As the Bear Market Melts Down, Where Will the Grass Be Greenest?

Bear Markets and snowmen have one thing in common; they don’t last forever.

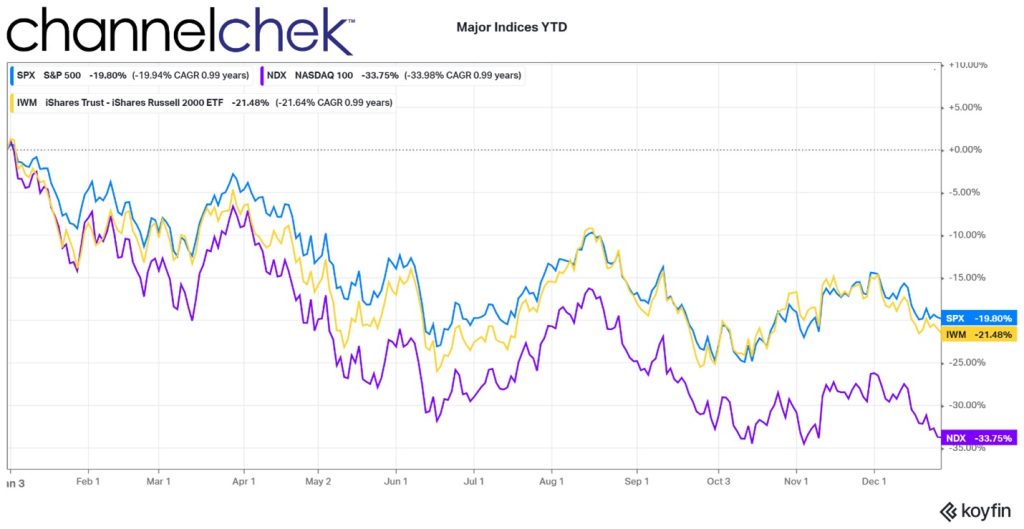

The entry point into an investment can have a huge impact on performance. Exits tend to be more critical when the stock has shown that it is not performing as planned. While this kind of exit may result in a loss, it allows the investor to preserve capital, liquid assets they can deploy if another good entry presents itself. The major stock market indices for 2022 are down 20% and more. Has this sell-off provided for performance-producing entry points in some stocks? Let’s look where we are as the countdown to 2023 has already begun.

About this Bear Market

Bear markets end – they always have. Pinpointing an exact bottom is not possible, so trying to be the first in for that great entry point may include a few false starts and some unhoped-for exits. The current slide in the stock market started around January 1, 2022. This was because some doubted whether inflation was transient at the time; by March, most understood the Fed was concerned that price increases were pervasive.

Fed Chair Powell, along with many Fed Presidents, began speaking hawkishly to not unduly surprise and unsettle markets as the central bank unwound the liquidity used in response to the novel coronavirus. What followed was unprecedented. Overnight lending rates went from an effective 0.08% to an effective 4.33% during the course of the year. This is more than 52 times the base lending rate at the start of the year. With these increases, no wonder the bear market continued.

Where Are We Now?

Expectations of overnight rate hikes in 2023 are for another 0.50%-0.75% increase leaving the target at, or just north of, 5%. This increase in the cost of money is small (.17 times) compared to the massive (52 times) rocking the markets in 2022.

So rate hikes are expected to be much lower as a percentage of current rates next year. And after the last FOMC meeting, markets have seemingly repriced lower with this expectation. If all goes as it is thought it will, the market is already priced for the worst. This is a bullish sign.

Put another way; most believe that with Fed funds beginning 2022 around zero, we’re likely much closer to the end of the Fed Funds tightening than to the beginning.

Inflation (CPI) for December won’t be reported until January 12, 2023. The latest CPI numbers show YoY up 7.1% in November, a slowing from 7.7% in October, which tapered from 8.2% the month before. The November reading of 7.1% taken by itself is a long way away from the Fed’s 2% target. But the trend in the CPI and PCE deflator also suggest the Fed is likely to monitor previous hikes to see if they will have the desired impact.

