The Details of the Hindenberg Research Report Include Serious Allegations

A legal face-off may be brewing as Block (SQ), the other company co-founded by Jack Dorsey, calls on the SEC for what Block calls an “inaccurate report.” The report Block (formerly Square) is referring to was released by Hindenberg Research on March 23. The research contends that Dorsey’s fintech company showed, “willingness to facilitate fraud against consumers and the government, avoid regulation, dress up predatory loans and fees as revolutionary technology, and mislead investors with inflated metrics.”

What is each side claiming, and what is the responsibility in releasing a report that may take Hindenberg into a fight with a company with a $44 billion market cap?

Who’s Involved?

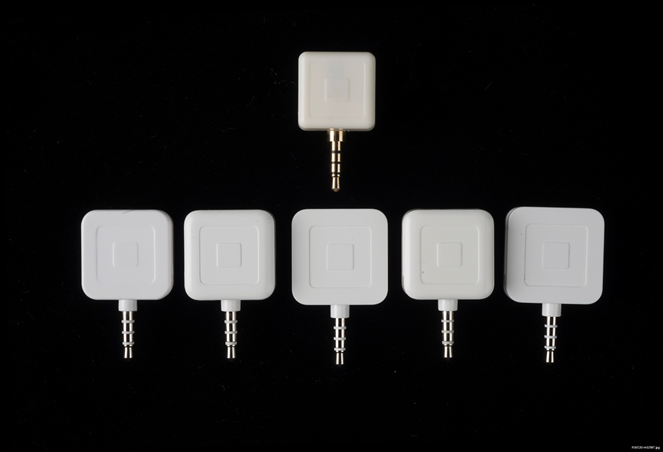

Block is a financial technology company specializing in mobile payments founded in 2009 by Jack Dorsey and Jim McKelvey. The company’s flagship product is a small, square-shaped credit card reader that plugs into a smartphone or tablet and allows businesses to accept credit and debit card payments. Block has added other financial products and services, including point-of-sale software, payroll processing, and business loans.

Hindenburg Research provides investors with investigative research and analysis for the purpose of helping them identify potential risks or fraudulent practices in publicly traded companies. They are described as a short-selling, research-based firm. The Research is often considered within the context of its short-position investment strategy.

What is Hindenberg’s Claim?

The research firm with a reputation of looking below the surface for trouble at firms, says Block is not what it claims to be. According to the Hindenberg report, the Dorsey-founded firm claims to have developed a frictionless and magical financial technology. The mission of this technology, the report quotes Block as saying is to empower the “unbanked” and the “underbanked.”

Hindenberg says that over two years of investigation that involved dozens of interviews with former employees that Block has systematically taken advantage of the demographics it claims to be helping. This refers to the stated mission of helping the underbanked. Instead, the research firm says this stands in conflict with, “the company’s willingness to facilitate fraud against consumers and the government, avoid regulation, and dress up predatory loans and fees as revolutionary technology, and mislead investors with inflated metrics.”

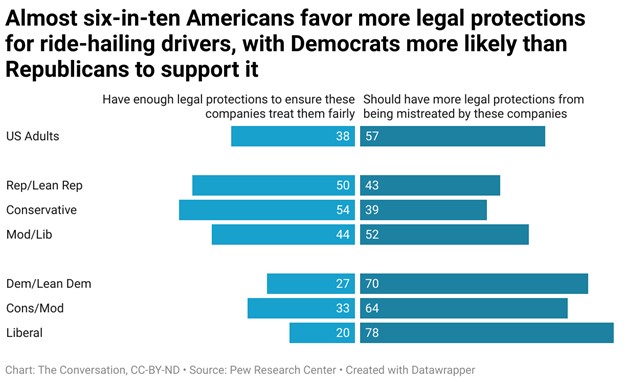

The two years of investigation also indicated that Block severely overstated its user counts and has understated its customer acquisition costs. This information, the report says, is based on former employees’ estimation that 40%-75% of accounts they reviewed were fake, involved in fraud, or were additional accounts tied to a single individual.

They claim a key metric that investors use to value the company are unclear. That is, how many individuals are on the Cash App. The report accuses the company reporting of misleading “transacting active” metrics filled with fake and duplicate accounts. Hindenberg says, “Block can and should clarify to investors an estimate on how many unique people actually use Cash App.”

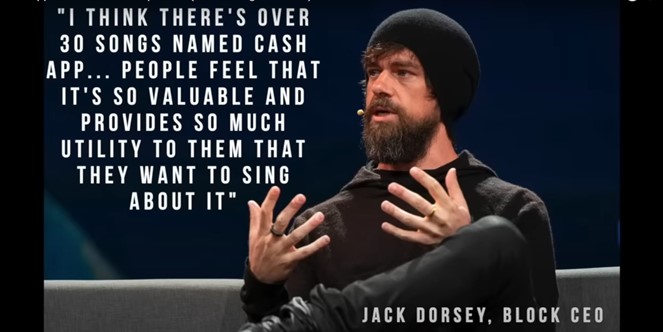

Hindenberg said the app is used for illegal activity and points to all the rap songs written about engaging in illegal activity, activity made possible with the help of the app. The research company even made a compilation video to demonstrate this point (link to video under “Sources” below).

A line in one of the songs is, “I paid them hitters through Cash App.” Heritage contests that Block paid to promote the video for the song called “Cash App” which described paying contract killers through the app. The song’s artist was later arrested for attempted murder.

According to the Hindenberg report, Block’s Cash App was also cited “by far” as the top app used in reported U.S. sex trafficking, according to a leading non-profit organization. Multiple Department of Justice complaints outline how Cash App has been used to facilitate sex trafficking, including sex trafficking of minors.

Beyond alleged facilitation of payment for crimes, the platform, former employees contend, is overrun with scam accounts and fake users. Examples of obvious distortions of user numbers is that “Jack Dorsey” has multiple fake accounts, including some that appear aimed at scamming Cash App users. “Elon Musk” and “Donald Trump” who have dozens of accounts in their names. Hindenberg contends they tested this flaw, “we ordered a Cash Card under our obviously fake Donald Trump account, checking to see if Cash App’s compliance would take issue—the card promptly arrived in the mail,” they gave as an example.

Block’s Response

Not to be dissed, management at Block called out the threatening press release. “We intend to work with the SEC and explore legal action against Hindenburg Research for the factually inaccurate and misleading report they shared about our Cash App business today.”

The Dorsey founded firm suggested that the research firm wrote the report for dubious reasons and that it may be part of an orchestrated reverse pump and dump, “Hindenburg is known for these types of attacks, which are designed solely to allow short sellers to profit from a declined stock price. We have reviewed the full report in the context of our own data and believe it’s designed to deceive and confuse investors.”

The company than comforted stakeholders saying, “we are a highly regulated public company with regular disclosures, and are confident in our products, reporting, compliance programs, and controls. We will not be distracted by typical short seller tactics.”

There’s Smoke, is There Fire?

Are the initial disparaging claims against Block’s business accurate? Is there merit to what Block says of Hindenberg Research? As Block may be seeking a legal remedy, it is unlikely that either party will be very vocal from here.

For investors, it’s logical that both parties cannot be right at the same time. One of the parties is overstating truth. If Block is indeed working with the SEC, this truth should eventually surface.

Managing Editor, Channelchek

Sources

https://youtu.be/StjWk3Mj-M4?t=8