Research News and Market Data on MGMLF

Vancouver, British Columbia–(Newsfile Corp. – March 16, 2023) – Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF) (FSE: M3G) (“Maple Gold” or the “Company“) is pleased to provide an update on ongoing exploration activities at its 100%-controlled Eagle Mine Property (“Eagle”) located in Québec, Canada. The Company is completing a compilation of current and historical drill data, new downhole electromagnetic (“EM”) conductor data, and the regional airborne geophysical survey data acquired by the Company in 2022 (see news from July 19, 2022). Drill target definition and permitting has been initiated for a planned ~5,000 metre (“m”) follow-up drill program in 2023 that will test undrilled zones with significant grade and volume potential.

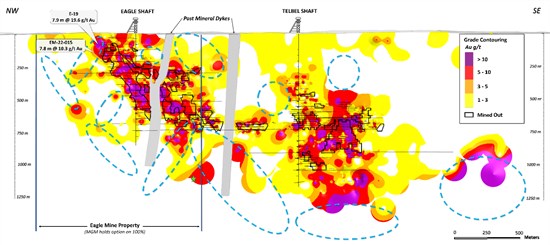

The Company expects to receive and report remaining assay results from completed drilling at Eagle in Q1 2023. Once final results are received, the Company will be updating its 3D model with new drilling and geophysical data to generate new sections and level plans and refine additional priority targets. The immediate focus of the 2023 drill program will be potential extensions of known high-grade (>5 grams per tonne (“g/t”) gold (“Au”)) mineralization, including areas up/down-plunge of EM-22-015, which returned seven (7) separate intercepts highlighted by 10.3 g/t Au over 7.8 m (see news from January 9, 2023).

Gold mineralization within the main mine horizon at Eagle is generally oriented northwest-southeast, which is consistent with modeled stratigraphy. New Maxwell plate modelling of downhole EM conductors at Eagle is consistent with this overall northwest-southeast trend; however, one of the EM anomalies is best modelled as a planar feature at high angles to the overall trend, suggesting that gold mineralization may be controlled not only by stratigraphy but also by cross-cutting structures, which are also supported by 3D drone magnetic inversion trends. The new downhole EM survey data provides support for the Company’s interpreted northeast-southwest trending cross-plunge potentially linking high-grade results from EM-22-015 to intercepts located approximately 60 m up-plunge in historical hole E-19 (19.6 g/t Au over a similar 7.9 m width). Additional historical drill holes intersected >5g/t Au roughly 250 m further down-plunge of EM-22-015, highlighting the grade and volume potential of a new zone that will be tested via follow-up drilling in 2023.

“We are excited by the new downhole EM results, which contribute key elements to our evolving 3D model for Eagle,” stated Fred Speidel, VP Exploration of Maple Gold. “This data is extremely valuable as it provides key information up to ~300 m surrounding any given drill hole, which can help guide us towards new potential gold zones. The Company views this and other open target areas at Eagle as an excellent opportunity to define additional high-grade ounces and we look forward to commencing initial follow-up drilling in Q2 2023.”

Conceptual Targets for Further Testing in 2023

The key conceptual result from 2022 drilling at Eagle was confirming the existence of several different styles of gold mineralization, over significantly greater widths than were previously defined, including:

- Quartz-carbonate veinlets in wallrock felsic tuffs;

- Semi-massive sulfides with apparently overprinting Fe-carbonate and quartz;

- Disseminated sulfides associated with bleached, foliated and pyritic microgabbro;

- Semi-massive sulfides associated with (and forming the matrix of) lapilli tuffs; and

- Sulfide-rich intervals in graphitic sediments of the Harricana Grp.

