Research News and Market Data on UNCY

June 25, 2024 7:30am EDT

– Successfully Established Favorable Tolerability and Safety of OLC –

– New Drug Application (NDA) Submission Anticipated in Q3 2024 –

– Webcast and Conference Call Today at 8:30 A.M. ET –

LOS ALTOS, Calif., June 25, 2024 (GLOBE NEWSWIRE) — Unicycive Therapeutics, Inc. (Nasdaq: UNCY), a clinical-stage biotechnology company developing therapies for patients with kidney disease (the “Company” or “Unicycive”), today announced positive results from the Oxylanthanum Carbonate (OLC) UNI-OLC-201 pivotal clinical trial with regard to both safety and tolerability endpoints. OLC is a next-generation lanthanum-based phosphate binding agent utilizing proprietary nanoparticle technology being developed for the treatment of hyperphosphatemia in patients with chronic kidney disease (CKD).

The study established promising tolerability of OLC at clinically effective doses in CKD patients on hemodialysis. In terms of tolerability, OLC had a low rate of discontinuation due to adverse events (AEs) with only 5/86 patients (6%) discontinuing from the Study. Of the 5 discontinuations, 3 were treatment-related and 2 were not related to treatment. Importantly, the Company believes the low discontinuation rate for OLC compares favorably to a discontinuation rate due to AEs of 14% for Fosrenol® from its U.S. Food and Drug Administration (FDA)-approved Package Insert.

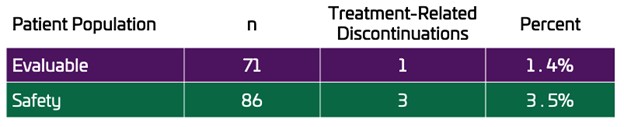

The primary endpoint was defined as the rate of discontinuations due to treatment-related AEs leading to discontinuation in the maintenance period. In the UNI-OLC-201 trial, there was only 1 discontinuation due to a treatment-related AE in the Evaluable Population (n=71), a rate of 1.4%. In the full Safety Population, a total of 3 patients discontinued due to treatment-related AEs, a rate of 3.5%.

The secondary endpoint assessing safety was also favorable as most treatment-related AEs were mild to moderate in severity and there were no treatment-related serious adverse events (SAEs) reported in the Safety Population. The treatment-related AEs reported in ≥5% of patients were diarrhea (9%) and vomiting (6%) which also compares favorably to Fosrenol and other phosphate binders on the market.

While the study was not designed to evaluate efficacy, the trial enrolled patients on stable doses of approved hyperphosphatemia medications. At baseline approximately 59% of patients had phosphate levels ≤5.5 mg/dL, the level recommended by KDOQI guidelines. After washout from the prior phosphate binders, 90% of patients were able to achieve phosphate levels ≤5.5ng/dL at the end of titration with OLC.

“We are immensely pleased with the outcome of the UNI-OLC-201 clinical trial as the results demonstrate extremely promising tolerability results in real-world dialysis patients,” said Shalabh Gupta, MD, Chief Executive Officer of Unicycive. “The study was well received by investigators and patients as we were able to successfully over-enroll the study with 71 evaluable patients. In addition, we were able to obtain phosphate control in 90% of the Safety Population during titration and OLC proved to be highly potent at lower doses. We would like to thank our investigators, study coordinators, and the patients who dedicated their time and energy for our clinical trial.”

Dr. Gupta continued, “We believe these favorable results confirming tolerability for OLC are the final data component needed to support submission of a New Drug Application to the FDA utilizing the 505(b)(2) regulatory pathway. The submission package will also include the previously disclosed preclinical data and the data establishing bioequivalence to Fosrenol. The encouraging performance of OLC gives us a high degree of confidence and provides potential clinical validation of OLC’s best-in-class commercial promise for patients suffering from hyperphosphatemia.”

“Based on real world evidence, approximately 40% of patients on dialysis are unable to achieve adequate serum phosphate control as defined by established KDOQI treatment guidelines1. The UNI-OLC-201 study was representative of the U.S. dialysis patient population. Uncontrolled hyperphosphatemia is an important problem for patients and physicians because it can lead to other major complications including cardiovascular disease. I am encouraged by the results from the OLC pivotal trial, and I believe that a product like OLC that improves phosphate control and reduces the number of pills could have a meaningful impact on the overall care of CKD patients on dialysis,” added Pablo Pergola, MD, PhD, Research Director, Clinical Advancement Center, Renal Associates, P.A., and principal investigator for the UNI-OLC-201 trial.

