The Argument for Higher Oil Market Prices is Fairly Straightforward

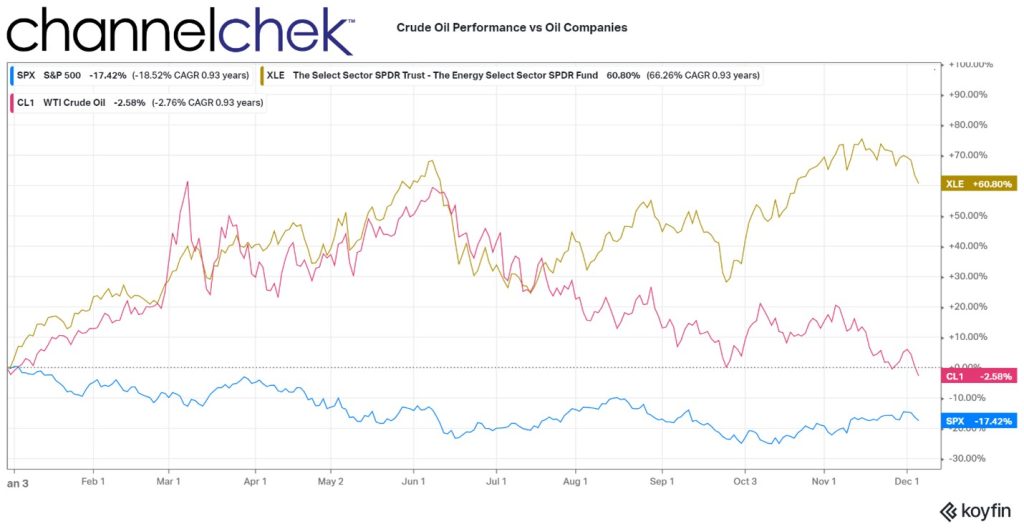

The price of oil is near its 2022 low. This lower per barrel cost is normal when the commodities market perceives the economy as slowing or that it will slow. What is surprising is that the price is near the low for the year when the Chinese are easing Covid restrictions and will soon be requiring more fuel; at the same time, a Russian oil cap, which is sure to bring less supply to the market, was just instituted this week. In the meantime, energy producers, up 60.8% on the year, are not sinking at the pace of oil prices.

Energy shares have been the big winners for 2022. And it is rare that they are flying solo, without the help of price increases of their underlying product. According to Bespoke Investment Group, last month marked the first time since 2006 that the S&P 500 energy sector has traded within 3% of a 12-month high while the price of West Texas Intermediate retreated more than 25% from its one-year peak..

The divergence has caught the attention of investors. Since drillers and miners tend to rise and fall with the prices of the commodities they produce, many expect the gap to narrow to its more historical norm. Most are looking for oil to rise rather than drillers to fall.

Pressures that could cause oil to rise include the EU winter season, the U.S. Strategic Reserves bumping up against depletion, OPEC+ keeping production quotas unchanged, and Western governments’ $60-a-barrel price cap on Russian crude. These, taken together, are expected to put upward pressure on per-barrel prices. The commodities market is not moving in accordance with these factors. Futures contracts for U.S. crude closed Monday 3.8% lower at $76.93 a barrel, its fourth-lowest settle of the year.

Working against the argument for higher crude prices is the expected slowing of world economies. The possibility of a recession in many global economies while central banks raise interest rates, is unknown. Any impact remains to be seen.

Managing Editor, Channelchek