Research News and Market Data on HMENF

August 14, 2025 8:00 AM EDT | Source: Hemisphere Energy Corporation

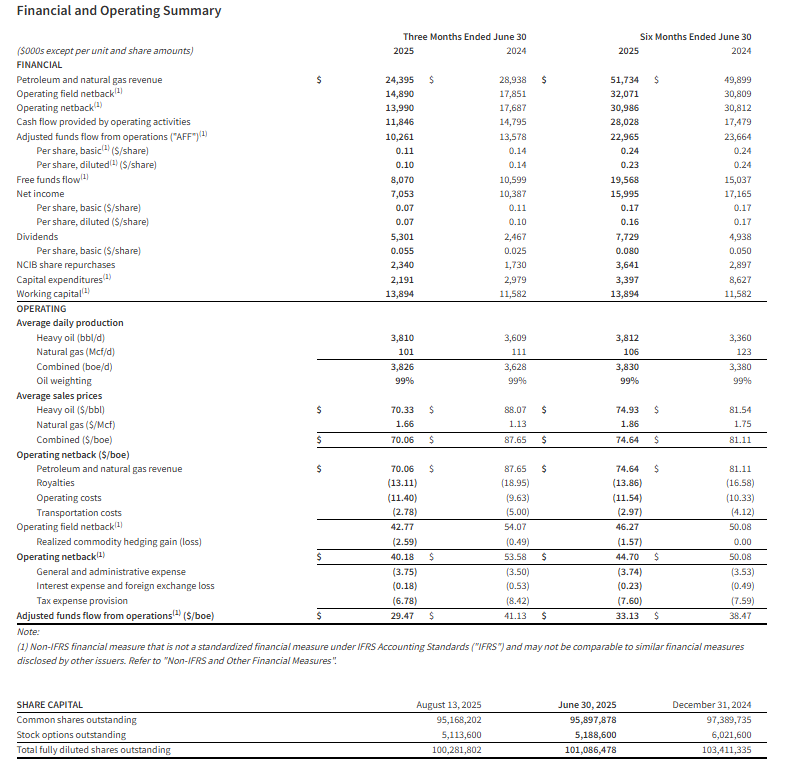

Vancouver, British Columbia–(Newsfile Corp. – August 14, 2025) – Hemisphere Energy Corporation (TSXV: HME) (OTCQX: HMENF) (“Hemisphere” or the “Company”) provides its financial and operating results for the second quarter ended June 30, 2025, declares a quarterly dividend payment to shareholders, and provides operations update.

Q2 2025 Highlights

- Attained quarterly production of 3,826 boe/d (99% heavy oil).

- Generated $24.4 million, or $70.06/boe, in revenue.

- Achieved total operating and transportation costs of $14.18/boe.

- Delivered an operating field netback1 of $14.9 million, or $42.77/boe.

- Realized quarterly adjusted funds flow from operations (“AFF”)1 of $10.3 million, or $29.47/boe.

- Executed a $2.2 million capital expenditure1 program, including preparatory spending for Hemisphere’s upcoming drilling program.

- Generated free funds flow1 of $8.1 million, or $0.07/share.

- Distributed $2.4 million, or $0.025/share, in base dividends to shareholders during the quarter.

- Distributed $2.9 million, or $0.03/share, in special dividends to shareholders during the quarter.

- Purchased and cancelled 1.3 million shares for $2.3 million under the Company’s Normal Course Issuer Bid (“NCIB”).

- Renewed the Company’s $35 million two-year extendible credit facility.

- Exited the first quarter with positive working capital1 of $13.9 million.

| (1) Operating field netback, adjusted funds flow from operations (AFF), free funds flow, capital expenditure, and working capital are non-IFRS measures, or when expressed on a per share or boe basis, non-IFRS ratio, that do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other entities. Non-IFRS financial measures and ratios are not standardized financial measures under IFRS and may not be comparable to similar financial measures disclosed by other issuers. Refer to the section “Non-IFRS and Other Specified Financial Measures”. |

Selected financial and operational highlights should be read in conjunction with Hemisphere’s unaudited condensed interim consolidated financial statements and related notes, and the Management’s Discussion and Analysis for the three months ended June 30, 2025 which are available on SEDAR+ at www.sedarplus.ca and on Hemisphere’s website at www.hemisphereenergy.ca. All amounts are expressed in Canadian dollars unless otherwise noted.

Quarterly Dividend

Hemisphere is pleased to announce that its Board of Directors has approved a quarterly base cash dividend of $0.025 per common share in accordance with the Company’s dividend policy. The dividend will be paid on September 12, 2025 to shareholders of record as of the close of business on August 29, 2025. The dividend is designated as an eligible dividend for income tax purposes.

Operations Update

With significant volatility in the economy and oil markets earlier this year, Hemisphere elected to defer the majority of its capital spending into the latter third of the year. With relatively flat base production, the Company has focused on balance sheet strength and shareholder returns through its share buyback program, base quarterly dividends, and the announcements of two special dividends year-to-date.

The Company’s drilling program is now scheduled to commence late in the third quarter. It will include several development wells in Atlee Buffalo in addition to at least one new well in Marsden, which will test a second oil-bearing zone on Hemisphere’s lands adjacent to its oil treating facilities and active polymer pilot project.

