Research News and Market Data on HMENF

November 25, 2025 8:00 AM EST | Source: Hemisphere Energy Corporation

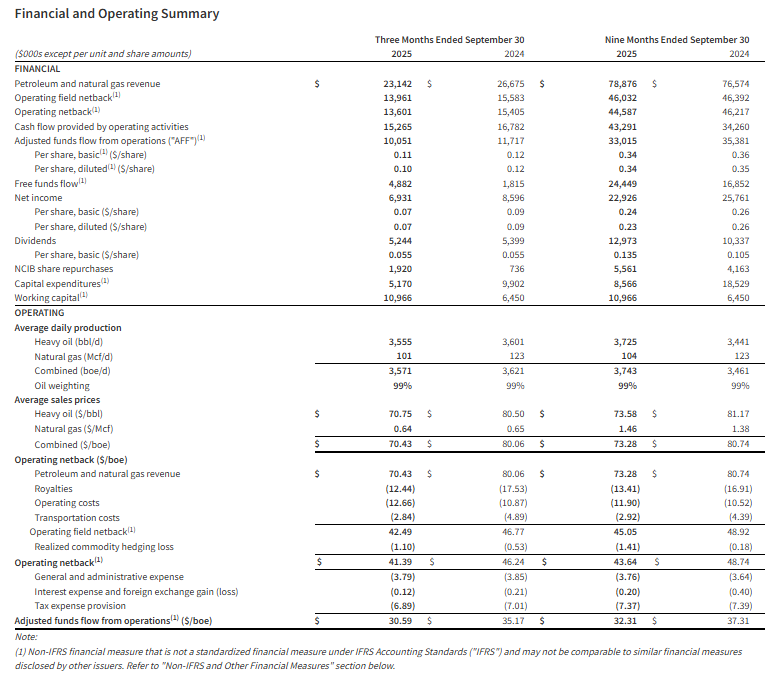

Vancouver, British Columbia–(Newsfile Corp. – November 25, 2025) – Hemisphere Energy Corporation (TSXV: HME) (OTCQX: HMENF) (“Hemisphere” or the “Company”) provides its financial and operating results for the three and nine months ended September 30, 2025, declares a quarterly dividend payment to shareholders, and provides an operations update.

Q3 2025 Highlights

- Attained quarterly production of 3,571 boe/d (99% heavy oil).

- Generated quarterly revenue of $23.1 million.

- Achieved total operating and transportation costs of $15.50/boe.

- Delivered operating netback1 of $13.6 million or $41.39/boe for the quarter.

- Realized quarterly adjusted funds flow from operations (“AFF”)1 of $10.1 million or $30.59/boe.

- Initiated a 2025 fall drilling program with $5.2 million in capital expenditures1.

- Generated quarterly free funds flow1 of $4.9 million.

- Exited the third quarter with a positive working capital1 position of $11.0 million.

- Paid a special dividend of $2.9 million ($0.03/share) to shareholders on August 15, 2025.

- Paid a quarterly base dividend of $2.4 million ($0.025/share) to shareholders on September 12, 2025.

- Purchased and cancelled 1.0 million shares for $1.9 million under the Company’s Normal Course Issuer Bid (“NCIB”).

- Renewed the Company’s NCIB.

| (1) Operating netback, adjusted funds flow from operations (AFF), free funds flow, capital expenditures, and working capital are non-IFRS measures, or when expressed on a per share or boe basis, non-IFRS ratio, that do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other entities. Non-IFRS financial measures and ratios are not standardized financial measures under IFRS and may not be comparable to similar financial measures disclosed by other issuers. Refer to the section “Non-IFRS and Other Specified Financial Measures”. |

Selected financial and operational highlights should be read in conjunction with Hemisphere’s unaudited condensed interim consolidated financial statements and related notes, and the Management’s Discussion and Analysis for the three and nine months ended September 30, 2025 which are available on SEDAR+ at www.sedarplus.ca and on Hemisphere’s website at www.hemisphereenergy.ca. All amounts are expressed in Canadian dollars unless otherwise noted.

Quarterly Dividend

Hemisphere is pleased to announce that its Board of Directors has approved a quarterly cash dividend of $0.025 per common share in accordance with the Company’s dividend policy. The dividend will be paid on December 30, 2025 to shareholders of record as of the close of business on December 9, 2025. The dividend is designated as an eligible dividend for income tax purposes.

