Palladium One High Grade Mineralization Extended 250 Meters Southwest of the Kaukua Open Pit Resource, Finland

Highlights

- Geological interpretation changed at the Kaukua Deposit.

- High-grade core zone extended to the southwest, 250 meters beyond the current Open Pit Mineral Resource Estimate (“MRE”).

- 3.2 g/t Palladium Equivalent (Pd_Eq) over 13.7 meters, within 1.6 g/t Pd_Eq over 113.6 meters, in hole LK21-102, with individual samples grading up to 9.6 g/t Pd_Eq over 1.00 meters.

- 3.3 g/t Pd_Eq over 9.6 meters, within 1.5 g/t over 113.4 meters, in hole LK21-100, with individual samples grading up to 5.9 g/t Pd_Eq over 1.5 meters.

- 2.2 g/t Pd_Eq over 19.6 meters, within 1.5 g/t Pd_Eq over 74.5 meters, in hole LK21-101.

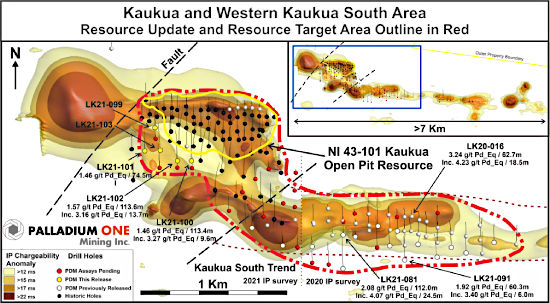

November 23, 2021 – Toronto, Ontario, Initial down plunge drilling, has extended mineralization 250 meters southwest of the open-pit constrained MRE of the Kaukua Deposit, by intersecting 2.2 g/t Pd_Eq over 19.6 meters, within 1.5 g/t Pd_Eq over 74.5 meters, starting at 273 meters down hole (LK21-101) (Figure 1), said Palladium One Mining Inc. (“Palladium One” or the “Company”).

Derrick Weyrauch, President and CEO commented: “The high-grade “Core Zone” of the Kaukua Deposit has been extended to the southwest and remains open for expansion. These are among the thickest intercepts to date within the Kaukua Deposit and will add significant tonnage to our existing resource endowment. An updated NI43-101 Mineral Resource Estimate is schedule for Q1 2022 and will incorporate these valuable results”