Management will continue to closely monitor oil market volatility and adjust capital spending accordingly. With almost $14 million in working capital, an undrawn credit line, and stable cash flow from its production base, Hemisphere is in a unique position to act on potential acquisition opportunities and continued shareholder returns in addition to executing its drilling program.

EnerCom Denver Conference

Ms. Ashley Ramsden-Wood, Chief Development Officer of Hemisphere, will be presenting at the EnerCom Denver Conference on Tuesday, August 19 at 2:45 pm Mountain Daylight Time (1:45 pm Pacific Daylight Time). The presentation will be livestreamed on EnerCom’s website at www.enercomdenver.com/webcast (Confluence C) and archived on Hemisphere’s website at www.hemisphereenergy.ca.

About Hemisphere Energy Corporation

Hemisphere is a dividend-paying Canadian oil company focused on maximizing value-per-share growth with the sustainable development of its high netback, ultra-low decline conventional heavy oil assets through polymer flood enhanced oil recovery methods. Hemisphere trades on the TSX Venture Exchange as a Tier 1 issuer under the symbol “HME” and on the OTCQX Venture Marketplace under the symbol “HMENF”.

For further information, please visit the Company’s website at www.hemisphereenergy.ca to view its corporate presentation or contact:

Don Simmons, President & Chief Executive Officer

Telephone: (604) 685-9255

Email: info@hemisphereenergy.ca

Website: www.hemisphereenergy.ca

Forward-looking Statements

Certain statements included in this news release constitute forward-looking statements or forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable securities legislation. Forward-looking statements are typically identified by words such as “anticipate”, “continue”, “estimate”, “expect”, “forecast”, “may”, “will”, “project”, “could”, “plan”, “intend”, “should”, “believe”, “outlook”, “potential”, “target” and similar words suggesting future events or future performance. In particular, but without limiting the generality of the foregoing, this news release includes forward-looking statements including that Hemisphere’s drilling program is now scheduled to commence late in the third quarter and will include several development wells in Atlee Buffalo in addition to at least one new well in Marsden, which will test a second oil-bearing zone on Hemisphere’s lands; that Hemisphere may adjust capital spending depending on oil market volatility; that Hemisphere is in a unique position to act on potential acquisition opportunities and continued shareholder returns; and that a dividend will be paid September 12, 2025 to shareholders of record as of the close of business on August 29, 2025.

Forward‐looking statements are based on a number of material factors, expectations or assumptions of Hemisphere which have been used to develop such statements and information but which may prove to be incorrect. Although Hemisphere believes that the expectations reflected in such forward‐looking statements or information are reasonable, undue reliance should not be placed on forward‐looking statements because Hemisphere can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified herein, assumptions have been made regarding, among other things: the current and go-forward oil price environment; that Hemisphere will continue to conduct its operations in a manner consistent with past operations; that results from drilling and development activities are consistent with past operations; the quality of the reservoirs in which Hemisphere operates and continued performance from existing wells; the continued and timely development of infrastructure in areas of new production; the accuracy of the estimates of Hemisphere’s reserve volumes; certain commodity price and other cost assumptions; continued availability of debt and equity financing and cash flow to fund Hemisphere’s current and future plans and expenditures; the impact of increasing competition; the general stability of the economic and political environment in which Hemisphere operates; the general continuance of current industry conditions; the timely receipt of any required regulatory approvals; the ability of Hemisphere to obtain qualified staff, equipment and services in a timely and cost efficient manner; drilling results; the ability of the operator of the projects in which Hemisphere has an interest in to operate the field in a safe, efficient and effective manner; the ability of Hemisphere to obtain financing on acceptable terms; field production rates and decline rates; the ability to replace and expand oil and natural gas reserves through acquisition, development and exploration; the timing and cost of pipeline, storage and facility construction and expansion and the ability of Hemisphere to secure adequate product transportation; future commodity prices; currency, exchange and interest rates; regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which Hemisphere operates; and the ability of Hemisphere to successfully market its oil and natural gas products.

The forward‐looking statements included in this news release are not guarantees of future performance and should not be unduly relied upon. Such information and statements, including the assumptions made in respect thereof, involve known and unknown risks, uncertainties and other factors that may cause actual results or events to defer materially from those anticipated in such forward‐looking statements including, without limitation: changes in commodity prices; changes in the demand for or supply of Hemisphere’s products, the early stage of development of some of the evaluated areas and zones; unanticipated operating results or production declines; changes in tax or environmental laws, royalty rates or other regulatory matters; changes in development plans of Hemisphere or by third party operators of Hemisphere’s properties, increased debt levels or debt service requirements; inaccurate estimation of Hemisphere’s oil and gas reserve volumes; limited, unfavourable or a lack of access to capital markets; increased costs; a lack of adequate insurance coverage; the impact of competitors; and certain other risks detailed from time‐to‐time in Hemisphere’s public disclosure documents, (including, without limitation, those risks identified in this news release and in Hemisphere’s Annual Information Form).

The forward‐looking statements contained in this news release speak only as of the date of this news release, and Hemisphere does not assume any obligation to publicly update or revise any of the included forward‐looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.