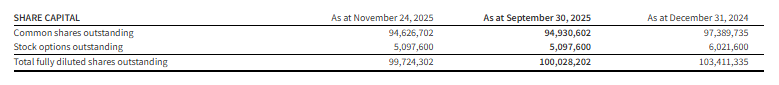

With the payment of the fourth quarter dividend, Hemisphere anticipates returning a minimum of $21.6 million to shareholders in 2025, including $9.6 million in quarterly base dividends, $5.8 million in two special dividends, and $6.2 million through NCIB share repurchases and cancellations. Based on the Company’s current market capitalization of $205 million (94.6 million shares issued and outstanding at a market close price of $2.17 per share on November 24, 2025), this represents an annualized yield of 10.5% to Hemisphere’s shareholders.

Operations Update

During the third quarter of 2025, Hemisphere’s production averaged 3,571 boe/d (99% heavy oil), representing a slight decrease of approximately 1% from the same period in 2024. The Company completed a number of workovers during the summer months, which contributed to production downtime during the quarter. However, September production of approximately 3,800 boe/d (99% heavy oil) was back in line with average levels of 3,830 boe/d (99% heavy oil) during the first six months of the year. This performance highlights the stability and low-decline characteristics of Hemisphere’s polymer flood assets in Atlee Buffalo, particularly given that no new wells had been placed on production since the Company’s third-quarter drilling program in 2024.

Throughout 2025, Hemisphere has taken a cautious approach to capital spending amid volatility in the global economy and oil markets, which resulted in delaying its drilling program until later in the year. In September the Company commenced a fall drilling program, which finished in early November. The new wells have just recently been put on production and will continue to be optimized over the coming months.

In October, Hemisphere successfully completed a scheduled facility turnaround and resolved unexpected issues with its power generation and injection systems. Although this short-term disruption will affect overall fourth-quarter production, all systems are now fully operational. November production has averaged approximately 3,800 boe/d (99% heavy oil, field estimate from November 1-22, 2025). Management anticipates fourth-quarter production will range between 3,400 – 3,500 boe/d (99% heavy oil) following this outage.

At the Company’s Marsden, Saskatchewan property, Hemisphere is continuing to evaluate its polymer pilot project. It has been approximately one year since injection commenced, and while an oil production response has not yet been noted, the data being collected is providing insights into reservoir performance. The Hemisphere team plans to advance its pilot project by evaluating the potential effects of producer/injector well spacing, polymer type and injection water, as well as reservoir heterogeneity and composition.

During its fall drilling program, Hemisphere attempted to test a second oil-bearing zone within its Marsden landbase. Unfortunately, drilling challenges prevented Hemisphere from being able to access the reservoir, and the Company is reviewing alternatives for future evaluation of the prospect.

Management anticipates WTI oil prices will average close to US$65 per barrel in 2025 and expects to exceed Hemisphere’s adjusted funds flow guidance estimate of $40 million for this price scenario, while projecting total capital expenditures to be on budget. This outlook holds despite the Company deferring its drilling program until late in the third quarter and experiencing unscheduled production downtime in the second half of the year. As a result, Hemisphere now estimates average annual 2025 production will be approximately 3,600 – 3,700 boe/d (99% heavy oil), compared to its original guidance of 3,900 boe/d (99% heavy oil).

The Company expects to release details on its 2026 guidance in January as part of its forward development planning. Supported by approximately $11 million in working capital, an undrawn credit facility, and strong cash flow from its low-decline production base, Hemisphere is well positioned with a robust balance sheet to pursue potential acquisition opportunities while continuing to deliver shareholder returns.

About Hemisphere Energy Corporation

Hemisphere is a dividend-paying Canadian oil company focused on maximizing value-per-share growth with the sustainable development of its high netback, ultra-low decline conventional heavy oil assets through polymer flood enhanced oil recovery methods. Hemisphere trades on the TSX Venture Exchange as a Tier 1 issuer under the symbol “HME” and on the OTCQX Venture Marketplace under the symbol “HMENF”.

For further information, please visit the Company’s website at www.hemisphereenergy.ca to view its corporate presentation or contact:

Don Simmons, President & Chief Executive Officer

Telephone: (604) 685-9255

Email: info@hemisphereenergy.ca

Website: www.hemisphereenergy.ca

SOURCE: Hemisphere Energy Corporation