Investors Receiving a 5% Yield are Losing to Inflation

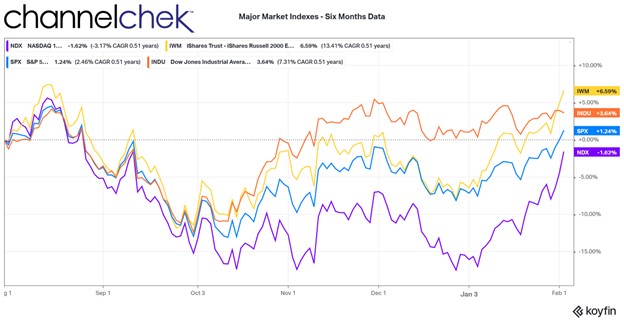

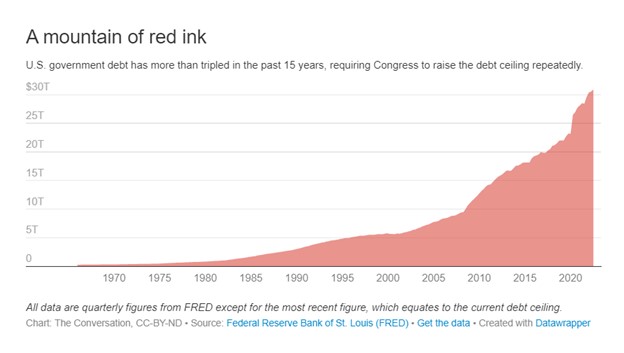

The CPI inflation report and the Fed’s relentless increases in Fed funds levels have pushed the six-month US Treasury Bill (T-Bill) above 5%. This is the first time since 2007 that this low-risk investment has topped 5%. Last year on this date, the six-month T-Bill was 0.76%. While the stock market is concerned that higher borrowing costs will have the Fed’s intended effect of slowing demand, rates are reaching a point where another concern creeps in. The concern is will traditional stock investors lay back and be satisfied getting paid interest.

More likely, the high cash position represents “dry powder” waiting for an opportunity.

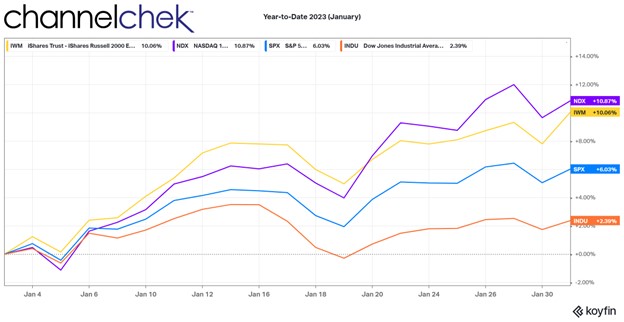

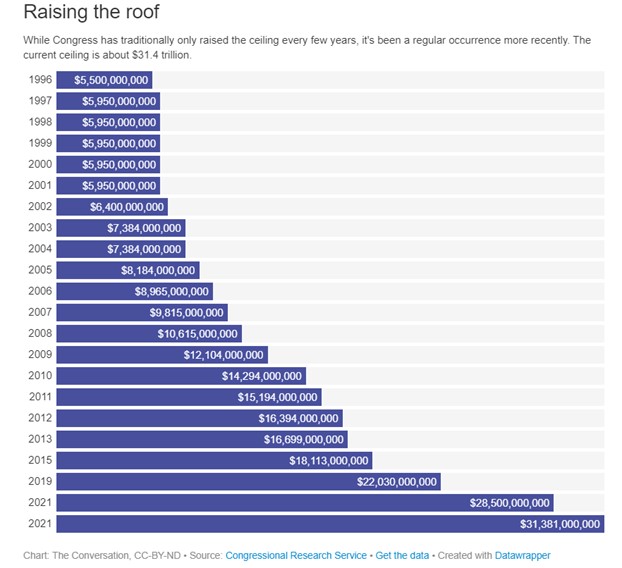

Short Term Rates

Money Market fund assets were $4.81 trillion for the week ended Wednesday, February 8, according to the Investment Company Institute. Just shy of the record MF balances reported in January. Higher than average cash levels have often been thought of as a bullish sign as it represents potential to drive stock prices up when flows toward equities increase.

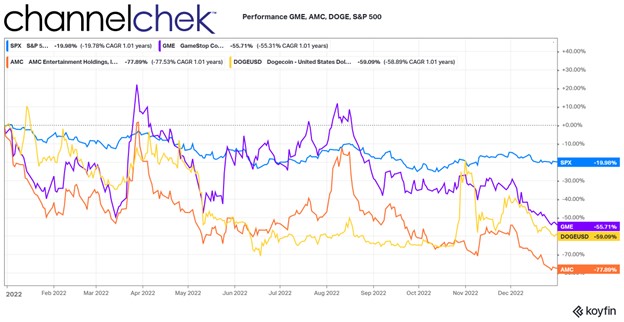

This may be part of the situation as we come off a dismal 2022 for equities, but there is likely something else incentivizing the retreat to safety. The higher interest rates are in the short end of the curve, investors are getting paid to retreat. High-yielding cash equivalents with six-month T-Bills now at 5% (10-year Treasuries are only 3.75%) may be more than a parking place. It may represent an alternative investment with a much more assured return.