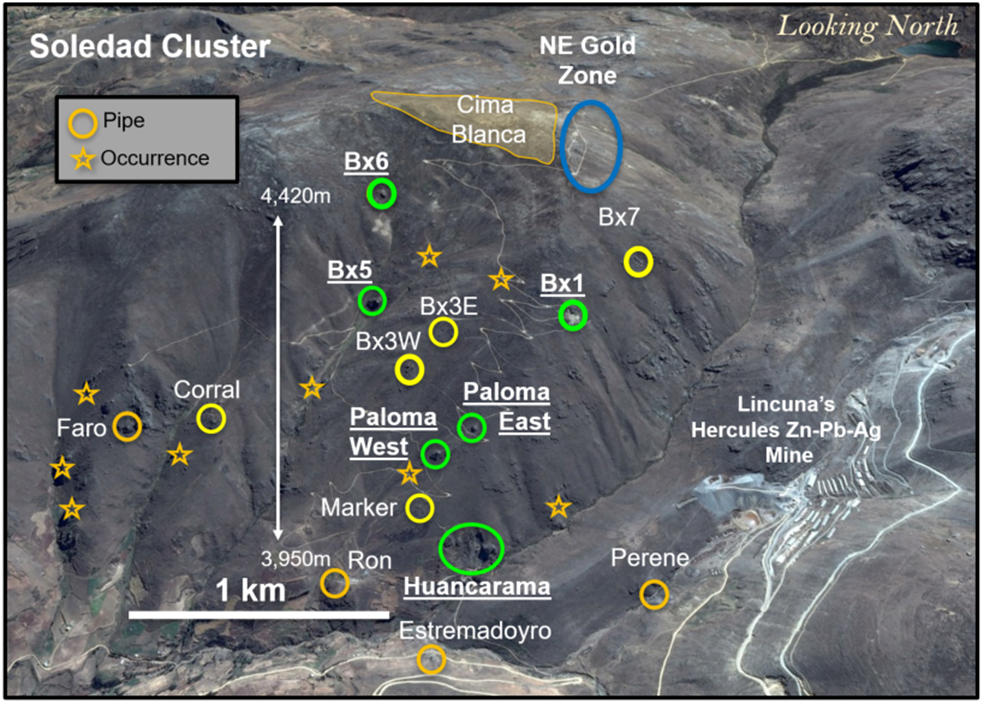

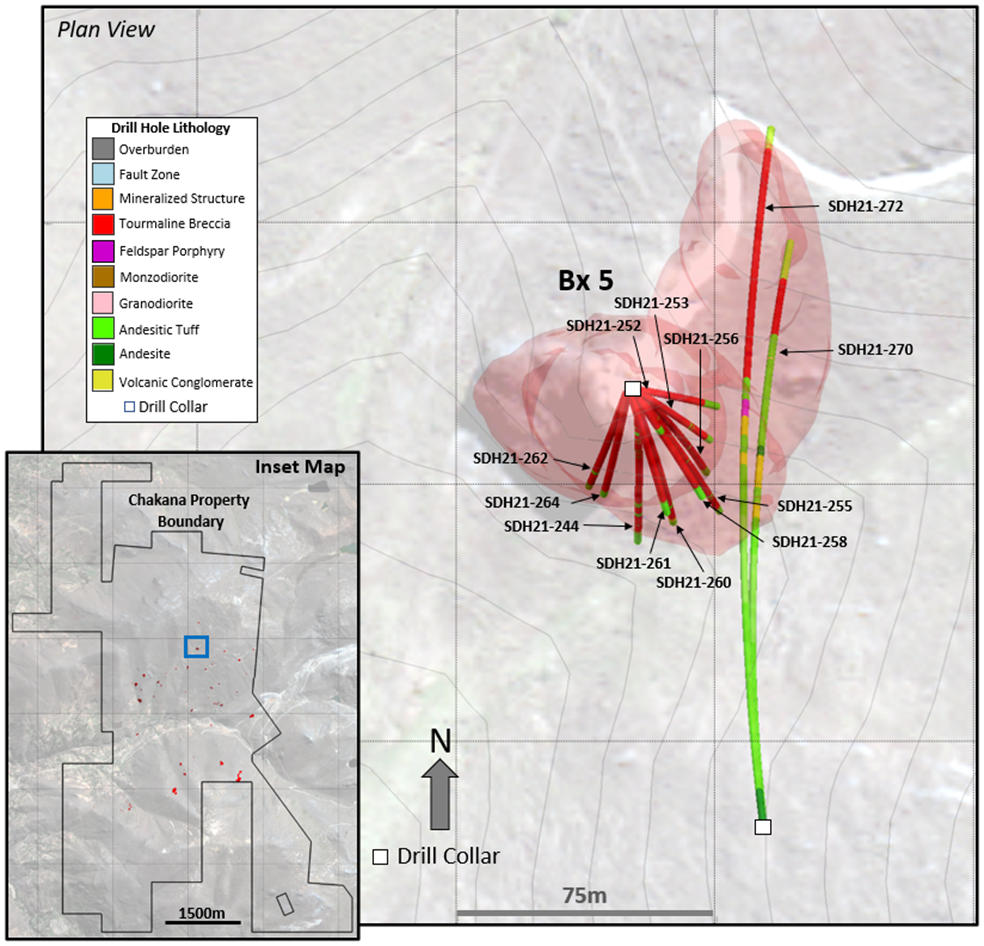

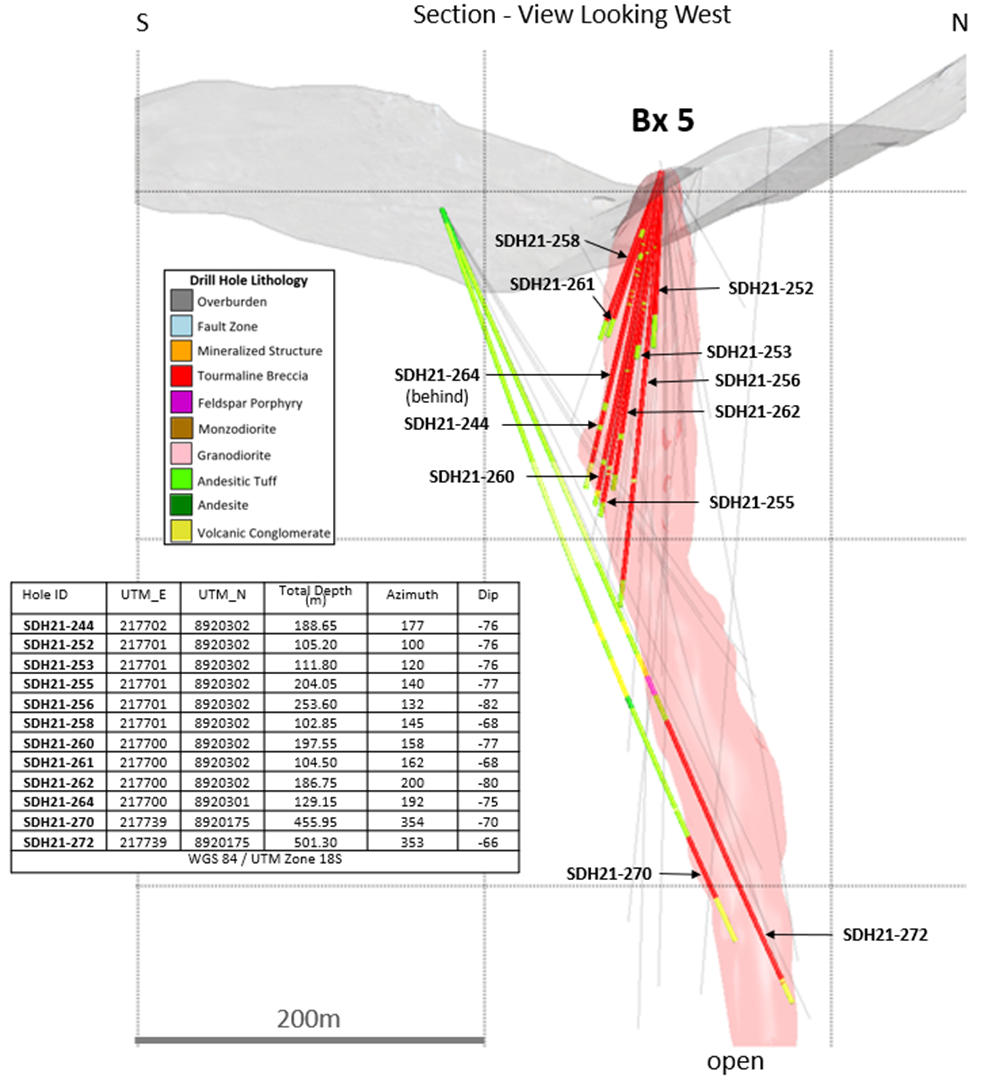

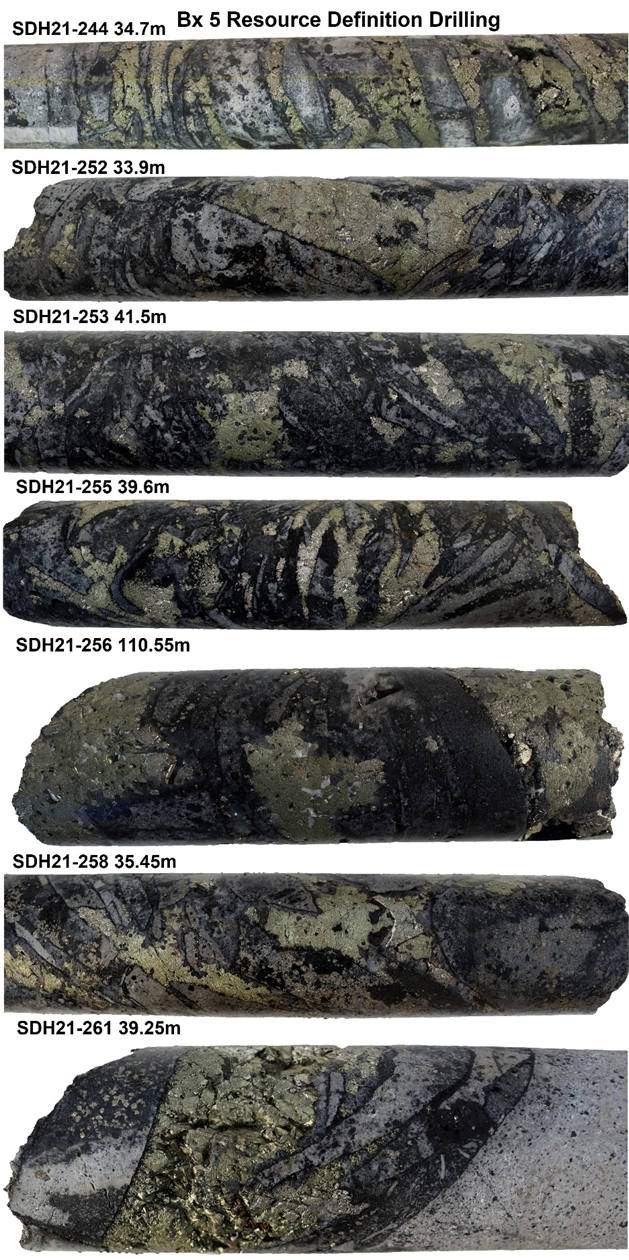

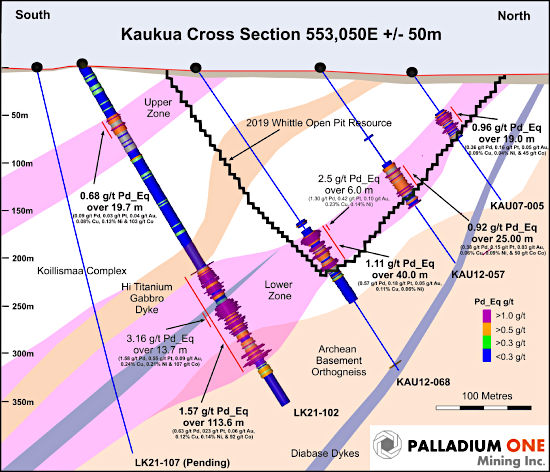

These drilling results extend the Kaukua Deposit mineralization southwest of the existing conceptual open-pit, where it remains open (Figure 1 and 2). Previous geological interpretations suggested that the Kaukua deposit was cut-off by a northwest trending fault, occupying a distinct magnetic low and topographic lineament. Drilling has now demonstrated that the magnetic low is the result of a later cross cutting dyke (now referred to as the high-titanium gabbro dyke) and that the Kaukua deposit remains open to the south. Significantly the high-grade “Core Zone” of the Kaukua Deposit has been extended 250 meters to the southwest and we have encountered some of the thickest intercepts (>100m) to date within the deposit.