The Fed Has Been Transparent

The Fed lowered rates in line with what they promised during the pandemic. Then after some transient talk, they raised rates as they expressed they would in 2022. Following the December FOMC meeting, they suggested they were not at the end, but the voting members’ expectations for where they will settle is an average of 5.40%. The forward-looking stock market, if they believe the Fed will again do as promised, should recognize this is a much lower increase. It is perhaps near the time to begin to build on positions. This could be the entry point many investors have been waiting for.

Small Cap Phenomenon

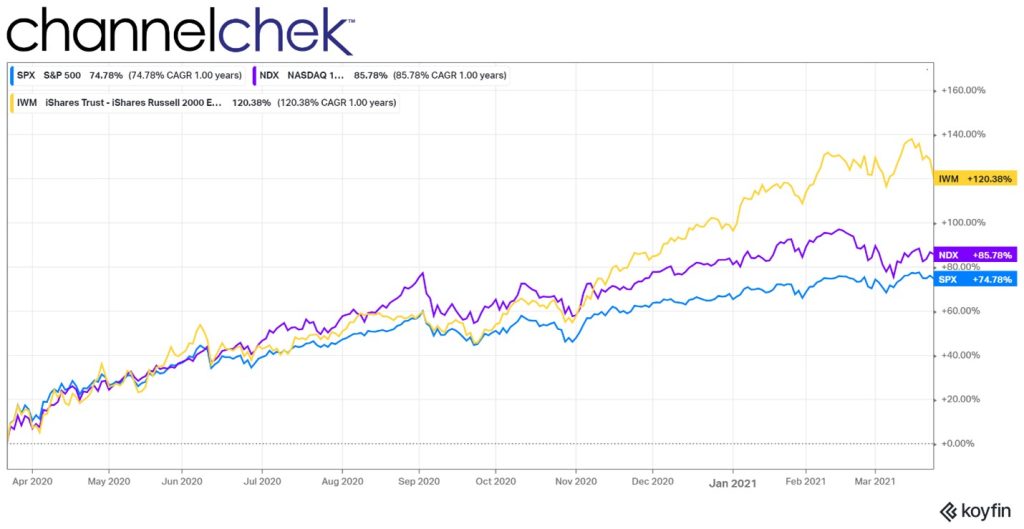

The chart below shows how much small cap stocks outperformed during the 12- months following the pandemic plunge. While small cap outperformance has been experienced during the past century of stocks’ post-sell-off periods, one only has to look back to the pandemic plunge to remember that it was small-caps (depicted below as IWM) that had been beaten down the most and by far outran the other major indices for the next year from the low of 2021.

Could this small cap phenomenon occur again after markets reach the bottom? Data demonstrates that small cap stocks tend to lead following a period of economic dislocation. One reason is US small caps have more of their business within the states and as a bonus, do well with a rising dollar. Current conditions suggest exploring smaller stocks. They have outperformed large caps following nearly every bear market of the last century. And today, the dollar has risen above its six-month high and is trending higher. While past movement comparisons don’t always include all the crosscurrents of the future, a strong argument could be made that a turnaround is near and small caps may again be the leaders by a wide margin.

Some Disclosure

Channelchek, the investment information platform you’re now reding has small cap stocks as its primary focus. The deep platform provides data on over 6000 stocks, with quality research updated regularly on many of them. Channelchek also provides videos and articles that may inspire informed stock selection. Stock selection, rather than just plowing investment dollars into an indexed ETF, may be preferable as indexed ETFs include sectors and stocks that may not be worthy of your portfolio.

Diversification across asset classes, sectors, and market capitalizations is considered prudent for long-term portfolios; individual allocations can be built on depending on where we are in the business and interest rate cycle. This includes an allocation to small cap equities, which perhaps should be expanded if the Fed is near the end of its tightening cycle. It could always be reduced later if the economy is deep into a growth cycle.

Take Away

Although we do not have a crystal ball to know exactly when the best entry point in any company stock is, if a century’s worth of data is any guide, the period following the end of a market downturn has been a good time to increase exposure to the small cap sector.

Register here for daily emails of research and ideas from Channelchek.

Managing Editor, Channelchek

Sources

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.newyorklifeinvestments.com/insights/investing-in-small-caps-following-a-market-downturn