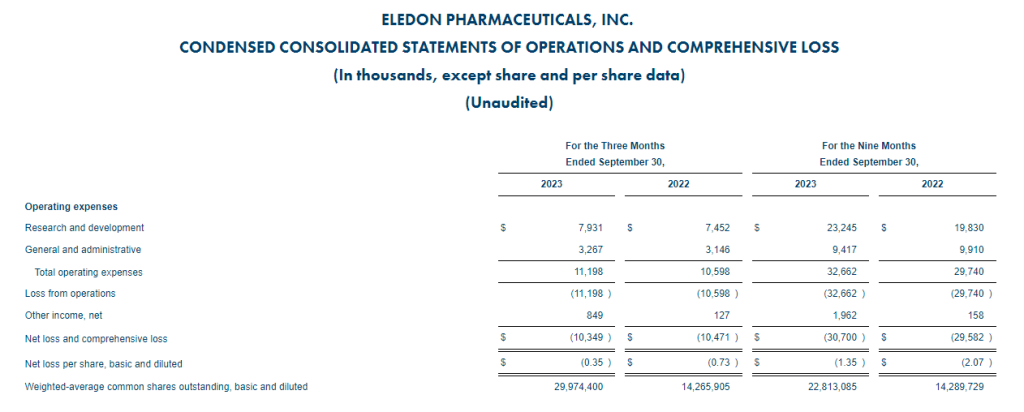

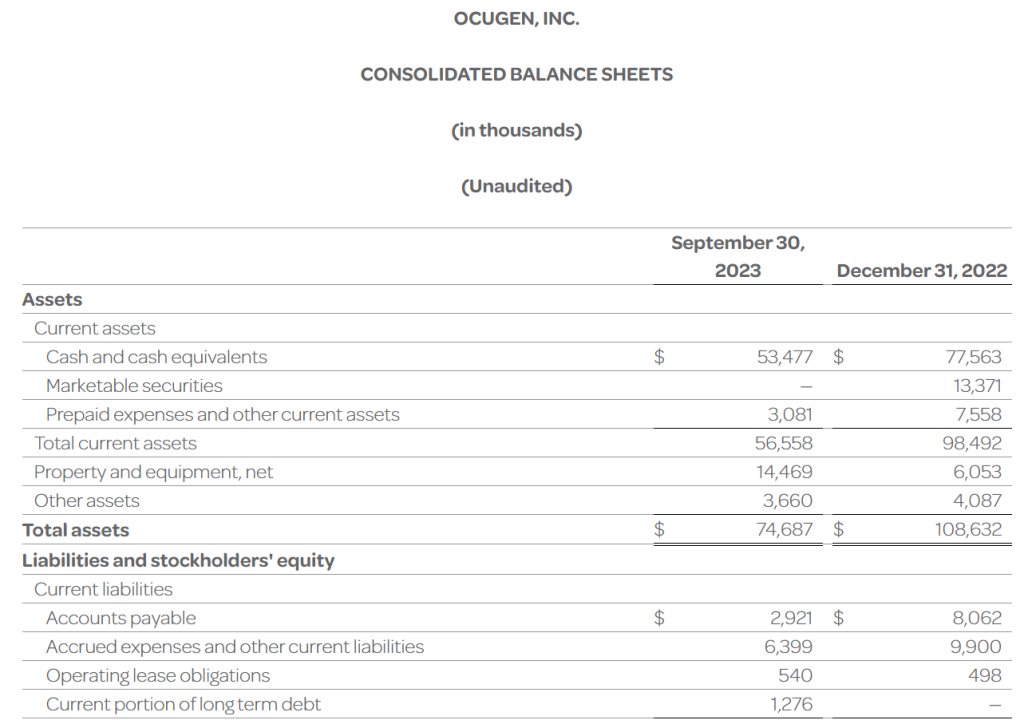

Third Quarter 2023 Financial Results

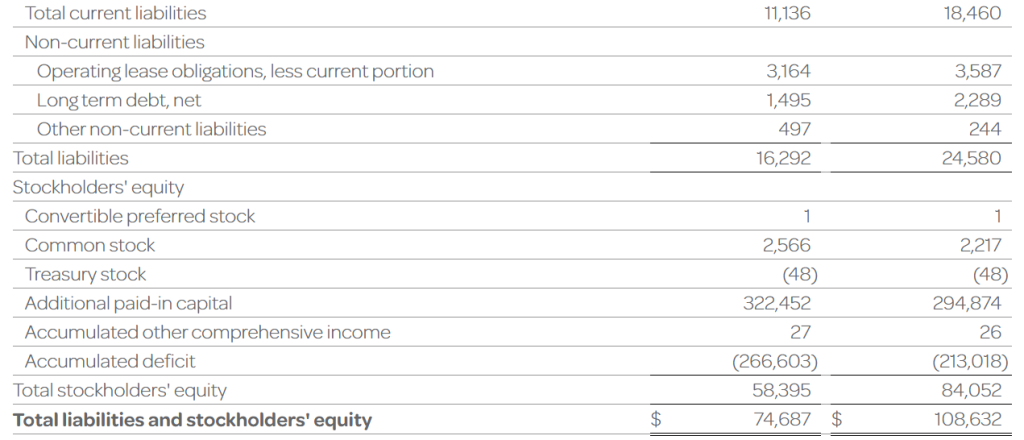

Cash Position: Cash totaled approximately $6.1 million as of September 30, 2023, compared to $10.9 million in cash as of December 31, 2022.

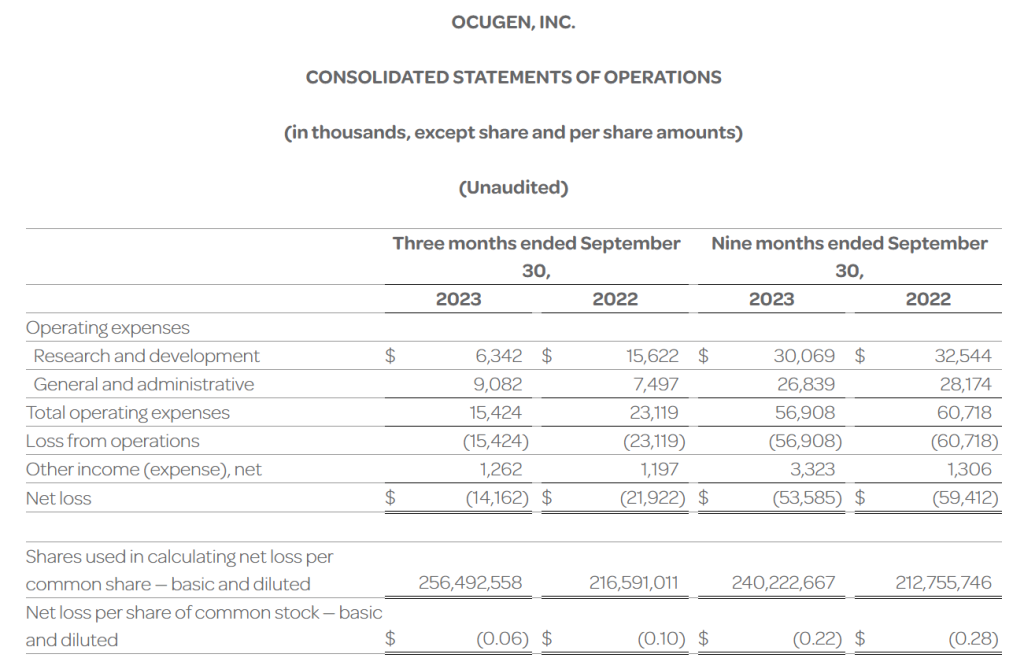

Research and Development (R&D) Expenses: R&D expenses were approximately $2.6 million for the quarter ended September 30, 2023, compared to approximately $2.3 million for quarter ended September 30, 2022. The increase was primarily related to an increase in scientific research expenses.

General and Administrative (G&A) Expenses: G&A expenses were approximately $2.4 million for the quarter ended September 30, 2023, compared to approximately $1.7 million for the quarter ended September 30, 2022. The increase for the quarter was primarily related to an increase in professional fees related to the write-off of deferred offering costs and an increase in investor relations costs.

Other Income, Net: Other income was approximately $0.08 million for the quarter ended September 30, 2023, compared to other income, net of $0.19 million for the quarter ended September 30, 2022, primarily related to a change in the fair value of warrant liability.

Net Loss: Net loss was approximately $4.9 million, or $0.36 per share, for the quarter ended September 30, 2023, as compared to net loss of approximately $4.9 million, or $0.48 per share, for the quarter ended September 30, 2022. Weighted average shares outstanding were 13,675,802 in the third quarter of 2023, compared to 10,165,622 in the third quarter of 2022.

