Nvidia’s stock tumbled nearly 8% on Tuesday, leading a broad decline in semiconductor stocks and contributing to a rough start for the market this month. The S&P 500 experienced a drop of over 1% amid a broader market slump, exacerbated by disappointing data from the ISM manufacturing index. This data raised concerns about the strength of the economy and the potential for the Federal Reserve to cut interest rates, which in turn impacted investor sentiment across various sectors.

The semiconductor sector, which has been a high-flyer over the past year thanks to the AI boom, saw significant losses. Nvidia, a dominant player in AI data center chips, saw its stock fall dramatically. Other major chipmakers also experienced declines, with Intel and Marvell down 8%, Broadcom falling around 6%, and AMD and Qualcomm each dropping 6%. The SMH, an index tracking semiconductor stocks, was down 6%, marking its biggest one-day loss in a month.

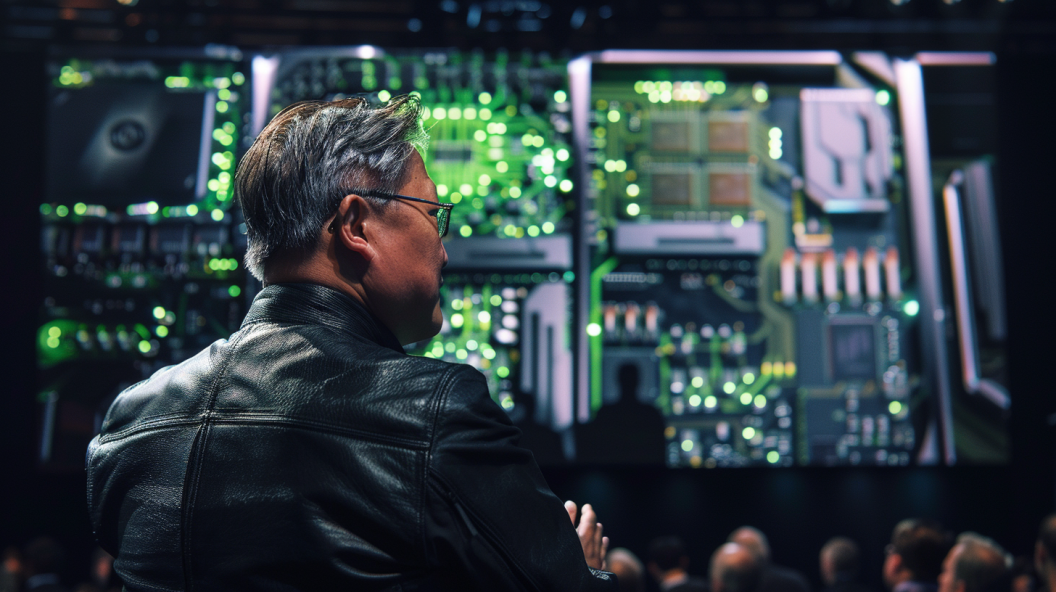

The optimism driving chip stocks had been fueled by the belief that the artificial intelligence revolution would lead to increased demand for semiconductors and memory. Nvidia, in particular, has seen its stock rise nearly 129% so far in 2024, bolstered by its leading position in AI data center chips. However, some investors were unsettled by Nvidia’s recent forecast, which suggested a potential slowdown in growth despite reporting impressive quarterly earnings of $30 billion and a 154% year-on-year increase in data center revenue.

Nvidia’s recent performance highlights the volatility in the semiconductor sector. The company’s stock had recently surged nearly 25% in three weeks following a global market sell-off, but Tuesday’s drop brought it to its lowest level since mid-August. The decline was attributed not only to the broader market downturn but also to concerns over Nvidia’s gross margins, which are expected to decrease slightly into the end of the year.

Meanwhile, other chipmakers are striving to capture investor attention with their AI products. Intel unveiled new laptop processors capable of running AI programs on-device, and Broadcom, which collaborates with major companies to develop custom AI chips, is set to report its third-quarter earnings on Thursday. Qualcomm continues to promote its chips as optimal for AI applications on Android phones.

Despite the challenges faced by Nvidia and other chipmakers, Wall Street remains largely optimistic about the sector’s long-term prospects. Analysts from Stifel reiterated their Buy rating on Nvidia, maintaining a $165 price target. They remain confident in Nvidia’s role as a primary beneficiary of the ongoing modernization of data center computing.

As Nvidia prepares to ramp up production of its next-generation Blackwell chip later this year, analysts expect the stock to potentially recover and continue its upward trajectory, provided the new products meet market expectations.