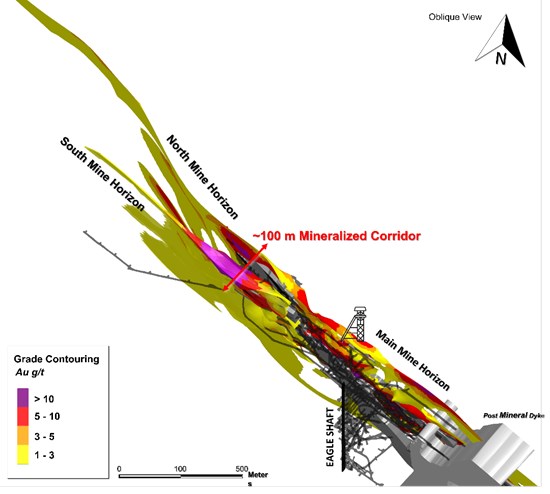

These different styles of mineralization define an expanded corridor of ~100 m in true width straddling the Harricana Fault Zone (see Figure 1).

Conceptual targets, focusing on higher grade x thickness (i.e. higher metal factor) areas with limited drilling are found at different depths along the margins and down-plunge of the historically mined areas (see Figure 2).

Figure 1: Oblique view showing the North and South Mine Horizons extending to the northwest from the Eagle Mine where the horizons merge.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3077/158649_23ef8863542f4bc8_001full.jpg

Figure 2: Long section (North Mine Horizon only) showing distribution of near-mine exploration targets (blue ellipses) for 2023 at Eagle and Telbel, considering regional and deposit-scale trends.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3077/158649_23ef8863542f4bc8_002full.jpg

As shown in Figure 2 above, the Company’s exploration targets include not only the extensions of known local mine trends, but also interpreted cross-plunges, potentially related to stretching lineations observed in core, notably in EM-22-015.

Annual Equity Incentive Plan Grants

Pursuant to its Equity Incentive Plan (the “Plan”) dated December 17, 2020 and the policies of the TSX Venture Exchange, the Company’s Board of Directors granted stock options (“Options”), Restricted Share Units (“RSUs”) and Deferred Share Units (“DSUs”) to certain employees, officers, directors and consultants. The Company granted Options to purchase an aggregate of 3,525,000 common shares of the Company (each, a “Common Share”), with an exercise price of $0.20 per Common Share. Each Option grant vests in three equal tranches over a 24-month period. Once vested, each Option is exercisable into one Common Share for a period of five years from the date of the grant. The Company also granted a total of 2,825,000 RSUs and 550,000 DSUs. Each RSU grant vests in three equal tranches over a 24-month period. Once vested, each RSU and DSU entitles the holder thereof to receive either one Common Share, the cash equivalent of one Common Share or a combination of cash and Common Shares, as determined by the Company, net of applicable withholdings. DSUs may not be exercised until a director ceases to serve on the Company’s Board of Directors.

Further details regarding the Plan are set out in the Company’s Management Information Circular filed on May 16, 2022, which is available on SEDAR.

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work.

About Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Québec’s prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel. In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

The district-scale property package also hosts a significant number of regional exploration targets along a 55 km strike length of the Casa Berardi Deformation Zone that have yet to be tested through drilling, making the project ripe for new gold and polymetallic discoveries. The Company is well capitalized and is currently focused on carrying out exploration and drill programs to grow resources and make new discoveries to establish an exciting new gold district in the heart of the Abitibi. For more information, please visit www.maplegoldmines.com.

ON BEHALF OF MAPLE GOLD MINES LTD.

“Matthew Hornor”

B. Matthew Hornor, President & CEO

For Further Information Please Contact:

Mr. Joness Lang

Executive Vice-President

Cell: 778.686.6836

Email: jlang@maplegoldmines.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward-Looking Statements:

This press release contains “forward-looking information” and “forward-looking statements” (collectively referred to as “forward-looking statements”) within the meaning of applicable Canadian securities legislation in Canada, including statements about exploration work and results from current and future work programs. Forward-looking statements are based on assumptions, uncertainties and management’s best estimate of future events. Actual events or results could differ materially from the Company’s expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.’s filings with Canadian securities regulators available on www.sedar.com or the Company’s website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/158649