For additional information on the Company’s financial results for the quarter ended September 30, 2023, please refer to the Form 10-Q filed with the SEC.

About THIO

THIO (6-thio-dG or 6-thio-2’-deoxyguanosine) is a first-in-class investigational telomere-targeting agent currently in clinical development to evaluate its activity in Non-Small Cell Lung Cancer (NSCLC). Telomeres, along with the enzyme telomerase, play a fundamental role in the survival of cancer cells and their resistance to current therapies. The modified nucleotide 6-thio-2’-deoxyguanosine (THIO) induces telomerase-dependent telomeric DNA modification, DNA damage responses, and selective cancer cell death. THIO-damaged telomeric fragments accumulate in cytosolic micronuclei and activates both innate (cGAS/STING) and adaptive (T-cell) immune responses. The sequential treatment with THIO followed by PD-(L)1 inhibitors resulted in profound and persistent tumor regression in advanced, in vivo cancer models by induction of cancer type–specific immune memory. THIO is presently developed as a second or later line of treatment for NSCLC for patients that have progressed beyond the standard-of-care regimen of existing checkpoint inhibitors.

About THIO-101, Phase 2 Clinical Trial

THIO-101 is a multicenter, open-label, dose finding Phase 2 clinical trial. It is the first trial designed to evaluate THIO’s anti-tumor activity when followed by PD-(L)1 inhibition. The trial is testing the hypothesis that low doses of THIO administered prior to an anti-PD-1 agent will enhance and prolong immune response in patients with advanced NSCLC who previously did not respond or developed resistance and progressed after first-line treatment regimen containing another checkpoint inhibitor. The trial design has two primary objectives: (1) to evaluate the safety and tolerability of THIO administered as an anticancer compound and a priming immune activator (2) to assess the clinical efficacy of THIO using Overall Response Rate (ORR) as the primary clinical endpoint. For more information on this Phase II trial, please visit ClinicalTrials.gov using the identifier NCT05208944.

About MAIA Biotechnology, Inc.

MAIA is a targeted therapy, immuno-oncology company focused on the development and commercialization of potential first-in-class drugs with novel mechanisms of action that are intended to meaningfully improve and extend the lives of people with cancer. Our lead program is THIO, a potential first-in-class cancer telomere targeting agent in clinical development for the treatment of NSCLC patients with telomerase-positive cancer cells. For more information, please visit www.maiabiotech.com.

Forward Looking Statements

MAIA cautions that all statements, other than statements of historical facts contained in this press release, are forward-looking statements. Forward-looking statements are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels or activity, performance or achievements to be materially different from those anticipated by such statements. The use of words such as “may,” “might,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “intend,” “future,” “potential,” or “continue,” and other similar expressions are intended to identify forward looking statements. However, the absence of these words does not mean that statements are not forward-looking. All forward-looking statements are based on current estimates, assumptions and expectations by our management that, although we believe to be reasonable, are inherently uncertain. Any forward-looking statement expressing an expectation or belief as to future events is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors including: (i) lower than anticipated rate of patient enrollment, (ii) the initiation, timing, cost, progress and results of our preclinical and clinical studies and our research and development programs, (iii) our ability to advance product candidates into, and successfully complete, clinical studies, (iv) the timing or likelihood of regulatory filings and approvals, (v) our ability to develop, manufacture and commercialize our product candidates and to improve the manufacturing process, (vi) the rate and degree of market acceptance of our product candidates, (vii) the size and growth potential of the markets for our product candidates and our ability to serve those markets, (viii) our ability to obtain and maintain intellectual property protection for our product candidates and (ix) other risks and uncertainties detailed from time to time in our filings with the Securities and Exchange Commission, including without limitation our periodic reports on Form 10-K and 10-Q, each as amended and supplemented from time to time. Any forward-looking statement speaks only as of the date on which it was made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. In this release, unless the context requires otherwise, “MAIA,” “Company,” “we,” “our,” and “us” refers to MAIA Biotechnology, Inc. and its subsidiaries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231107515213/en/

Investor Inquiries

MAIA Biotechnology

Joseph McGuire

Chief Financial Officer

jmcguire@maiabiotech.com

904-228-2603

Investor Relations

ir@maiabiotech.com

Source: MAIA Biotechnology, Inc.

Released November 7, 2023