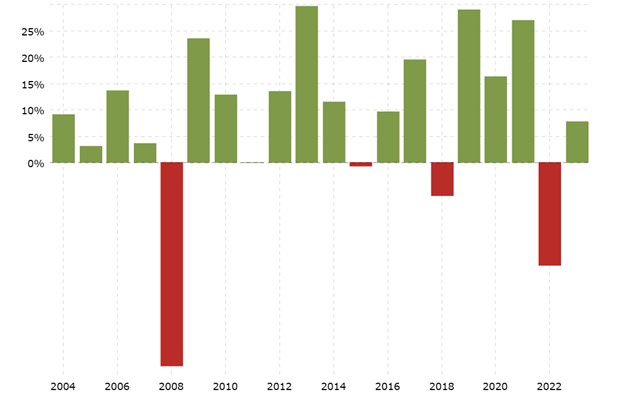

Ten Year Quarterly Returns S&P 500

Is 5% an Acceptable Return?

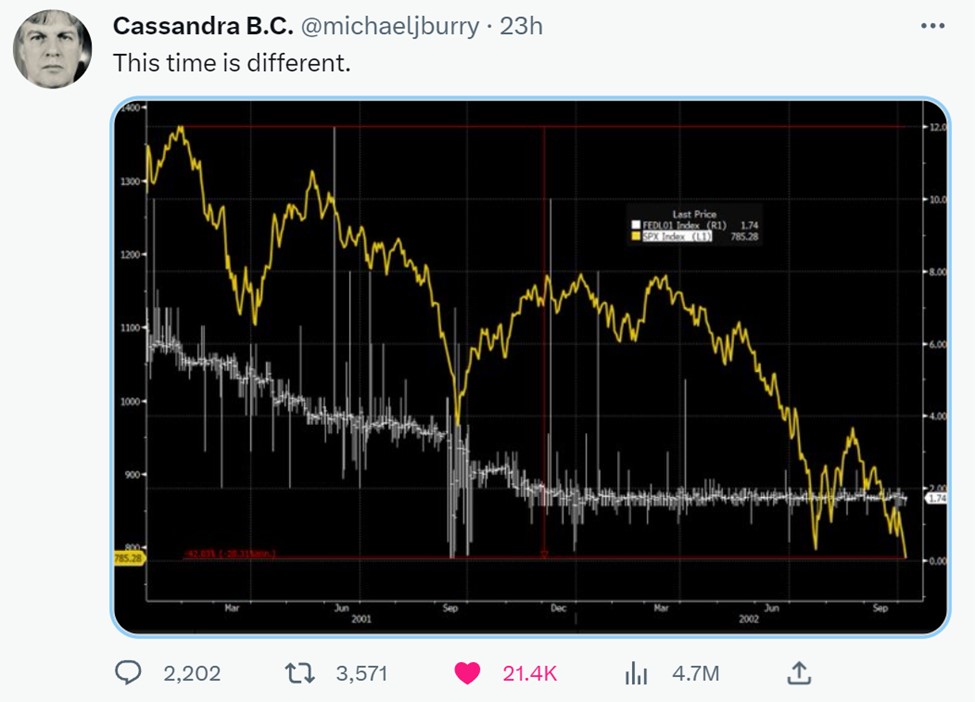

With inflation at 6.4%, the answer is no. But it is definitely preferable to seven of the periods on the 10-year chart above. And with January’s consumer price index (CPI) report revealing signs of sticky to reaccelerating inflation, the Federal Reserve is more likely to be hiking rates for longer than expected.