Conference Call & Webcast Details

Unicycive will host a webcast and conference call with accompanying slides today at 8:30 a.m. ET. The live and archived webcast may be accessed on the Unicycive website under the Investors section: Events and Presentations. The live call can be accessed by dialing +1 (646) 876-9923 with Meeting ID: 96518079674 and Passcode: 273069.

Presentation slides will be provided at the start of the conference call on the Unicycive website under the Investors section: Events and Presentations.

OLC-201 Data Summary

Overview

The results from the trial are focused on two patient populations: the full Safety Population and the Evaluable Population. The Safety Population (n=86) included all patients who entered titration and received at least one dose of OLC. The Evaluable Population (n=71) required a patient to have a serum phosphate level of ≤5.5 mg/dL at the end of titration and received at least one dose of OLC in the maintenance period.

Once patients were enrolled into the trial, they went through a washout period for two weeks to clear their current phosphate binder from the body. Participants were initially dosed at 500 mg of OLC three times a day (TID) and titrated to a clinically effective dose that is defined as the dose required to achieve a serum phosphate level of ≤5.5 mg/dL. The maximum dose of OLC tested was 3000 mg/day (1000 mg TID). As a reminder, all approved phosphate binders are administered on a dose titration schedule based on the control of serum phosphate. Once titrated to a clinically effective dose, patients were then treated in a maintenance period with OLC for four weeks to evaluate tolerability.

Demographics and Enrollment Summary

In the study, 106 patients were enrolled, of which 86 patients entered titration and were followed as the Safety Population. Of the 86, 78 entered the maintenance period. Of the 78 patients that entered maintenance, 7 patients did not have phosphate control, leaving an Evaluable Population of 71 patients, exceeding the planned enrollment number of 60. Of the 86 patients, the trial enrolled 47 males and 39 females with a mean age of 62. Renvela® was the most prescribed phosphate binder for patients entering the study.

Primary Endpoint – Tolerability:

The objective of the OLC-201 trial was to evaluate the tolerability of clinically effective doses of OLC in CKD patients on dialysis. A clinically effective dose was established when a patient achieved a serum phosphate level ≤5.5 mg/dL. Tolerability was assessed based on the incidence of treatment-related AEs leading to discontinuation from the study in the maintenance period. In the OLC-201 trial, there was only 1 discontinuation due to a treatment-related AE in the Evaluable Population, a rate of 1.4%. In the Safety Population of 86 patients there were only 3 treatment-related discontinuations, a rate of 3.5%. In total, 5 patients discontinued due to AEs in the Safety Population, 3 were related to OLC and 2 were deemed unrelated to OLC.

Secondary Endpoint – Safety:

The secondary endpoint assessing safety was reported as the treatment-related AEs occurring in ≥5% of patients. The safety analysis covered all 86 patients in the Safety Population. Consistent with the AEs observed with other phosphate binders, the AEs were gastrointestinal related with diarrhea and vomiting being the most common at 9% and 6% respectively. There were no treatment-related serious adverse events (SAEs). Six patients experienced SAEs but those were deemed not related to OLC treatment. Most treatment-related AEs were mild to moderate in severity with only 2 AEs reported as severe.

Unicycive continues to assess the pharmacokinetics from this trial and those final data will be included in the NDA package.

Serum Phosphate Control

While the UNI-OLC-201 study was not designed to evaluate efficacy, the trial enrolled patients on stable doses of approved hyperphosphatemia medications. At baseline 59% of patients had phosphate levels ≤5.5 mg/dL, the level recommended by KDOQI guidelines. After washout from the prior phosphate binders, 90% of patients were able to achieve phosphate levels ≤5.5ng/dL at the end of titration with OLC. This includes the last serum phosphate levels from all patients including those that discontinued during titration: 77/86 (90%).

In addition, 69% of the 71 Evaluable Patients achieved a target serum phosphate level of ≤5.5 mg/dL at OLC doses of 1500 mg/day or lower.

About Oxylanthanum Carbonate (OLC)

Oxylanthanum carbonate is a next-generation lanthanum-based phosphate binding agent utilizing proprietary nanoparticle technology being developed for the treatment of hyperphosphatemia in patients with chronic kidney disease (CKD). OLC has over forty issued and granted patents globally. Its potential best-in-class profile may have meaningful patient adherence benefits over currently available treatment options as it requires a lower pill burden for patients in terms of number and size of pills per dose that are swallowed instead of chewed. Based on a survey conducted in 2022, Nephrologists stated that the greatest unmet need in the treatment of hyperphosphatemia with phosphate binders is a lower pill burden and better patient compliance.2 The global market opportunity for treating hyperphosphatemia is projected to be in excess of $2.5 billion in 2023, with the United States accounting for more than $1 billion of that total.3 Despite the availability of several FDA-cleared medications, 75 percent of U.S. dialysis patients fail to achieve the target phosphorus levels recommended by published medical guidelines.

