Alphabet shares surged to a record high on Monday, climbing nearly 6% after Berkshire Hathaway disclosed a new multibillion-dollar stake in the Google parent company. The purchase, totaling 17.85 million shares valued at approximately $4.9 billion, marks one of Berkshire’s final large investments under Warren Buffett’s leadership — and a notable shift for a conglomerate traditionally cautious about high-growth tech stocks.

Berkshire’s move represents a major endorsement of Alphabet’s expanding artificial intelligence strategy during a period of heightened scrutiny across the tech sector. While many investors have begun questioning whether the rapid rise of AI-driven valuations is sustainable, Berkshire’s investment signals confidence in Alphabet’s fundamentals and its long-term ability to capitalize on AI innovation.

The investment also stands out given Berkshire’s historic stance on technology. Although Apple remains Berkshire’s largest holding, Buffett has long viewed it as more of a consumer products company than a pure tech play. A direct investment in Alphabet, however, reflects a meaningful step toward embracing companies at the center of the AI revolution. Market strategists point out that the move aligns with value-investing principles, given Alphabet’s comparatively attractive valuation relative to other AI frontrunners.

Investor sentiment around tech has become more cautious in recent months. Business leaders and market analysts have warned that the AI boom — powered by heavy data-center spending and ambitious product pipelines — could be creating inflated expectations. The Roundhill Magnificent 7 ETF, which tracks top tech names such as Microsoft, Nvidia, and Alphabet, has been mostly flat since September after significantly outperforming the broader market earlier in the year.

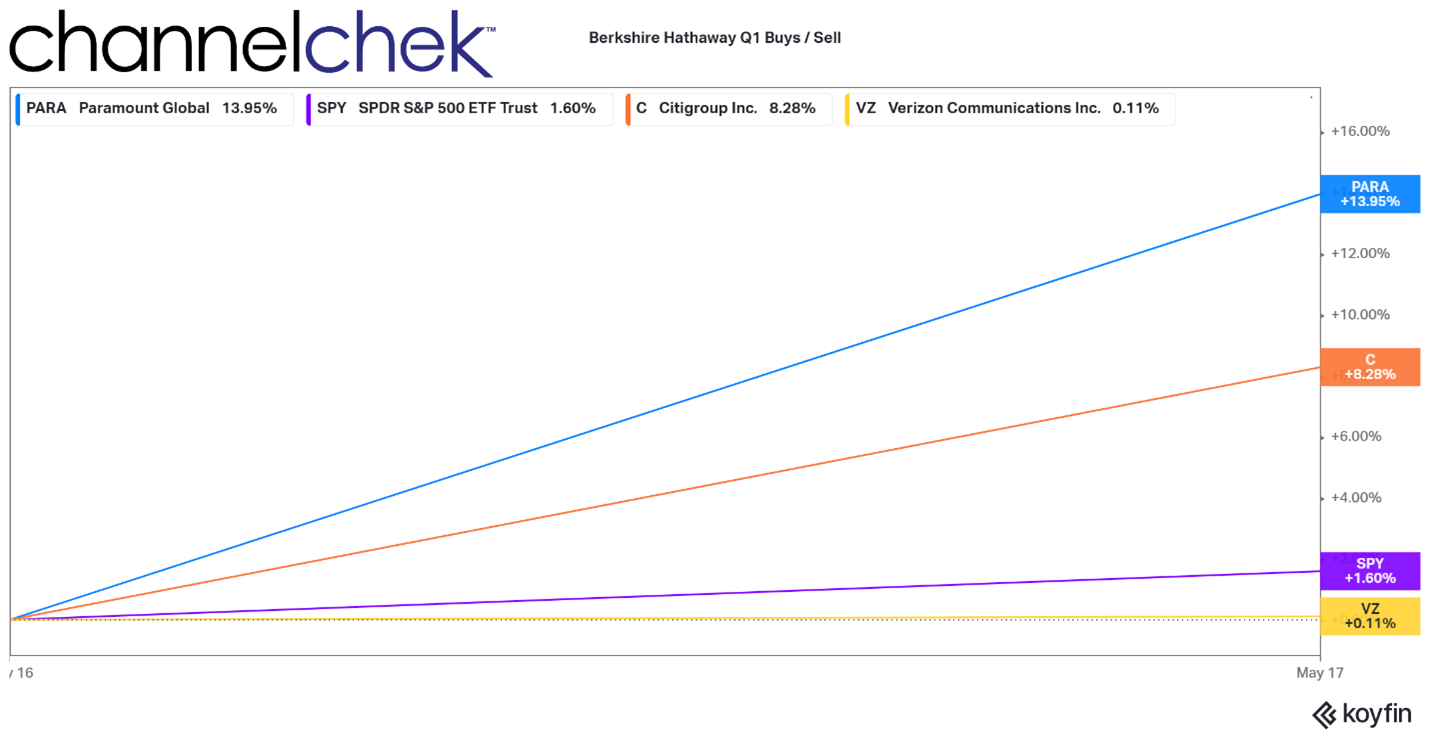

Despite the broader slowdown, Alphabet has stood out as one of the strongest performers among the “Magnificent Seven” stocks. Shares have surged nearly 14% in the current quarter and are up 46% year-to-date, making it the group’s top performer. Analysts attribute this strength to Alphabet’s accelerating AI investments, robust cloud division growth, and its ability to leverage its massive advertising business to fund further innovation.

Alphabet also trades at a relative discount compared to its peers, with shares valued at roughly 25 times forward earnings estimates. Microsoft trades at 29 times, while Nvidia approaches 30 — making Alphabet an appealing option for an investor focused on balancing growth potential with valuation discipline.

CFRA analysts highlight that Berkshire’s investment validates Alphabet’s strategic direction, particularly around Google Cloud and the expanding Gemini AI ecosystem. Recent earnings revealed that AI-powered tools and infrastructure investments are helping transform Google Cloud into a major growth engine, reversing its earlier status as a distant third player in the cloud market.

The move also reflects a bit of unfinished business for Buffett, who has previously acknowledged regretting missing the chance to invest in Google early on. With Berkshire preparing for leadership transition as Greg Abel is set to assume the CEO role at the end of 2025, the investment may represent a final major pivot toward companies leading the next technological era.

Alphabet’s rally could add roughly $180 billion in market value if gains hold. And with Berkshire’s reputation for long-term conviction, the investment has quickly captured the attention of both institutional and retail investors — offering a strong signal of confidence amid an increasingly cautious tech landscape.