Research News and Market Data on DFMTF

NEWS PROVIDED BY

17 Oct, 2023, 08:00 ET

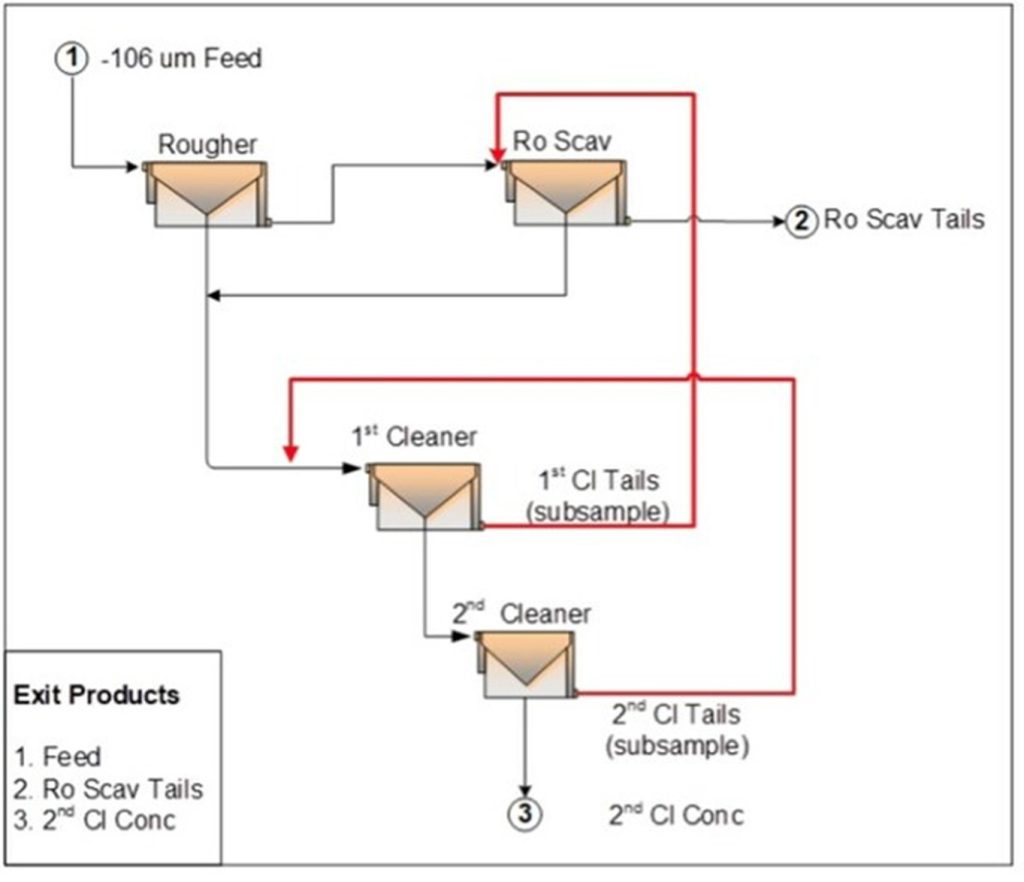

VANCOUVER, BC, Oct. 17, 2023 /CNW/ – Defense Metals Corp. (“Defense Metals” or the “Company“) (TSXV: DEFN) (OTCQB: DFMTF) (FSE: 35D) is pleased to announce that SGS Canada Inc. in Lakefield, Ontario has shipped samples of mixed rare earth oxide and mixed rare earth carbonate to interested parties on behalf of the Company. These samples were generated during 2023 hydrometallurgical piloting test work performed on concentrate produced by earlier flotation pilot plant testing of a 26-tonne bulk sample taken from the Company’s wholly-owned Wicheeda Rare Earth Element (REE) deposit.

The samples are being distributed to certain select major processors, refiners, and metals traders located in Europe, Asia and North America, allowing the recipients to independently verify the high-quality of REE products from the Wicheeda deposit, and establishing Wicheeda as an important, future North American source of the rare earths needed to satisfy the rapidly increasing demand. The sample specifications are varied based on the recipients’ particular requirements, and these parties could represent future offtake or strategic partners for Defense Metals and these shipments are a critical step toward defining such potential opportunities.

Craig Taylor, CEO of Defense Metals, commented, “Given that rare earth magnet production needs to double in the next decade to satisfy the demand created by electric vehicles, a new and significant western supplier, such as Defense Metals, is essential. To put this increased demand into perspective, it is the equivalent of bringing into production one Mountain Pass mine, currently the only North American rare earth producer, every year for the next ten years. With the Wicheeda Project’s superior logistics, together with our confidence in the metallurgical processing characteristics of Wicheeda mineralization, Defense Metals continues to position itself as a significant contributor to the North American green energy solution.”

Defense Metals to Attend 19th International Rare Earths Conference

Defense Metals also announces that it will be attending in the 19th International Rare Earths Conference in San Antonio, U.S., hosted by Metal Events, from October 18-20, 2023.

For additional information on the conference please visit the following link:

About the Wicheeda Rare Earth Element Project

Defense Metals’ 100% owned, 6,759-hectare (~16,702-acre) Wicheeda Project is located approximately 80 km northeast of the city of Prince George, British Columbia; population 77,000. The Wicheeda deposit is readily accessible by all-weather gravel roads and is near infrastructure, including hydropower transmission lines and gas pipelines. The nearby Canadian National Railway and major highways allow easy access to the deep-water port facilities at Prince Rupert, the closest major North American port to Asia.

About Defense Metals Corp.

Defense Metals Corp. is a mineral exploration and development company focused on the development of its 100% owned Wicheeda Rare Earth Element project located near Prince George, British Columbia, Canada. Defense Metals Corp. trades in Canada under the symbol “DEFN” on the TSX Venture Exchange, in the United States, under “DFMTF” on the OTCQB, and in Germany on the Frankfurt Exchange under “35D”.

Defense Metals is a proud member of Discovery Group. For more information please visit:

http://www.discoverygroup.ca/

For further information, please visit www.defensemetals.com or contact:

Todd Hanas, Bluesky Corporate Communications Ltd.

Vice President, Investor Relations

Tel: (778) 994 8072

Email: todd@blueskycorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains “forward–looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, statements relating to the shipment of rare earth samples, advancing the Wicheeda REE Project to production, potential contracts and agreement, technical, financial and business prospects of the Company, its project and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of rare earth elements, the anticipated costs and expenditures, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration and metallurgical results, risks related to the inherent uncertainty of exploration and development and cost estimates, the potential for unexpected costs and expenses and those other risks filed under the Company’s profile on SEDAR at www.sedarplus.ca. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather and climate conditions, failure to maintain or obtain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of personnel, materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), risks relating to inaccurate geological, metallurgical and engineering assumptions, decrease in the price of rare earth elements, the impact of Covid-19 or other viruses and diseases on the Company’s ability to operate, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to, the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, loss of key employees, consultants, or directors, increase in costs, delayed results, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward–looking statements or forward–looking information, except as required by law.

SOURCE Defense Metals Corp.