Unicycive is seeking FDA approval of OLC via the 505(b)(2) regulatory pathway. As part of the clinical development program, two prior clinical studies were conducted in over 100 healthy volunteers. The first study was a dose-ranging Phase I study to determine safety and tolerability. The second study was a randomized, open-label, two-way crossover bioequivalence study to establish pharmacodynamic bioequivalence between OLC and Fosrenol. Based on the topline results of the bioequivalence study, pharmacodynamic (PD) bioequivalence of OLC to Fosrenol was established.

About Hyperphosphatemia

Hyperphosphatemia is a serious medical condition that occurs in nearly all patients with End Stage Renal Disease (ESRD). If left untreated, hyperphosphatemia leads to secondary hyperparathyroidism (SHPT), which then results in renal osteodystrophy (a condition similar to osteoporosis and associated with significant bone disease, fractures and bone pain); cardiovascular disease with associated hardening of arteries and atherosclerosis (due to deposition of excess calcium-phosphorus complexes in soft tissue). Importantly, hyperphosphatemia is independently associated with increased mortality for patients with chronic kidney disease on dialysis. Based on available clinical data to date, over 80% of patients show signs of cardiovascular calcification by the time they become dependent on dialysis.

Dialysis patients are already at an increased risk for cardiovascular disease (because of underlying diseases such as diabetes and hypertension), and hyperphosphatemia further exacerbates this. Treatment of hyperphosphatemia is aimed at lowering serum phosphate levels via two means: (1) restricting dietary phosphorus intake; and (2) using, on a daily basis, and with each meal, oral phosphate binding drugs that facilitate fecal elimination of dietary phosphate rather than its absorption from the gastrointestinal tract into the bloodstream.

About Unicycive Therapeutics

Unicycive Therapeutics is a biotechnology company developing novel treatments for kidney diseases. Unicycive’s lead drug candidate, oxylanthanum carbonate (OLC), is a novel investigational phosphate binding agent being developed for the treatment of hyperphosphatemia in chronic kidney disease patients on dialysis. UNI-494 is a patent-protected new chemical entity in clinical development for the treatment of conditions related to acute kidney injury. For more information, please visit Unicycive.com and follow us on LinkedIn, X, and YouTube.

Forward-looking statements

Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified using words such as “anticipate,” “believe,” “forecast,” “estimated” and “intend” or other similar terms or expressions that concern Unicycive’s expectations, strategy, plans or intentions. These forward-looking statements are based on Unicycive’s current expectations and actual results could differ materially. There are several factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results; our clinical trials may be suspended or discontinued due to unexpected side effects or other safety risks that could preclude approval of our product candidates; risks related to business interruptions, which could seriously harm our financial condition and increase our costs and expenses; dependence on key personnel; substantial competition; uncertainties of patent protection and litigation; dependence upon third parties; and risks related to failure to obtain FDA clearances or approvals and noncompliance with FDA regulations. Topline data from the Oxylanthanum carbonate (OLC) pivotal trial is preliminary and subject to change based on further detailed analysis. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: the uncertainties related to market conditions and other factors described more fully in the section entitled ‘Risk Factors’ in Unicycive’s Annual Report on Form 10-K for the year ended December 31, 2023, and other periodic reports filed with the Securities and Exchange Commission. Any forward-looking statements contained in this press release speak only as of the date hereof, and Unicycive specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Fosrenol® (lanthanum carbonate) is a registered trademark of Shire International Licensing BV.

Renvela® (sevelamer carbonate) is a registered trademark of Sanofi.

1KDOQI treatment guidelines

2Reason Research, LLC 2022 company sponsored survey. Results here.

3Fortune Business InsightsTM, Hyperphosphatemia Treatment Market, 2021-2028

Investor Contact:

ir@unicycive.com

(650) 543-5470

SOURCE: Unicycive Therapeutics, Inc.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d5d3fbf1-f566-4d9c-9a33-489e7b4cf1f4

Source: Unicycive Therapeutics, Inc.

Released June 25, 2024