Figure 1. Historic and current drilling in the Kaukua and Kaukau Southwest area having a drill data cut off date of September 4, 2021 (hole LK21-128), assays have been received for holes up to LK21-103, the remainder are pending. Background is Induced Polarization (“IP”) Chargeability.

Figure 2. Cross sections showing holes LK21-102, 107 and historic holes KAU07-005, KAU12-057 and 068 and their position with respect to the 2019 Kaukua Mineral Resource Estimate Whittle Open Pit.

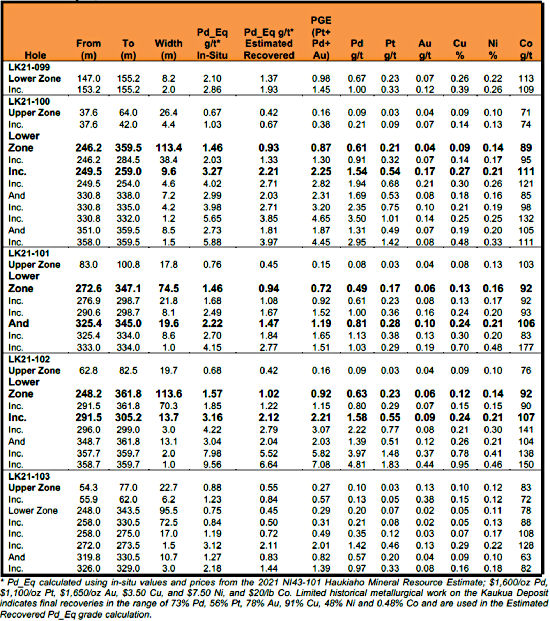

Table 1. LK Project, Kaukua Drill Hole Results

Palladium Equivalent

The Company is calculating Palladium equivalent using US$1,600 per ounce for palladium, US$1,100 per ounce for platinum, US$1,650 per ounce for gold, US$3.50 per pound for copper, US$7.50 per pound for nickel, and $20/b cobalt consistent with the calculation used in the Company’s September 2021 NI 43-101 Haukiaho Resource Estimate.

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101

About Palladium One

Palladium One Mining Inc. is a mineral exploration and development company targeting district scale, Platinum-Group-Element (“PGE”)-Copper-Nickel deposits in leading mining jurisdictions. Its flagship project is the Läntinen Koillismaa (“LK”) PGE-Copper-Nickel project in north-central Finland, having an existing pit-constrained NI43-101 Mineral Resource Estimate and ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. In Canada, is the 2020 Discovery of the Year Award winning Tyko Copper-Nickel Project a high sulphide tenor, Copper-Nickel project.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company’s expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.