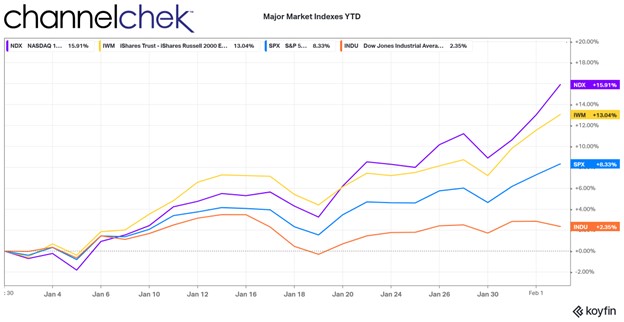

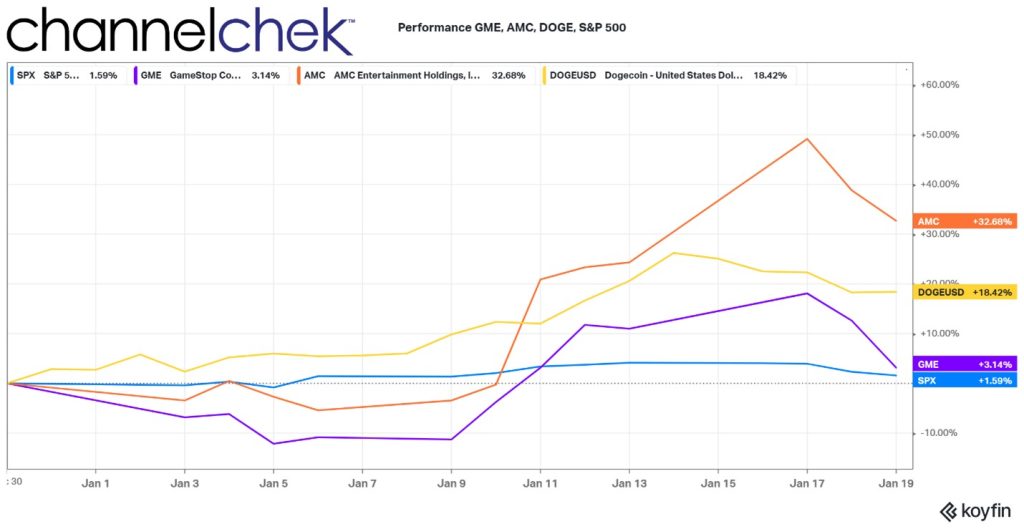

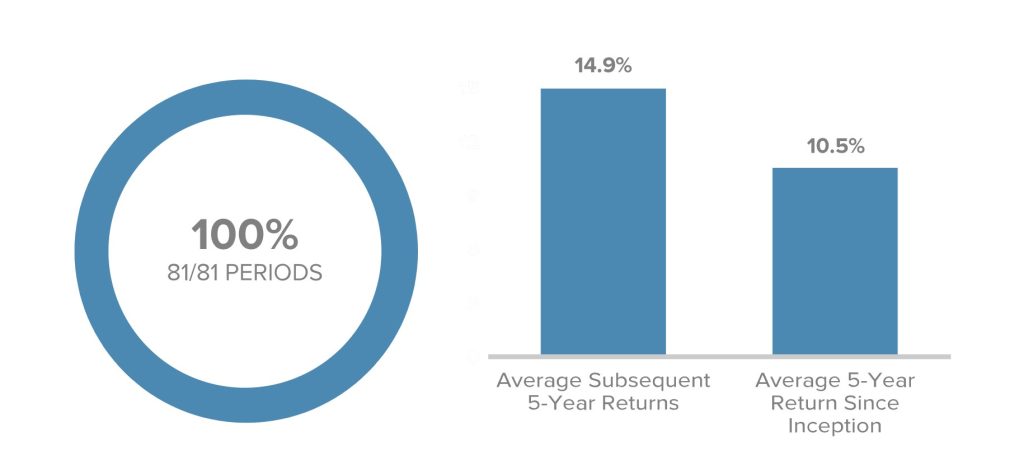

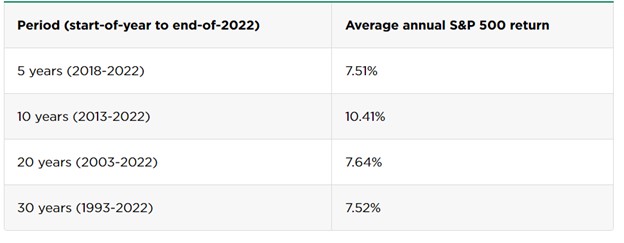

For investors looking to invest for longer periods, the stock market handily beats inflation. In other words, for the various time frames below, S&P 500 investors did not see their assets erode due to inflation.

Beating inflation is foundational to investing. Far exceeding it is the goal of many. Investors are not doing this choosing cash, in fact they are choosing to lose buying power rather than risk that the market doesn’t perform as it has historically.

S&P 500 Return for Periods 5-Years to 30-Years

Take Away

Data released on Tuesday February 14 showed the inflation rate (CPI) slowed to 6.4% in January. The cost of goods and services rose 0.5% during the month. The half percentage is the largest one month erosion of purchasing power in three months.

Investors content with 4%-5% returns should consider that they are losing ground to persistent inflation.

Investors with a five-year time horizon or longer should weigh the risks of earning yields below the inflation rate to the ups and downs of stocks. In fact, as more do, the 4-5 trillion in cash can make or quite a bull market.

Managing Editor, Channelchek

Sources

https://www.bls.gov/news.release/archives/cpi_01162008.pdf